Exploring Latin America’s Real Estate Markets: Argentina

Latin America’s real estate market remains fertile ground for analysis, shaped by stark economic contrasts, political complexity, and evolving social dynamics. Within this diverse landscape, the Argentina Real Estate Market stands out as one of the most dynamic and complex. Marked by a history of economic volatility, structural inflation, and a long-standing tradition of using property as a hedge against currency devaluation, Argentina presents a uniquely complex market that some real estate professionals consider both challenging and opportunistic due to its macroeconomic history.

While these challenges may appear as red flags to some, they also create strategic opportunities for investors who understand the local context. Argentina offers a rare combination: a highly urbanized population, a dollarized market structure, burgeoning sectors like short-term rentals, and a middle class that consistently favors real estate as a reliable store of value despite recurring economic crises.

Continuing our “Exploring Real Estate Markets” series, this edition focuses on the Argentina Real Estate Market, following previous deep dives into Colombia and Mexico. We break down the macroeconomic backdrop, explore the market’s most active sectors, and assess emerging trends, policy reforms, and investment dynamics shaping this pivotal South American market.

Macroeconomic Trends Impacting the Argentina Real Estate Market

Argentina is going through an unprecedented stage of economic transition, after more than a decade of fiscal imbalances, exchange controls and interventionist policies. Between 2022 and 2023, Argentina experienced significant macroeconomic deterioration, including annual inflation exceeding 200%, structural fiscal deficit, negative international reserves, and a regulatory environment that restricted both local and foreign investment.

However, the change of administration at the end of 2023 marked the beginning of a drastic shift in economic strategy. The new government has promoted agenda of aggressive fiscal consolidation, progressive elimination of subsidies, price liberalization and exchange rate unification, with the aim of restoring macroeconomic balance and attracting investment. This reconfiguration has led to a sharp drop in economic activity in the short term, but it has also generated positive signals in the financial markets, with a gradual recovery of reserves and greater predictability in the exchange rate.

In this context, the Argentine real estate market is in a stage of redefinition. In the short term, the retraction of consumption, the increase in the cost of financing and the fall in construction activity have affected the dynamics of buying and selling, especially in the middle and popular segment. However, at the same time, the relative stability of the free dollar and the end of the exchange rate gap are generating new entry opportunities for investors with liquidity.

The Argentina real estate market is showing signs of a bottom in property prices across several submarkets after years of real decline.. At the same time, traditional rentals are undergoing regulatory reconfiguration after the repeal of the Rental Law, while temporary rentals continue to be a profitable alternative in cities with high tourist flows or corporate demand.

Projections for the Argentina real estate market largely depend on the stabilization program’s continuity. If the reforms manage to be sustained and inflation slows, the sector is likely to experience a gradual rebound in 2025-2026, especially in the premium residential segment, the office market adapted to hybrid work and developments linked to tourism or agribusiness.

Investment Trends and Policy Shifts in the Argentina Real Estate Market

Since Javier Milei’s inauguration in December 2023, Argentina has undergone a radical shift in its economic policy, oriented towards deregulation, trade liberalization, and the reduction of the size of the state. These measures have had significant impacts on the economy and on the perception of investors, both local and foreign.

Structural reforms and economic deregulation

The Milei administration implemented Decree 70/2023, known as the “mega-decree”, introducing sweeping changes in economic and labor legislation. Among the measures highlighted are the elimination of price controls, the liberalization of the foreign exchange market and the reduction of state subsidies. In addition, the privatization of public companies was promoted, and the Incentive Regime for Large Investments (RIGI) was established, aimed at attracting investments in strategic sectors such as mining, energy and technology.

Recent Economic Trends

These policies have had mixed effects on the economy. On the one hand, inflation, which had reached levels above 200% annually, began to decelerate, standing at around 55.9% in November 2024, the lowest level in more than four years. Likewise, the country’s risk decreased significantly, falling below 500 points for the first time since 2018.

However, the economy suffered a contraction in GDP in the first quarters of 2024, with declines of 4.6% (I quarter 2024) and 3.4% (II quarter 2024) respectively. However, in the fourth quarter, growth of 1.4% was recorded, driven in part by a recovery in the agricultural sector. Projections for 2025 are optimistic, with growth estimates ranging from 3.5% to 5.5%, according to different sources. In addition, GDP per capita had a significant recovery by the end of 2024 with an increase of more than 8%.

Foreign direct investment (FDI)

In the third quarter of 2024, despite pro-investment reforms, FDI in Argentina reached in 2024 its lowest level since 2020, in the third quarter of 2024 net FDI inflows in Argentina totaled USD 2,395 million, explained by reinvested earnings of USD 1,151 million, equity contributions of USD 669 million, net proceeds from debt transactions of USD 572 million and mergers and acquisitions of USD 4 million.

In addition, investment projects have been announced in sectors such as lithium and mining. For example, YPF Tecnología signed an agreement with the Israeli company XtraLit to develop direct lithium extraction projects in Argentina, using sustainable and efficient technologies.

Prospects and challenges

The reforms implemented have improved certain macroeconomic indicators and have generated positive expectations among some investors. However, significant challenges remain, such as the need to consolidate macroeconomic stability, strengthen the institutional framework, and ensure the social sustainability of the policies adopted.

Key Drivers of the Argentina Real Estate Market: Prices, Financing, and Development Trends

The Argentine real estate market in 2024 showed signs of stabilization after years of contraction, influenced by macroeconomic factors, government policies, and changes in demand.

Home Price Trends in the Argentina Real Estate Market

The Argentine residential market has been strongly affected by a decade of economic instability, high inflation and successive crises. Since 2019, the peso has lost 96% of its value against the dollar, and inflation reached 133.5% in 2023, and an average of 110% by 2024.

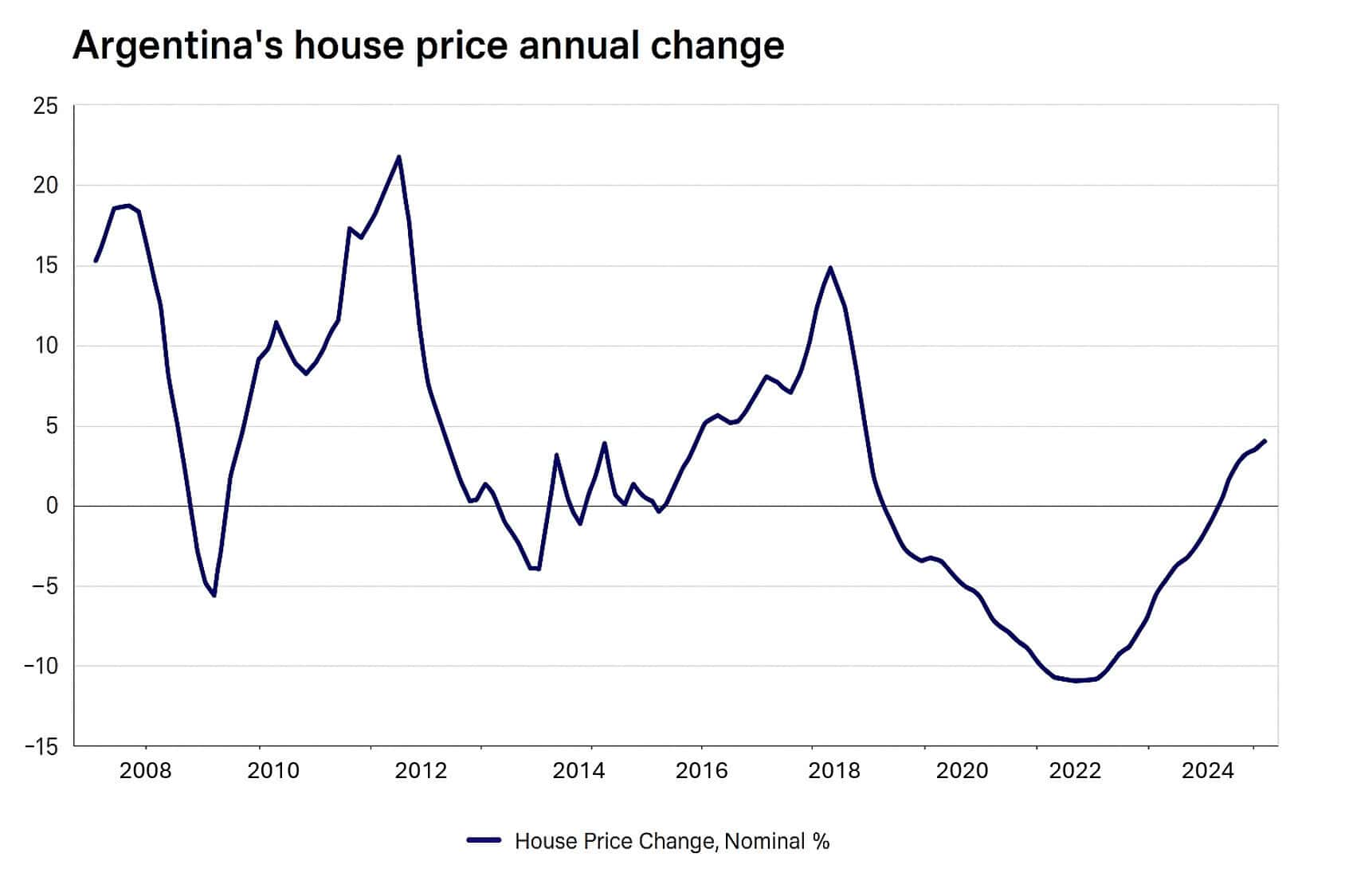

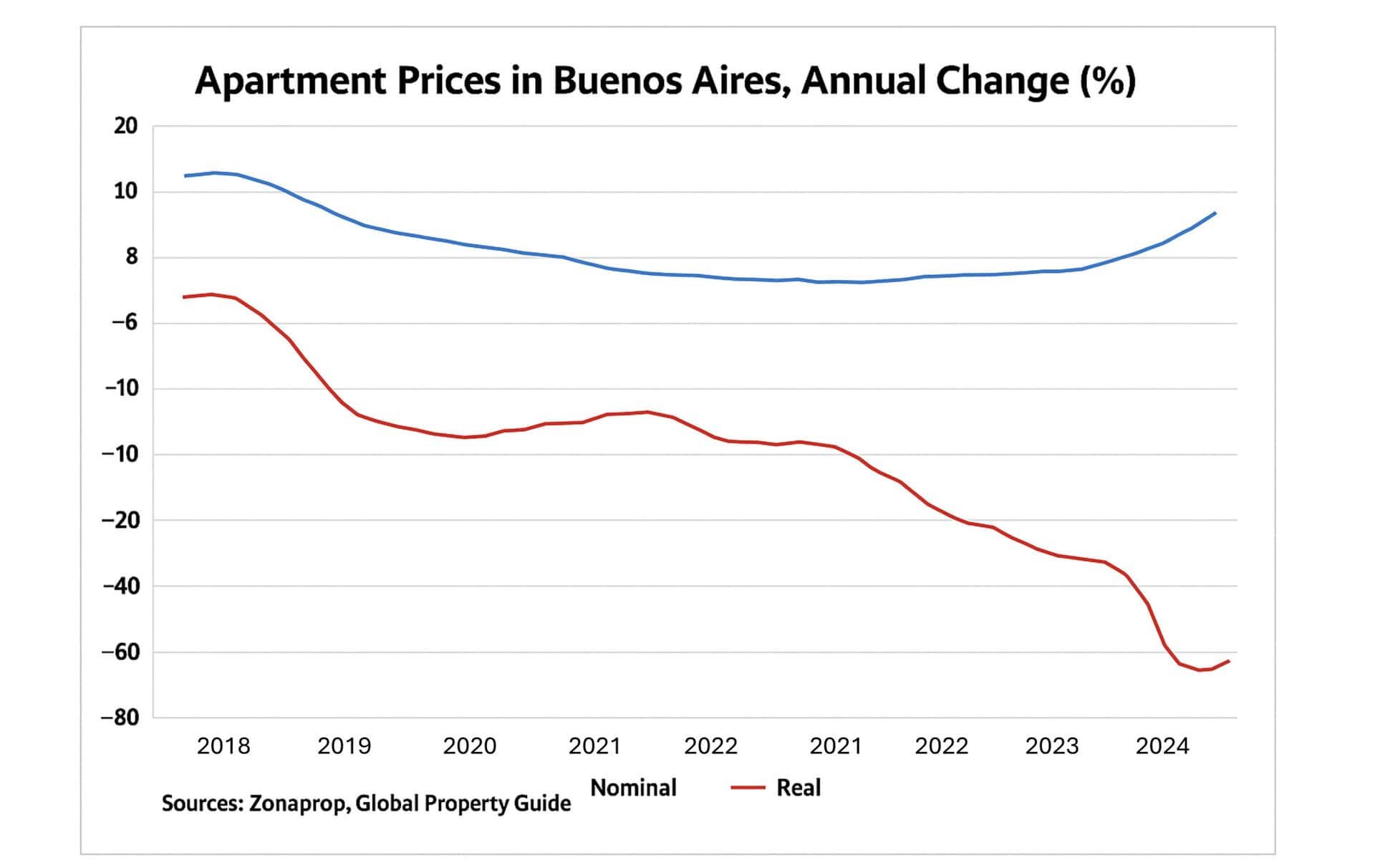

Although nominal prices of apartments in Buenos Aires rose by 5.49% year-on-year in the second quarter of 2024 (to USD 2,269/m²), the adjustment for inflation shows a real drop of 71.6%. In other words, the purchasing power of real estate continues to deteriorate. This downward trend in real terms has been going on for more than ten years.

During 2024, prices of homes for sale registered an increase of 5.7%, marking the first sign of recovery in six years. However, this increase remained below the accumulated inflation in the same period, indicating a negative real appreciation of the value of the properties.

- Average value per m² (CABA, August 2024): USD 2,199

- Prices remain 20-25% below the 2019 peak

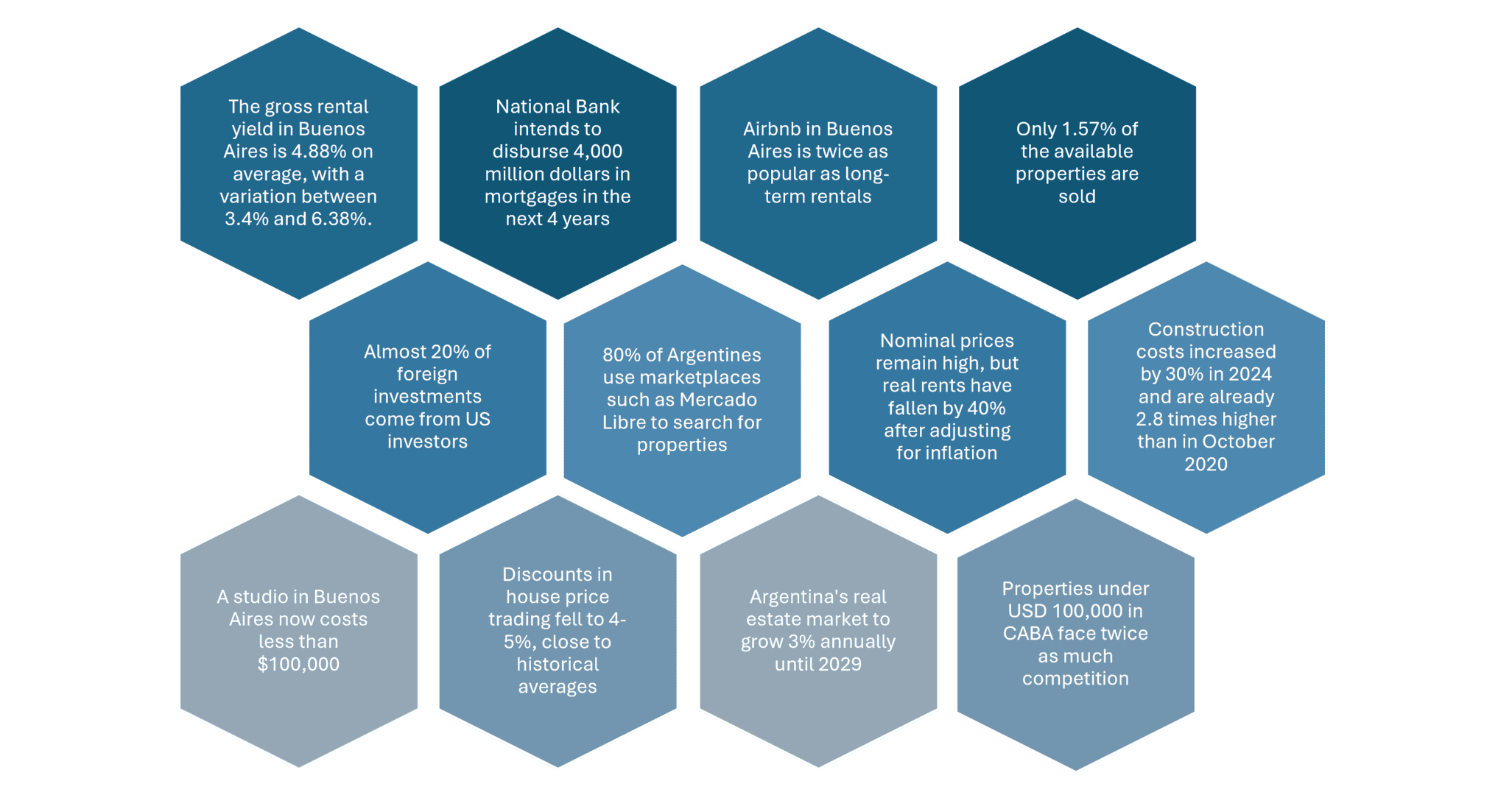

Graphic: Annual change in house prices in Argentina

Source: https://www.globalpropertyguide.com/latin-america/argentina/home-price-trends

Graphic: Apartment prices in Buenos Aires, annual change (%)

Source: https://www.colegio-escribanos.org.ar/category/estadisticas-de-escrituras/

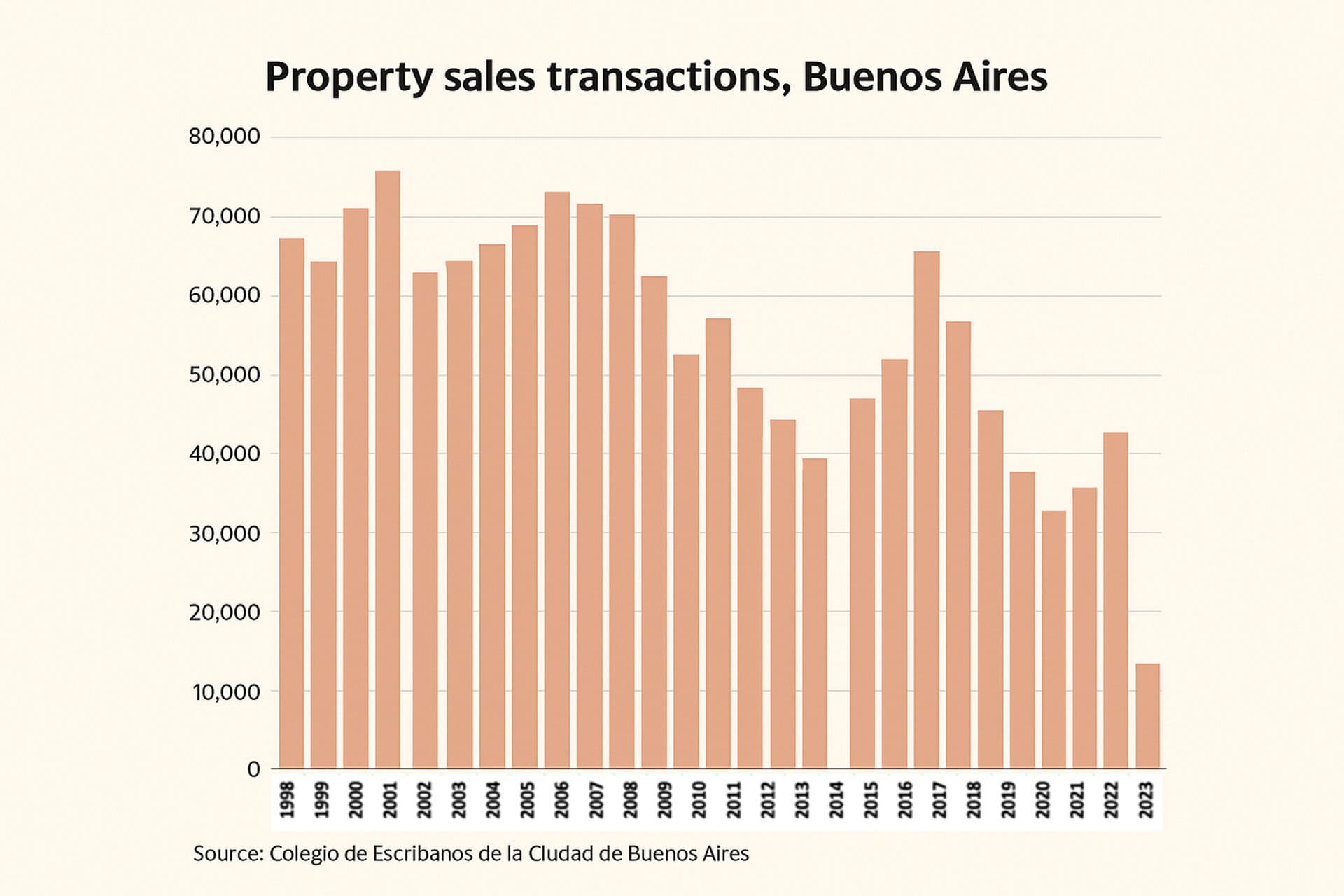

Graphic: Real Estate Sales Transactions, Buenos Aires

Source: https://www.colegio-escribanos.org.ar/category/estadisticas-de-escrituras/

Financing Challenges and Mortgage Trends in the Argentina Real Estate Market

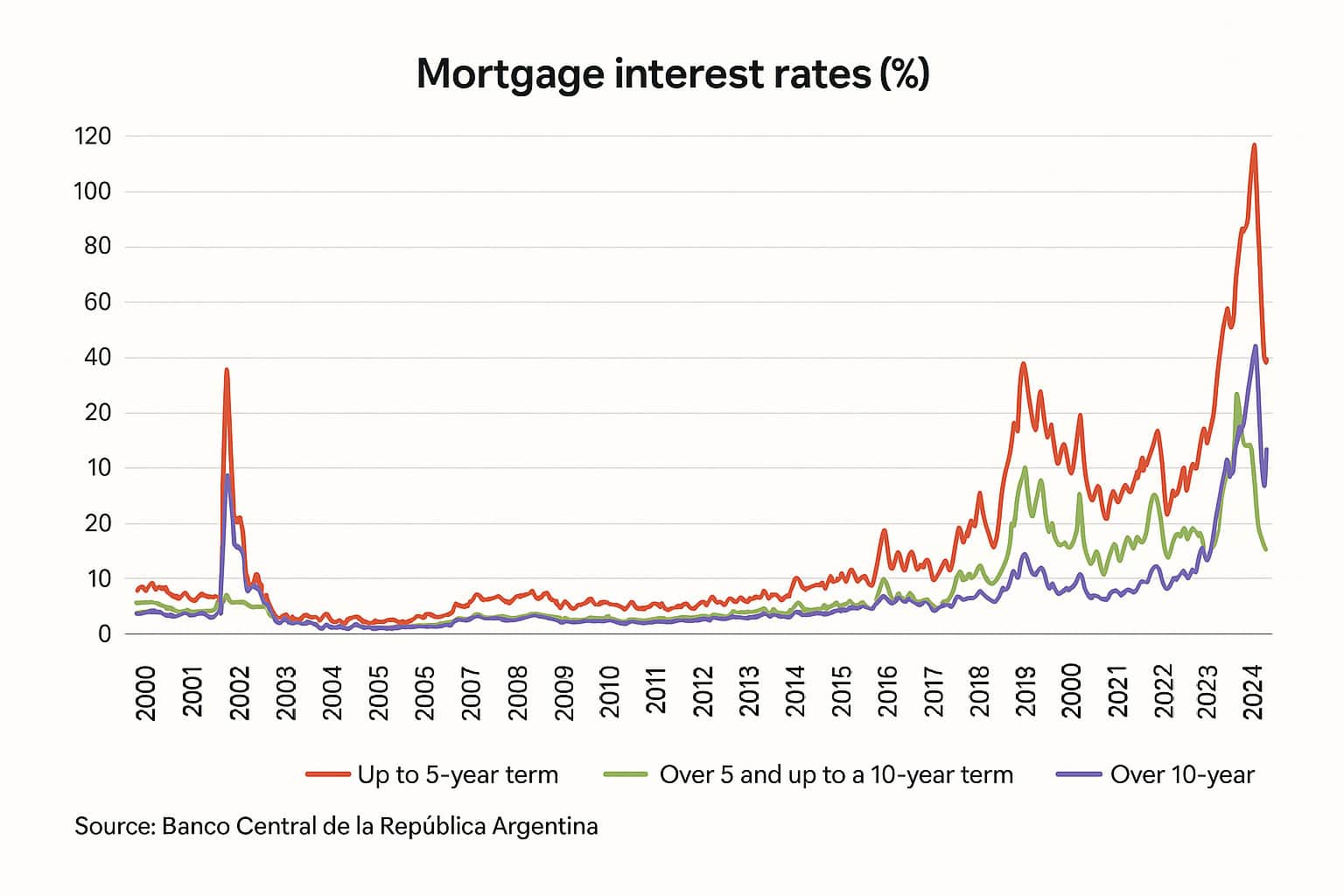

Despite the sharp cut in rates by the Central Bank (from 75% to 28% annually in one year), the Argentine mortgage market was practically paralyzed during the previous years. In 2023, mortgage loans accounted for less than 0.4% of GDP—the lowest level in decades—up from 5.36% in 2000.

The UVA system, implemented in 2016 to index payments to inflation, failed to boost access to housing, largely due to the constant loss of the value of the peso and the dollarization of real estate prices. Although current rates are more accessible in nominal terms, the lack of real credit, devaluation, and exchange controls continue to severely limit mortgage financing.

Mortgage credit experienced a significant reactivation in 2024, with more than 11,000 loans granted, reaching the best level since 2018. This recovery was driven by the implementation of new policies, such as the introduction of the “future good mortgage”, which allows financing projects under construction or without deeds, facilitating access to housing.

- +11,000 mortgages granted, the best number since 2018.

- UVA-adjusted lines were reactivated, mainly for well-financed developments.

- New regulatory tool: “Divisible mortgage” for projects under construction.

Graph: Mortgage Interest Rate

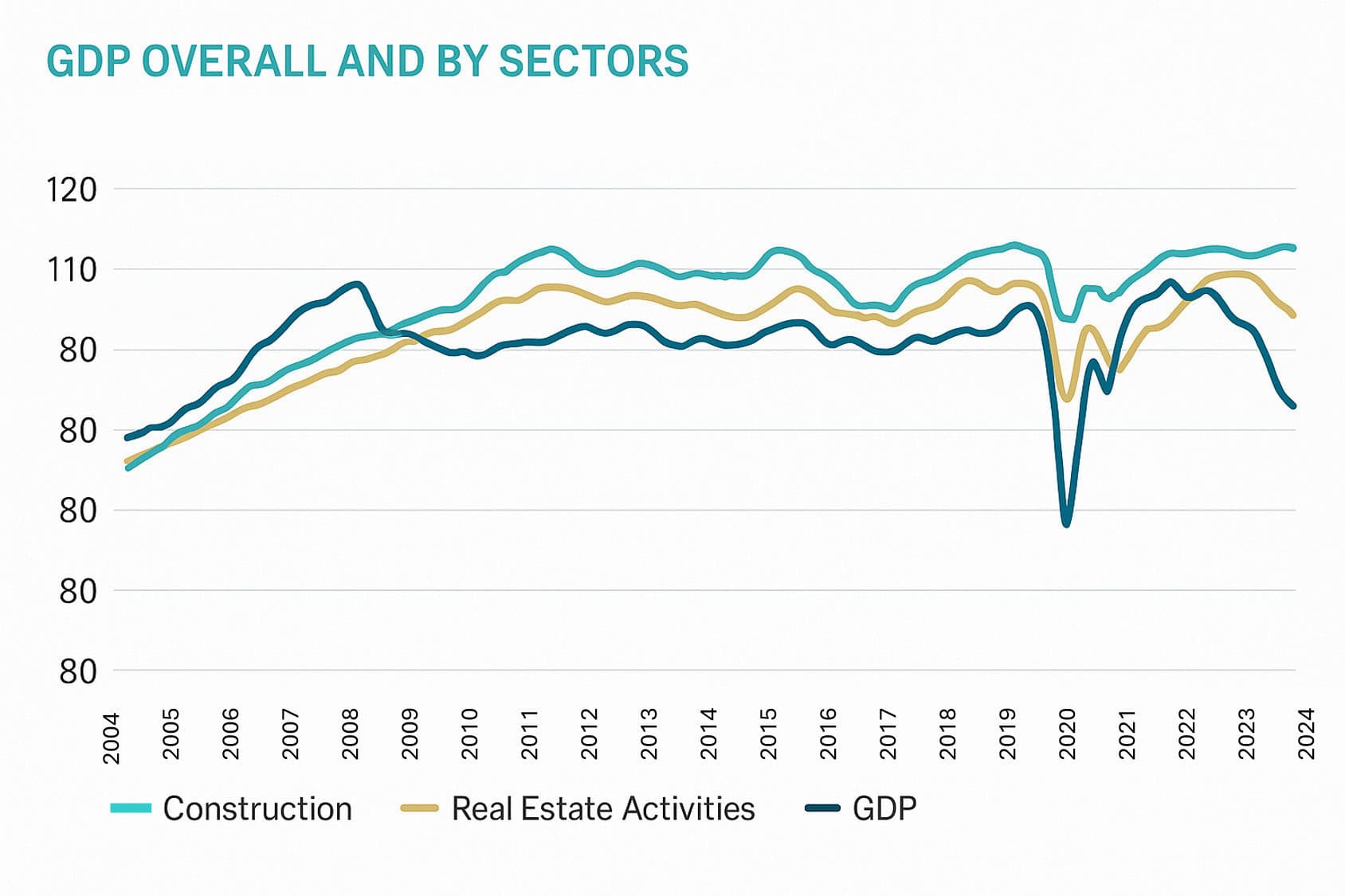

New Construction and Building Activity in the Argentina Real Estate Market

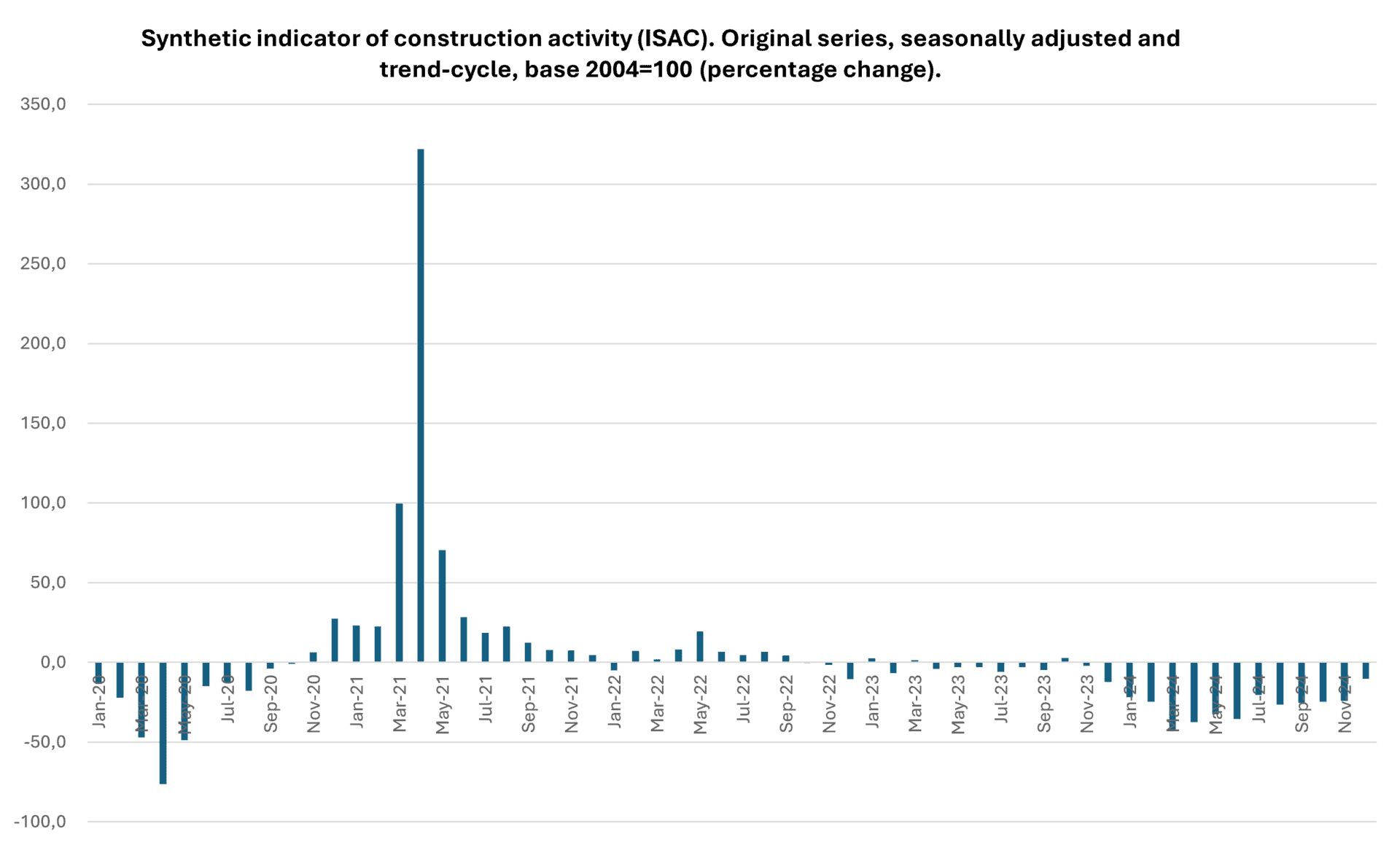

Construction collapsed between 2H23 and 1H24, remaining 15% below its historical average. Although it is a volatile sector, it constitutes the most significant drop in the last 20 years without counting the COVID-19 crisis. On the other hand, real estate activities have continued on a growing path, albeit moderately.

Construction activity faced challenges in 2024. The Synthetic Indicator of Construction Activity (ISAC) showed a decrease of 35.2% in June compared to the same month of the previous year, and a cumulative decrease of 32.7% in the first six months of the year. In addition, during the first quarter of 2024, 31,832 homes were approved, representing a decrease of 35.7% compared to the same period in 2023.

Despite of the fact that construction is facing a challenging moment, there are positive signs thanks to the implementation of several policies of economic openness, the year 2025 shows signs of recovery. In March 2025, the synthetic indicator of construction activity (ISAC) shows an increase of 15.8% with respect to the same month of 2024.

In March 2025, the seasonally adjusted series index shows a negative variation of 4.1% with respect to the previous month, and the trend-cycle series index shows a positive variation of 0.3% with respect to the previous month.

- INDEC’s Synthetic Indicator of Construction Activity (ISAC) fell by 35.2% year-on-year in June 2024.

- Public construction fell sharply due to the cut in national public works.

- Approved homes Q1 2024: 31,832 (−35.7% vs. 2023)

During the previous administration, the tightening of restrictions in the context of instability and growing macroeconomic imbalances motivated the channeling of savings through the purchase of properties since they maintained attractive prices.

Although some restrictions remain, the new government partially freed the foreign exchange market and resolved the fiscal and monetary imbalances by relieving the tension in the exchange rate, providing stability, extending decision-making horizons, stimulating credit, rebuilding purchasing power, and thus, boosting the sale of properties.

Graphic: General GDP, construction and real estate activities

Source: Argentina | Real Estate & Construction Outlook 2024

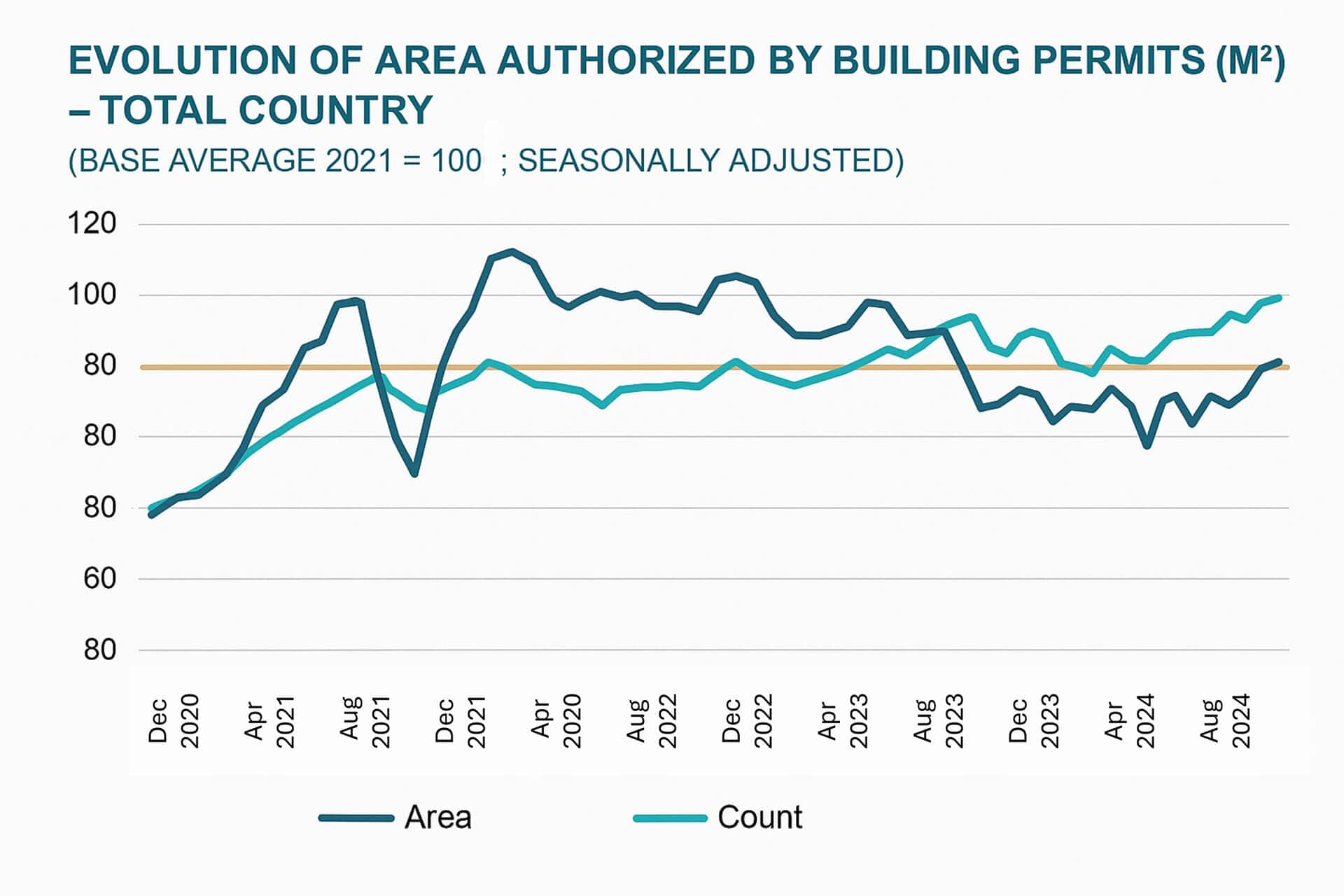

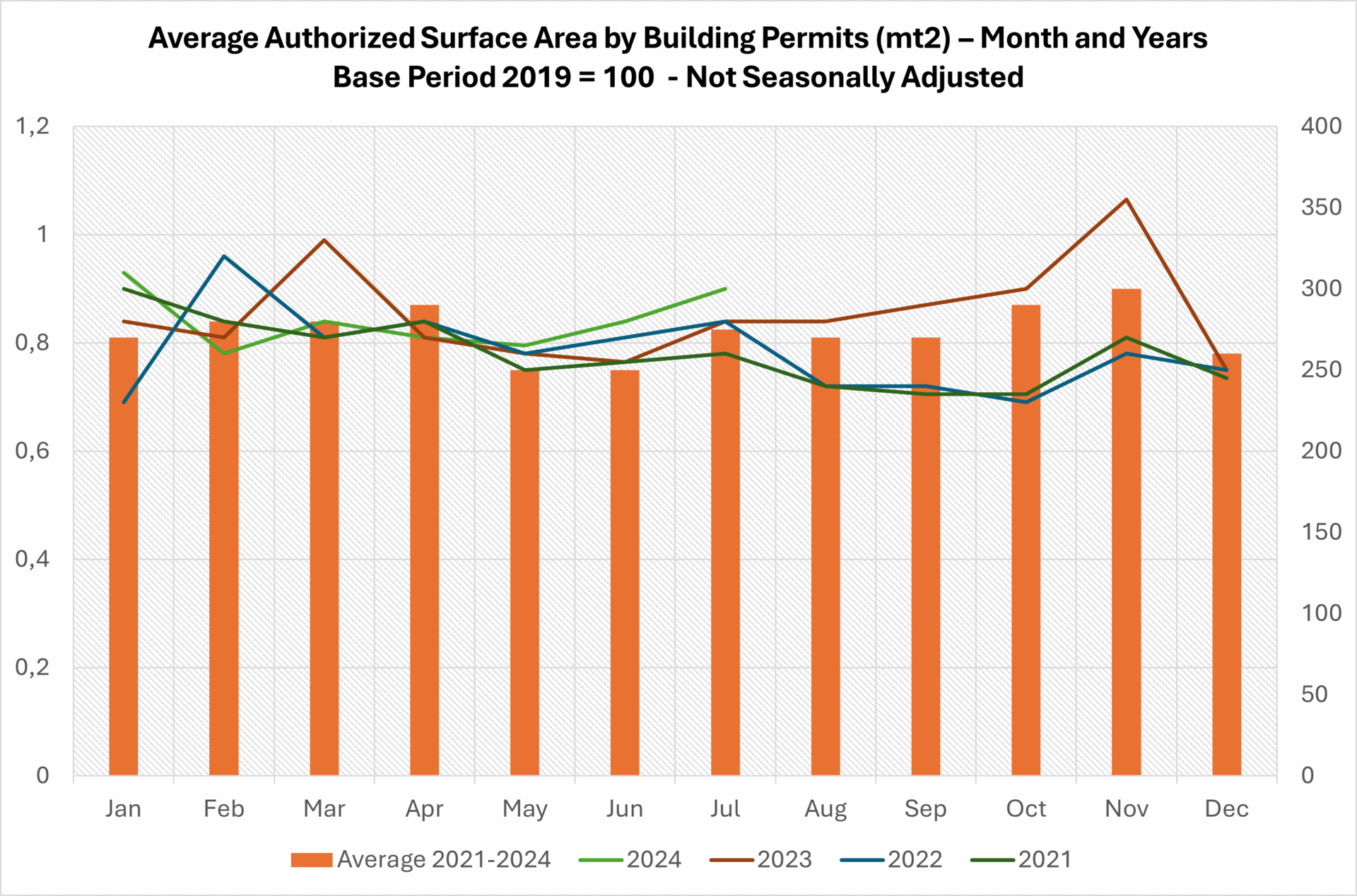

Land valuation and building permits.

In the first half of 2024, the lowest figures (both in area and quantity) in the last four years were recorded. However, the average surface area exceeds those observed in that period, so fewer real estate developments are being carried out, but of greater size.

The slowdown in inflation and the reduction of interest rates changed the dynamics that the Argentine financial system showed in previous years, stimulating the supply of credit to the private sector. Thus, after having touched historic lows, mortgage loans gained renewed momentum, responding to the repressed demand for real estate.

Since 2023, the parcel-weighted average of the median VUT (New Unit Land Values) per cluster (group of localities), was estimated this year at $17,558/m² (44 USD/m²) at the provincial level. The highest values in the entire province are found in Córdoba Capital, near the Plaza España area, where they reach a peak of $2,670,000/m² (6,675 USD/m²), in contrast to the city’s median value of $42,500/m² (106 USD/m²).

- In Buenos aires, The Real M2 Index for the month of February 2025 was 2,099 U$S/m2.

- Provincial median of urban land: 32 USD/m²

- Value in premium areas of Córdoba capital (Plaza España): up to 5,500 USD/m²

- Suburban areas present opportunities for more accessible developments.

Graphic: Evolution of the area authorised by building permits (m2)

Source: Argentina | Real Estate & Construction Outlook 2024

Graphic: Average area authorized by building permits (m2) per month and year.

Source: Argentina | Real Estate & Construction Outlook 2024

Foreign Investment Trends in the Argentina Real Estate Market

In 2024, Argentina received net foreign direct investment (FDI) inflows of US$ 6,572 million in the first quarter. In the third quarter of 2024, FDI inflows were US$ 2,395 million. In 2024, FDI flows into Argentina were lower than in previous years, reaching the fourth lowest level since 2003.Detail of 2024:- First quarter: US$ 6,572 million in net inflows.

- Third quarter: US$ 2,395 million in net inflows.

- Previous years: Foreign direct investment in Argentina averaged US$ 168.79 million from 2003 to 2024.

- Real estate accounts for a marginal proportion.

- Some foreign players have begun evaluating deals in anticipation of a rebound in 2025-2026.

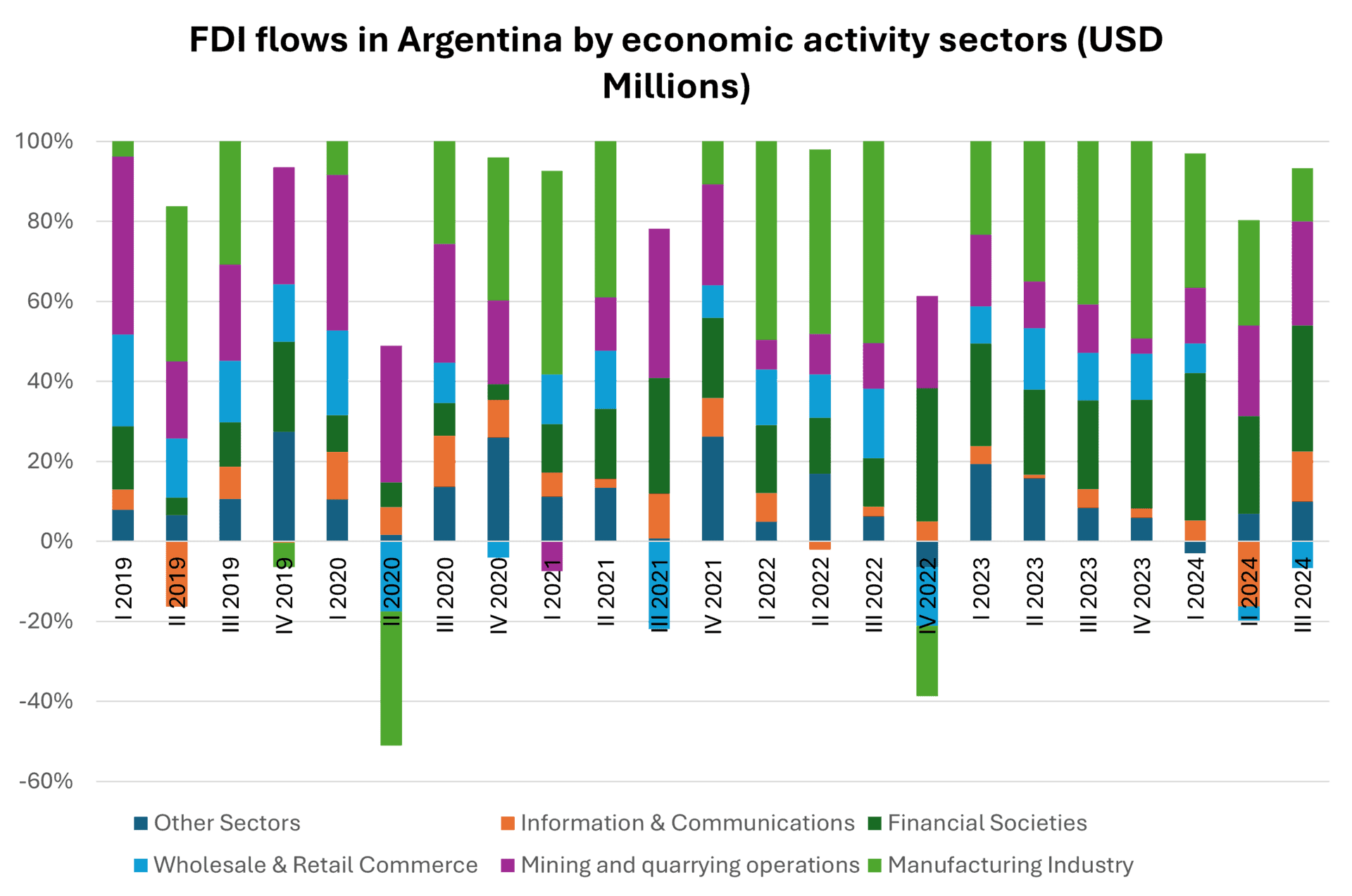

In an opening by type of transactional flow between the main sectors (graph below), it can be seen that in “Manufacturing industry” and “Wholesale and retail trade” the main net income in the third quarter of 2024 corresponded to capital contributions.

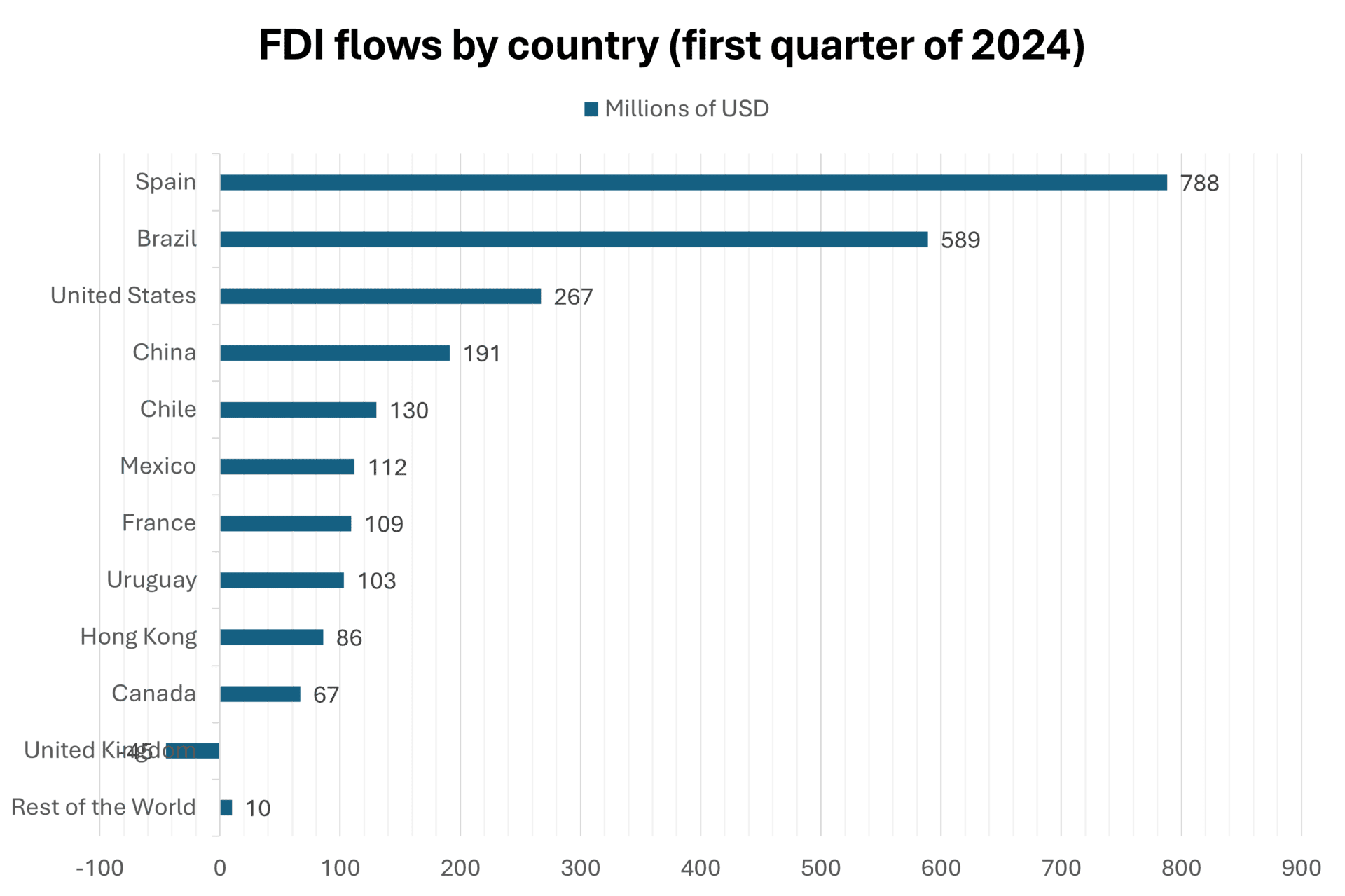

In relation to the countries from which transactional FDI flows originate, during the third quarter of 2024 (Chart 10), Spain was the main one, with net revenues of USD 788 million (+2% YoY); followed by Brazil, with USD 589 million (-48% YoY). Then came the United States, with USD 267 million (-81% YoY); China, with net flows of USD 191 million (-43% YoY); and Chile, with USD 130 million (+134% YoY).

Graphic: FDI flows in Argentina by sectors of economic activity

Chart: FDI flows by country (third quarter of 2024)

Other Stats Relevant to 2025

- The cost of construction doubled in 2024, with a 120% increase between October 2023 and December 2024, due to the increase in the prices of materials and labor.

- Access to housing remains a challenge, especially for young people between the ages of 25 and 35, who face difficulties in accessing a rental or buying their first home.

- Increase in deeds: During the last 6 months of 2024, 78,500 deeds were registered in the City of Buenos Aires, which represents an increase of 12% compared to the same period of the previous year.

- In February 2025, the average price per square meter in the Autonomous City of Buenos Aires reached USD 2,370, with an increase of 1.3% compared to the previous month.

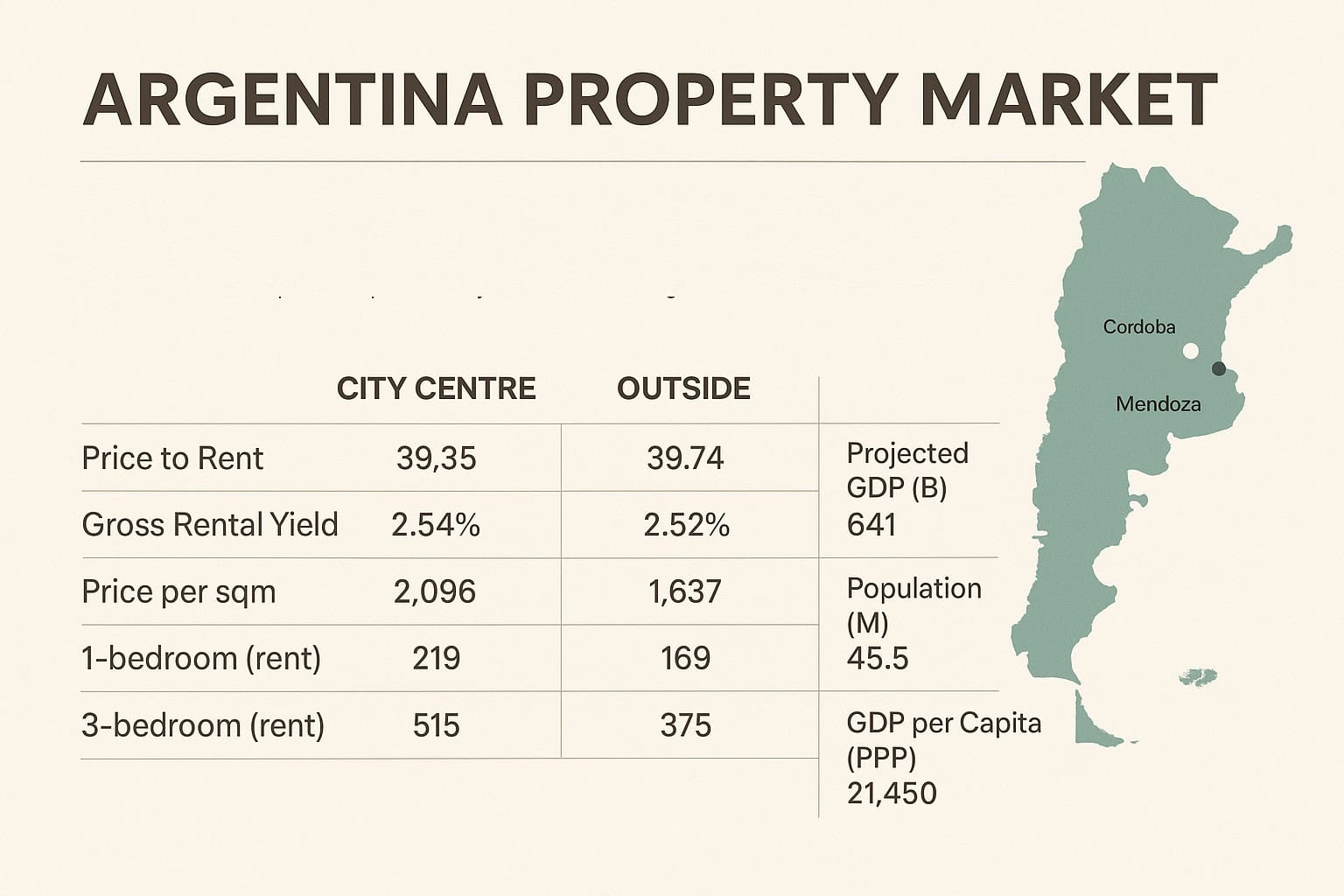

- The gross annual return for traditional rentals is between 2% and 4%, while for temporary rentals in tourist areas it can reach between 8% and 10%.

- Housing projects in areas such as Tigre, Pilar, Cañuelas and the Atlantic Coast have drawn interest from investors and buyers, particularly due to local development trends and pricing levels.

- New real estate developments are incorporating eco-efficient technologies, such as solar panels and rainwater harvesting systems, responding to a growing demand for sustainable properties.

- The reintroduction of mortgage loans has been fundamental to the rebound of the market, facilitating access to housing for many families.

- Monthly UVA mortgage payments now align closely with rental costs, encouraging property acquisition.

- The Argentine real estate market is estimated to grow at a compound annual growth rate of 3.8% between 2025 and 2034, reaching a value of USD 33.25 billion in 2034.

- The purchase and sale of used real estate will continue to boom, especially in cities with high demand, due to inflation and construction costs that limit access to new housing.

In summary, the Argentine real estate sector in 2024 showed signs of recovery in certain aspects, such as mortgage credit, but also faced significant challenges in terms of construction activity and foreign investment. Future developments will depend mostly on macroeconomic stability and the policies implemented to encourage investment and access to housing.

Source: https://data.worldbank.org/country/argentina

Reforms Reshaping the Argentina Real Estate Market and Investor Landscape

Since December 2023, the Argentine government has embarked on a reform agenda aimed at dismantling the inherited regulatory apparatus and restoring macroeconomic balances through shock measures. This new institutional architecture seeks, in theory, to generate more favorable conditions for productive investment and the efficient allocation of resources. However, its immediate effects on the real estate market and foreign capital are diverse and still in the consolidation stage.

Main economic and regulatory policies implemented

- Decree of Necessity and Urgency (DNU) 70/2023: massive deregulation of key sectors, partial labor reform, repeal of interventionist laws (including the Rental Law), and flexibility of civil and commercial contracts.

- Progressive exchange rate unification: dismantling of the clamp and reduction of the gap between the official and parallel dollar.

- Large Investment Incentive Regime (RIGI): legal framework for projects over USD 200 million with tax and customs benefits for up to 30 years, aimed at attracting foreign capital in strategic sectors such as energy, infrastructure and mining.

- Tax and fiscal reforms: adjustment of public spending, elimination of subsidies, and proposal for tax simplification.

Implications for Foreign Investment

In the short term, the perception of the country’s risk remains high, but there are initial signs of a reversal:

- Country risk fell below 1,300 points for the first time since 2020, and sovereign bonds began to recover in value.

- Investment funds are in the due diligence stage in sectors such as renewable energy, logistics and mixed-use developments, although they are still cautious about exchange rate volatility.

- The RIGI has aroused concrete interest from international mining groups, but it has not yet had traction in traditional real estate due to the initial exclusion of the sector from the regime.

Accessibility to the real estate market

The reforms have had a mixed impact on accessibility:

- The repeal of the Rental Law reactivated the traditional rental market, allowing greater contractual flexibility and prices more aligned with supply and demand. This especially benefited owners and developers.

- However, the elimination of subsidies and the rise in tariffs, added to depressed real wages, reduced the ability of average demand to pay.

- The reactivation of mortgage credit is still incipient and is not enough to compensate for the structural lack of access to financing.

Effects on the real estate market:

- Stable prices in dollars but depressed in real terms: values have stabilized after six years of decline, generating floor expectations for buyers with liquidity.

- Greater dynamism in dollarized segments: projects in wells, boutique developments and opportunities in premium locations show moderate traction.

- Real estate as a store of value: in a still volatile environment, real estate continues to be the preferred vehicle to protect capital in contexts of uncertainty, especially in off-market operations.

Emerging Trends in the Argentina Real Estate Market: Outlook for 2025

After a 2024 marked by macroeconomic correction and regulatory reorganization, 2025 is projected as a key stage to observe signs of selective reactivation in the Argentine real estate market. Although fiscal and monetary adjustment will continue to condition access to credit and short-term demand, significant movements are anticipated in different segments of the sector, particularly among investors with strategic planning capacity.

- Progressive revaluation of undervalued assets

With real estate prices in dollars still below their historical peaks (20%-30% cumulative fall since 2018), some analysts expect that if current trends continue, there may be selective price stabilization or recovery in consolidated areas by 2025..

This phenomenon would be led by:

- Market participants with access to hard currency.

- Private funds and regional family offices that anticipate macroeconomic stabilization.

- Reversal of expectations around the free dollar and exchange rate unification.

- Consolidation of the traditional rental market

After the repeal of the Rental Law in 2023, the urban rental market is expected to consolidate more dynamically in 2025:

- Increase in the formal offer, with more flexible contracts and in dollars.

- Professionalization of small owners (use of platforms, delegated management).

- Increased price segmentation based on location, amenities, and duration.

- Rise of temporary rental and reconversion of assets

The short-term rental model, driven by platforms such as Airbnb, will continue to expand, especially in cities with strong tourist attraction or digital nomads (Buenos Aires, Mendoza, Bariloche, Córdoba).

- Reconversion of offices or studio apartments in disuse.

- Micro developments are aimed exclusively at short rentals.

- Greater local regulatory pressure to formalize the activity.

- Reactivation of developments

With the partial return of credit and a construction cost environment still competitive in dollars, “from the pit” developments with staged financing (fiduciary, pre-sale) will gain ground:

- In metropolitan and suburban areas with unmet demand.

- Small-scale projects, less exposed to macro risk.

- Products aimed at the middle class with affordable plans in adjusted pesos.

- Logistics, industrial and business parks as a focus of interest

E-commerce, the reconfiguration of logistics chains and the growth of agriculture will continue to drive interest in modern industrial spaces, logistics warehouses, technology parks and intermodal nodes:

- High demand for functional, flexible assets close to urban centers.

- Foreign capital interest in agricultural and agro-industrial areas of the NOA and NEA.

- Provincial tax incentives as a key variable for localization.

- Potential for public-private partnerships (PPPs) on state soil

In the context of retraction of direct public investment, PPPs could emerge as a tool to boost urban and housing development:

- Urban planning agreements and transfer of public land for mixed developments.

- Opportunities in former railway properties, port areas, highway edges.

- Articulation with local governments as a bridge to unblock projects.

Real estate events in Argentina for 2025

- Expo Construir 2025. May 7 and 8, 2025

Description: Expo Construir is positioned as the epicenter of innovation, where leading companies present the latest trends, technologies and products that are transforming the construction industry. For two days, it brings together entrepreneurs, developers, builders, suppliers and influential experts, becoming the definitive meeting point of the sector. This event offers a unique platform for networking, learning, and exploring new business opportunities.

More information: https://expoconstruir.com/

2nd Argentine Congress of Infrastructure and Construction May 15 and 16, 2025

The cycle will offer master classes, round tables, conferences and various stands. The main topics of the Congress will focus on major infrastructure projects for the country’s development, public works concessions and public-private partnership (PPP), environmental aspects related to infrastructure projects, international management and financing, artificial intelligence and new technologies, as well as social projects and community development.

More information: https://cpic.org.ar/primer-congreso-argentino-de-infraestructura-y-construcciones/

- Expo Real Estate Argentina. August 28 & 29, 2025

It is the most relevant real estate investment and development event in Latin America, in its 17th edition in Argentina. For two intense days, it brings together developers, brokers, architects, investors and leaders in the sector to present projects, share knowledge and generate high-level networking. It includes a fair with more than 150 exhibitors, conferences with international references and training spaces for professionals in the field. Organizers: SyG Group

More information: https://exporealestatelatam.com/

- Argentina GRI Real Estate 2025

Buenos Aires – Estimated date: September 2025 (to be confirmed)

The GRI Club meeting for Argentina brings together the main leaders of national and international real estate. Through closed debates and round tables, C-level executives and developers analyze the structural challenges of the local market, the evolution of financing, the arrival of international funds and opportunities in segments such as residential, logistics and industrial rent.

More information: https://www.griclub.org/club/real-estate/gri-club-latam_27

- Real Estate Market Seminar 2025 – Universidad Torcuato Di Tella

Buenos Aires – May 2025 (exact date to be confirmed)

Academic and business event that addresses the economic, regulatory and behavioral perspectives of the real estate market in Argentina. Economists, developers and legal experts participate, with a focus on the evolution of prices, construction activity and the challenges of financing in inflationary contexts.

Organizers: UTDT Business School

- National Congress of Real Estate Development and Investment 2025

Regional meeting that brings together the main real estate players in the interior of the country. It includes roundtables on investment opportunities in suburban corridors, new models of affordable housing and urban reconversion strategies in intermediary cities. Organizers: Chamber of Real Estate Developers of Rosario – Business Association of Rosario

- National Meeting of Real Estate Chambers 2025

Córdoba – June 12 and 13, 2025 – 10:00am to 6:00pm | ART (GMT-3)

Event that brings together representatives of provincial and municipal real estate chambers to discuss public policies, legal framework and professional challenges of real estate brokerage in Argentina. Issues such as access to housing, new technologies for intermediation and regulatory proposals are also addressed.

Organizers: FIRA (Real Estate Federation of the Argentine Republic)

Explore upcoming opportunities, expand your network, and stay up to date with key industry trends. Check our calendar here: A.CRE Events

Some of the main Real Estate Projects in Argentina

Located in the Puerto Madero district, the Harbour Tower is a 194-meter-high residential tower that is part of the Madero Harbour complex. This development includes office buildings, residences, a hotel in project, convention center, gastronomic promenade and green areas. Designed with LEED standards, it incorporates sustainable technologies such as solar panels and rainwater recovery.

Designed by the Foster and Partners studio, this office tower under construction is located at the intersection of Córdoba Avenue and Alem Avenue. With a triangular design and sustainable materials, the building seeks to obtain LEED Gold certification. It will have open public spaces and gardens integrated into its structure.

Located in the General Paz neighborhood of Cordoba, Greenlife III is a collaboration between Vistas360 and other developers. This residential project focuses on offering modern units with amenities and green spaces, adapting to contemporary housing trends

A continuation of the successful Betania Urbano, Más Urbano is a development of 32 residential units in the Nueva Córdoba neighborhood. The project seeks to attract young professionals and students, offering modern design and strategic location.

Presented by Grupo GCH, Orion Parque is a multifunctional development that will include residences, offices and commercial spaces. Designed with a futuristic approach, the project seeks to adapt to new urban and technological needs.

Near Del Libertador and Cabildo avenues, more than 20 real estate projects are being carried out with investments that exceed USD 250 million. These developments take advantage of the area’s efficient urban infrastructure and environmental quality.

Chart: Construction Activity (Annual Growth)

Source: https://www.indec.gob.ar/indec/web/Nivel4-Tema-3-3-42

Conclusion: What’s Next for the Argentina Real Estate Market?

The Argentine real estate market is at a structural crossroads. After several years of real deterioration in prices, a fall in construction activity and the absence of mortgage credit, 2024 has marked the beginning of a complex but promising transition. The shift in macroeconomic approach—based on fiscal discipline, market liberalization, and institutional deregulation—has begun to reshape the environment for developers, investors, and end-users.

In the short term, the scenario is characterized by a contracting economy, still high inflation and restrictions on access to financing for average demand. Despite this, there are signs of a bottom in real estate values, a slight reactivation of mortgage credit and greater regulatory flexibility that favors the dynamism of certain segments such as traditional rentals, temporary rentals and developments from wells.

At the institutional level, the implementation of the RIGI, the repeal of the Rental Law and the creation of new tools such as divisible mortgages, aim to rebuild the minimum conditions for the sustainable growth of the sector. However, the effective traction of investment, particularly foreign investment, will depend on the political continuity of reforms, the sustained slowdown in inflation, and the recovery of purchasing power.

Looking ahead to 2025, projections suggest a selective recovery scenario:

- Investors with liquidity will continue to lead the activity in an environment of still attractive prices in dollars.

- Sustainable and multifunctional projects will be preferred for their adaptability to new urban demands.

- Segments such as logistics, short rentals and suburban developments will show greater dynamism in the face of the sluggishness of the mid-residential market.

- Key events such as Expo Real Estate and the return of institutional capital will mark relevant milestones in the reactivation of the sector.

In summary, the Argentina real estate market remains highly complex, with a variety of evolving factors that professionals are watching closely for shifts in potential risks and opportunities. Understanding its cyclical logic, its dollarized structure, the evolution of its regulatory frameworks and its deep-rooted culture of refuge in bricks and mortar will be key to operating intelligently and capturing opportunities in a country that, historically, rewards those who know how to anticipate its structural turns.

References

- Infobae. (2024, August 28). Prices of homes for sale rose 5.7% so far in 2024: it is the first sign of recovery in 6 years. https://www.infobae.com/economia/2024/08/28/los-precios-de-las-viviendas-en-venta-subieron-57-en-lo-que-va-2024-es-primera-senal-de-recuperacion-en-6-anos/

- Infobae. (2025, February 24). Mortgage credit grew again and reached the best level since 2018 in 2024. https://www.infobae.com/economia/2025/02/24/el-credito-hipotecario-volvio-a-crecer-y-alcanzo-en-2024-el-mejor-nivel-desde-2018/

- INDEC. (2024, August). Synthetic indicator of construction activity (ISAC). National Institute of Statistics and Censuses. https://www.indec.gob.ar/uploads/informesdeprensa/isac_08_24AAD4420D27.pdf

- Habitat Observatory. (2024, May). Construction Licenses – March 2024. https://observatoriohabitat.org/wp-content/uploads/2024/05/LC_Marzo_2024-1.pdf

- IDECOR. (2024). Urban land: consult the map with the georeferenced values of 2024. Government of Cordoba. https://www.idecor.gob.ar/suelo-urbano-consulta-el-mapa-con-los-valores-georreferenciados-de-2024/

- BAE Business. (2025, February 13). Foreign investment had the worst year of the century in 2024. https://www.baenegocios.com/economia/La-inversion-extranjera-tuvo-en-2024-el-peor-ano-del-siglo-20250213-0099.html

- Reuters. (2025, May 5). YPF and Israel’s XtraLit will invest in lithium with clean technology in Argentina. https://www.reuters.com/latam/negocio/P5XUWG4435NPFPM3JGOUPQFCDA-2025-05-05/

- Argentine Politics. (2025, March). The cost of construction doubled in 2024 while home prices remained stable. https://www.politicargentina.com/notas/202503/64708-el-costo-de-la-construccion-se-duplico-en-2024-mientras-el-precio-de-las-viviendas-se-mantuvo-estable.html

- iProfessional. (2025). How many operations were made with mortgage credit in Argentina in 2024. https://www.iprofesional.com/realestate/423551-cuantas-operaciones-hicieron-credito-hipotecario-argentina-2024

- La Voz Inmobiliaria. (2024). Real estate market developments and projects for 2025. https://lavozinmobiliaria.com.ar/nota/3466/desafios–desarrollos-y-proyectos-del-mercado-inmobiliario–de-cara-al-2025/

- InfoConstrucción. (2024). The buildings and developments that are coming this 2025. https://infoconstruccion.com.ar/mercado-inmobiliario-los-edificios-y-desarrollos-que-se-vienen-este-2025/

- Infobae. (2024, December 29). It is going up: challenges, developments and projects of the real estate market in the face of a 2025 in which it will go for its recovery. https://www.infobae.com/economia/2024/12/29/se-va-para-arriba-desafios-desarrollos-y-proyectos-del-mercado-inmobiliario-de-cara-a-un-2025-en-que-ira-por-su-recuperacion/

- CEDU. (2024, January 7). Which are the neighborhoods in CABA that will lead the construction? https://cedu.com.ar/2024/01/07/cuales-son-barrios-caba-que-lideraran-construccion/

- https://www.globalpropertyguide.com/latin-america/argentina/price-history

- Central Bank of the Argentine Republic. (2024). The BCRA lowered the monetary policy rate and strengthened control over monetary programming. https://www.bcra.gob.ar/

- BBC News. (2024). Argentina country profile. https://www.bbc.com/

- Association of Notaries of the City of Buenos Aires. (2024). Number of deeds of sale executed in April 2024. https://www.colegio-escribanos.org.ar/

- Financial Times. (2024). Argentina’s pro-business outlook lures buyers back to Buenos Aires. https://www.ft.com/

- Fitch Ratings. (2024). Fitch affirms Argentina at ‘CC’. https://www.fitchratings.com/

- Focus Economics. (2024). Argentina: GDP slides at a more pronounced pace in Q4. https://www.focus-economics.com/

- Global Property Guide. (2024). Gross rental yields in Argentina: Buenos Aires and 2 other cities. https://www.globalpropertyguide.com/

- (2024). Everyone sells, no one buys: there are 163,000 Buenos Aires apartments for sale and less than 2% of the transactions are completed. https://www.infobae.com/

- (2024). The rise in Buenos Aires rental prices slowed down. https://buysellba.com/

- National Institute of Statistics and Census (INDEC). (2024). Indicators of the conjuncture of construction activity. May 2024. https://www.indec.gob.ar/

- International Monetary Fund. (2024). Argentina. https://www.imf.org/

- International Monetary Fund. (2024). IMF Executive Board completes the eighth review of the extended arrangement under the Extended Fund Facility for Argentina. https://www.imf.org/

- (2024). Argentine Central Bank eases foreign exchange regulations for micro, small, and medium companies to access the FX market. https://www.lexology.com/

- CABA Real Estate Market. (2024). CABA: Strong rise in deeds. March 2024. https://mercadoinmobiliariocaba.com/

- Real Estate Report. (2024). M2 real: values continue to rise. https://www.reporteinmobiliario.com/

- (2024). Argentina enters technical recession as job losses mount under Milei. https://www.reuters.com/

- (2017). Argentina’s Macri boosts mortgage credits to win back middle class. https://www.reuters.com/

- S&P Global. (2023). Argentina’s balance between debt and fiscal management and electoral objectives in 2023. https://www.spglobal.com/

- Trading Economics. (2024). Argentina consumer price index. https://tradingeconomics.com/

- Trading Economics. (2024). Argentina government debt to GDP. https://tradingeconomics.com/

- (2024). The average price registered an increase of 4.3% in the first half of 2024. https://www.zonaprop.com.ar/

Frequently Asked Questions about Argentina’s Real Estate Market

How has the Argentine real estate market been affected by recent macroeconomic reforms?

Recent reforms, including Decree 70/2023, have led to deregulation, price liberalization, and fiscal tightening. These have improved macroeconomic indicators such as inflation and exchange rate stability but caused short-term GDP contraction. The real estate sector is slowly stabilizing, with “signs of a bottom in property prices” and renewed investor interest.

What trends are emerging in housing prices in Argentina?

In 2024, nominal apartment prices in Buenos Aires rose by 5.49% YoY, yet in real terms, prices are still down 71.6% from inflation-adjusted levels. Values remain 20–25% below their 2019 peak, though a modest recovery is underway with prices “marking the first sign of recovery in six years.”

Has mortgage financing improved in Argentina?

Yes. In 2024, over 11,000 mortgages were granted — the highest number since 2018 — due to falling interest rates and new tools like the “future good mortgage” and “divisible mortgage,” which are aimed at improving housing access.

What are the main challenges facing the construction sector in Argentina?

Construction activity dropped sharply in 2024, with the ISAC falling 35.2% YoY in June and housing approvals down 35.7% in Q1 2024. Causes include reduced public works, macro instability, and delayed investment, though a 15.8% uptick in March 2025 offers a potential turnaround.

Which real estate segments show growth potential in Argentina for 2025?

Segments with strong outlooks include temporary rentals (8–10% returns), boutique developments, suburban housing, logistics parks, and “from the pit” developments. Traditional rentals are also recovering after the repeal of the Rental Law, enabling more flexible leasing arrangements.

What role does foreign direct investment (FDI) play in Argentina’s real estate market?

FDI in real estate remains marginal. Although reforms generated optimism, total FDI in Q3 2024 was just USD 2.395 billion, among the lowest since 2003. Some foreign investors are in the due diligence stage, but confidence remains cautious due to volatility.

What is the Large Investment Incentive Regime (RIGI) and how does it affect real estate?

RIGI offers long-term tax and customs benefits for strategic investments over USD 200 million. While it has attracted interest in mining and energy, “it has not yet had traction in traditional real estate” due to its initial exclusion from eligible sectors.

How are building permits and land values trending across Argentina?

Permitted building area fell to its lowest in four years in early 2024, but average project size increased. Provincial median land values were ~USD 32/m², with premiums in areas like Plaza España, Córdoba (up to USD 5,500/m²). Suburban zones offer development opportunities.

What is the outlook for Argentina’s real estate sector in 2025?

2025 is projected to bring selective reactivation, especially for investors with liquidity. Drivers include price stabilization, reactivated mortgages, deregulation, and growth in short-term rentals and logistics. Recovery will hinge on inflation control, policy continuity, and sustained credit access.