Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

All-in-One (Ai1) Model for Underwriting Development and Acquisitions (Updated July 2025)

As many of you recall, in 2015 I set out to build an Excel alternative to the widely-used (and now discontinued) ARGUS DCF. With career moves and a lot of other A.CRE-related side projects, this undertaking has been slow going. Alas, in 2016…

Hold-Sell Analysis in Real Estate (Updated June 2024)

In course 3 of our A.CRE Accelerator, we use a case study that revolves around a hold-sell (i.e. hold vs sell) analysis scenario to teach the anatomy of the real estate DCF. In that scenario, the student is an asset manager working for an open-end…

All-in-One (Ai1) Walkthrough #2 – Office, Retail, Industrial Rent Roll Tab

This walkthrough, our second in the series, will detail how to use the office/retail/industrial rent roll (see ORI-RR Tab). The rent roll tab is arguably the most important, and most complex, tab in the All-in-One model. Below we post a video…

Modeling a Mortgage Loan Assumption Using the All-in-One

I recently had a discussion in the All-in-One support forum about how to model a mortgage loan assumption using my All-in-One Model for Underwriting Acquisitions and Development. Prior to version 0.77, this required manually overriding various…

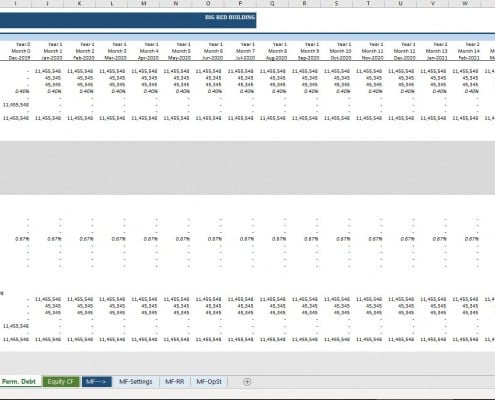

All-in-One (Ai1) Walkthrough #1 – Permanent Debt Tab (Updated Nov 2019)

In an effort to provide greater instruction on how to use our All-in-One Underwriting Tool for Real Estate Development and Acquisition, we've developed a series of walkthrough videos and posts on the methodology behind the various components…

Quick Tutorial: Add Line Items to OpSt Sheet in All-in-One

I was recently asked the question whether it's possible to add more other income or operating expense line items to the MF-OpSt or ORI-OpSt worksheets in my All-in-One Model for Underwriting Acquisitions and Development. Short answer is: out…

Understanding Treatment of Time 0 in the All-in-One Model

I received a very astute question/concern from a user of our All-in-One(Ai1) model in our Ai1 Support Forum late last month. I initially set out to answer the question in writing, but the more I thought about my response, the more I concluded…

All-in-One (Ai1) Walkthrough #10 – Underwriting a Value-Add Office Investment

This walkthrough, our tenth in the series, takes you through the entire process of underwriting a hypothetical office value-add opportunity using the All-in-One (Ai1) Model. This walkthrough comes as a response to a question we recently received…

All-in-One (Ai1) Walkthrough #9 – Print Mode and the IRR Matrix Report

This walkthrough, our ninth in the series, touches on the newly added (beta v0.5.3) 'Print Mode' and IRR Matrix Report in our All-in-One (Ai1) model. Print mode further enhances the printability of the model while the IRR Matrix Report adds…

All-in-One (Ai1) Walkthrough #8 – Tenancy Analysis Report for Office, Retail, and Industrial

This walkthrough, our eight in the series, explains how the Tenancy Analysis report for office, retail, and industrial real estate underwriting works in our All-in-One (Ai1) model. The Tenancy Analysis report includes a tenant rollover schedule,…

New Support Forum for the All-in-One (Ai1) Underwriting Model

Since releasing the first beta version of the All-in-One Underwriting Model, we've fielded hundreds of emails related to the model. Inquiries range from questions to feature requests to thank yous. We welcome the chance to interact with our…

All-in-One (Ai1) Walkthrough #7 – Ground Lease Valuation Module

This walkthrough, our seventh in the series, explains how the Ground Lease Valuation Module works and how to implement this tool into your analysis. The All-in-One Model includes two methods to account for a ground lease. The first is to simply…

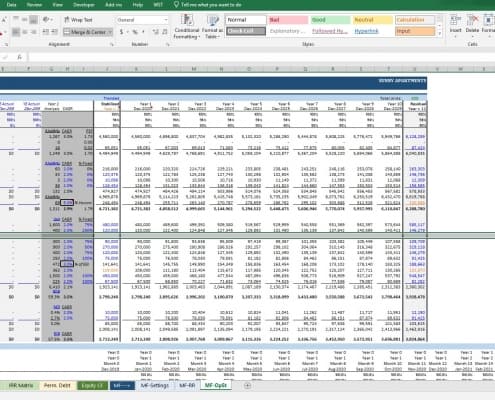

All-in-One (Ai1) Walkthrough #6 – Underwriting a Hypothetical Multifamily Acquisition

This walkthrough, our sixth in the series, takes you through the entire process of underwriting an apartment acquisition opportunity using the All-in-One Model's new multifamily module. I've created hypothetical assumptions for this exercise…

A Note About The Limitations of Microsoft Excel in Modeling Real Estate

I think its important to point out that my All-in-One (Ai1) Underwriting Model for Real Estate Development and Acquisition is not a surefire replacement for your non-Excel valuation/underwriting solutions. In fact, it's likely you (or your employer)…

All-in-One (Ai1) Walkthrough #5 – The Residual Land Value Calculation Module

This walkthrough, our fifth in the series, explains how the Residual Land Value Calculation module works and how to implement this tool into your analysis. You might recall, a few months back we discussed the concept of residual land value…