Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

A.CRE Value-Add Apartment Acquisition Model (Updated Jun 2025)

We've shared a handful of apartment models over the years. Several of those are capable of analyzing apartment acquisitions but none was built for the express purpose of modeling value-add apartment deals. As a result, each has its limitations…

Condominium Development Model (Updated Jun 2025)

After posting the construction draw module that demonstrates how to calculate the true LTC of a development loan, I decided that since we have yet to publish a condo development model, to build upon that module to create one.

This condominium…

Office Real Estate Development Model (Updated Jun 2025)

I'm excited to share my Office Development Model in Excel. This pro forma analysis tool comes as I've continued to build and share specialty real estate models, tailor-made for specific investment scenarios and property types.

This model…

Land Development Model – Multi-Scenario (Updated Jun 2025)

Over the years, we've shared eight development-focused real estate financial models and numerous development-specific tools to the A.CRE Library of Excel Models. Nevertheless, there's been a hole in the development offerings in our library.…

Data Center Development Model

As the built environment evolves to meet the demands of an increasingly digital world, data centers have emerged as one of the most sophisticated and capital-intensive asset classes in commercial real estate. What was once considered a niche…

All-in-One (Ai1) Model for Underwriting Development and Acquisitions (Updated Jun 2025)

As many of you recall, in 2015 I set out to build an Excel alternative to the widely-used (and now discontinued) ARGUS DCF. With career moves and a lot of other A.CRE-related side projects, this undertaking has been slow going. Alas, in 2016…

Watch Me Build a Residential Land Development Model (Updated June 2025)

Over the years, we've created a sizable library of Watch Me Build videos covering Excel models for various real estate investment and property types. However, we've yet to create a Watch Me Build involving for-sale product. So this weekend,…

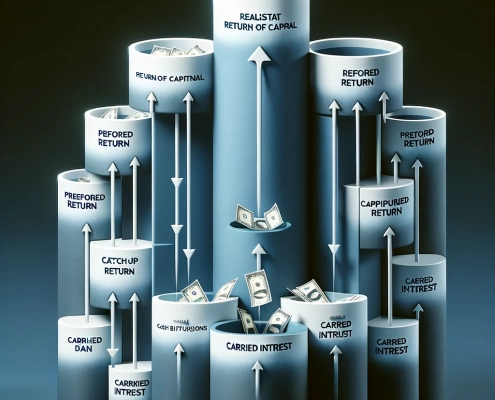

Real Estate Equity Waterfall Model – IRR and Equity Multiple Hurdles (Updated June 2025)

Over the years, this real estate equity waterfall with annual periods and IRR or Equity Multiple hurdles has been one of the most popular models in our library of real estate Excel models. It's been downloaded thousands of times and we've received…

A.CRE Build-to-Rent (BTR) Development Model (Updated May 2025)

Build-to-rent (BTR) has become more and more common in CRE and now accounts for a meaningful share of development. In the past, we've recommended A.CRE readers use our Apartment Development Model for BTR analysis. However, as we've received…

Single Tenant NNN Lease Valuation Model (Updated May 2025)

I originally built this single tenant net lease (NNN) valuation Excel model back in 2016. Based on some feedback from a few of our readers, I've since made quite a few updates (see v2.0 updates video below). This model is an attempt to re-think…

Self Storage Acquisition Model (Updated May 2025)

I've spent the past few weekends working on a purpose-built Self Storage Acquisition Model, and I'm now happy to share the result of that work with you. This is a model that's been requested by quite a few A.CRE readers over the past few years.…

Residential Land Development Pro Forma (Updated Apr 2025)

As many of you know, I started my career in residential land development first as a broker and later as a principal. During that time, I built my fair share of residential land development Excel pro formas, modeling returns and forecasting cash…

Short-Term Rental Acquisition Model

In today’s real estate landscape, short-term rentals (STRs) stand out as one of the most dynamic and potentially high-yield asset classes. From compact urban units serving business travelers to luxury vacation homes attracting high-net-worth…

Multifamily (Apartment) Acquisition Model (Updated Apr 2025)

Our library of real estate Excel models has a variety of decent apartment models, including our All-in-One model and our Apartment Development Model - both robust models in their own right. However, if you're looking for a straight multifamily…

Ground Lease Valuation Model (Updated Mar 2025)

The topic of ground leases has come up several times in the past few weeks. Numerous A.CRE readers have emailed to ask for a purpose-built Ground Lease Valuation Model. And I'm in the process of creating an Advanced Concepts Module for our real…