Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Loan Payment Schedule and Balance Tracking Tool (Updated Aug 2024)

A childhood friend called me this week and asked for a favor. He is the lender on a private real estate loan and was wanting a way to personally service the loan. Namely, he needed a tool to issue monthly invoices, track the principal vs interest…

Real Estate Equity Waterfall Model With Cash-on-Cash Return Hurdle (Updated Jul 2024)

Over the years, Michael and I have built and shared numerous real estate equity waterfall models, all multi-tiered and most with internal rate of return (IRR) hurdles. And as our readers have downloaded those models, I've received dozens of…

Analyzing a Real Estate Investment from the Perspective of an LP

We received a question from an A.CRE reader this week that I thought warranted a thorough response. The question was, and I paraphrase, "I am an LP looking for models to help vet syndication deals. Do you have any models that can be used to…

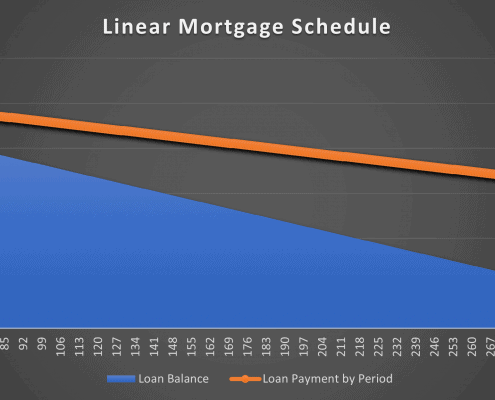

Linear Mortgage Payment Schedule Tool (Updated July 2024)

We recently shared a new modeling test to our library of real estate case studies entitled UK Debt Advisory Firm Modeling Test. In that case study, the test asked the real estate professional to analyze the returns of three different debt options.…

STNL Sales Comp Analysis Tool – Custom GPT by A.CRE

At A.CRE, we've built dozens of custom GPTs for internal and external purposes. Some of the GPTs have general application, while others are custom GPTs specifically for commercial real estate. And among those custom GPTs specifically for CRE,…

Watch Me Solve a REPE Technical Interview Modeling Test (Updated July 2024)

What better way to spend some free time over the Thanksgiving holiday, than to record myself completing a real estate private equity technical interview exercise! While I've offered help with the real estate technical interview in the past,…

An Overview Of IPMT and PPMT Excel Functions – Uses And Drawbacks (Model + Case Study)

We recently received an intriguing question in the Q&A section of the A.CRE Real Estate Financial Modeling Accelerator regarding the uses of the IPMT and PPMT Excel functions. As such, I’d like to take the opportunity to discuss it.

First…

Case Study #10 – Class A Industrial Warehouse + Rooftop Solar PV Plant (Case + Solution)

This case study explores a development of a 40-acre warehouse in Kasara, near Nashik, India. This industrial case study combines rental income with solar energy initiatives. In this article, we'll examine the financial strategies, including…

Hold-Sell Analysis in Real Estate (Updated June 2024)

In course 3 of our A.CRE Accelerator, we use a case study that revolves around a hold-sell (i.e. hold vs sell) analysis scenario to teach the anatomy of the real estate DCF. In that scenario, the student is an asset manager working for an open-end…

Underwriting a Tenant with Private Credit (Updated June 2024)

Recently, we had an Accelerator member ask a question about how to accurately determine a credit rating and spec income discount rate for a private tenant in a single tenant net lease deal. While the scenario specifically involved a medical…

A.CRE Geocoding Excel Add-in to Auto-Populate Latitude and Longitude in Excel (Updated Jun 2024)

The A.CRE Geocoding Excel Add-in uses the Google Geocoding API to automatically convert a given address to latitude and longitude coordinates, or to convert a given latitude and longitude coordinate to an address. The add-in makes auto-populating…

Why Your IRR and XIRR are Different (Updated June 2024)

This post was inspired by a question on our real estate financial modeling Accelerator forum. Additionally, Spencer and I frequently get emails asking about this very issue, which is 'why the IRR (internal rate of return) and XIRR (extended…

Case Study #5 – The Jefferson Branded Condo Development – Case Only (Updated June 2024)

This is the fifth in a series of commercial real estate case studies shared by A.CRE. These case studies are meant to help you practice to master real estate financial modeling. The Jefferson Branded Condo Development puts you in the position…

A.CRE 101: How to Use the Income Capitalization Approach to Value Income-Producing Property (Updated May 2024)

In commercial real estate, there are a few generally accepted methods for appraising (or valuing) real property. The three most common are the Cost Approach, the Sales Comparison Method, and the Income Approach. The Income Approach includes…

Forecasting After-Tax Cash Flow in Real Estate Analysis (Updated May 2024)

When modeling real estate investments, industry practice is generally to stop at before-tax cash flow, rather than after-tax cash flow. And this makes sense in most instances. No two owners of real estate have the exact same tax situation and…