Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Watch Me Build a Residential Land Development Model (Updated June 2025)

Over the years, we've created a sizable library of Watch Me Build videos covering Excel models for various real estate investment and property types. However, we've yet to create a Watch Me Build involving for-sale product. So this weekend,…

Tutorial on How to Model Irregular Growth Rates in Real Estate

When building a real estate financial model, managing income and expense growth is rarely as simple as applying a fixed growth rate year over year. In real estate investment analysis, growth assumptions need to be flexible, dynamic, and reflective…

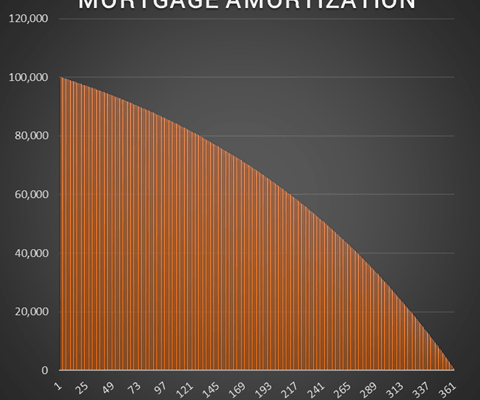

Watch Me Build a Dynamic Mortgage Amortization Table in Excel (Updated September 2024)

There are a few basic, yet fundamental, real estate modeling skills you must master before anyone will take you seriously as a real estate professional. Building a mortgage amortization schedule is one of them.

Virtually every model you…

Watch Me Build a 3-Tier Real Estate Equity Waterfall Model (Updated Aug 2024)

As I've mentioned in other Watch Me Build posts, one way to become a better real estate financial modeling professional, is to watch other professionals model. Thus, the more exposure you can get to other's methods, the more adept a real estate…

How to Run Monte Carlo Simulations in Excel (Updated Aug 2024)

So you want to run Monte Carlo simulations in Excel, but your project isn't large enough or you don't do this type of probabilistic analysis enough to warrant buying an expensive add-in. Well, you've come to the right place. Excel's built-in…

Watch Me Solve a REPE Technical Interview Modeling Test (Updated July 2024)

What better way to spend some free time over the Thanksgiving holiday, than to record myself completing a real estate private equity technical interview exercise! While I've offered help with the real estate technical interview in the past,…

Hold-Sell Analysis in Real Estate (Updated June 2024)

In course 3 of our A.CRE Accelerator, we use a case study that revolves around a hold-sell (i.e. hold vs sell) analysis scenario to teach the anatomy of the real estate DCF. In that scenario, the student is an asset manager working for an open-end…

A.CRE Geocoding Excel Add-in to Auto-Populate Latitude and Longitude in Excel (Updated Jun 2024)

The A.CRE Geocoding Excel Add-in uses the Google Geocoding API to automatically convert a given address to latitude and longitude coordinates, or to convert a given latitude and longitude coordinate to an address. The add-in makes auto-populating…

Why Your IRR and XIRR are Different (Updated June 2024)

This post was inspired by a question on our real estate financial modeling Accelerator forum. Additionally, Spencer and I frequently get emails asking about this very issue, which is 'why the IRR (internal rate of return) and XIRR (extended…

A.CRE 101: How to Use the Income Capitalization Approach to Value Income-Producing Property (Updated May 2024)

In commercial real estate, there are a few generally accepted methods for appraising (or valuing) real property. The three most common are the Cost Approach, the Sales Comparison Method, and the Income Approach. The Income Approach includes…

Watch Me Build – Modeling a Rent Schedule in Both Excel and Using AI (Updated May 2024)

In this Watch Me Build video I show you how to build a custom rent schedule module for long-term leases. The foundation of the module is a simple INDEX/MATCH combination that takes a rent schedule and models the rent cash flows across the entire…

Hide and Unhide Tabs using Drop-down Menus in Excel (Updated Apr 2024)

I'd like to share a handy little trick I learned this week for hiding and unhiding tabs in Excel using drop-down menus. Now this method requires you to use some basic VBA code and to save the Workbook as a Macro-Enabled file but don't be intimidated…

Watch Me Build – American-Style Real Estate Equity Waterfall (Updated Apr 2024)

A few years ago, I recorded my screen as I built a 3-tier real estate equity waterfall model. What I didn't mention in that Watch Me Build video, is that the kind of waterfall I built is colloquially called a European-style equity waterfall.…

Modeling a Property Tax Abatement in Real Estate (Updated Jan 2024)

We often field questions about how to model property tax abatements. It's a concept we cover in our the 'Advanced Modeling - Property and Portfolio' endorsement in our Accelerator real estate financial modeling training program and something…

Using an IRR Matrix to Determine Hold Period (Updated Dec 2023)

When building a real estate financial pro forma, it's important to model for and include a summary of various return and risk metrics. Among the different return metrics, the internal rate of return (IRR) - both on an unlevered and levered…