Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

A.CRE Value-Add Apartment Acquisition Model (Updated Jun 2025)

We've shared a handful of apartment models over the years. Several of those are capable of analyzing apartment acquisitions but none was built for the express purpose of modeling value-add apartment deals. As a result, each has its limitations…

All-in-One (Ai1) Model for Underwriting Development and Acquisitions (Updated Jun 2025)

As many of you recall, in 2015 I set out to build an Excel alternative to the widely-used (and now discontinued) ARGUS DCF. With career moves and a lot of other A.CRE-related side projects, this undertaking has been slow going. Alas, in 2016…

Single Tenant NNN Lease Valuation Model (Updated May 2025)

I originally built this single tenant net lease (NNN) valuation Excel model back in 2016. Based on some feedback from a few of our readers, I've since made quite a few updates (see v2.0 updates video below). This model is an attempt to re-think…

Real Estate Debt Module in Excel (Updated May 2024)

I thought I'd share the real estate debt module I originally built for the ARGUS alternative in Excel. Most debt modules I've seen in real estate financial models only include the ability to model fully amortizing senior debt. Mike challenged…

Construction Draw and Interest Calculation Model (Updated Feb 2024)

I originally uploaded this equity/construction loan draw and interest calculation tool to our library of real estate financial analysis models in 2016. Over the years, I've continued to update it as suggestions, comments, and requests…

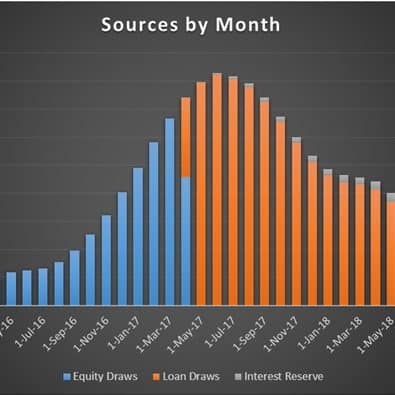

Real Estate Sources and Uses of Capital Module (Updated Feb 2024)

An important component in any acquisition, development, and value-add model is the Sources and Uses of Capital section. Of course, how the sources and uses are modeled and how those cash flows are visualized will vary from one model to the next.…

Real Estate Development Tracker (Updated Feb 2024)

One of the many challenges of both analyzing real estate development deals and managing development projects is understanding and tracking the numerous differing but intertwining work streams. The more a development team takes the time…

Using an IRR Matrix to Determine Hold Period (Updated Dec 2023)

When building a real estate financial pro forma, it's important to model for and include a summary of various return and risk metrics. Among the different return metrics, the internal rate of return (IRR) - both on an unlevered and levered…

Student Housing Acquisition Model (Updated Apr 2023)

I've spent a fair amount of my career analyzing privately-owned student housing investments. Nevertheless, I've yet to share a purpose-built, institutional-quality student housing acquisition model. So, I thought I'd take some time and build…

Create A Dynamic Revenue Row to Calculate Multiple Tenant Leases (Updated Nov 2022)

I recently received an email from one of our readers asking how to create a dynamic revenue row for a pro forma that can capture rent changes for multiple tenants. I thought that this would make a great post for the site and would be a good…

A.CRE Hotel Valuation Model in Excel (Updated Sept 2022)

I am excited to introduce our new Hotel Valuation (Acquisition) Model to underwrite both stabilized and value-add hotel opportunities. This hotel pro forma is designed to allow users to do everything from a quick back of the envelope exercise…

Physical Occupancy Calculation Model for Real Estate (UPDATED MAY 2022)

As many of you know, I'm in the midst of moving my family from Milwaukee to Dallas, and quite frankly I'm getting sick of eating out and sleeping in hotel rooms. So what better way to unwind from hours of whining kids and tiresome travel, than…

Pro Forma For Multifamily Renovation (Updated 11.17.2021)

I'm excited to share the Pro Forma for Multifamily Renovation model with all of you. This multifamily renovation model is made to analyze value add apartment acquisition opportunities and has a lot of functionality that is meant to provide you…

Tutorials for A.CRE Value-Add Apartment Acquisition Model

As promised, I'm following up the release of the A.CRE Value-Add Apartment Acquisition model with a series of walk-throughs and tutorials to help you better understand the various elements of the model. The tutorials start with the basics -…

Multifamily Redevelopment Model (Updated June 2020)

This is an Excel model I originally built from scratch back in 2015 for quickly assessing multifamily redevelopment opportunities. It was designed to work best for scenarios where individual units will be rehabbed over the hold at varying times.…