Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Watch Me Build a Residential Land Development Model (Updated June 2025)

Over the years, we've created a sizable library of Watch Me Build videos covering Excel models for various real estate investment and property types. However, we've yet to create a Watch Me Build involving for-sale product. So this weekend,…

Best Practices in Real Estate Financial Modeling (Updated Nov 2024)

Before you use one of our real estate financial models (i.e. Excel templates), or before you set out to build your own real estate analysis tool in Excel, it's important to keep in mind a few real estate financial modeling best practices. This…

Learning Real Estate Financial Modeling in Excel (Updated Oct 2024)

We're often asked by our readers how we learned to be proficient in real estate financial modeling. The question usually arises because the person wants to know how to model real estate in Excel to either land a job in commercial real estate…

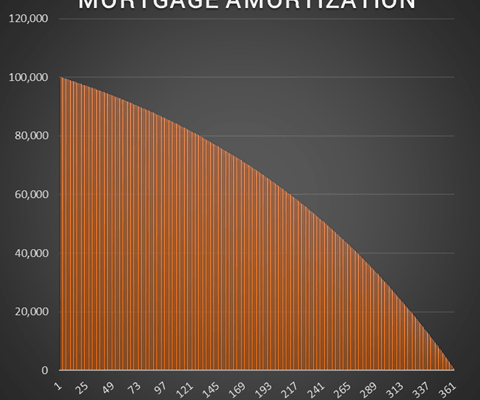

Watch Me Build a Dynamic Mortgage Amortization Table in Excel (Updated September 2024)

There are a few basic, yet fundamental, real estate modeling skills you must master before anyone will take you seriously as a real estate professional. Building a mortgage amortization schedule is one of them.

Virtually every model you…

Deep Dive – Land Acquisition and Assemblage (Updated September 2024)

This is a topic I'm all too familiar with. You see, I cut my teeth in real estate largely sourcing and negotiating residential and mixed-use land acquisition opportunities. I've put land deals together both as a fiduciary and as a principal,…

Watch Me Build a 3-Tier Real Estate Equity Waterfall Model (Updated Aug 2024)

As I've mentioned in other Watch Me Build posts, one way to become a better real estate financial modeling professional, is to watch other professionals model. Thus, the more exposure you can get to other's methods, the more adept a real estate…

A.CRE 101: How To Use The Discounted Cash Flow (DCF) Method To Value Income Producing Property (Updated Aug 2024)

The Discounted Cash Flow Method is a method to value a project by taking all future projected cash flows of the project and discounting them back to time zero (date of purchase) using a predetermined discount rate (the discount rate when used…

Using SUMPRODUCT to Calculate Weighted Average in Real Estate (Updated Aug 2024)

In my experience, using the SUMPRODUCT function in Excel to calculate weighted average is one of the most oft-used Excel techniques in real estate financial modeling. I learned this technique on day one of my first real estate internship and…

Using the Cash-on-Cash Return in Real Estate Investment Analysis (Updated Aug 2024)

I’ve fielded a handful of Cash-on-Cash (CoC) return questions of late. So, I thought it would be worthwhile to write a post on what the Cash-on-Cash return metric tells me about a potential real estate investment. This article is a primer,…

The Road To A Stabilized NOI – Underwriting Real Estate Capital Reserves (Case Study – Case Only)

Achieving a stabilized Net Operating Income (NOI) in real estate requires careful planning and sound execution. One element that can cause confusion is when underwriting capital reserves. Should they go above the line (i.e., as an Operating…

Analyzing a Real Estate Investment from the Perspective of an LP

We received a question from an A.CRE reader this week that I thought warranted a thorough response. The question was, and I paraphrase, "I am an LP looking for models to help vet syndication deals. Do you have any models that can be used to…

Watch Me Solve a REPE Technical Interview Modeling Test (Updated July 2024)

What better way to spend some free time over the Thanksgiving holiday, than to record myself completing a real estate private equity technical interview exercise! While I've offered help with the real estate technical interview in the past,…

Deep Dive – Sources of Capital: Real Estate Private Equity (Updated July 2024)

Capital for commercial real estate investments is generally sourced from one or more of the following buckets: public equity, public debt, private equity, or private debt. In my experience, few people fully understand these four buckets of capital,…

From Data to Decisions: Analyzing Real Estate Trends to Forecast Market Growth

Real estate market trend analysis is crucial for experienced professionals to identify up-and-coming neighborhoods. On a gut level, driving the streets of a community and engaging with residents, even for just an hour or two, can provide a clear…