Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

A.CRE 101: CRE Risk Profiles (Updated May 2023)

In this post we will go into detail about the four CRE risk profiles commonly ascribed to commercial real estate opportunities. In order of least risky to most risky, they are as follows:

Core

Core Plus

Value Add

Opportunistic

This…

4-Tier Equity Multiple Waterfall – Download and Watch Me Build (UPDATED APR 2022)

Here is a simple, yet very powerful, 4-tier equity multiple waterfall module. This post contains both a completed version of the module ready to plug into a real estate financial model as well as a 'Watch Me Build' template and companion video…

Bite-Sized CRE Lessons – A.CRE 30 Second Video Tutorials

As we continue to build out our A.CRE 101 series and our Glossary of Commercial Real Estate terms, we've started to supplement these initiatives with short (<30 second) video clips on how to do various CRE calculations and modeling tasks…

Keyboard Shortcuts I Use Constantly When Modeling in Excel (Formatting)

The more you model real estate in Microsoft Excel, the faster and more accurate you become - and hopefully as a consequence the more valuable you become to real estate employers and investors. Part of the process of mastering real estate financial…

Watch Me Build – IRR Partitioning in Excel

In this post, I'd like to show you how to partition the internal rate of return of your real estate investment in Excel. I also throw in a quick equity multiple partition, to highlight how the time value of money affects your returns. I've recorded…

The “Secret” to Learning Real Estate Financial Modeling

Just like any skill in life, there are tips and tricks to learning that skill. Some suggestions are more helpful than others, although all contribute in some way. In this episode, we share one of the more valuable tips - what our marketing team…

Watch Me Build – Capital Stack with Mezzanine Debt

One of the more difficult aspects of modeling a real estate development is figuring out how to handle equity and debt cash flows. This becomes all the more difficult when a second tranche of debt is introduced. In this Watch Me Build video,…

All You Need to Know About Real Estate Gross-Ups

"Gross-up" clauses have caused confusion, and occasionally consternation, amongst tenants signing commercial leases for the first time. While many tenants are happy to pay for building services they use on a daily basis, many are riled when…

Watch Me Build a Tenant Rollover Analysis Model

The feedback has been positive on the ‘Watch Me Build a Multifamily Model’ video I recorded earlier this year. So I thought I’d follow that up with another. This time I build a Real Estate Tenant Rollover Analysis Model and talk through…

Watch Me Build a Multifamily Real Estate Model (Updated Feb 2020)

One way to become a better real estate financial modeling professional, is to watch other professionals model. I know in my career being able to physically see how others tackle different modeling problems has shaped my methods and made me better…

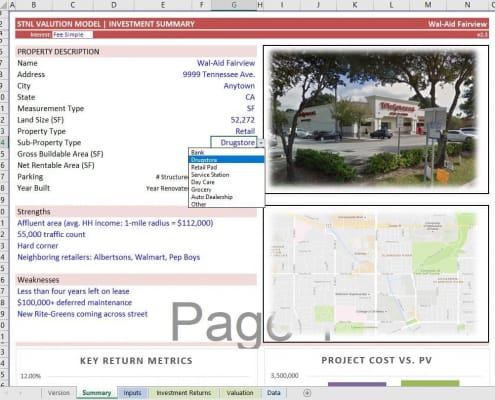

Create Dynamic Sub-Property Type Drop-Down Menus in Excel

A few years ago, I created a tutorial on building smart drop-down menus in Excel using dynamic named ranges and data validation lists. This offered a great way to have drop-down menus in your model that could be easily changed by the user to…

Watch Me Build Data Tables For Real Estate Sensitivity Analysis

This is a 3 part mini-series on using data tables in Excel to perform real estate sensitivity analysis. In this series, I'll walk you through how to build both one-variable and two-variable data tables in parts 1 and 2. And in Part 3, I'll walk…

Watch Me Build A Construction Draw Schedule (Updated Jan 2020)

In the following video, I record my screen and narrative my steps as I build a basic construction draw schedule. I've also included the template and completed worksheets from this Watch Me Build exercise.

Are you an Accelerator member? See…

Watch Me Expand the Home Construction Pro Forma

I'm regularly asked to expand my single family home construction pro forma to analyze the construction of more than one home. I've contemplated adding that functionality to the model, but it is such a custom task that no template could really…

Roll Up Your Monthly Cash Flow Line Items Into Annual Periods Using Only One Formula For The Whole Sheet

While building out my hotel development model (currently underway), I decided to take a break and record a video about how I roll up the monthly cash flow line items on my Monthly Cash Flow sheet into annual cash flow line items on a separate…