Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Real Estate Equity Waterfall Model – IRR and Equity Multiple Hurdles (Updated June 2025)

Over the years, this real estate equity waterfall with annual periods and IRR or Equity Multiple hurdles has been one of the most popular models in our library of real estate Excel models. It's been downloaded thousands of times and we've received…

Ground Lease Valuation Model (Updated Mar 2025)

The topic of ground leases has come up several times in the past few weeks. Numerous A.CRE readers have emailed to ask for a purpose-built Ground Lease Valuation Model. And I'm in the process of creating an Advanced Concepts Module for our real…

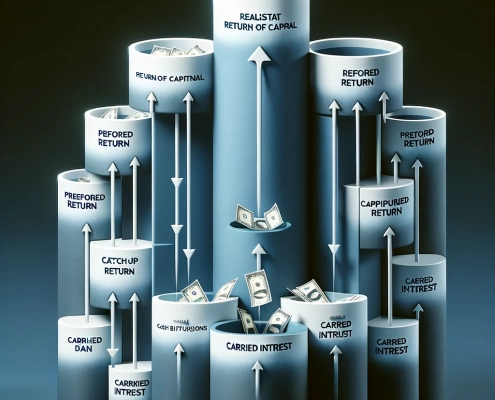

Real Estate Equity Waterfall Model with Catch Up and Clawback (Updated Dec 2024)

A question came up recently in the A.CRE Accelerator's real estate waterfall modeling course regarding how to model GP Catch Up (i.e. Sponsor Catch Up) and LP Clawback provisions. I put together a quick video tutorial in response to that question,…

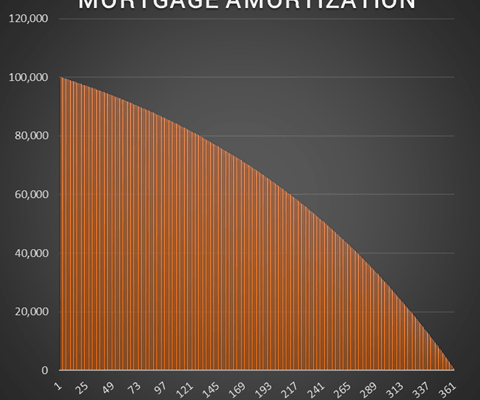

Watch Me Build a Dynamic Mortgage Amortization Table in Excel (Updated September 2024)

There are a few basic, yet fundamental, real estate modeling skills you must master before anyone will take you seriously as a real estate professional. Building a mortgage amortization schedule is one of them.

Virtually every model you…

Real Estate Equity Waterfall Model With Cash-on-Cash Return Hurdle (Updated Jul 2024)

Over the years, Michael and I have built and shared numerous real estate equity waterfall models, all multi-tiered and most with internal rate of return (IRR) hurdles. And as our readers have downloaded those models, I've received dozens of…

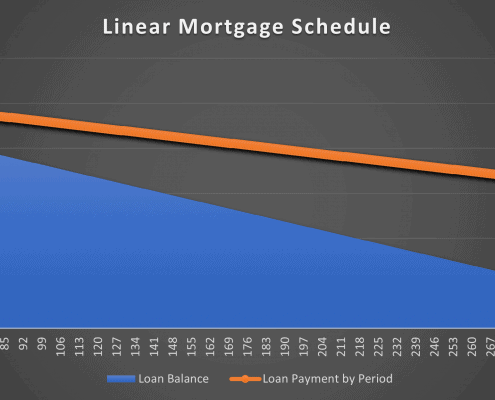

Linear Mortgage Payment Schedule Tool (Updated July 2024)

We recently shared a new modeling test to our library of real estate case studies entitled UK Debt Advisory Firm Modeling Test. In that case study, the test asked the real estate professional to analyze the returns of three different debt options.…

Forecasting After-Tax Cash Flow in Real Estate Analysis (Updated May 2024)

When modeling real estate investments, industry practice is generally to stop at before-tax cash flow, rather than after-tax cash flow. And this makes sense in most instances. No two owners of real estate have the exact same tax situation and…

Advanced Mortgage Amortization Module (Updated May 2024)

In recent months, I've been working on an advanced real estate investment amortization table with interest-only capability, fixed and variable interest rates, multiple interest calculation methods (i.e. 30/360, Actual/Actual, Actual/365, Actual/360),…

Real Estate Debt Module in Excel (Updated May 2024)

I thought I'd share the real estate debt module I originally built for the ARGUS alternative in Excel. Most debt modules I've seen in real estate financial models only include the ability to model fully amortizing senior debt. Mike challenged…

Watch Me Build – Modeling a Rent Schedule in Both Excel and Using AI (Updated May 2024)

In this Watch Me Build video I show you how to build a custom rent schedule module for long-term leases. The foundation of the module is a simple INDEX/MATCH combination that takes a rent schedule and models the rent cash flows across the entire…

Real Estate Capital Account Tracking Tool (Updated Apr 2024)

I'll be the first to admit that real estate asset management doesn't get the attention it deserves on AdventuresinCRE.com. The real reason for this is that we're not necessarily asset management experts. I spent some time working in asset management…

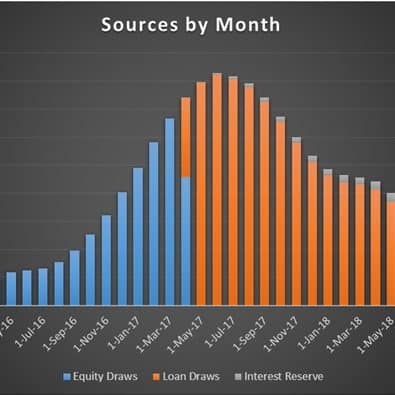

Construction Draw and Interest Calculation Model (Updated Feb 2024)

I originally uploaded this equity/construction loan draw and interest calculation tool to our library of real estate financial analysis models in 2016. Over the years, I've continued to update it as suggestions, comments, and requests…

Real Estate Sources and Uses of Capital Module (Updated Feb 2024)

An important component in any acquisition, development, and value-add model is the Sources and Uses of Capital section. Of course, how the sources and uses are modeled and how those cash flows are visualized will vary from one model to the next.…

Using an IRR Matrix to Determine Hold Period (Updated Dec 2023)

When building a real estate financial pro forma, it's important to model for and include a summary of various return and risk metrics. Among the different return metrics, the internal rate of return (IRR) - both on an unlevered and levered…

Actual + Forecast Construction Draw Schedule with S-Curve (Updated Dec 2023)

Several times in the last month, I've been asked to tackle an interesting real estate financial modeling challenge - pare actual construction draw cash flows with s-curve cash flow forecasts to create an Actuals + Forecast Construction Draw…