Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Refinance Risk Analysis Tool in Excel (Updated Nov 2023)

Generally speaking, equity real estate investors spend their time modeling the upside while their debt partners spend their time modeling the downside. Equity investors generally focus on an investment's internal rate of return, cash-on-cash…

1031 Exchange – Overview and Analysis Tool

A 1031 Exchange, or Like-kind Exchange, is a strategy in which a real estate investor can defer both capital gains tax and depreciation recapture tax upon the sale of a property and use that money, which has not been taxed, to purchase a like-kind…

Commercial Real Estate Lease Analysis Tool (Updated Jul 2023)

The topic of analyzing commercial real estate leases from the perspective of the landlord and/or tenant has come up several times over the years. And while I generally respond to requests for new models or tools at A.CRE, I've been hesitant…

Create A Dynamic Revenue Row to Calculate Multiple Tenant Leases (Updated Nov 2022)

I recently received an email from one of our readers asking how to create a dynamic revenue row for a pro forma that can capture rent changes for multiple tenants. I thought that this would make a great post for the site and would be a good…

Tenant Sales and Occupancy Cost in Retail Underwriting (UPDATED JUNE 2022)

When underwriting a retail investment, rollover risk is an incredibly important consideration. You, as a prospective debt or equity investor in the property, need to understand how secure the cash flows you're buying are; or in other words,…

Publicly Traded Tenant Analysis Tool (Updated May 2022)

In this post and corresponding video, I am going to walk you through a revamped tenant health worksheet that I shared a long time ago on the site. I spent some time giving it a makeover and decided to put together a video walkthrough for it.

Publicly…

Physical Occupancy Calculation Model for Real Estate (UPDATED MAY 2022)

As many of you know, I'm in the midst of moving my family from Milwaukee to Dallas, and quite frankly I'm getting sick of eating out and sleeping in hotel rooms. So what better way to unwind from hours of whining kids and tiresome travel, than…

4-Tier Equity Multiple Waterfall – Download and Watch Me Build (UPDATED APR 2022)

Here is a simple, yet very powerful, 4-tier equity multiple waterfall module. This post contains both a completed version of the module ready to plug into a real estate financial model as well as a 'Watch Me Build' template and companion video…

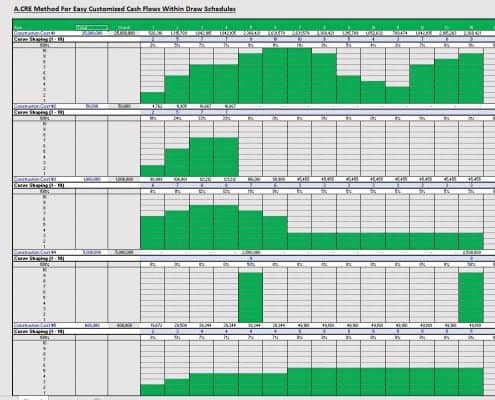

Development Draw Schedule – Visually Customize Each Line Item (UPDATED APR 2022)

Working a lot with development draw schedules, I have always been looking for a catch all solution as to how one could easily model all the unique ways cash actually flows over time during the process. The norm for many is to model cash flows…

Construction Draw Schedule: Accounting For True LTC (Updated Apr 2022)

When lenders provide debt for a development project, they lend based on a Loan-to-Cost ratio (LTC), which is simply the percent of the total budget the lender will agree to lend to the borrower. So, if a project costs $10MM, and a lender loans…

Convert Monthly Cash Flows to Quarterly and Annual Cash Flows (Updated Mar 2022)

Over the past few years, I've been working to build an ARGUS DCF alternative in Excel - or otherwise known here as the A.CRE All-in-One (Ai1) Model. As I've worked on that model, I've been jotting down modeling techniques I use and think would…

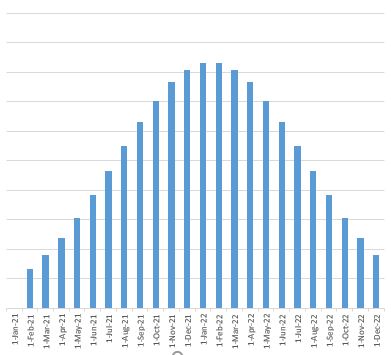

S-Curve Forecasting in Real Estate Development (Updated Sep 2021)

One of the reasons Michael and I blog, is to force ourselves to be continually learning. I built the first version of my real estate waterfall model, because I wanted to better understand the mechanics of modeling an equity waterfall with IRR…

Real Estate Equity Waterfall Model – Monthly Periods (Updated Jul 2021)

When I decided to share my real estate equity waterfall model in Excel, I never imagined it would be as popular as it has. The model has been downloaded thousands times and many of you have written to extend your thanks for sharing. It is gratifying…

Real Estate Acquisition Due Diligence Checklist

Most of the Excel tools we share on Adventures in CRE are real estate financial models, but occasionally we'll venture into building other CRE-related tools. Over the past several months, I've been working on a real estate acquisition checklist…

Real Estate Development Due Diligence Checklist

Last year, I shared a Real Estate Acquisition Due Diligence Checklist that was quite popular. Soon after its release, we began getting requests for a similar tool, but for development deals. So allow me to share a Real Estate Development Due…