Commercial Real Estate Lease Analysis Tool (Updated Jul 2023)

The topic of analyzing commercial real estate leases from the perspective of the landlord and/or tenant has come up several times over the years. And while I generally respond to requests for new models or tools at A.CRE, I’ve been hesitant to build this particular tool. The reason is that my experience is heavily landlord focused and I’ve never worked on the tenant rep side of the business.

However, a recent discussion in the Q&A section of our real estate financial modeling Accelerator program coupled with some insights from a few tenant rep brokers has given me the encouragement I needed. And so, over the past few months I’ve been slowly building a Commercial Real Estate Lease Analysis Tool. Today I’m excited to share the tool with you.

Below find written and video walkthroughs of the tool, as well as a link to download the most recent version. As with all of our Excel models/tools, this tool undoubtedly contains errors. Plus, I’m always looking for ideas to improve the tool. So, if you find a bug or have a feature you’d like included in a future version, shoot us a note.

Why Analyze Commercial Real Estate Leases?

So, how might a tool like this be helpful or valuable? The answer to that question depends on who you are.

Perhaps you’re a tenant rep broker forecasting the tenant cash flows of a proposed lease. Or perhaps you’re a prospective buyer of a building assessing the economics of one or more existing leases. Or maybe you are a tenant wanting to compare the net present value of one lease proposal against another.

At its core, this tool lays out the specifics of a lease (via the Lease Abstract) and then forecasts the cash flows of that lease. How you then use those cash flow forecasts depends on what role you play in the transaction.

How to Use the Commercial Real Estate Lease Analysis Tool

The analysis in this tool is contained within three primary worksheets (i.e. tabs), with two additional supplemental worksheets. The majority of the inputs are entered onto one worksheet: the “Lease Abstract’, with the majority of the calculations contained on the ‘Lease CF’ worksheet, and the majority of the outputs visualized on the ‘Summary’ worksheet.

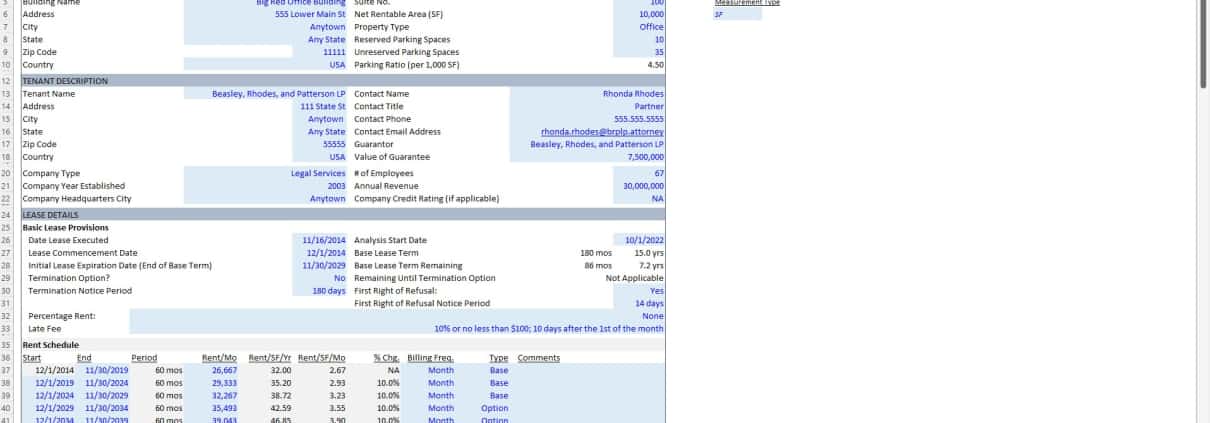

Lease Abstract Tab

A Lease Abstract is a document, common to commercial real estate, that summarizes the most salient aspects of a commercial real estate lease. Stakeholders to a lease generally first turn to the lease abstract when they have questions about the lease before reading through the lease itself.

The ‘Lease Abstract’ tab is effectively an institutional-quality lease abstract. But because it’s contained in an Excel tool, and is structured in a specific way, the cash flows related to the lease are calculated based on the inputs in the lease abstract.

The sections of the Lease Abstract tab include:

- Description of Rentable Space

- Tenant Description

- Lease Details

- Rent Schedule

- Other Rent

- Expenses (The space’s proportionate share) and who pays what

- Insurance Requirements

- Tenant Inducements Due (i.e. outstanding amounts landlord has yet to pay to tenant)

- Tenant Investment in Space

- Comments

- Prepared By

You can learn about the nuances of completing each of these sections in the walk-through video below.

The meat of this tool is the ‘Lease Abstract’ tab. It is here where the details about the lease are entered, and from which the cash flows are calculated.

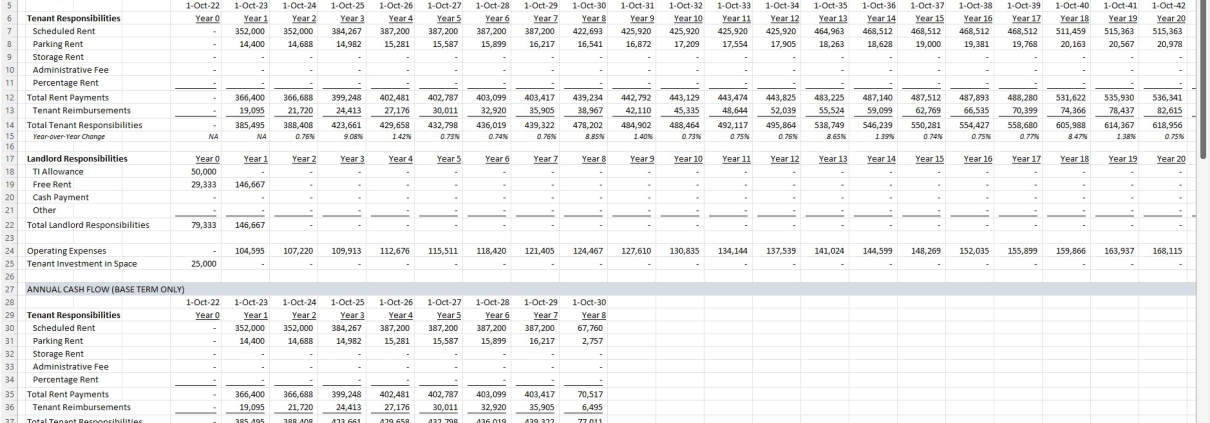

Lease CF Tab

Once you’ve completed the Lease Abstract, the monthly (and annual) cash flows related to the lease are automatically calculated. Those cash flows include:

- Annual Cash Flow (Base Term + Options)

- Annual Cash Flow (Base Term Only)

- Landlord Cash Flow and Analysis (Base Term Only)

- Tenant Cash Flow and Analysis (Base Term Only)

- Cash Flow Annualized (Base Term Only)

- Monthly Cash Flow (Base Term + Options)

- Monthly Cash Flow (Base Term Only)

The monthly cash flows are calculated first, and then are rolled up into annual periods. Therefore, if you have a specific question about the cash flows it’s always helpful to first go to the monthly cash flows.

Cash flows from the tenant and landlord perspective are calculated on the Lease CF tab, using the inputs entered on the Lease Abstract tab.

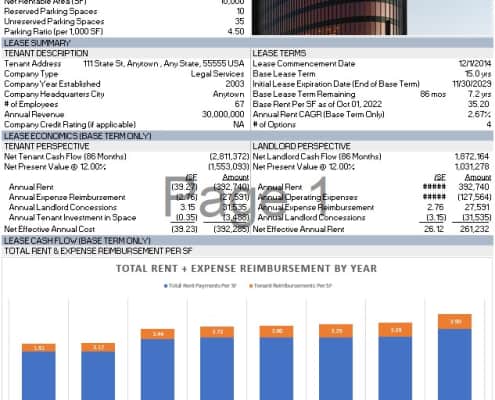

Summary Tab

A summary of the lease abstract and lease cash flows are shown on the Summary tab.

With the lease-specific inputs entered on the Lease Abstract tab, and the cash flows calculated on the Lease CF tab, a summary of both are visualized on the Summary tab. The Summary tab includes:

- Property Description

- Property Image

- Lease Summary

- Lease Description

- Lease Terms

- Lease Economics (Base Term Only)

- Tenant Perspective

- Landlord Perspective

- Lease Cash Flow (Base Term Only) visualized in a dynamic column chart

The Summary tab is built to be printable, as is the Lease Abstract tab. Again, you can learn more about that in the walkthrough video below.

Video Walkthrough – Using the Commercial Real Estate Lease Analysis Tool

In addition to the written guidance above, I’ve put together a video that walks you through the various sections of the model. Note that this video is based on beta v0.1 of the model.

Download the Commercial Real Estate Lease Analysis Tool

To make this model accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming – typical real estate analysis tools sell for $100 – $300+ per license). Just enter a price together with an email address to send the download link to, and then click ‘Continue’. If you have any questions about our “Pay What You’re Able” program or why we offer our models on this basis, please reach out to either Mike or Spencer.

We regularly update the model (see version notes). Paid contributors to the model receive a new download link via email each time the model is updated.

Frequently Asked Questions about the Commercial Real Estate Lease Analysis Tool

Version Notes

v0.4

- Added Lease Start override (Lease Abstract – L26) that forces analysis start date (and lease cash flows) to better align with the lease start day of the month

- Modified Analysis Start input to only be Month/Year

- Updated date header in Lease CF tab to be ‘Period Ending’

- Fixed Time 0 date to be one day prior to lease start

v0.3

- Removed beta tag

- Misc. updates to placeholder values

- Misc. formatting updates

Beta v0.2

- Expanded size of ‘Tenant Name’ input on Lease Abstract

- Changed ‘Concessions Due’ heading to ‘Tenant Inducements Due’ heading to more accurately represent the inputs

- Removed the ‘Per SF/M2’ from the ‘Net Effective Annual Rent’ label on the Lease Abstract

- Fixed issue where ‘Years’ wasn’t appearing on the column chart on the Summary tab

- Increased the vertical size of the Summary tab

- Misc. formatting fixes/improvements

Beta v0.1

- Initial release