Learning Real Estate Financial Modeling in Excel (Updated Oct 2024)

We’re often asked by our readers how we learned to be proficient in real estate financial modeling. The question usually arises because the person wants to know how to model real estate in Excel to either land a job in commercial real estate (e.g., private equity, development, acquisition, debt) or to analyze their own deals.

In fact, we’ve answered the question so many times we decided to develop our own A.CRE Accelerator – a program consisting of 17 case-based real estate financial modeling courses and a private Q&A section that takes the student from unqualified to proficient in under three months.

With that said, not everyone has the time or resources to pay for a robust Accelerator. As such, I thought I’d share what I consider to be the three pillars of knowledge one must possess to be considered proficient in modeling real estate. I’ll then point to some resources on A.CRE as well as to external resources to help you craft your own path to real estate financial modeling proficiency.

Proficiency in real estate modeling requires mastering the principles of finance, real estate, and Microsoft Excel.

I. A Sound Understanding of Finance

Modeling commercial real estate is fundamentally about ascertaining the present value of a future stream of cash flows – cash flows that just so happen come from a real estate asset. In fact, when we speak to undergraduate real estate students, we often say that “real estate modeling is essentially about predicting the future; the future cash flows of a real estate investment”.

In other words, if you are considering buying an apartment building today, how much do you value the future cash flows that the apartment building is likely to generate? If you project the cash flows to be more volatile (e.g., the apartment building is not yet built), the value of those less-than-certain future cash flows are worth less to you than if the future cash flows more certain (e.g., the apartment building is completed and 97% occupied).

Consequently, mastering real estate modeling requires a sound grasp of basic finance principles. You must understand finance concepts such as:

- Time value of money and how to measure returns on a time value of money basis

- Risk and return and different methods for calculating risk and return

- Various types of rates including interest rate and discount rate

- Corporate capital structure and how to calculate a firm’s cost of capital

There are several options, some more obvious than others, to gain the finance knowledge you need to model real estate. Many of us learned finance in either undergraduate or graduate school. I took more than my fair share of finance courses during my graduate real estate studies at the Baker Program in Real Estate at Cornell University – and most universities offer finance courses.

If taking a university finance course doesn’t fit your budget or schedule, another great option is to take a free MOOC course.

There are two finance related MOOC courses you ought to check out. The first is an Introduction to Time Value of Money taught by the University of Michigan’s Gautam Kaul. The second is an Introduction to Corporate Finance, taught by Michael Roberts from the Wharton School of the University of Pennsylvania.

With these courses, not only will you be taking quality finance courses taught by professors from two of the top business schools in the world, but the courses are open and often free to all!

II. A Mastery of Real Estate Principles

The second pillar of modeling real estate in Excel, is mastering the principles of real estate. The models you build are only as good as the assumptions you make. If your assumptions are weak, the results will likewise be weak. Hence the saying in modeling: “garbage in, garbage out.”

Many of us learned real estate principles through some combination of education and real-world experience. Of course, many real estate modelers who lack a seasoned mastery of real estate principles rely on others to feed them assumptions – this is common with newly hired analysts fresh out of school. Still, even newly hired analysts come into their position knowing the terminology and understanding how real estate works.

Some of the indispensable real estate specific concepts and vocabulary you have to know include:

- Debt vs equity

- Types of spreads

- Risk and return metrics (e.g. IRR, equity multiple, DSCR, mortgage yield, LTV)

- Setting up a pro forma operating statement (PGI –> EGR –> NOI –> CFAF)

- Market leasing assumptions (rent, vacancy, TIs, LCs)

- The fundamental value equation (value = NOI ÷ cap rate)

- Public real estate vs. private real estate (REITs vs private equity funds)

- The real estate investment process

- Different valuation methods (comparable sales, replacement cost, discounted cash flow)

- Real estate taxes

The challenge with mastering real estate is that, as an academic study, real estate is relatively young. Even today, most universities don’t teach real estate principles, and consequently, real estate customs and conventions vary from region to region and from company to company. Despite this challenge, there are places to go to learn the principles of real estate.

Here at Adventures in CRE, we have quite a few resources that will help get you up to speed with real estate principles.

- A.CRE 101 Series

- A.CRE Glossary of CRE Terms

- Our Deep Dive in Real Estate Series

- A.CRE Library of Real Estate Excel Models

III. Advanced Proficiency in Microsoft Excel

Modeling real estate requires an advanced proficiency working with Microsoft Excel. Of course, there are other real estate cash flow modeling tools used in the industry such as ARGUS, but Excel is used universally and is the most important software program to master.

When I was learning to model, there was no program like our real estate financial modeling Accelerator program. So, I was forced to learn Excel through a combination of non-real estate online courses, self-study books, Excel courses during my undergrad and grad years, Excel Q&A forums, YouTube tutorials, and good old fashioned learn by trial and error.

In addition to the free Excel models, tools, and Excel-specific resources found on A.CRE, I’ve compiled a list of Excel training materials online that I’ve found to be useful in mastering Excel. Given that we are all at different stages of Excel proficiency, I’ve organized the list by beginner, intermediate, and advanced levels.

Beginner

- Take our Definitive Guide to Microsoft Excel for Real Estate (Free)

- Microsoft Excel for Beginners YouTube Playlist (Free)

- Complete our ‘Mastering MS Excel for Real Estate’ Endorsement (Included in A.CRE Accelerator Core membership)

Intermediate

- 15 Segment Intermediate Excel Tutorial on YouTube (Free)

- Excel Skills for Business (Intermediate I) (Paid)

Advanced

- A.CRE Accelerator Core Curriculum (Included in the A.CRE Accelerator Core membership)

- 15 Segment Advanced Excel Tutorial (Free)

Leveraging AI in Real Estate Financial Modeling

In recent years, artificial intelligence (AI) tools have become invaluable for enhancing learning and maximizing productivity in financial modeling. For those looking to sharpen their Excel skills, tools like Claude.ai, Gemini, and ChatGPT can offer personalized, real-time support, effectively accelerating your learning curve. These AI platforms can provide step-by-step explanations, help solve problems, and suggest optimized workflows, making them a powerful supplement to traditional Excel learning.

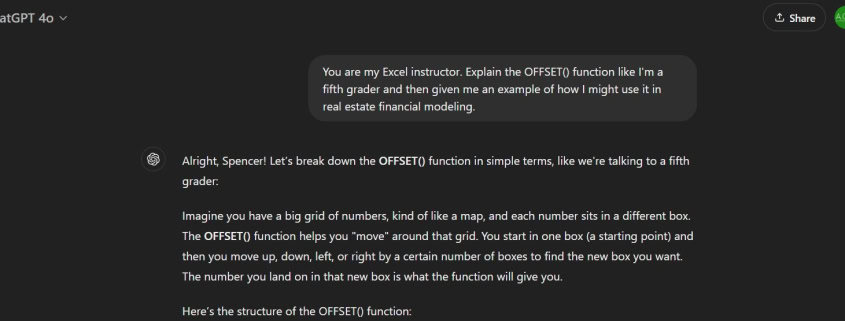

So, for instance. Go to ChatGPT.com, Claude.AI, or Gemini.Google.com and then prompt the LLM as follows:

“You are my Excel instructor. Explain the OFFSET() function like I’m a fifth grader and then given me an example of how I might use it in real estate financial modeling.”

You will then be given a detailed mini-tutorial on how to use the OFFSET() function. You could then complete the exercise it gives you in Excel, upload the completed file, and ask it if it’s correct.

Thus, AI becomes your personal Excel tutor.

Additionally, AI can be your Excel companion. You can use AI to write VBA code, craft complex formulas, or troubleshoot Excel errors. AI can even suggest the logic and structure for entire models based on your objectives, helping you ensure that your financial models are both efficient and accurate.

So, for instance, imagine you need to model out the lease cash flows for a tenant with irregular rental increases (e.g. $100,000 year one, $107,500 year two, $107,500 year three, $120,000 years 4-7, then $150,000 thereafter) and you want a dynamic way to accomplish that. You could ask it for ideas, and it could offer logic, structure, and formula advice.

Conclusion on Real Estate Financial Modeling Proficiency

Of course, as I mentioned at the beginning, the A.CRE Accelerator is a great way to cut to the chase in terms of what you need to learn and in what order. While the focus is on real estate financial modeling and assumes you have at least a basic foundation working in Excel, it fuses finance, real estate, and Excel well to help you get proficient as quick as possible.

Becoming a great real estate excel modeler takes time, dedication, and a commitment to mastering the three pillars of real estate financial modeling: finance, real estate principles, and Microsoft Excel. The sooner you begin to master the skill, the sooner you’ll be prepared to land the job or lock up your first deal.