Real Estate Acquisition Due Diligence Checklist

Most of the Excel tools we share on Adventures in CRE are real estate financial models, but occasionally we’ll venture into building other CRE-related tools. Over the past several months, I’ve been working on a real estate acquisition checklist that can be used by real estate acquisition teams to track the progress of their due diligence tasks. Thanks to the help of several friends who offered suggestions for items I had missed, I’ve finally completed that tool. And today, I’m excited to share it with the A.CRE community.

Note: You might also check out our Real Estate Development Due Diligence Checklist

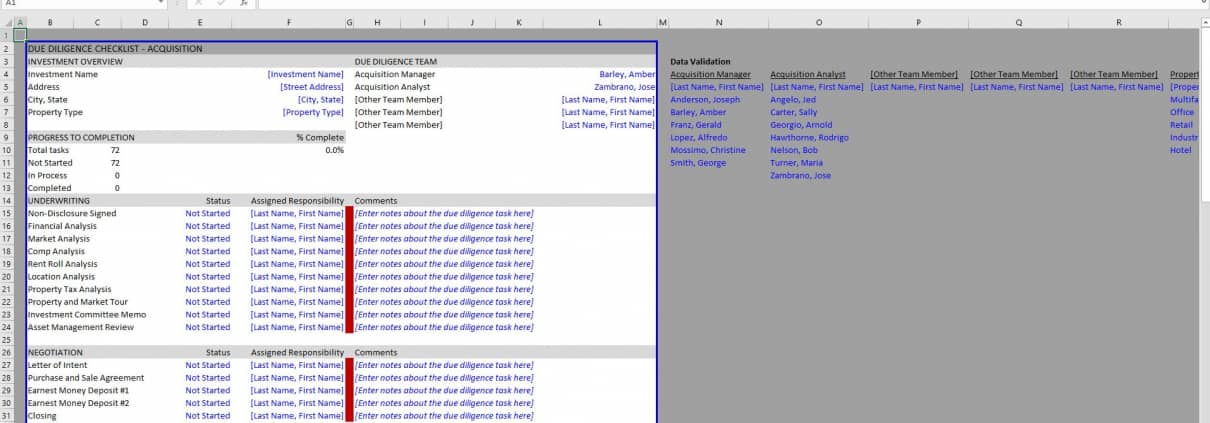

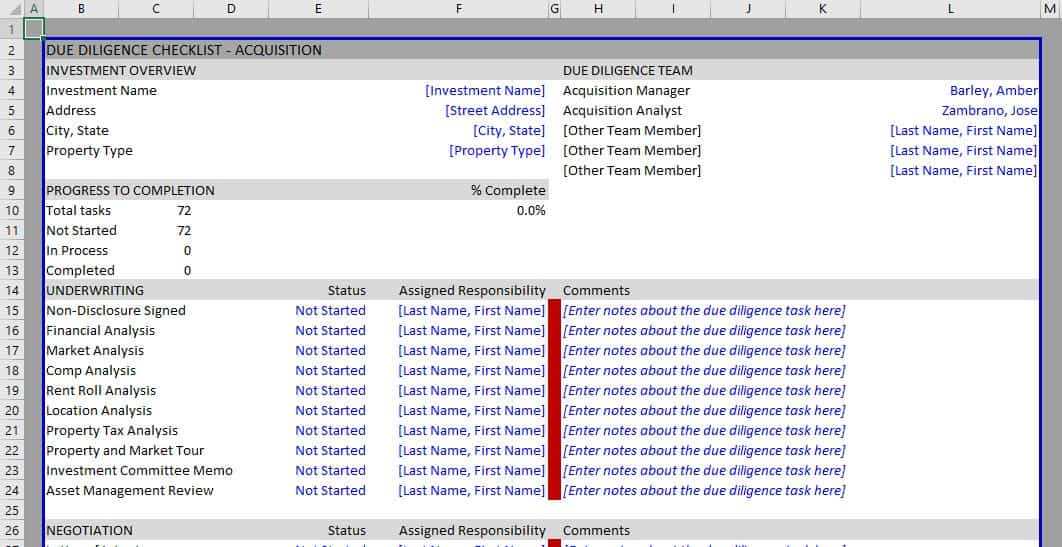

A screenshot of the due diligence checklist – the checklist comes pre-filled with 72 due diligence tasks across six sections

Why Use a Due Diligence Checklist

Now in my 17th year as a real estate professional, I’ve been party to my fair share of real estate transactions. Some go smoother than others, but in my experience I’ve found the surest way to a messy closing is to fail to track what needs to get done. Hence the reason for a due diligence checklist.

This is all the more important in frothy markets with short closings. The success of the deal, and your professional reputation, are put to the test when you have 30 days or less to get it all done.

Thus, a due diligence checklist becomes your road map. It reminds you daily of what’s completed, what’s in process, and what hasn’t even been started yet. It keeps you on task and organized. It’s key to getting everything done before the clock runs out.

How to Use this Real Estate Acquisition Due Diligence Checklist

This particular checklist is made for acquisition teams. While the mechanics of the model could be adapted for other types of transactions, and I will be using this template to build a development checklist next, the due diligence items are specific to acquisition transactions.

The tool is simple and intuitive to use. Nevertheless, I’ve written instructions and recorded a quick walk through video.

Sections of the Acquisition Due Diligence Checklist

The top portion of the tool includes an ‘Investment Overview’ and ‘Due Diligence Team’ section, where you’ll enter general property information and the names of the team members working on the deal.

Below the investment information section you’ll find a ‘Progress to Completion’ section where the model tracks percentage complete. I use a rudimentary weighted average formula to track progress, weighting each line item with 0 if Not Started, 0.5 of In Process, and 1 if Completed. The total percent complete is shown in cell F10.

Next come the due diligence line items. There are 72 pre-filled tasks across six sections: Underwriting, Negotiation, Property Condition, Environmental, Legal/Entitlement/Insurance, and Lease Review. Next to each line item there are three input cells: Status, Assigned Responsibility, and Comments.

Under Status, you’ll find a drop-down menu where you can mark the task as either ‘Not Applicable’, ‘Not Started’, ‘In Process’, or ‘Completed’.

Under Assigned Responsibility you’ll find a drop-down menu dynamically populated with the acquisition team members’ names. And next to the Assigned Responsibility column you’ll find a narrow column with colors. The cell changes color based on the progress of the task, turning white when ‘Not Applicable’, red when ‘Not Started’, yellow when ‘In Process’, and green when ‘Completed’.

Finally, to the right of the color column you’ll find a series of columns where you can enter comments. It is here where you note elements specific to each task.

The Data Validation Section

The worksheet is preset to print preview mode, so only the printable portion of the worksheet is white. Outside of the printable section you’ll find the ‘Data Validation’ section. The data validation lists are used in the drop-down menus within the checklist.

The data validation lists that you’ll need to change are marked in blue and consist of job titles (e.g acquisition manager) and team member names. Change the job title name (row 4) and then change the names in the list below each job title. Th drop-down lists will dynamically change to include the newly added names and job titles.

Video Walk-through of Acquisition Checklist Tool

While I’m confident you can figure the model out without much guidance, I thought I’d record a quick walk-through of how to use the real estate acquisition checklist tool anyway. If you have any further questions, please don’t hesitate to reach out.

Download the Real Estate Acquisition Checklist Tool

To make this model accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming – typical real estate Excel tools sell for $100 – $300+ per license). Just enter a price together with an email address to send the download link to, and then click ‘Continue’. If you have any questions about our “Pay What You’re Able” program or why we offer our models on this basis, please reach out to either Mike or Spencer.

We regularly update the model (see version notes). Paid contributors to the model receive a new download link via email each time the model is updated.

Frequently Asked Questions about the Real Estate Acquisition Due Diligence Checklist

Version Notes

v1.1

- Added progress tracking by individual

- Column to count tasks assigned to an individual (column J4:)

- Column to calculate percentage of tasks completed by assigned individual (column K4:)

- Misc. formatting updates

v1.0

- Initial release