Multifamily Redevelopment Model (Updated June 2020)

This is an Excel model I originally built from scratch back in 2015 for quickly assessing multifamily redevelopment opportunities. It was designed to work best for scenarios where individual units will be rehabbed over the hold at varying times. It’s a simple way to quickly analyze the viability of this type of multifamily investment.

Since that time, the model has been through various updates based on feedback from users of the model.

It can work for properties with 1-12 units. Keep in mind however, there are probably more appropriate models out there for one and two-unit properties – see Spencer’s single family investment model. This model is not meant for new development.

Note: If you need something more robust, check out our Pro Forma for Multifamily Renovations

About the Multifamily Redevelopment Model

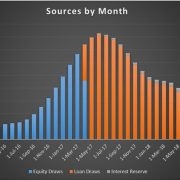

The model was built to give the user a lot of independent control over certain variables affecting assumptions throughout the hold period. For example, a user can control the annual rent increase for every year, pick between one of two methods for choosing the purchase price, and also project how much of an increase in rent per unit would be experienced after each unit rehab is completed.

Due to there being a lot of moving parts, there are many checks to help prevent inconsistencies with assumptions. For example, if you change the holding period, but did not change the construction schedule and you assume an exit before the construction is done, there will be a warning. There will also be a warning if you go below the minimum debt service coverage ratio among other checks and balances.

How to Use the Multifamily Redevelopment Model

Download the latest version of the model and then start on the A&R tab. It’s there where the bulk of the assumptions are entered.

There are instructions and bits of information throughout the model. Not all of the explanation is included, but it should be fairly intuitive. I hope you find it useful and if you happen to discover any errors, please contact me.

Interested in learning to build or modify your own real estate financial models? Consider joining our real estate financial modeling Accelerator program.

Download the Multifamily Redevelopment Model

To make this model accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming – similar back-of-the-envelope real estate Excel models sell for $50 – $200+ per license). Just enter a price together with an email address to send the download link to, and then click ‘Continue’. If you have any questions about our “Pay What You’re Able” program or why we offer our models on this basis, please reach out to either Mike or Spencer.

We regularly update the model (see version notes). Paid contributors to the model receive a new download link via email each time the model is updated.

Version Notes

Version 7.0

- Added version tab for change tracking

- Adapted for use with A.CRE ‘My Downloads’ section

- Misc. formatting updates and enhancements

Frequently Asked Questions about the Multifamily Redevelopment Model