Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Watch Me Build – Capital Stack with Mezzanine Debt

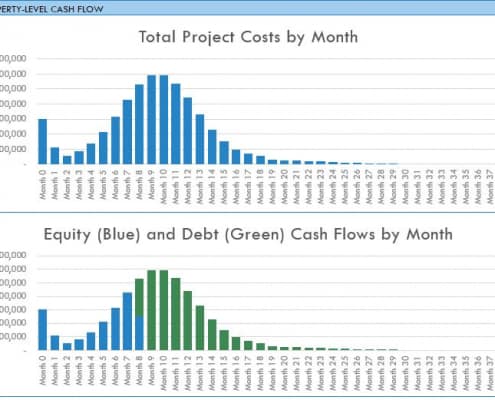

One of the more difficult aspects of modeling a real estate development is figuring out how to handle equity and debt cash flows. This becomes all the more difficult when a second tranche of debt is introduced. In this Watch Me Build video,…

Watch Me Build a Tenant Rollover Analysis Model

The feedback has been positive on the ‘Watch Me Build a Multifamily Model’ video I recorded earlier this year. So I thought I’d follow that up with another. This time I build a Real Estate Tenant Rollover Analysis Model and talk through…

Watch Me Build a Multifamily Real Estate Model (Updated Feb 2020)

One way to become a better real estate financial modeling professional, is to watch other professionals model. I know in my career being able to physically see how others tackle different modeling problems has shaped my methods and made me better…

Using VBA to Hide Rows in Excel

Over the next few minutes, I will show you two techniques for automatically hiding and showing rows in Excel using VBA code. These techniques I use regularly in my real estate financial models to make for a more intuitive user experience.

In…

Watch Me Build Data Tables For Real Estate Sensitivity Analysis

This is a 3 part mini-series on using data tables in Excel to perform real estate sensitivity analysis. In this series, I'll walk you through how to build both one-variable and two-variable data tables in parts 1 and 2. And in Part 3, I'll walk…

Watch Me Build A Construction Draw Schedule (Updated Jan 2020)

In the following video, I record my screen and narrative my steps as I build a basic construction draw schedule. I've also included the template and completed worksheets from this Watch Me Build exercise.

Are you an Accelerator member? See…

How to Create Dynamic, In-Cell Buttons and Toggles in Microsoft Excel

Creating intuitive, user-friendly, visually appealing models is one aspect of mastering real estate financial modeling. One way to make your models easy for people to use and more attractive in general is to use dynamic, theme-appropriate, in-cell…

Watch Me Expand the Home Construction Pro Forma

I'm regularly asked to expand my single family home construction pro forma to analyze the construction of more than one home. I've contemplated adding that functionality to the model, but it is such a custom task that no template could really…

Using Conditional Formatting in Real Estate Financial Modeling

Your real estate financial models are only as good as their ability to be used by others. Or in other words, if others can't figure out how to use your model, it isn't worth much! So when building real estate financial model templates, besides…

Using the Floating Summary Box in Real Estate Modeling

Over the next few minutes, I'll share a great modeling tip for efficiently visualizing the more salient metrics in your real estate models. Now I should mention, this is a tip I shared a few years ago. But given the complexity of many of the…

Using the OFFSET Function in Real Estate Financial Modeling

In a previous post, I showed you how to use the OFFSET function to create dynamic lists in Excel. As you become more comfortable using this function in real estate financial modeling, you'll find that it has almost infinite applications when…

Create a Dynamic Real Estate Chart in Excel

Most of the real estate financial models we've shared over the years are dynamic to analysis period. Meaning, we've included an input to adjust the length of the analysis period, and the model will adjust the results accordingly.

This is…

How to Use the Apartment Acquisition Model’s Monte Carlo Simulation Module

You may recall that a couple of weeks ago, I began to explore Stochastic Modeling concepts, or the idea of adding probability into my models, to get a more complete picture of the risk-return metrics of an investment. I became interested in…

How to Use the Construction Draw and Interest Calculation Model

As promised, I've recorded a tutorial on how to use my construction draw and interest calculation model. The 20 minute tutorial walks you through how to use the model to forecast construction cash flows during your development period. The model…

Apartment Valuation Tutorial Using the Real Estate Acquisition Model

I promised a how-to video for my real estate apartment acquisition model, and so I thought I'd use an actual property to do so. I grabbed a property from Loopnet that is currently for sale, and dropped the information from the listing into…