Case Study #10 – Class A Industrial Warehouse + Rooftop Solar PV Plant (Case + Solution)

This case study explores a development of a 40-acre warehouse in Kasara, near Nashik, India. This industrial case study combines rental income with solar energy initiatives. In this article, we’ll examine the financial strategies, including partnerships and funding, and the project’s five-year lifecycle with a video tutorial and link to download the case study at the end.

Practice makes perfect! This is a real scenario based on actual properties and situations. Names and locations have been changed for confidentiality reasons, but the fundamentals are real-to-life.

Each case study shared in this series mirrors real world situations, either in terms of the types of deals you will look at in various roles or the types of modeling tests you’ll be required to perform as part of the interview process. You can browse this and other case studies in the A.CRE Library of Real Estate Case Studies.

Note from Spencer and Michael: This is another post in a growing series that we call ‘International CRE’. Written by CRE professionals based outside of the United States, this series is a collection of deep dives into various CRE topics relevant to real estate professionals all over the world. One of the reasons we love the International CRE series is that things are not done the same in one country to the next, and this series highlights those differing perspectives.

This particular post is written by our friend Padmaa Iyer. Padmaa is an India-based Real Estate Fundraising Strategist and Chartered Accountant. She is also a long-time A.CRE reader and graduate of our Accelerator Program. A huge thank you to Padmaa for sharing her knowledge with the A.CRE community!

Case Study Context

About the Area

Pinkstones has shortlisted quite a large chunk of land this time–about 40 acres in Kasara–for their next dream development: ‘Shining Sheds Industrial Complex,’ a grade A (i.e. Class A) industrial warehouse.

The land parcels of warehousing clusters in the metropolitan are overly saturated and simply unbuyable. On the other hand, tier 2 & tier 3 cities are becoming more attractive for e-commerce operations, which continue to make deeper roots all across the country. Improved road infrastructure has supported this trend. Kasara’s location, near tier 2 Nashik city and surrounding regions, offers an affordable option for big industrial warehouses that can be an essential link in the supply chain of several industries.

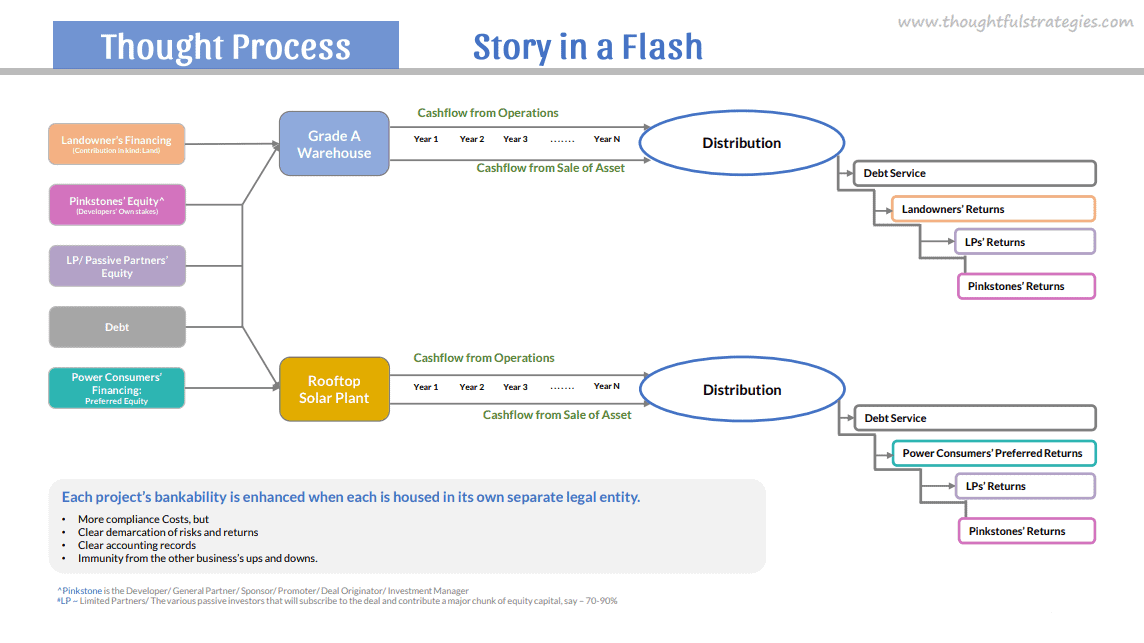

Pinkstones aims to achieve two goals with this one initiative: build a lucrative income generating real estate asset and generate additon green revenue through a solar plant on the rooftop. They wish to reach at least 70% energy independence soon, with the potential of energy storage systems to be discussed in a subsequent case study.

About the financing

To finance this project, aside from investing their own money and that of the their potential passive investor partners, Pinkstones is looking at 2 more potential sources: partnering with landowners for land acquisition funding and securing partial funding for the solar plant from multinational corporation (MNC) or third-party logistics (3PL) tenants. These tenants would benefit from reduced electricity costs and priority in investment returns.

The financial model in this industrial case study will explore the 5-year life cycle of this venture, including a hypothetical sale at the end of year five, assessing the viability and impact of these strategies and assumptions.

Key considerations include:

- The profitability of a joint venture with landowners

- How long the project will take to complete and stabilize

- Whether it is worthwhile to finance from the power consumers

- The returns for Pinkstones as well as their passive/LP Investors

Foreign investors require the financial model to be presented in their respective currencies, necessitating a version that supports at least five foreign currencies: USD, SGD, Euro, AED, and AUD, in addition to INR.

Industrial Case Study Warehouse Key Assumptions

1. Land

Pinkstones has finalized 40-acres of a contiguous parcel of non-agricultural land near Kasara (Maharashtra State), adjacent to the Mumbai Nashik highway that is perfectly suitable for a large grade A industrial warehouse.

They are thinking of 2 options to acquire the land:

1. Outright Purchase

- Pay 10% of land price upfront as a token money in 2 equal instalments over the first 2 months.

- Pay balance 90% after the land due diligence is over.

2. Joint development with Landowners

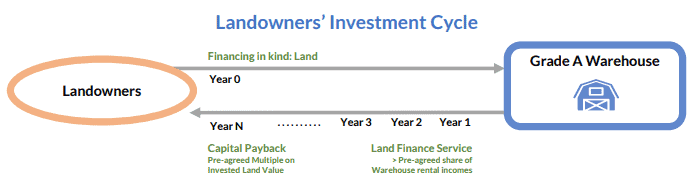

This is a kind of Revenue Participation Financing from the landowners. Pinkstones would pay little upfront and have the comfort of paying it back as the project starts generating income.

- Pay 5% of the agreed price as the initial token money. Enter the balance value as a “Quasi-equity loan” from the landowners in the books against the total cost of land purchase price.

- Pay 12% share of the rental incomes (excluding solar business income) as a monthly interest service to the landowners.

- Pay 1.5 x of their Quasi-equity loan at the time of sale of business in full repayment of their capital and returns.

Additional costs include approximately 5% of the land price for stamp duty and registration, and about 1% as brokerage fees, payable over three months post-registration.

Land due diligence costs are included in the budget estimates, with market value between ₹1.8 to ₹2 crores per acre, aiming to close at ₹1.5 crores per acre.

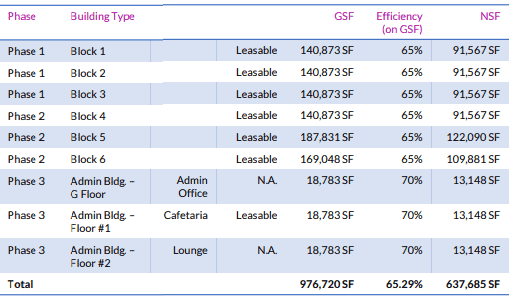

2. Development Plan

- Permissible Ground Coverage Ratio is 55%.

- Land Area ~ 40 acres = 161,874 SM = 1,742,400 SF.

- Ground Coverage ~ 55% = 958,320 SF.

Of the total ground coverage, 98% will be dedicated to building 6 blocks of grade A warehouse and an admin building. 2% will be reserved to install Solar BESS in the near future (out of the scope of this industrial case study).

The warehouse blocks will alsos be developed in 2 Phases and the admin building will be built in a 3rd Phase.

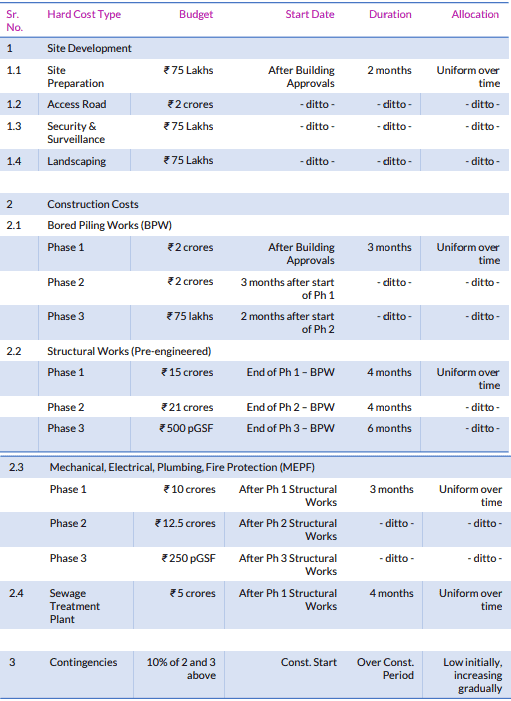

3. Budget Estimates

3. Budget Estimates

Note: 1 lakh (1*10^5) = 0.1 million (0.1*10^6) and 1 crore (1*10^7) = 10 million (10*10^6) ]

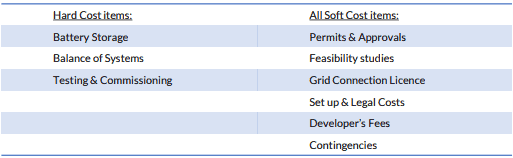

Hard Cost Estimates

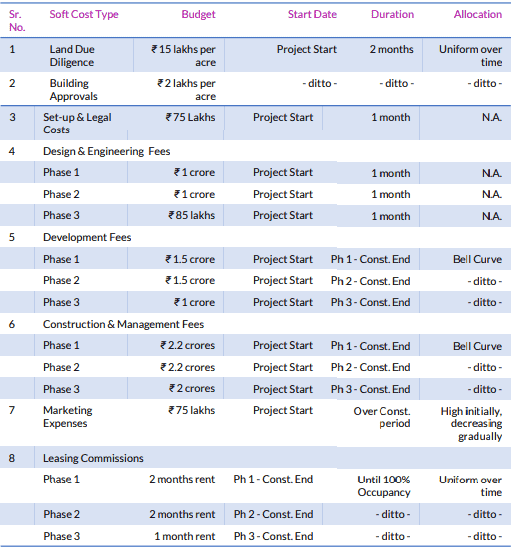

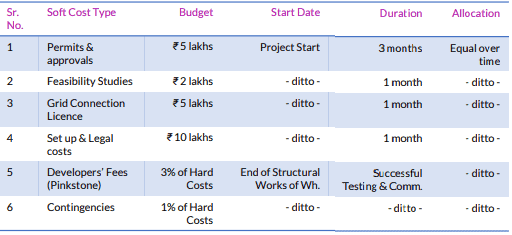

Soft Cost Estimates

4. Equity

Capital

In addition to all the land related expenses, Pinkstones needs to arrange equity for the following preliminary cost items:

For the rest of the development costs, they will seek out senior secured construction loan from banks.

Pinkstones will put 20% of their own money and raise remaining 80% from other potential passive investors/LPs.

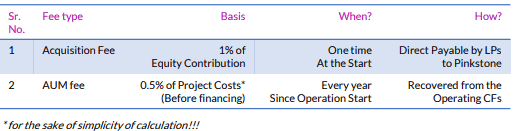

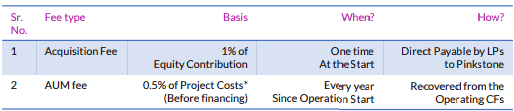

Pinkstone’s Fees

5. Debt

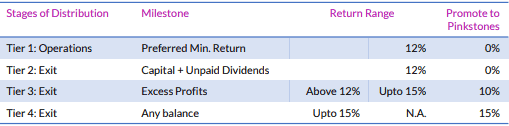

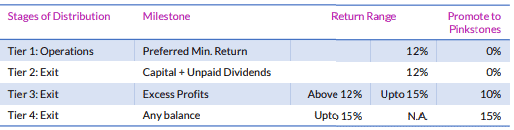

Waterfall Distribution Terms

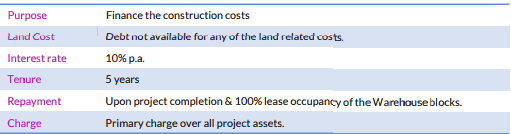

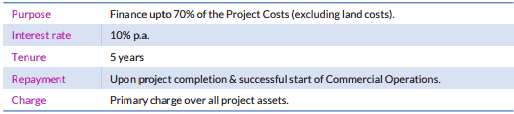

Construction Loan

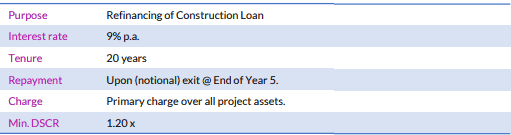

Permanent Loan

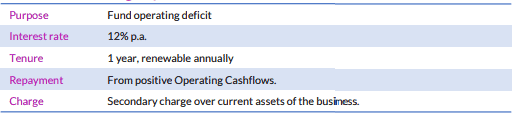

Short Term Working Capital Loan

6. Operations

This business will make money through 2 means:

- Leasing out the warehousing spaces to high quality 3PL/ FMCG/ E-com tenants

- Selling electricity from its rooftop solar plant to the occupants of the warehouse.

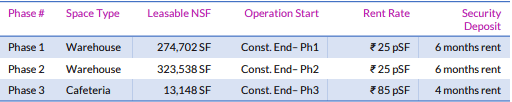

Rental Income

The first month will be rent free for the warehouse tenants and the first 15 days will be rent free for the contractor who rents the cafeteria space.

Also, a 5% increase in rent rates is expected every year.

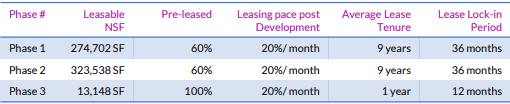

Leasing Plan

Other Income Sources

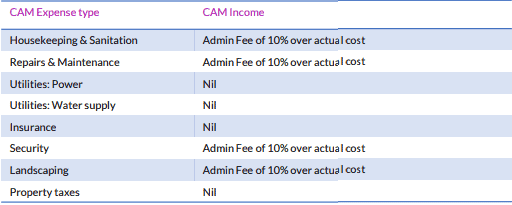

- CAM Income

- A nominal rent for the rooftop space from the solar business

CAM Income

Rent for Rooftop Space charged to Solar Business

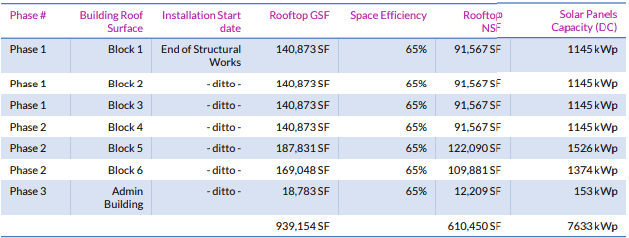

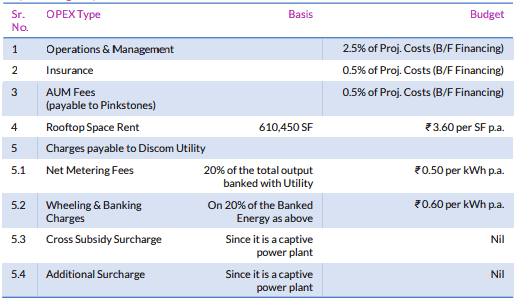

Solar panels are going to affixed over 65% of the roof area of the 7 buildings (6 Warehouse boxes and 1 admin building). To keep it fair and at arms’ length, a very nominal rent of 30 paise per SF per month (i.e. ₹ 3.60 per SF p.a.) is to be charged to the solar business.

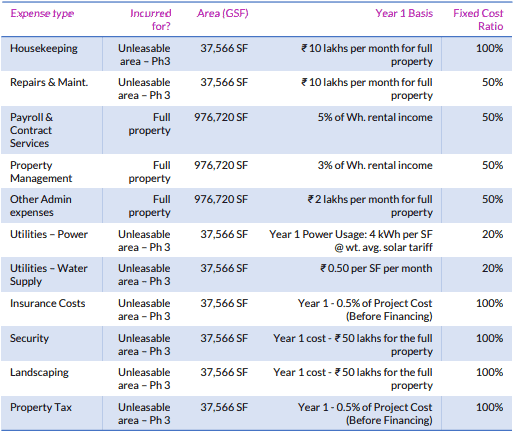

Operating Expenses

While some routine maintenance expenses are to be incurred only for the unleasable portion (Admin office + Lounge area) of the admin building, some expenses will be borne for the entire gated premises.

CAPEX Provision

A nominal 2% of the warehouse rental income is to be set aside for any CAPEX contingencies of the property.

7. Exit Value

Pinkstones wants to show a foreseeable lifecycle of this asset to their investors. What will the asset value look like at the end of 5 years? Will any investors want to liquidate and encash their stakes?

Exit valuation by the direct capitalisation (i.e., capitalisation of the NOI at market rent yield rate) will be useful to research this.

The market rent yield rate/cap rate of the analysis starts at 9%. We’ll assume it will keep rising 10 bps annually so as to factor in the aging of the asset.

An all inclusive selling cost of 1% will be applied on the exit value.

Industrial Case Study Rooftop Solar Key Assumptions

1. Development

The installation process of solar panels will start once the structure of each building is ready.

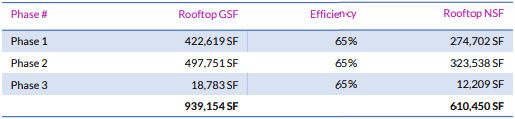

The plant capacity is estimated to be 7.6 MWp. This is based on the area available on each of the roofs to install solar panels.

Assuming it will take 80 SF to install 1 kWp, we calculate the capacity of all the solar panels that will be installed in the total available area.

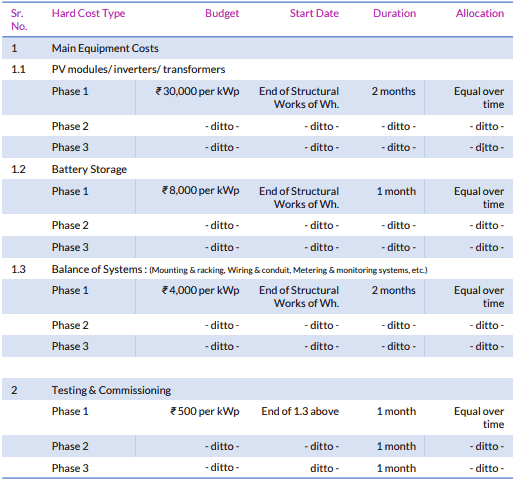

2. Budget Estimate

Hard Cost Estimates

Soft Cost Estimates

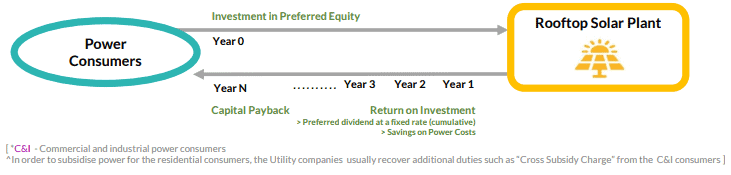

3. Preferred Equity

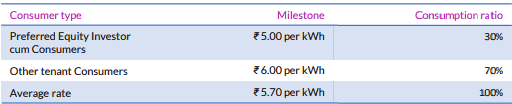

The FMCG/3PL/ e-commerce tenants of a grade A warehouse usually sign up for long-term leases often spanning more than 5 years. Extensive use of automation technologies and electric vehicles only amplify their need for larger, cheaper, and more sustainable sources of power. Pinkstones feels these people could be a good source of funding for the rooftop solar project.

Pinkstones has come up with the following offer for the most qualitative tenants:

- Contribute Preferred Equity Capital to the solar project.

- In return, buy power at cheaper tariffs vis-à-vis the non investing tenant consumers and also the rates of the local fossil fuel run grid.

- Plus, get a decent fixed return on your investment and a priority in the repayment of capital at exit.

A fixed preferred equity return coupon will limit their participation in the sharing of residual profits, thereby saving Pinkstones from risking themselves and their partners much.

Terms for the Preferred Equity Participants:

- Contribute 30% of the total equity requirement.

- Buy power at a discounted tariff rate.

- Receive a cumulative effective rate of return at 12% p.a. as the project starts making profits.

- Receive return of capital on a priority basis before other equity partners in the event of the sale of the asset.

4. Equity

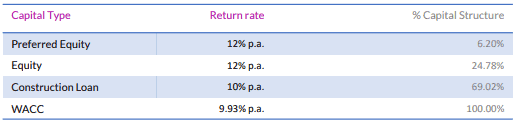

Pinkstones needs to raise equity for at least 30% of the project costs, so as to seek out loans from banks for the balance amount.

The following items will be funded with equity:

Pinkstones will put 20% of their own money and raise the remaining from other potential passive investors/LPs. We’ll assume power consumers will subscribe to the 30% preferred equity offer and the other investors will contribute the remaining 50%.

Pinkestones’ Fees

Waterfall Distribution Terms

The partnership for the sake of distribution of residual profits consists of Pinkstones and their LPs only. Therefore, amongst themselves (excluding the preferred equity guys) their capital contribution ratio is 71:29.

5. Debt

Construction Loan

Permanent Loan

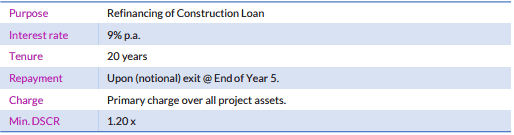

Debt Service Coverage Ratio

There won’t always be the same amount of sunshine every days. Seasonality is a given. In the periods when energy generation is low, incomes will also be lower.

To protect against this variability in revenue, an amount equivalent to 2 months of the debt service due on permanent loan will be set aside in the Debt Service Reserve account from the Operating Cashflows. This will prevent defaulting on debt servicing in the months of cash shortage.

6. Operations

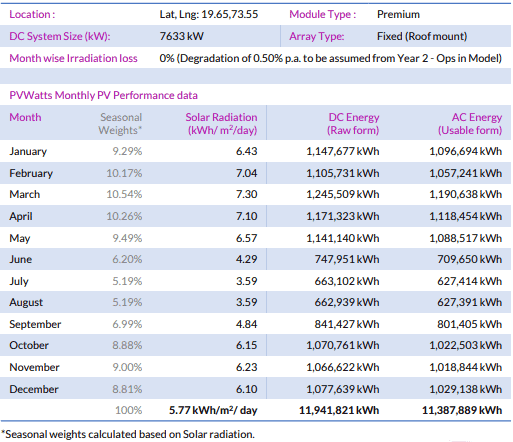

Energy Output

For this back-of-the-napkin ideation stage, Pinkstones has found the right hack. They go to the free PVWATTS CALCULATOR on the National Renewable Energy Laboratory (NREL) website and pull out the monthly volume report to understand their potential energy production.

Performance Ratio*

The performance ratio as indicated by the PVWATTS calculator (the ratio of AC (usable form) energy to DC (raw form) energy) is a good 95%+.

[ 11,387,889 kWh/ 11,941,821 kWh = 95.36%]*This information has no direct use in any formula in the financial model. It just indicates the efficiency of the solar panels & inverters in minimizing losses and maximizing energy output.

Annual Yield per kWp

Annual yield (DC) per kWp is 1564 kWh. [ 11,941,821 kWh/ 7633 kWp ]

Annual yield (AC) per kWp is 1492 kWh. [ 11,387,889 kWh/ 7633 kWp ]

Formula = Annual Energy Volume (kWh) / Plant Capacity (kWp)

Capacity Utilisation Fatory (CUF)

The capacity utilisation factor for this project is a realistic 17%. Meaning, out of the total installed capacity, the actual annual energy yield will be around 17% subject to seasonal variations.

CUF (DC) = 17.85% [ 1564 kWh/ 8766 hours ]

CUF (AC) = 17.02% [ 1492 kWh/ 8766 hours ]

Formula = Annual Yield per kWp / Total hours in the year

Output Scenarios

While the above PVWATTS report indicates a base case scenario (P50 or 50% probability), Pinkstones wants to use the most conservative estimate of the energy yields. They’ve found that a probability formula called NORM.INV in MS-Excel will help them to find the P90 estimate–90% probability of actualising (more conservative)–and the P99 estimate–99% probability of actualising (most conservative).

A standard deviation of 5% is assumed for this purpose. Mean value will be the base case estimate of annual yield already calculated.

Tariff Rates

The bitter truth is this: going green; saving the planet; cleaning the air, water, etc. will never be the biggest motivation for people to choose solar as their source of power over the hassle-free grid-supplied electric system.

Rates of fossil fuel state-run utilities range from ₹8.00 to ₹12.00 per kWh on a tiered usage basis. It’s a no-brainer that the tariff rates that Pinkstones offer must be cheaper to make sense.

Operating Expenses

7. Exit Value

Pinkstones wants to show a foreseeable lifecycle of this asset to their investors. What will the asset value look like at the end of 5 years? This is if any investor wants to liquidate and encash their stakes.

The lifespan of solar plants is usually presumed to be 25 years. Exit valuation by the DCF of the remaining 20 years’ operating CFs will be good to know for this purpose. The cashflows will be discounted using WACC.

Although the panel efficiency slows down to around 80% by the end of this period, no salvage value will be captured (thereby giving a conservative estimate).

An all inclusive selling cost of 1% is to be applied on the exit value.

Industrial Case Study Overview

Special Investors

Landowner Financing

You can call this source of funds by various names–land equity, quasi-equity financing or revenue participation finance from landowner, joint development agreement, etc. By doing this, you enlist the landowner as one of your funding partners, but only a limited one. You should offer such terms that fix up their returns and allow you to still have your equity and management control over your project.

Sometimes the landowner may not want to exit on the exit date. They may instead want to reinvest back into the asset and continue as an equity investor. This can be a great help in managing the end of the holding period.

Put yourself in Pinkstones’ shoes:

Will offering too much of a share of the warehouse rents chip away at your own profitability?

Should you keep the landowners out of the side incomes such as rooftop solar?

Will you be able to accommodate the crazy exit multiple your landowner is asking?

What will the best offer look like to you and your land financier?

Your go-to tool to find your own answers: This financial model.

For more reading:

Land Equity – Collaborative Development Strategies with the Landowner

How this Land Aggregation Strategy Helps Developers Raise More Debt and Scale Up Fast

Power Consumer Financing

Power is quite a regulated business. There are a lot of do’s and don’ts attached to it by regulators.

This especially matters if you wish to excuse yourself from paying certain additional duties and charges to your power utility company that you’d otherwise be liable to pay when using grid supplied electricity. After all, the whole point of building a private power plant is to save on energy costs.

Group Captive Scheme

There is a thing called a “Group Captive Scheme” under the Indian electricity laws that allows power plant developers to accept investments from power consumers.

In fact, this scheme was initially launched to facilitate different C&I power consumers coming together, pooling their equity, and approaching banks for further funding to build a power plant for their joint captive use.

There are two major advantages of this scheme:

- Exemption from paying certain duties and charges to the government that C&I consumers are otherwise liable to pay.

- Open access to state transmission and distribution infrastructure for shipping energy over longer distances.

BUT there are 3 conditions that power consumer investors must fulfil:

- Ownership – Jointly invest at least 26% equity.

- Consumption – Consume at least 51% of the power generated.

- Proportionality – Consume power in proportion to the equity you invested.

If you were Pinkstones:

Why should your tenant power consumers invest in your project and not somewhere else?

In what ways can you sweeten the deal for them?

How will you make sure that you don’t burden yourself in the process?

Your go-to tool to contemplate these and many other questions is the financial model.

How much of the Indian Group Captive Scheme is applied in this Industrial Case Study?

This industrial case study does not strictly adhere to the Group Captive Scheme. The purpose of it is to spark ideas for alternative and possibly better ways of operating.

Preferred Equity

The power consumers’ investments are structured into the project as preferred equity rather than a mezz. loan. Preferred equity could still be called a kind of equity that has a fixed income and priority in return distributions but limited involvement in management.

This way, Pinkstones finds it easier to comply with rule no. 1 above and pitch their project for further construction loan to bank/FI lenders.

Power Quota proportionate to investment

However, rule no. 3 from above is not followed. The power consumers do not get 1.96 x (51/26) times their investment percentage.

This is for two reasons:

- This is not a Group Captive Plant, its a plain captive plant. Energy is produced and consumed within the gated premises without using state infrastructure for distribution and consumption.

- If you give consumers a disproportionate quota of power at a lower rate, it may compromise your profitability, since they already are getting tariff discounts and a decent fixed interest rate on their investment.

If you indeed wish to apply this rule, make sure the other terms you offer (coupon rate, tariff rate, etc) are balanced accordingly.

Power Consumers’ Investment Cycle

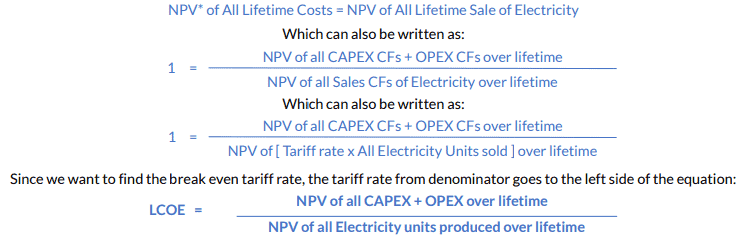

You’ve may have heard this term be discussed extensively in a macro sense. Energy scientists of the world compare the LCOE on a per MWh or per kWh basis for different renewable energy generation sources vis-à-vis the conventional fossil fuels to see which is the most cost competitive.

Let’s use LCOE in a micro sense in the context of this project.

What is LCOE?

LCOE is nothing but a break-even cost metric. If you set your power tariff rate below this rate, it would not be viable. The break even is the point where all cash inflows equal all cash outflows. That is:

This explains why we discount a non-cash number such as the ‘total electricity units’ in the denominator.

What should be the right discount rate for this LCOE to make sense?

I believe it should be the inflation rate. This is the rate at which the various operating costs rise year over year. All CAPEX is usually spent in the beginning with mostly no escalations. It is the inflation rate in reference to that will increase your tariff rate year over year. Use that one single inflation rate to discount all the future values in the above formula back to the present.

Click here for a great explanation by Edson Bortoni.

Conclusion

Create Your Own Case Study

This industrial case study offers insights into key decisions involved in developing and managing large-scale industrial warehouses. By applying the provided data and strategies, you’ll learn how to optimize asset value, manage development budgets, and meet investment criteria—essential skills for any CRE professional. For those looking to deepen their expertise, our Real Estate Case Study Creator provides a platform to test and enhance your modeling skills in a controlled, realistic setting. This GPT creates completely custom real estate case studies from scratch and allows users to craft case studies to simulate scenarios they are interested in or expect to encounter in their professional lives. This customization allows users to focus on particular areas of interest or challenge, making the practice sessions as relevant and effective as possible. We encourage both seasoned practitioners and newcomers to use this resource to refine their approach and decision-making in commercial real estate investments.

- Note: Custom GPTs are now available to both paid and free users of ChatGPT. Click here to learn more.

Download the Industrial Case Study files

In addition to the web-based case, we’ve created a complete Excel file with the solution, and a PDF version to download and use offline. As with our real estate financial models, this case study and solution are offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming). Just enter a price together with an email address to send the download link to, and then click ‘Continue’.

We occasionally update these cases and solutions (see version notes). Paid contributors will receive lifetime access to the case, solution, and all updates.

Frequently Asked Questions about Class A Industrial Warehouse + Rooftop Solar PV Plant Case Study

Version Notes

v1.0

- Initial release