Mezzanine Debt

Putting ‘Mezzanine Debt’ in Context

Scenario Overview:

Wasatch West Alliance, a real estate private equity firm, is exploring an investment opportunity in the Gallery at Cottonwood Creek, a 150,000-square-foot grocery-anchored retail center located in a vibrant suburban area near Salt Lake City, UT. The property is anchored by a well-known national grocery chain, which attracts substantial foot traffic to the center. In addition to the anchor tenant, the retail center features several inline tenants, including a fitness center, a popular local coffee shop, and a variety of service-based businesses.

The Challenge:

The property is currently 85% leased, with some tenants paying below-market rents due to older leases. The sponsor, a regional retail operator with extensive experience in value-add projects, intends to implement a capital improvement program to modernize the center, increase occupancy to 95%, and adjust rents to market rates. The sponsor anticipates that these enhancements will significantly increase the property’s Net Operating Income (NOI) over the next two years.

The Financing Structure:

To finance the acquisition and repositioning of the Gallery at Cottonwood Creek, the sponsor has secured a senior loan that covers 60% of the purchase price. However, there is still a 20% gap between the senior loan and the sponsor’s equity contribution. To bridge this gap, Wasatch West Alliance is considering providing a $6 million mezzanine debt investment.

Role of Mezzanine Debt:

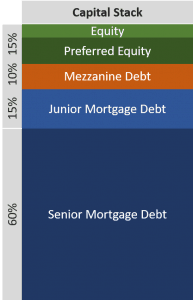

Mezzanine debt in this context serves as a subordinate loan, positioned between the senior mortgage debt and the sponsor’s equity in the capital stack. Unlike senior debt, which is secured by the real property itself, mezzanine debt is secured by an interest in the entity that owns the real property. This means that in the event of a default, Wasatch West Alliance, as the mezzanine lender, would have the right to foreclose on the ownership entity through a UCC foreclosure—a process that is typically faster and less costly than a real estate foreclosure.

Given its subordinate position, mezzanine debt carries a higher interest rate, often ranging from 10-15% annually, to compensate for the additional risk. This higher return reflects the fact that mezzanine debt investors stand behind the senior lender in terms of claim priority but ahead of the equity investors. If the property performs well and the sponsor successfully executes the business plan, the mezzanine loan would be repaid before any equity distributions, ensuring that Wasatch West Alliance receives its returns before the sponsor profits.

For example, if the repositioning plan at the Gallery at Cottonwood Creek is successful, and the property’s value increases due to higher occupancy and market rents, the senior debt will be paid off first. Following this, Wasatch West Alliance would receive the repayment of their mezzanine loan, including the agreed-upon interest, before any residual cash flow is distributed to the equity investors. Should the property not perform as expected, the mezzanine lender has the added security of being able to take control of the ownership entity, potentially stepping in to oversee the property’s management or sell it to recoup their investment.

Conclusion:

In this hypothetical scenario, mezzanine debt offers Wasatch West Alliance an attractive investment opportunity by providing a higher yield compared to senior debt, while still benefiting from a degree of security due to the ability to foreclose on the ownership entity in case of default. This flexible financing tool allows the sponsor to complete their capital stack without having to dilute their equity, all while providing the mezzanine lender with a structured return that balances risk and reward.

Frequently Asked Questions about Mezzanine Debt in Real Estate

What is mezzanine debt in real estate?

Mezzanine debt is “a subordinate loan on real property secured by an interest in the entity that owns the real property rather than on the real property itself.”

Where does mezzanine debt fall in the capital stack?

It “falls between mortgage debt and equity.” Mezzanine lenders are repaid after senior lenders but before equity holders.

How is mezzanine debt secured?

It is secured “by an interest in the entity that owns the real property,” allowing lenders to foreclose on the entity through a UCC foreclosure in case of default.

What is a UCC foreclosure and why is it significant?

A UCC foreclosure allows the mezzanine lender “to foreclose on the entity” owning the property. This process is “faster and less expensive” than a traditional real estate foreclosure.

Why does mezzanine debt carry a higher interest rate?

Because of its “riskier place in the capital stack,” mezzanine debt “carries a higher interest rate,” often between 10–15% annually.

How was mezzanine debt used in the Gallery at Cottonwood Creek project?

Wasatch West Alliance considered providing a $6 million mezzanine loan to bridge the 20% financing gap between the senior loan and the sponsor’s equity.

What are the repayment dynamics of mezzanine debt?

If the project performs well, the mezzanine lender is repaid “before any equity distributions.” If not, the lender can take control of the ownership entity to recover its investment.

How does mezzanine debt benefit the sponsor?

It enables the sponsor “to complete their capital stack without having to dilute their equity,” while retaining upside potential if the business plan succeeds.

Why is mezzanine debt attractive to investors like Wasatch West Alliance?

It offers “a higher yield compared to senior debt,” plus the added security of UCC foreclosure rights in the event of underperformance or default.

Click here to get this CRE Glossary in an eBook (PDF) format.