Excel Pro Forma for Flipping Houses (Updated Jan 2025)

Before moving to the principal side of the business, I began my career as a self-described real estate investment specialist, largely working as a land broker but dabbling in other areas including the popular “single-family flip” space. In all honesty, I wasn’t qualified for the title. In fact, I had little to no actual experience investing in real estate at the time. But as is the case with many young brokers, to bring in business I had little choice but to follow the oft-repeated refrain: “fake it ’til ya make it.”

Those were the days of the late-night television, “buy with no money down and become a millionaire instantly”, real estate training shysters. Every Dick, Tom, and Harriet was “investing” in real estate – driving up valuations to unsustainable levels and setting themselves and others up for eventual ruin. And while, to a certain extent I too got caught up in the irrational exuberance, it was a unique training ground for a burgeoning career in real estate.

You might also like my single family home construction pro forma for home builders.

As I picked up more and more clients and bird-dogged one single-family flipping opportunity after another, I became quite good at developing tools for analyzing the financial feasibility of those investments. And since that time, my capabilities with Excel, real estate valuation, and financial modeling have only continue to grow.

So, in that vein, I present to you my Excel Pro Forma for Flipping Houses.

Excel Pro Forma for Flipping Houses

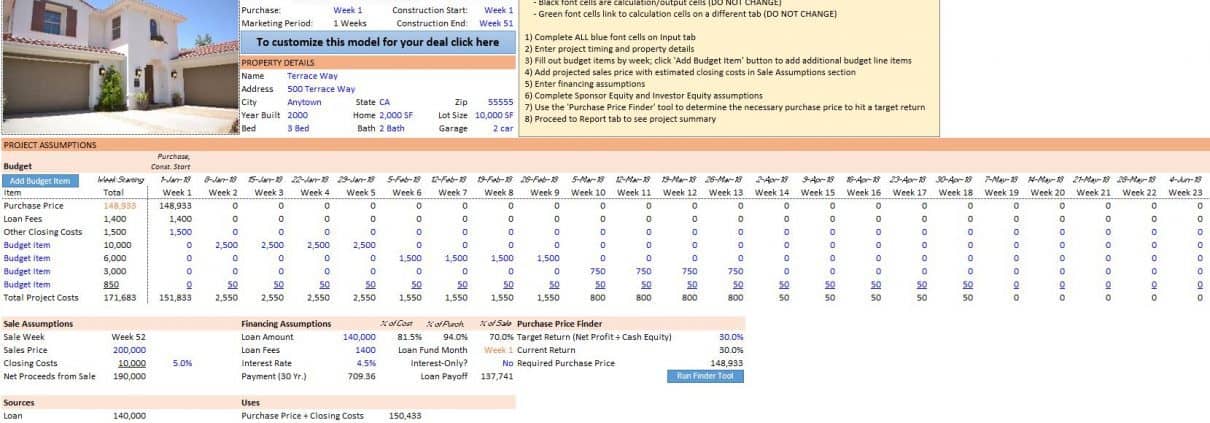

This Excel Pro Forma is meant to help the residential real estate investor make an initial assessment of a prospective property. It is a “back-of-the-envelope” model capable of estimating the potential profit, assess the cash required to completion, and arrive at an appropriate purchase price for the home.

It’s purposely simple, clean, and made to be filled out in a matter of minutes. This also means it lacks the complexity of a full financial model but works great at the early stages of a flip to sift out the non-viable deals.

Simple, Clean, User-Friendly yet Robust Excel Model

Quick Guide to Using the Excel Spreadsheet

After downloading the file (see link to download the model below), open the file in Excel 2007 or newer for Windows or Excel 2011 or newer for Mac. The file is a macro-enabled workbook, with two macros included – one for adding new budget rows and the second for the purchase price finder tool. The file will initially ask you to click to enable the macros.

With the file open, you will first fill out the assumptions (blue font cells) on the Inputs tab and then head to the Reports tab to view the results of your assumptions.

Basic Pro Forma Rules

- Blue font cells are mandatory input cells

- Orange font cells are optional input cells

- Black font cells are calculation/output cells (DO NOT CHANGE)

- Green font cells link to calculation cells on a different tab (DO NOT CHANGE)

Basic Steps to Completing the Workbook

- Complete ALL blue font cells on Input tab.

- Enter project timing and property details.

- Fill out budget items by week; click ‘Add Budget Item’ button to add additional budget line items.

- Add projected sales price with estimated closing costs in Sale Assumptions section.

- Enter financing assumptions.

- Complete Sponsor Equity and Investor Equity assumptions.

- Use the ‘Purchase Price Finder’ tool to determine the necessary purchase price to hit a target return.

- Proceed to Report tab to see project summary.

Watch the Video Tutorial for the Excel Pro Forma for Flipping Houses

Download the Excel Pro Forma for Flipping Houses

To make this model accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming – typical real estate Excel models sell for $100 – $300+ per license). Just enter a price together with an email address to send the download link to, and then click ‘Continue’. If you have any questions about our “Pay What You’re Able” program or why we offer our models on this basis, please reach out to either Mike or Spencer.

We regularly update the model (see version notes). Paid contributors to the model receive a new download link via email each time the model is updated.

Frequently Asked Questions about the Excel Pro Forma for Flipping Houses

Version Notes

v1.8

- Extended max hold period to 104 weeks (two years)

- Misc updates to placeholder values

v1.7

- Added Property Tax and Property Insurance reserves as fixed line items in Project Budget

- Misc updates to placeholder values

v1.6

- Fixed Secondary Financing payment calculation logic (Calculation tab row 11)

- Misc updates to placeholder values

v1.51

- Removed VBA password protection

- Renamed Module1 to Macros

v1.5

- Fixed issue where in certain cases the Secondary Loan payoff wasn’t included in the return calculation

- Increased decimal place to two for % of Sources on Reports tab

- Added Loan Payoff Month Input to Senior and Secondary debt inputs

- Allows for paying off one or both tranches of debt prior to sale date

- Allows for paying off Senior Mortgage with Secondary Debt mid-hold

- Provides greater flexibility to debt analysis

- Updated Secondary Financing logic in Sources table to exclude Secondary Debt when Senior Mortgage is paid off prior to analysis end month

- Minor updates to placeholder assumptions

v1.4

- Minor updates to placeholder assumptions

- Reconfigured positioning of sections on Inputs tab to allow for a new ‘Secondary Financing’ section

- Renamed Loan to ‘Senior Mortgage Loan’

- Built ‘Secondary Financing’ module (i.e. for Hard Money or Mezzanine Debt)

- Added ‘Secondary Financing’ assumptions on ‘Inputs’ tab

- Added Secondary Financing to Sources on Inputs tab

- Updated row 23 on ‘Inputs’ tab to accommodate loan fees from multiple loans; loan fees now automatically fund in loan start month

- Updated Calculation tab to included Secondary Financing

- Added Secondary Financing to Sources on Reports tab

- Fixed issue where Levered IRR did not calculate on hold periods shorter than 52 weeks

- Misc. formatting updates

v1.3

- Updated Version tab

- Added time zero logic, to make this model more consistent with institutional commercial models

- Now includes ability to forecast project budget either Straight-Line or Manually

- Added ‘Forecast Method’, ‘Start Wk.’, and ‘End Wk.’ columns to Inputs tab

- Forecast Method column includes two-option list

- Updated formulas and added conditional formatting in Budget cash flow section on Inputs tab

- Loan Fees in Financing section now links to Loan Fees line item in Budget

- Converted all number formats to ‘Accounting’

- Added dummy budget items

- New pie chart design

- Misc. formatting enhancements and fixes

v1.2

- Added version tab

- Misc. formatting improvements

- Fixed issue where ‘Purchase Price Finder’ tool was not solving correctly

- Set VBA to visible

- Removed ‘Return to Adventures in CRE’ button from Inputs tab

- Removed sheet protection from all worksheets