Land Equity – Collaborative Development Strategies with the Landowner

In this article, we’ll talk about land equity development strategies where the landowner contributes their land to the partnership. In these situations, land ownership is either immediately conveyed or deferred until development is complete. Read below to learn about land equity as a source of leverage, what’s in it for the landowner, two example structures for this situation, how it accounts on the books, and more.

Note – if the landlord were to not give away their property title, this would be considered a case of ground lease, not land equity.

Note from Spencer and Michael:

This is another post in a growing series that we call ‘International CRE’. Written by CRE professionals based outside of the United States, this series is a collection of deep dives into various CRE topics relevant to real estate professionals all over the world. One of the reasons we love the International CRE series is that things are not done the same in one country to the next, and this series highlights those differing perspectives.

This particular post is written by our friend Padmaa Iyer. Padmaa is an India-based Real Estate Fundraising Strategist and Chartered Accountant. She is also a long-time A.CRE reader and graduate of our Accelerator Program. A huge thank you to Padmaa for sharing her knowledge with the A.CRE community!

Land Equity in Development – a Smart Source of Leverage for Sponsors

Land costs usually comprise a very big chunk of development costs, ranging anywhere between 20-40% of the total cost. And debt is often unavailable for funding the land cost.

No formal channel lender (such as a bank or an institutional lender) will want to invest in your development project unless you substantiate your own “skin in the game” and make it shovel-ready. This simply means that as a sponsor or GP, you have to scramble up a huge equity investment right from the beginning.

But what if you decide you want to kickstart your project without blowing too much cash upfront?

In such a case, one interesting source of leverage you should consider is Land Equity. Land equity can instantly make your business model asset-light. It can also raise up the bankability quotient of your project, thereby making it much more straightforward for you to raise funds from the subsequent sources of capital.

Of course, the onus is on you to think up an irrefusable win-win offer for your potential land partner(s). You need to reason up the risk-reward calculus to them.

In the rest of this article we’ll dive into the following topics:

What’s in it for the Landowner in Land Equity Development Strategies?

This land equity development strategy is a very attractive one for potential investors, but what’s in it for a landowner? Since they’re working directly with the developer, landowners get a near-guaranteed higher value for their land. This allows them to sell outright at current market values whereas beforehand they may have been unable to. Depending on the deal’s structure, the landowner may instead receive a cut of rental profits, ownership over certain housing units, or another agreed-upon payment.

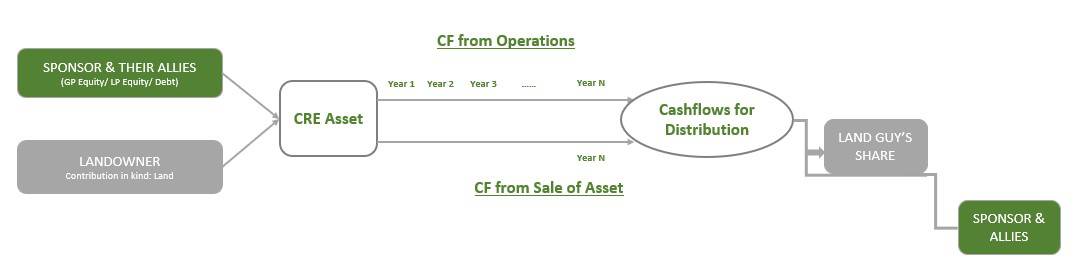

The chart below depicts the priority in distributions that Landowner will always have

Two Example Structuring Scenarios Using a Land Equity Development Strategy

Most CRE deals follow one of two business models:

- Build – Operate – Sell

- Build – Sell.

Let’s look at how to structure a strategic tie-up in each of the above scenarios.

Scenario #1 – Build – Operate – Sell

Context: Commercial Development

Most commercial developments follow a Build-Operate-Sell model. You build/acquire the CRE property, run it (e.g., by leasing it out) for some years and then sell it at an opportune time when your overall returns are optimum.

Landowner’s contribution: Land

Consideration to Landowner:

During Operations:

A pre-determined share of rental revenues/profits. The landowner will most likely prefer a share of the rental income rather than that of the operating net profits. This tends to be a more prudent and hassle-free choice for them. Well otherwise, why would they want to spend their time and resources checking the veracity of the your various other bills and ways of accounting?

At Exit:

Either this could be a fixed multiple over the landowner’s contribution or they could claim a valuation of their share of rental income by the direct cap method

Exit Valuation for Landowner = Share of Rentals (Forward 12Mo) ÷ Applicable Cap Rate

An Example – Scenario #1

JB wants to sell their 20 acres of land.

Pinkstone developers offer them an opportunity to participate in the ongoing spree of large-scale industrial warehouse development. Joining hands with Pinkstone could allow them to maximize their upside by remaining invested until the developer itself exits the deal.

In this case, let’s say the property develops in 1 year and Pinkstone exits the deal 1 year afterward. JB also chooses to sell their stakes along with Pinkstone. The property is stabilized immediately upon development.

The Numbers look like this:

Current Market Value of the Land – 2.4 MM

Overall Project Costs (land makes up 30%) – 8 MM

Developer’s Offer to the Landowner:

Share of monthly lease rentals – 30%

Share of Exit Value – Direct Cap Valuation of the Proportionate rental share.

During Operations

Development Yield – 10% p.a.

Meaning Potential Rental Incomes – 800,000 (8 MM * 10%)

Landowner’s share – 240,000

At Exit

Applicable Cap rate – 7%

Exit Value for the asset – 11.43 MM (800,000 / 7%)

Landowner’s share – 3.43 MM (240,000 / 7%)

Choice – Today v/s Post Development

Returns for Landowner today – 2.4 MM

Returns over 2 years – 3.67 MM (240,000 + 3.43 MM)

Scenario #2 – Build – Sell

Context: Residential Development

Most residential developments follow a build-sell model. You build residential homes in order to sell off and immediately encash your investments. Final exit happens when the last of the homes you built is handed over to your home-buyer.

Landowner’s contribution: Land

Consideration to Landowner:

Since operations comprise both building and selling, there is no separate operational income apart from the exit cashflows. Every time a housing unit is sold, a partial exit happens.

So how do you structure distributions in this case?

Enter: Revenue Participation Finance.

The landowner may say, “Give me a certain fixed multiple over the current market price of my land.”

Mode of payment? “Give me my cut as a fixed share from your sales cashflows until all of my dues are paid off.…”

Or the landowner may rather ask for a payback in kind.

A certain portion of the developed area (# housing units) in return for their land.

An Example – Scenario #2

MJ wants to encash their 10 acres of land.

Redstone developers propose to MJ a Joint Development Arrangement to build a sprawling mid-rise apartments complex on their land.

Under this JDA, MJ is to get 25% of the cashflows from the sale of flats to homebuyers until they’ll have received 2 x of the value of their land value today.

The development process will take 4 quarters to complete. If things go well as per Redstone’s plans, all the units will be sold off after 6 quarters.

The Numbers look like this:

Current Market Value of the Land – 1.4 MM

Overall Project Costs (land makes up 20%) – 7 MM

Developer’s offer to the Landowner:

Share of Quarterly Sales Cashflows – 25%

Until 2 x of the Land’s Current Market Value has been paid.

Developer’s Sales Cashflows

The developer expects to make a 40% margin over Project Costs. This means cashflows from sales will likely be 9.8 MM collected over 6 quarters as below:

| Qtr 2 | Qtr 3 | Qtr 4 | Qtr 5 | Qtr 6 | |

| Sales CFs | 1MM | 2MM | 2.5MM | 3MM | 1.3MM |

| Land Guy’s Cut | 250,000 | 500,000 | 625,000 | 750,000 | 675,000 |

|

(25%) |

(25%) | (25%) | (25%) |

Balance paid off |

Choice – Today v/s Post Development

Returns for Landowner today – 1.4 MM

Returns over 2 years – 2.8 MM

How does it impact your balance sheet?

Though we may call the landowner’s contribution as Land Equity, Quasi-Equity Loan, or a Revenue Participation Finance from the Landowner, this item doesn’t go as an item of equity into your SPE balance sheet. This is for a couple of reasons.

Why?

First of all, this is usually not in your partners’ interest. The landowner’s contributions are limited to the land that they bring in and thus they don’t participate in the management of the project’s ongoings (if they do, then your role as a developer reduces to that of just a contractor). Also, the landowner gets a first preference share out of the rental incomes/developed product/sale proceeds before anyone else.

Secondly, auditors don’t approve of this. There is no such class as ‘land equity’ recognized or recommended by any accounting standard board anywhere in the world.

Then how will it be recorded in the books?

As an item of Debt. The landowner’s contribution is recorded at the current market value less any advance tokens given to them, i.e., the cost of the land for the project.

Okay, now how do we bifurcate the pay-outs made to the landowner into interest and principal?

One important thing to keep in mind here is that this landowner doesn’t care about fancy return measurement metrics such as IRR or CAGR. Instead, they simply want a certain multiple over the current price of their asset. Preferably double or more. Period.

That’s why it’s better to keep it simple. Until all the promised excess over the recorded debt (dues to the landowner) in the books is paid off, it will be charged off as an interest expense. Once all the promised excess returns are paid off, start amortizing the principal balance from the balance sheet.

Land Equity in a Joint development – a Potential Win-Win

The strategies we discussed here are just 2 of the many possible ways in which the landowners and the developers could join hands. No “one size fits all” rules here!

How do the parties perceive the risk-return trade-off in the deal?

Answer to this is what will lead to reaching a middle ground with terms and conditions that make sense to both the sides.

The fun part of such capital stacking strategies is that it allows you room for creative thinking. Only after you as a deal maker are clear on the structure, does your army of experts, viz., your legal counsel, accountants, tax experts, etc. arrive at your thought party — to think through the doability and executions.”

Frequently Asked Questions about Land Equity – Collaborative Development Strategies with the Landowner

What is a land equity development strategy?

It is a strategy where the landowner contributes their land to a development project in exchange for future financial returns, such as rental share, sale proceeds, or developed units. “Land equity can instantly make your business model asset-light” and is used when “land ownership is either immediately conveyed or deferred until development is complete.”

What’s the benefit for the landowner?

The landowner may receive a share of rental income, developed units, or a multiple of the current land value. “Landowners get a near-guaranteed higher value for their land” and can participate in profits instead of selling outright.

How is land equity different from a ground lease?

In a land equity deal, the title is transferred to the partnership, while in a ground lease the landowner retains title. “If the landlord were to not give away their property title, this would be considered a case of ground lease, not land equity.”

What are the two common structuring scenarios for land equity deals?

Build-Operate-Sell: Landowner gets rental income and a share of exit proceeds.

Build-Sell: Landowner receives a portion of sales cashflows or finished units until a target multiple is reached.

“These strategies are just 2 of the many possible ways in which the landowners and the developers could join hands.”

How are landowner contributions recorded on the books?

They are recorded as a liability (debt), not equity. “There is no such class as ‘land equity’ recognized… by any accounting standard board.” Payouts are first treated as interest until the promised excess is met, then as principal amortization.

How is land equity a form of leverage for developers?

It reduces upfront capital needs and can enhance project bankability. “Land equity… can raise up the bankability quotient of your project,” making it easier to secure additional capital.

What is Revenue Participation Finance?

It is a payment model where the landowner receives a fixed percentage of sales cashflows until a specified return multiple is reached. “Give me my cut as a fixed share from your sales cashflows until all of my dues are paid off.”

How do landowners typically view returns in these deals?

They generally prefer simple multiples over metrics like IRR. “They simply want a certain multiple over the current price of their asset. Preferably double or more.”