A.CRE Build-to-Rent (BTR) Development Model (Updated May 2025)

Build-to-rent (BTR) has become more and more common in CRE and now accounts for a meaningful share of development. In the past, we’ve recommended A.CRE readers use our Apartment Development Model for BTR analysis. However, as we’ve received numerous requests over the few years for a purpose-built BTR model – including an inquiry in a recent live A.CRE AMA session – I decided to take the time to create one and share it to our library of real estate models.

So, with that said, allow me to introduce the A.CRE Build-to-Rent Development Model. This model is built on the foundation of our Apartment Development Model, employing many of the same methodologies and modules used in that model. Thus, if you’re familiar with that model, this one will come easy to you.

Below you’ll find an introduction to BTR as a property type, an overview of this BTR development model, as well as written and video walkthroughs of how to get started using this Excel pro forma.

Note: I did not add a beta tag to the initial release of this model, as the underlying foundation model has been used thousands of times and updated dozens of times. However, given the changes I made to that base model in order to accommodate BTR scenarios, there will be bugs that will need to be found and fixed. As always, please let us know when you run into issues or have suggested additions, and we’ll roll out fixes and new features in future versions.

We’re excited to share a Build-to-Rent (BTR) Development Model with the A.CRE community.

What is Build-to-Rent (BTR) – Also Referred to as BFR (Build-for-Rent)?

Build-to-Rent (BTR), sometimes referred to as Build-for-Rent (BFR), is an emerging sector within the real estate industry focusing on the development of residential communities specifically designed for long-term rental. This model caters to the growing demand for single-family neighborhood living without the commitments of homeownership.

BTR projects consist of attached and detached homes, developed en masse within a neighborhood, where all units are owned and managed by a single entity. These communities often feature amenities similar to those found in multifamily developments, such as parks, fitness centers, and community spaces, enhancing the rental living experience while fostering a strong sense of community.

The BTR model is particularly appealing in today’s market, as it addresses both the flexibility desired by modern renters and the investment stability sought by developers and investors. For renters, BTR communities offer the privacy and space of single-family homes, coupled with the convenience of professional management and maintenance-free living.

For investors, these projects promise consistent revenue streams through rental income, along with potential for long-term property value appreciation. As such, BTR developments are not just reshaping rental housing options but also offering a new avenue for real estate investment and community development.

Build-to-Rent (BTR) is an emerging investment strategy in commercial real estate.

Terminology in Build-to-Rent

Nomenclature in Build-to-Rent is evolving and sometimes distinct from other investment strategies. We recently wrote a post discussing BTR-specific terminology to help you better navigate this space.

Basic Objectives for this Build-to-Rent Development Model

This Build-to-Rent Development Model was built on the framework for my popular Apartment Development Model. That model has been downloaded and used by ten of thousands of commercial real estate professionals.

That model, as with this BTR Development Model, was created with a few criteria that guided the model’s creation. First, I wanted the model to be robust – meaning the model had to be able to do everything an institutional-quality BTR development model can do. I’ve seen hundreds of institutional (and non-institutional) real estate models in my career, and I can honestly say this model holds its own in terms of features and functionality.

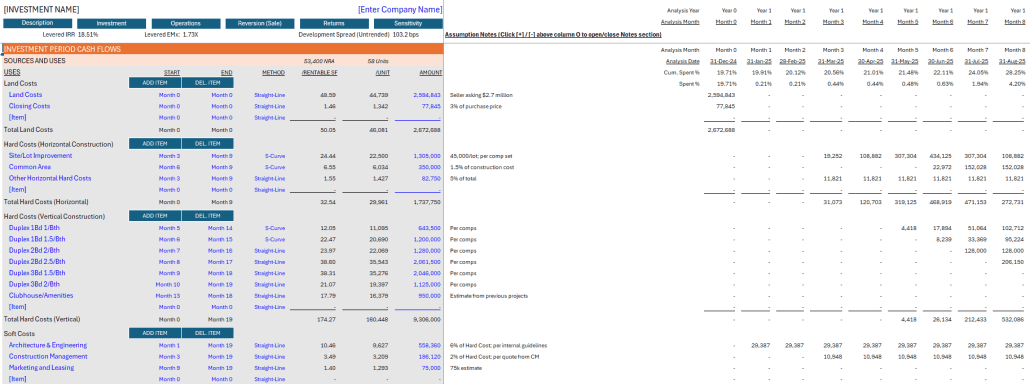

Second, I wanted it to be simple and intuitive. It seems conventional modeling wisdom is, the more comprehensive a model, the more tabs it must have. And I’m as guilty of this as the next guy – my Ai1 model has 30+ tabs! However, I wanted this Excel pro forma to be different. I set out to build a development model with just one primary assumptions tab, and one primary report tab. And while the model contains several three optional worksheets (i.e. Detailed OpEx, Commercial Income, and Annual Cash Flow tabs), all assumptions necessary to run a full analysis are housed on one simple to use and navigate tab.

Screenshot of the ‘Investment Cash Flow’ (Project Budget / Sources and Uses) of the BTR Development Model

Finally, I wanted the model to be visually appealing. I paid special attention to heading, subheading, input, output, and other formatting elements. I built attractive toggle and recalculate buttons and separated the various sections using attractive formatting styles. The printer-friendly Summary tab, which displays the high-level outcomes of the analysis, uses custom charts and sections to visualize the cash flow, risk, and return results. While I admit what is visually appealing is in the eye of the beholder, I’m pleased with the results and hope you will be too.

This model likely still contains errors. If you spot an error, have a feature request, or would like to make a suggestion to improve the model, please let me know.

Overview – A.CRE Build-to-Rent (BTR) Development Model

The A.CRE Build-to-Rent (BTR) Development Model includes one primary inputs tab, one summary report tab, one optional cash flow report tab, two optional input tabs, one data tab, and a tab to track version changes to the model.

Version Tab (Visible by default)

The model opens initially to this tab so you can see what changes have been made in the most recent version of the model. On this tab you can also find links to model tutorials, guides, support, and other information.

Underwriting Tab (Visible by default)

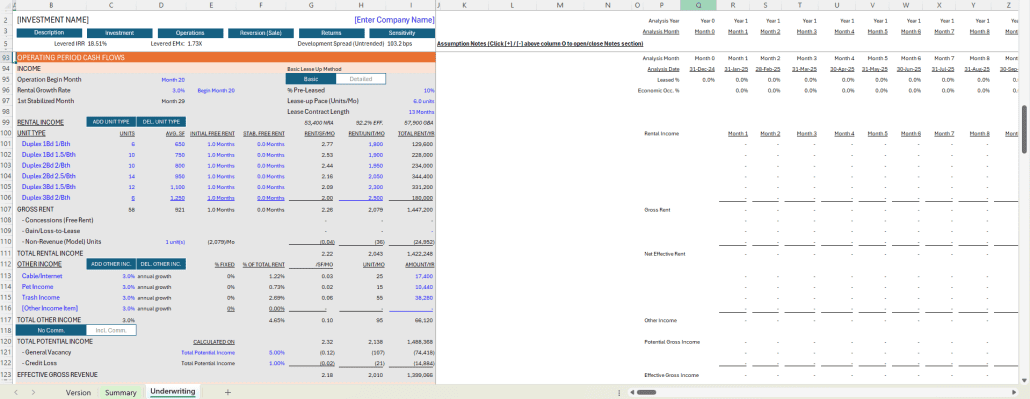

The Underwriting tab is where all of your primary inputs are entered. The tab is broken up into six sections, built from top to bottom. The sections can be accessed either by scrolling down to each or using the buttons along the top of the screen. The six sections are ‘Description’, ‘Sources/Uses’, ‘Operations’, ‘Reversion (Sale)’, ‘Returns’, and ‘Sensitivity’.

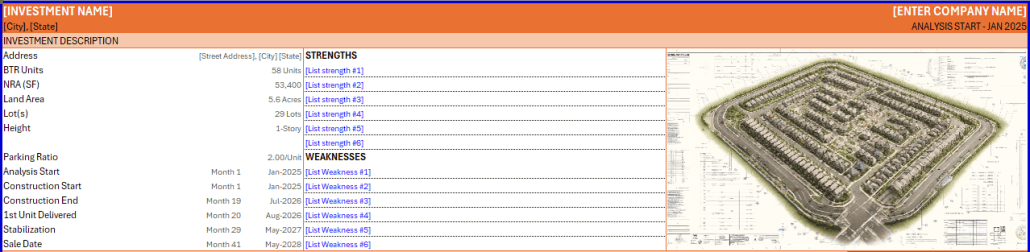

Summary Tab (Visible by default)

While the return metrics levered IRR, levered EMx, and Development Spread are shown shown along the top of the Underwriting tab, the bulk of the risk and return metrics are shown/visualized on the Summary tab. The summary tab also includes six charts, a strengths/weaknesses section, a frame to include a picture/map, and a summary of the investment. The Summary tab is meant to be printed, and as such the view mode is set to Print Preview by default.

Annual Cash Flow (Hidden by default)

The annual cash flow tab rolls up the monthly cash flows to annual periods, so you can view high-level cash flows on one page. The report is printable. You can access the report by pressing the ‘Show’ toggle on the Summary tab with the Property Cash Flow section.

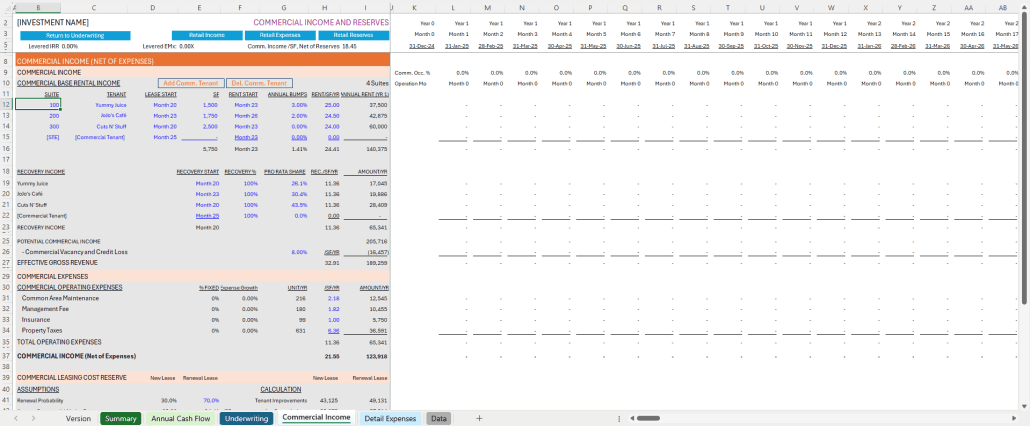

Commercial Income Tab (Hidden by default)

On the Underwriting tab, the user has the option to model commercial income. When this mode is toggled on, a ‘Commercial Income’ tab becomes available. In this tab, the user enters a commercial rent roll, expense recovery assumptions, basis commercial operating expense assumptions, and leasing cost assumptions. The outcomes from this tab flow back to the Underwriting tab, where commercial line items (e.g. ‘Commercial Income’ and Commercial Leasing Cost Reserves’) are added to the analysis.

Detail Expenses Tab (Hidden by default)

Similar to modeling retail income, on the Underwriting tab the user has the option to toggle a detailed operating expenses mode. Rather than entering annual values for the ten preset operating expense line items, when the user toggles the ‘Detailed’ operating expense mode on the Underwriting tab, a ‘Detail Expense’ tab becomes available where the user can detail out operating expenses. The detail then flows back to the Underwriting tab.

Data Tab (Hidden by default)

Some basic backend settings are housed in a Data tab. These settings are related to the s-curve development cash flow forecasting module, date and period headers, and may include other settings as the model evolves.

Guides and Tutorials for Using the Build-to-Rent (BTR) Development Model

Below you’ll find a video for how to use the Build-to-Rent Development model. This walk through is based on the initial release version of the model. As new versions of the model are released, I’ll look to add follow-on videos to describe new features and changes.

Compatibility

This version of the model is only compatible with Excel 2013, Excel 2016, and Excel 365

Download the A.CRE Build-to-Rent (BTR) Development Model

To make this model accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming – typical real estate development models sell for $100 – $300+ per license). Just enter a price together with an email address to send the download link to, and then click ‘Continue’. If you have any questions about our “Pay What You’re Able” program or why we offer our models on this basis, please reach out to either Mike or Spencer.

We regularly update the model (see version notes). Paid contributors to the model receive a new download link via email each time the model is updated.

Frequently Asked Questions about the A.CRE Build-to-Rent (BTR) Development Model

Version Notes

v1.3

- Added ‘% of EGI’ option for Asset Management Fee

- Updated dropdown in D235 to include ‘% of EGI’ option

- Updated E235:I235 to accommodate ‘% of EGI’

- Rewrote logic starting in FA209 to include ‘% of EGI’ logic

- Updated placeholder value for Total Construction Debt Start Month from land cost start to minimum of land, hard, and soft cost start

- Updated placeholder value for Financing Fees Start Month from land cost start to minimum of land, hard, and soft cost start

- Misc. formatting improvements

v1.2

- Various performance improvements

- Misc. updates to placeholder values

v1.1

- Optimized workbook for performance enhancement

- Added Gross/Net labels to Partnership and Property Return section of Summary tab

- Enhanced ResidualLandValue macro for iterative convergence to target Development Spread

- Added iterative Goal Seek approach to ensure Development Spread remains consistent after recalculation of construction interest.

- Implemented screen updating improvements to boost macro performance and reduce screen flicker.

- Misc. updates to placeholder values

v1.0

- Initial release

- Adapted Apartment Development Model for use with Build-to-Rent (BTR) Residential Development opportunities