Self Storage Acquisition Model (Updated May 2025)

I’ve spent the past few weekends working on a purpose-built Self Storage Acquisition Model, and I’m now happy to share the result of that work with you. This is a model that’s been requested by quite a few A.CRE readers over the past few years. I released a Self Storage Development Model last year, and that release only intensified the demand for a Self Storage model for acquisitions.

Below find a written explanation of how the model is built, a video walking you through how to use it, and a link to download the model. Enjoy!

This model likely still contains errors. If you spot an error, have a feature request, or would like to make a suggestion to improve the model, please let me know.

How the Self Storage Acquisition Model Was Built

This model was built using the core functionality of our Value-Add Apartment Acquisition model. In recent years, I’ve designed my models using a combination of independent modules all connected to one another. I also incorporate the Investment Cash Flow, Operating Cash Flow, and Reversion Cash Flow DCF framework taught in our real estate financial modeling training Accelerator program. What this bolt-on technique allows me to do is to easily adapt existing models for other purposes.

So in this case, I took my Value-Add Apartment Acquisition model, replaced the apartment Operating Cash Flow module with a self storage Operating Cash Flow module, and made a variety of miscellaneous changes to the other modules and voila. A robust, institutional-quality, purpose-built Self Storage Acquisition Model. And it only took about 20 hours to complete, rather than the hundreds of hours it would have taken had I built the model from scratch.

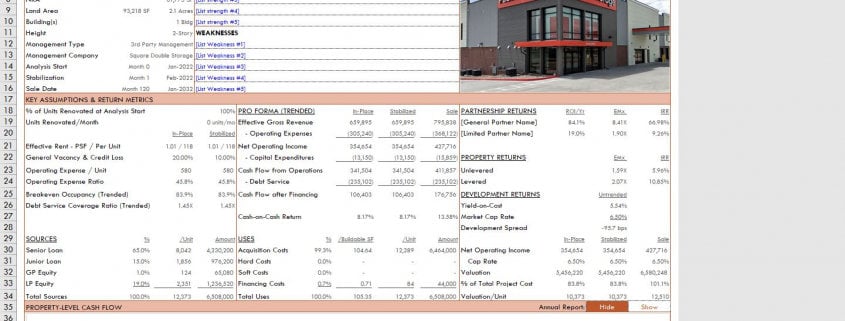

The ‘Summary’ tab includes key facts, assumptions, returns, and two column charts to visualize the cash flows

Using the Model – Self Storage Acquisition Model

Given that the backbone of the Self Storage Acquisition model is the Value-Add Apartment Acquisition model, if you’ve used my Value-Add Apartment Acquisition model than you can use this model.

The model only contains three worksheets, but don’t assume it’s lacking in functionality. This model contains everything you would expect from an institutional self storage acquisition model. If you’re familiar with my modeling work, a few years ago I moved to a design concept where all of the underwriting is on one worksheet – the ‘Underwriting’ worksheet.

This greatly improves the user experience, makes modifying/improving the model much easier, improves model performance from a memory and CPU standpoint, and I think is more intuitive once you get used to it.

When you first open the model, you find three visible worksheets: Version, Summary, and Underwriting. By default, a 4th worksheet called Annual Cash Flow is hidden. But you can make this worksheet visible by clicking the ‘Annual Report: Show’ button on the Summary tab. Below, I talk through what each worksheet contains.

Version Tab (Visible by default)

The model opens initially to the Version tab so you can see what changes have been made in the most recent version of the model. On this tab you can also find links to model tutorials, guides, support, and other information.

Summary Tab (Visible by default)

While the return metrics levered IRR, levered EMx, Cash-on-Cash Return, and other property and partnership-level returns are shown in various places on the Underwriting tab, the most important metrics are summarized / visualized on the Summary tab. The summary tab also includes two charts, a strengths/weaknesses section, a frame to include a picture/map, and a summary of the investment. The Summary tab is meant to be printed, and as such the view mode is set to Print Preview by default.

Underwriting Tab (Visible by default)

The Underwriting tab is where all of your primary inputs are entered. The tab is broken up into six sections, built from top to bottom. The sections can be accessed either by scrolling down to each or using the buttons along the top of the screen. The six sections are ‘Description’, ‘Investment Cash Flow’, ‘Operating Cash Flow’, ‘Reversion (Sale) Cash Flow’, ‘Returns (Property and Partnership)’, and ‘Sensitivity’.

Annual Cash Flows (Hidden by default)

The Annual Cash Flow tab rolls up the monthly cash flows to annual periods, so you can view high-level cash flows on one page. The report is printable. You can access the report by pressing the ‘Show’ toggle on the Summary tab within the Property Cash Flow section.

Video Guide for Using the Self Storage Acquisition Model

Below find a walk-through video of the Self Storage Acquisition model. This video was based on v1.0 of the model, and includes a quick overview of all of the features of this Excel model. Please let us know if you spot any bugs/errors or have a feature request.

Compatibility

This version of the model is only compatible with Excel 2013, Excel 2016, and Excel 365

Download the Self Storage Acquisition Model

To make this model accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming – typical real estate acquisition models sell for $100 – $300+ per license). Just enter a price together with an email address to send the download link to, and then click ‘Continue’. If you have any questions about our “Pay What You’re Able” program or why we offer our models on this basis, please reach out to either Mike or Spencer.

We regularly update the model (see version notes). Paid contributors to the model receive a new download link via email each time the model is updated.

Frequently Asked Questions about the Self Storage Acquisition Model

Version Notes

v1.4

- Ran Workbook optimization; 75,106 cells were optimized to improve workbook performance

- Renamed Levered IRR and Levered EMx to G-Levered IRR and G-Levered EMx to reiterate that they are Gross returns (i.e. property-level returns)

- Fixed issue where Refi Loan Funding and Payoff was not visualized in Annual Cash Flow report

- Updated Total Loan Draws and Loan Payoffs lines to now link to rows 226 and 233 on the Underwriting worksheet

- Minor updates to placeholder values

v1.32

- Fixed issue where ‘Lender Reserve’ was not being capitalized (i.e. was not appearing as a Use, and therefore no Source was created to cover the Use)

v1.31

- Fixed ‘Data Validation’ for IO input in Refi debt module

- Fixed formula in cell E98 to use loan payoff rather than initial loan balance

- Minor updates to placeholder values

v1.3

- Fixed link to Total Equity details calculation (i.e. ‘Click for Details’ link in F62)

- Misc. updates to placeholder values

v1.2

- Added buttons to Unit and Other income sections to ‘Add’ and ‘Delete’ Unit Types and Other Income line items

- Misc. updates to placeholder values

v1.1

- Created ‘Add Unit Type’ and ‘Delete Unit Type’ functionality; Add unlimited unit types and delete all but two of the unit types

- Wrote two new macros: Add_Unit_Type and Delete_Unit_Type

- Added buttons above Unit Mix table to add or delete unit types

- Created new named ranges (Rel_Unit_Type and Items_Unit_Type)

- Created ‘Add Other Income’ and ‘Delete Other Income’ functionality; Add unlimited Other Income line items and delete all but two of the Other Income line items

- Wrote two new macros: Add_Other_Income and Delete_Other_Income

- Added buttons above Other Income section to add or delete Other Income line items

- Created new named ranges (Rel_Other_Income and Items_Other_Income)

- Added ‘Lender Reserve’ module

- Inserted ‘Lender Reserve’ line to Investment Cash Flows (row 47); enter forecast method, amount, when the reserve will be released, and what % will be released

- Inserted ‘Lender Reserve Release’ line to Property-level Cash Flow section (row 220); reserve is returned (i.e. released) to owner via this line

- Fixed an issue where Year 6 growth rates were not being used in analysis (year 5 were used for all remaining years)

- Added ‘Refinance Outcome’ section to Subsequent Financing section

- Includes ‘Equity Returned’ amount and % of total

- Includes ‘Equity Still Invested’ amount and % of total

- Changed cells J93:J94 (Subsequent Financing Funding month) to an output, given that the Funding month is driven by the initial loans’ payoff month

- Updated formula that calculates placeholder initial Loan Term (F76:F77) to be dynamic to Refi vs. Sell selection

- Misc. formatting updates

v1.0

- Initial release

- Adapted from the A.CRE Value-Add Apartment Acquisition Model