All-in-One (Ai1) Walkthrough #6 – Underwriting a Hypothetical Multifamily Acquisition

This walkthrough, our sixth in the series, takes you through the entire process of underwriting an apartment acquisition opportunity using the All-in-One Model’s new multifamily module. I’ve created hypothetical assumptions for this exercise written out in PDF format (download link below) and then use those assumptions to assess an appropriate purchase price for this opportunity.

In an effort to provide greater instruction on how to use our All-in-One Underwriting Tool for Real Estate Development and Acquisition, we’re developing a series of walkthrough videos and posts on the methodology behind the various components of the model. Our hope is that if you are empowered with the how, you’ll be more willing/able to provide feedback to improve the model.

If you haven’t already, you can download the model here. This walkthrough uses beta version 0.4.1 of the All-in-One Model.

Video Walkthrough – Underwriting an Apartment Acquisition

Assumptions – Hypothetical Apartment Acquisition

You can download these assumptions in PDF format here.

Investment Summary

- Investment name: Saddle Ranch Estates

- Parking: 319 spaces

- Year built: 2005

- Analysis Start: Jan 1, 2018

- Construction length: 0 months

- Analysis Period: 10 years

- Apartment Units: 248

Valuation

- Market NOI cap rate for comparable properties: 4.75%

- Forecast growth in cap rate: 5 bps per year

- Exit cap rate: 5.25%

- Target unlevered IRR: 7.00%

- Selling costs @ reversion: 2.0%

Permanent Debt Assumptions

Senior Debt

- Amount: 65% of acquisition cost

- Loan Fees: 0.5% of loan amount

- Interest rate: 4.25%

- Amortization: 30 years

- Interest-only: None

Junior Debt

- None

Partnership Assumptions

- Equity split: 95/5 LP/GP

- Preferred return: 6.0% paid pro rata

- Promote: 80/20 to a 10% IRR, 70/30 to a 15% IRR, 60/40 thereafter

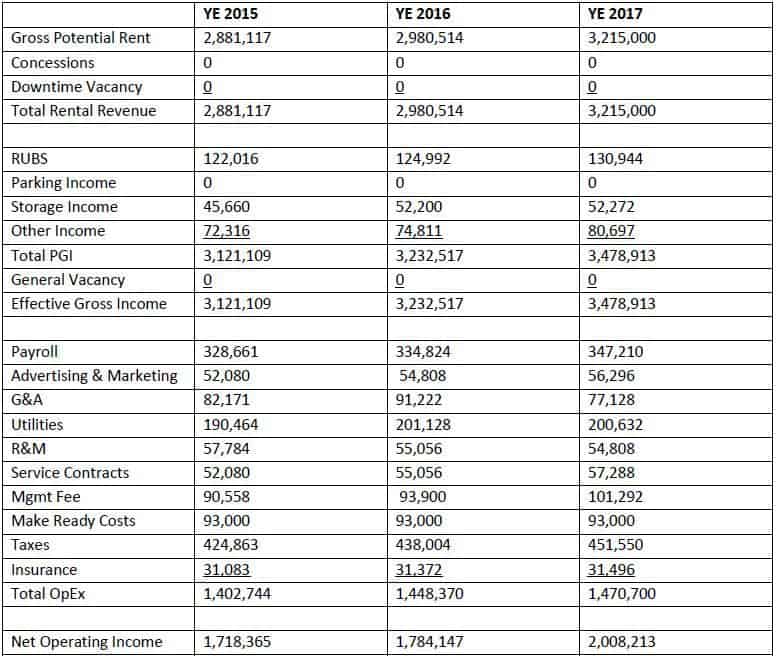

Operating History

Operating Assumptions

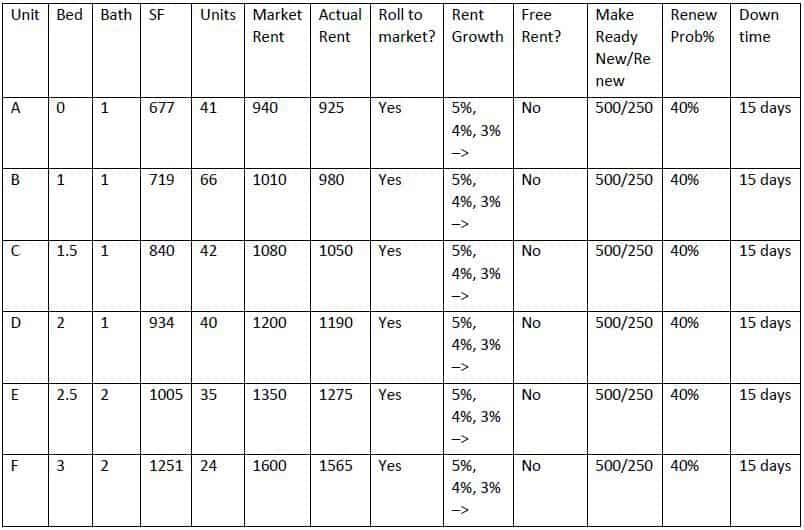

Unit Mix

Other Income

- Utility Reimbursement: $45/unit/mo

- Parking Income: $0

- Storage Income: 110 storage units @ $45/storage unit/month with 10% vacancy

- Other Income: 2.50% of Total Rental Revenue

General Vacancy

- 3.5%

Operating Expenses

- 2017 actuals grown by 2%

- Mgmt fee @ 3%

- % Fixed – All at 100%

- Expenses grown at 2%

Capital Expenditures

- Other CapEx: Capital Improvement Plan – $800,000 in year one, $800,000 in year two

- Capital Reserve: $250 per unit

Frequently Asked Questions about Underwriting a Hypothetical Multifamily Acquisition using the Ai1 Model

What is the purpose of this walkthrough?

The walkthrough demonstrates how to underwrite a hypothetical multifamily acquisition using version 0.4.1 of the A.CRE All-in-One (Ai1) Model. It walks through how to apply the model’s multifamily module to assess acquisition pricing and returns based on a detailed set of assumptions.

What are the key assumptions used in the underwriting example?

The key assumptions include:

248 apartment units built in 2005

10-year hold period

Exit cap rate of 5.25% (with 5 bps annual growth)

Senior debt at 65% LTV, 4.25% interest, 30-year amortization

Equity structure: 95/5 LP/GP with preferred return and promote waterfall

CapEx of $800,000 in each of the first two years, plus $250/unit capital reserves

Other income from utilities, storage, and a percentage of rent

What are the partnership waterfall terms in the case?

The waterfall structure includes:

Preferred return of 6.0% paid pro rata

Promote splits: 80/20 up to 10% IRR, 70/30 up to 15% IRR, and 60/40 thereafter

LP/GP equity split is 95%/5%

What are the sources of other income in this underwriting?

Other income includes:

$45/unit/month utility reimbursement

110 storage units at $45/unit/month with 10% vacancy

2.50% of total rental revenue from miscellaneous income sources

What are the CapEx assumptions in this analysis?

Capital expenditures include:

$800,000 in year one and $800,000 in year two for improvements

$250 per unit per year for capital reserves

These expenses are modeled to reflect a renovation and stabilization strategy.

How is the exit value calculated in the model?

The exit value is based on the projected Net Operating Income (NOI) in year 11, divided by the exit cap rate of 5.25%, which is grown from a market cap rate of 4.75% by 5 bps annually. Selling costs of 2.0% are deducted to calculate net sales proceeds.

What does the walkthrough aim to teach about using the Ai1 Model?

The walkthrough teaches users how to:

Navigate the Ai1 Model’s multifamily module

Input acquisition, debt, and operating assumptions

Analyze return metrics such as IRR and equity multiple

Evaluate exit assumptions and capital events over a 10-year hold

It’s designed to build real-world underwriting proficiency using A.CRE’s modeling tools.