All-in-One (Ai1) Walkthrough #10 – Underwriting a Value-Add Office Investment

This walkthrough, our tenth in the series, takes you through the entire process of underwriting a hypothetical office value-add opportunity using the All-in-One (Ai1) Model. This walkthrough comes as a response to a question we recently received in the Ai1 Support Forum. Here is the question:

We are exploring the route of acquiring a value add office building. We will likely not take on any debt to start. I have a few questions as it relates to the model. I’m struggling to figure out how to enter an acquisition price of x dollars but also have some sort of development piece layered in.

My goal is to acquire the property for x dollars, put x dollars into cap ex per year while leasing the building up and exiting the property in year x. Could you please walk me through how this could be achieved.

In an effort to provide greater instruction on how to use our All-in-One Underwriting Tool for Real Estate Development and Acquisition, we’re developing a series of walkthrough videos and posts on the methodology behind the various components of the model. Our hope is that if you are empowered with the how, you’ll be more willing/able to provide feedback to improve the model.

If you haven’t already, you can download the model here. This walkthrough uses beta version 0.5.5 of the All-in-One Model.

Two Ways to Model Value-Add Using the Ai1

There are two methods for modeling value-add investments using the Ai1. The first method is to use the Development Module (set Development Length on the ‘Summary’ tab to a value greater than 0), modeling the renovation cash flows on the ‘Budget’ tab while setting the Operations Begin Date (on the ‘Summary’ tab) equal to the Analysis Start Date (also entered on the ‘Summary’ tab). Doing this allows for a bridge loan during the non-stabilized period (i.e. called construction financing in the model), which is taken out by a permanent loan at stabilization (per the Stabilization Date set on the ‘Summary’ tab).

However, in this hypothetical case it doesn’t make sense to use the first method. That is because the hypothetical investment won’t include debt, nor will it require robust renovation cash flow modeling. Thus, I choose to use the simpler second method. The second method involves using the Acquisitions module (leave Development Length on the ‘Summary’ tab set to 0), and modeling the renovation cash flows as ‘Other CapEx’ on the ‘ORI-OpSt’ tab. In the following video and using the assumptions below, I walk you through how to use this second method to model a value-add office investment using the Ai1 model.

Download the assumptions of this hypothetical value-add office investment in a PDF format

Video Walkthrough – Underwriting a Hypothetical Value-Add Office Investment

Assumptions – Hypothetical Value-Add Office (No Debt and <15% Occupied)

Investment Summary

- Investment name: Suburbs Park

- Parking: 85 spaces

- Year built: 1996

- Analysis start: Jan 1, 2018

- Construction length: 0 months

- Analysis period: 3 years

- Tenants: 6

- Net Rentable Area: 21,200 (1st Floor – 6,200 SF, 2nd Floor – 7,500 SF, 3rd Floor – 7,500 SF)

Valuation

- In-place acquisition Price: $3,250,000 plus $75,000 in acquisition costs

- Market NOI cap rate for comparable properties: 6.00%

- Forecast growth in cap rate: 0 bps per year

- Exit cap rate: 6.00%

- Selling costs @ reversion: 2.0%

Permanent Debt Assumptions

Senior Debt

- None

Junior Debt

- None

Partnership Assumptions

- None

Renovation Budget and Timing

- Lobby – $250,000 – 12 months

- Bathrooms – $50,000 – 12 months

- Exterior Upgrades – $100,000 – 24 months

- Deferred Maintenance – $75,000 – 24 months

- Soft Costs – $65,000 – 24 months

Operating Assumptions

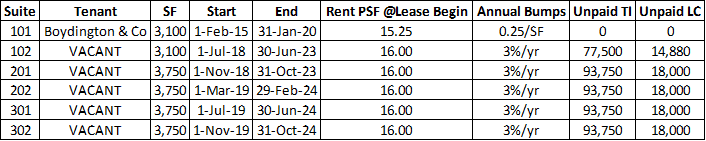

Rent Roll as of Analysis Start

Other Income

- Expense Recovery – 100% of reimbursable operating expenses (NNN)

- Parking Income – $0

- Antenna Income – $15,000/yr

- Misc. Income – $7,500/yr

General Vacancy

- 8.0%

Operating Expenses

- Payroll @ $1.75 PSF; G&A @ $0.50 PSF; Utilities at 2.25 PSF; R&M @ 1.50 PSF; mgmt fee @ $27,500/yr; taxes @ $42,500/yr; insurance @ 12,500/yr

- Non-reimbursable @ 0.5% of EGI

- % Fixed: All but taxes, and insurance @ 0%; insurance @ 100%, taxes @ 75%

- Expenses grown at 2%

Capital Expenditures

- Other CapEx: Per budget and timing; monthly cash flow schedule modeled in new tab

- Capital Reserve: $0.35 PSF

Note on Limitations of the ORI Module

While the All-in-One is meant to handle more complex lease scenarios and therefore can do a lot of the things that people turn to non-Excel solutions for, it still has Excel-specific limitations that it’s important to be aware of.

First, the ORI module does not support reimbursement of management fees. The complexity of handling the circular nature of reimbursing management fees outweighs the benefit. As a workaround, we’ve included an Admin Fee that when modeled as approximately the same amount as the management fee gets you to approximately the same outcome.

Second, the ORI module is limited to three generations of leases. This is to avoid exceeding Excel’s memory capacity. Given that the max analysis period in the All-in-One is 10 years, and most long-term leases are 3+ years long with downtime between leases, this limitation shouldn’t affect most people. But if your scenario includes leases shorter than three years, you’ll likely need to use a different solution or shorten your analysis period.

Finally, the lease reimbursement module in the All-in-One has limitations. While NNN and Gross leases generally model well, when you get into gross modified/base year type leases, the reimbursement amounts or more approximations that an accurate forecast of the reimbursements. This again is due to the limitations of Excel. If you need an exact forecast of future reimbursement cash flows, you’ll need to use a non-Excel solution.

Frequently Asked Questions about Underwriting a Value-Add Office Investment using the Ai1 Model

What are the two methods for modeling a value-add investment in the Ai1 model?

The first method is to use the Development Module and model renovation costs on the ‘Budget’ tab. The second method is to leave Development Length at 0 and model renovations as ‘Other CapEx’ on the ORI-OpSt tab, which is simpler and better suited when no debt is used.

Which modeling method was used in the walkthrough and why?

The walkthrough used the second method (no development module) because the deal involved no debt and didn’t require detailed renovation modeling. Renovation costs were modeled as ‘Other CapEx’.

How are renovation costs entered into the Ai1 model using the second method?

Renovation costs are input under Other CapEx in the ‘ORI-OpSt’ tab. The example modeled specific items like lobby, bathrooms, and exterior upgrades on a monthly cash flow schedule.

Can this value-add model work without any debt financing?

Yes. The walkthrough explicitly modeled the investment without any senior or junior debt, showing how to structure the model purely with equity funding.

What are some limitations of the ORI module in the Ai1 model?

Key limitations include:

No reimbursement of management fees

Only supports three lease generations

Lease reimbursements for base year/gross modified leases are approximations, not exact forecasts

What are the exit assumptions in this value-add scenario?

Exit cap rate: 6.00%

Selling costs at reversion: 2.0%

Exit after 3 years of operation

How is other income and reimbursement structured in the model?

Expense Recovery: 100% of reimbursable operating expenses

Other Income includes:

Antenna Income: $15,000/year

Misc. Income: $7,500/year

No parking income modeled

Where should general operating assumptions be entered in the Ai1 model?

Operating assumptions, including vacancy, payroll, utilities, taxes, etc., are entered on the ‘ORI-OpSt’ tab. Expense growth, fixed/variable settings, and capital reserves are also set there.