The A.CRE Method For Doing Cap Rate Mental Math – Practice Tool

At the bottom of this post is a downloadable practice tool for the A.CRE Method for doing cap rate mental math. The tool will generate an endless number of random cap rates and NOIs to practice with and will walk you step by step through how to solve for each scenario you are working in. You can read through this quick step-by-step guide and also watch the video below for instructions. Also, if you have not read the original post, please click here to learn more.

Step by Step Guide

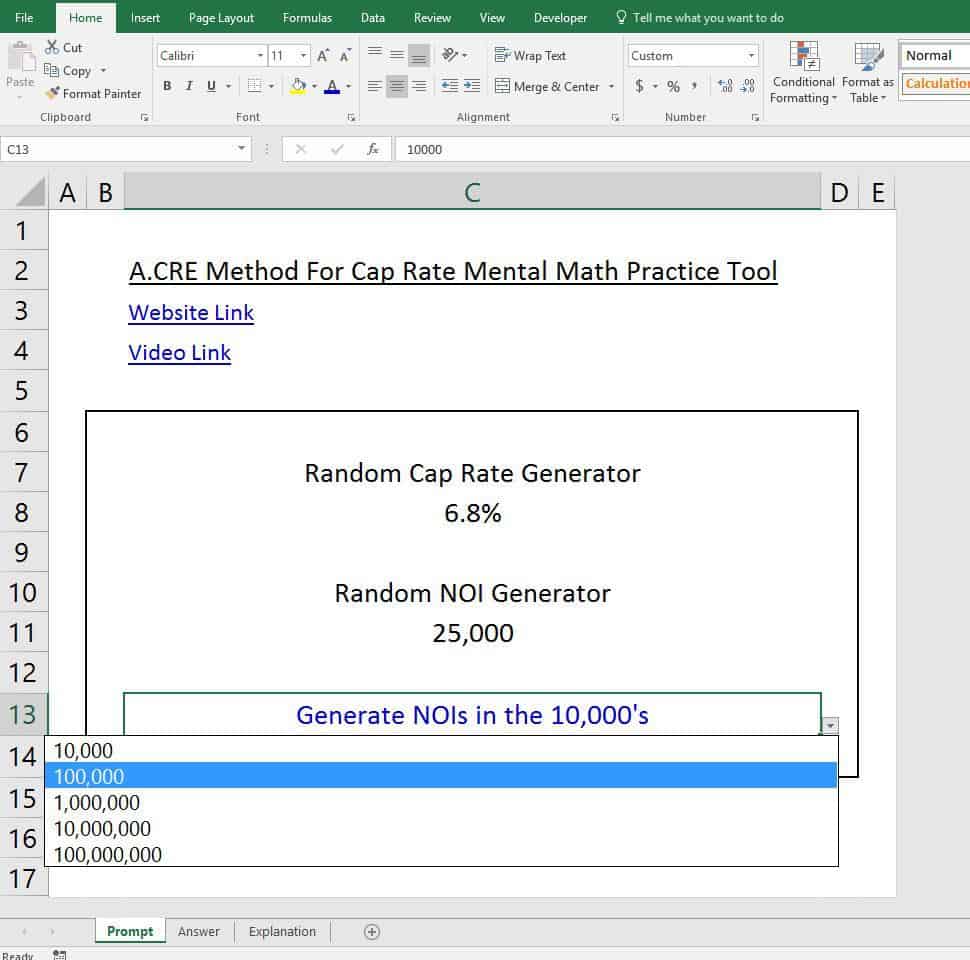

The tool is an excel based file with three tabs: (1) a Prompt tab, (2) an Answer tab, and (3) an Explanation tab.

Prompt Tab

The Prompt tab is where you will be given a random cap rate and NOI to solve for the property value. Simply click F9 to generate new prompts. Cell C13 is a drop down menu that will allow you to change the range of the NOIs you are practicing with. You can pick NOI ranges from the $10,000’s to the 100,000,000’s as shown in the screenshot below.

Answer Tab

The answer tab gives you both the exact answer and the approximate answer you should have come up with using the method. Keep in mind that your approximate answer may be different from what is shown. As long as you are within 5% or so of the actual answer than consider yourself right. Doing cap rate math in your head is supposed to provide approximate answers, not exact answers.

Explanation Tab

The Explanation tab walks you step by step through the process of how you would think about solving this using the A.CRE Method. The explanation tab is pretty thorough, but if you are unclear about a step or need to refresh, go back to the original post and you can reread about the process and also practice each step with the flash cards.

Download

Click here to download the file

Video

Frequently Asked Questions about the A.CRE Method for Cap Rate Mental Math

What is the A.CRE Method for cap rate mental math?

The A.CRE Method is a simplified mental math technique to estimate property value using a given cap rate and NOI. It’s designed to help quickly approximate values without a calculator, which is useful in real-world scenarios where rapid estimation is required.

What does the Excel practice tool include?

The Excel tool includes three tabs:

Prompt Tab – Generates random cap rate and NOI prompts for practice.

Answer Tab – Displays both exact and approximate answers.

Explanation Tab – Step-by-step guide showing how to solve using the A.CRE Method.

How do I generate new practice prompts?

On the Prompt tab, press F9 to generate new random cap rate and NOI values. You can also adjust the NOI range using the dropdown menu in Cell C13.

What is an acceptable range for approximate answers?

Your estimate should be within 5% of the exact value. The goal is to get close enough to guide quick decision-making, not to match the exact number perfectly.

What if my mental math answer is off by more than 5%?

If your approximation is off by more than 5%, revisit the Explanation tab to review each step of the A.CRE Method. You may also want to re-read the original blog post and use the flash cards for targeted practice.

Can I change the NOI range in the practice tool?

Yes. In Cell C13 of the Prompt tab, use the dropdown menu to choose from NOI ranges spanning from $10,000s up to $100,000,000s. This allows you to tailor your practice to real-world scenarios at different investment scales.

Where can I learn the original A.CRE Method?

To learn the full A.CRE Method, click the link in the post labeled “original post”. It contains a detailed breakdown of the method along with flash card practice tools and video guidance.