Modeling a Mortgage Loan Assumption Using the All-in-One

I recently had a discussion in the All-in-One support forum about how to model a mortgage loan assumption using my All-in-One Model for Underwriting Acquisitions and Development. Prior to version 0.77, this required manually overriding various calculation cells (i.e. black font cells). So I updated the model to make handling assumable debt more intuitive.

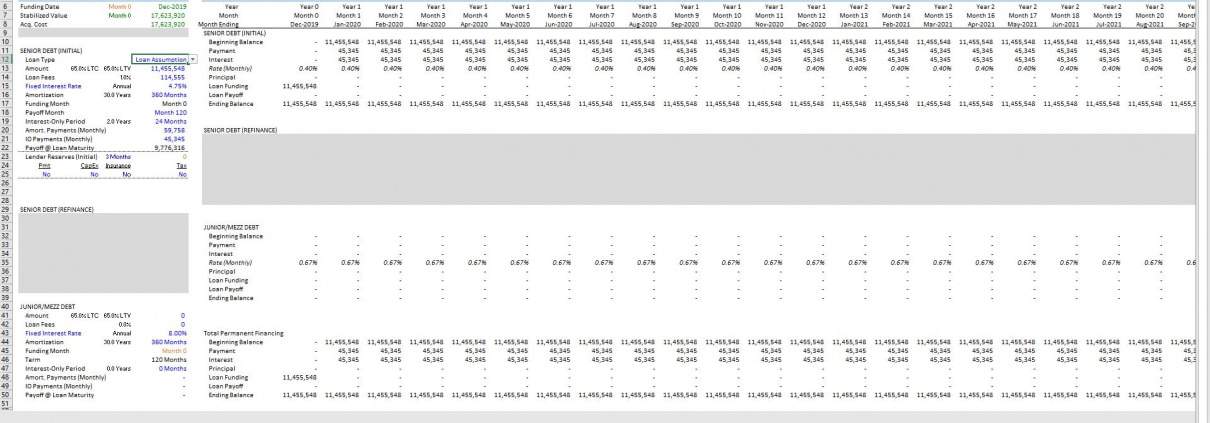

In the following quick tutorial, I show you how to model a loan assumption on the Perm. Debt tab. I also talk through modeling subsequent debt when the loan being assumed matures in the middle of the analysis period.

In v0.77, the Ai1 was updated to include the option to model a loan assumption.

When You Might Have a Loan Assumption

So what do I mean when I say “model a loan assumption”? When does this come up? And why does one need to analyze a loan assumption?

If you’re on an acquisitions team, you’ve undoubtedly come across this scenario. It really is quite common. Most real estate is encumbered by one or more mortgage loans. Each loan has a finite life (i.e. loan term), at the end of which the loan matures. Generally when a loan has a fixed interest rate, the lender will charge a fee (i.e. prepayment fee) to payoff the loan early. These prepayment fees can be quite significant.

Oftentimes, the owner of real estate will decide to sell a property prior to the end of the loan term. And in those cases, it often doesn’t make sense to payoff the loan and incur a prepayment fee. So instead, the owner will choose to sell the real estate and pass the existing loan on to the next buyer.

When a buyer takes over the mortgage obligations from a previous borrower, this is called a loan assumption (i.e. the buyer “assumes” the responsible for that loan). Most loans allow for this, subject to certain restrictions of course such as minimum buyer experience, net worth, etc.

So when a buyer purchases a property encumbered by existing debt, that buyer is responsible to continue paying the debt service on that loan until it matures.

If you are that buyer, and you’re needing to understand the impact that loan assumption will have on a prospective acquisition, you will use a tool such as the All-in-One to analyze that impact.

Steps to Follow to Model a Mortgage Loan Assumption

Modeling an acquisition subject to existing debt using the All-in-One is quite simple. But first, you need to know certain information about the existing loan including:

- Loan balance

- Original amortization period

- Contract interest rate

- Months remaining on loan term

- Months remaining on interest-only period, if applicable

- Monthly amortizing loan payment

- Monthly interest-only payment, if applicable

With the above information, you can quickly and easily model the existing loan on the Perm. Debt tab of the All-in-One.

- Toggle cell E12 o the Perm. Debt tab to ‘Loan Assumption’

- Enter the existing balance in cell E13

- Enter the loan assumption fee, if any, in cell E14

- Enter the contract interest rate in cell E15

- Enter the original amortization period, in months, in cell E16

- Enter the number of months remaining on the loan term in cell E18

- Enter the number of interest-only months remaining, if any, in cell E19

- Enter the monthly amortizing payment amount in cell E20

- Enter the monthly interest-only payment, if applicable, in cell E21

You can then scroll to the right to see the cash flows from this existing debt. If the existing loan matures prior to the end of the analysis period, the ‘Senior Debt (Refinance)’ assumptions in cells B29:B38 will become available. Use those cells to model additional debt, if needed, starting on the month that the existing loan matures.

Important Note: The model assumes interest on the existing debt is a) fixed, and b) calculated on a 30/360 basis.

Quick Video Tutorial – Modeling Mortgage Loan Assumption

Now that I’ve laid out the steps for modeling existing debt, allow me to quickly show you how to do this. If you have more questions, please don’t hesitate to ask in the All-in-One Support Forum.

Frequently Asked Questions about Modeling a Mortgage Loan Assumption Using the All-in-One

What is a loan assumption in real estate acquisitions?

A loan assumption occurs when a buyer takes over the existing mortgage obligations from the seller. As the article explains, “the buyer ‘assumes’ the responsibility for that loan,” which is common when the prepayment fee to retire the loan is prohibitively high.

Why might a seller prefer a loan assumption rather than paying off the debt?

Paying off a loan before maturity can result in significant prepayment fees. Sellers often choose loan assumptions to avoid these fees, allowing the buyer to take over the mortgage instead of retiring it early.

What version of the All-in-One model supports loan assumptions?

Loan assumptions became easier to model starting with version 0.77 of the All-in-One model. The update introduced a dedicated feature on the Perm. Debt tab to handle loan assumptions without needing to override formula cells.

Which inputs are required to model an assumed loan in the Ai1 model?

To model an assumed loan, you’ll need:

Loan balance

Interest rate

Original amortization period

Months remaining on loan and any interest-only period

Monthly amortizing and/or interest-only payments

Any loan assumption fee

These are entered into cells E12–E21 on the Perm. Debt tab.

What happens if the assumed loan matures before the analysis period ends?

If the assumed loan matures mid-hold, the model activates the ‘Senior Debt (Refinance)’ inputs in cells B29:B38. You can use these fields to model refinancing debt beginning the month the original loan matures.

How is interest calculated for the assumed loan in the model?

The model assumes fixed-rate interest and uses a 30/360 day-count convention for interest calculations, as noted in the tutorial.

Where do I model the loan assumption in the All-in-One model?

You enter all loan assumption details in the Perm. Debt tab. Specifically, you toggle cell E12 to “Loan Assumption” and complete fields E13 through E21 with the loan terms.

What should I do if I have questions when using the Ai1 model for loan assumptions?

You’re encouraged to use the All-in-One Support Forum for any questions or troubleshooting help. The tutorial’s author specifically invites users to ask there for guidance.