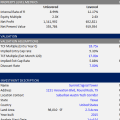

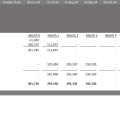

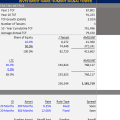

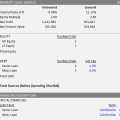

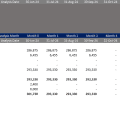

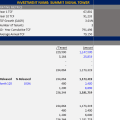

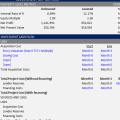

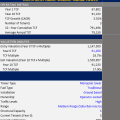

Cell Tower Valuation Model

A fully dynamic, Excel-based tool designed to underwrite, evaluate, and monitor cell tower acquisition opportunities with institutional-grade precision. This model offers a transparent framework for forecasting tower-level cash flows, structuring capital stacks, and analyzing returns across a range of investment scenarios.

Built for professionals acquiring stabilized or value-add tower assets, the model provides the analytical depth needed to evaluate income durability, calculate reversion values, and confidently structure deals. It supports strategies across the spectrum, from core acquisitions to opportunistic investments with a clear exit horizon. (View description of model)

Note: Compatible with Microsoft Excel 2013 and newer.

To make this tool accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (choose ‘Free’ if you need) or maximum (your paid support helps keep the content coming – typical real estate Excel tools sell for $100 – $300+ per license).

Instructions: 1) set a price, 2) tell us where (email address) to send the model, 3) enter payment details (if applicable), and then 4) click ‘Proceed with Download’. The system will send you a download link, as well as add the file to your ‘My Downloads’ page.

Related products

-

Back-of-the-Envelope Office, Retail, Industrial Acquisition Model

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page -

Waterfall Model For Real Estate Joint Ventures with Catch Up

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page -

Simple Acquisition Model for Office, Retail, and Industrial Properties

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page -

Commercial Mortgage Loan Analysis Model

Select options This product has multiple variants. The options may be chosen on the product page