Case Study #15 – Andes Digital Gateway: Hyperscale Data Center Development (Case Only)

For our 15th case study, we explore institutional development and investment analysis in the rapidly expanding digital infrastructure sector. These case studies are designed to help you practice and perfect your real estate financial modeling skills. This Andes Digital Gateway case study places you in the role of a Development Associate at Quantum Infrastructure Partners (“Quantum”), a U.S.–based real estate advisory and development consulting firm specializing in digital infrastructure.

In this scenario, you’ll evaluate the financial feasibility of underwriting and structuring a full life‑cycle hyperscale data center development strategy for a modular campus in Mesa, Arizona. This opportunity presents compelling demand drivers, including data center sales tax incentives, competitive power pricing, and robust fiber networks, alongside fundamental development, lease‑up, and capital market risks.

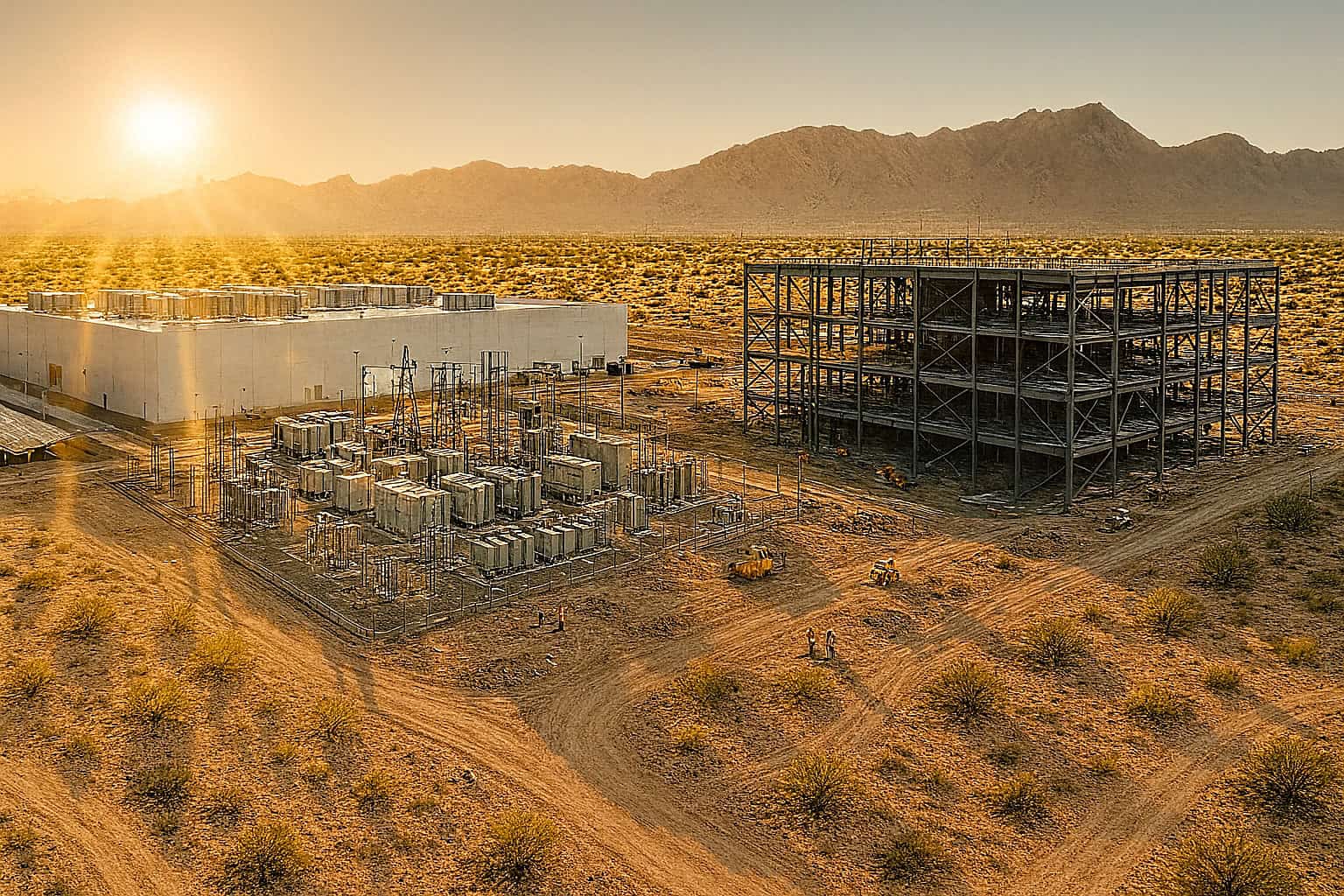

An aerial view of a hyperscale data center development site located in a desert landscape, inspired by Mesa, Arizona.

As with all A.CRE case studies, names and some details have been adjusted for confidentiality, but the fundamentals and modeling challenges reflect real‑world deals. Whether you’re preparing for a role in development, capital markets, or sharpening your modeling proficiency for interviews, this case simulates the complex analysis required in hyperscale data center development and institutional real estate today.

Andes Digital Gateway – Background

You are a Development Associate at Quantum Infrastructure Partners, advising Axis Global Investors, a global infrastructure fund seeking to invest in core‑plus digital infrastructure. Your team is responsible for underwriting, structuring, and modeling the project from site acquisition through delivery, lease‑up, refinancing, and exit.

Axis is evaluating the development of Andes Digital Gateway, a 20 MW IT load data center campus designed to Uptime Tier IV specifications with N+2 electrical redundancy and 2N+1 mechanical systems. The campus will be delivered in two 10 MW phases, targeting hyperscale, AI infrastructure, and enterprise cloud customers.

Location: Mesa, Arizona – Elliot Road Tech Corridor, a premier data center submarket driven by favorable tax treatment, competitive operating costs, strong connectivity, and low climate risk.

Project Details

Property & Development Profile

- Land Parcel Size: 190,000 SF

- Gross Building Area: 140,000 SF

- White Space (Net Rentable): 85,000 SF

- Total IT Load: 20 MW

- Projected PUE (Power Usage Effectiveness): 1.45

- Certifications: Uptime Tier IV

Phased Delivery:

- Construction Start: Month 0 (July 1, 2026)

- Construction End: Month 24

- Operations Begin: Month 25

- Phase I Ramp: Month 30

- Phase II Ramp: Month 39

- Exit / Sale: Month 72

Project Costs

Land Costs

- Land Acquisition: $7,980,000

- Closing Costs: $332,500

- Total Land Cost: $8,312,500

Hard Construction Costs

- Sitework & Civil: $8,220,000

- Structural Concrete/Steel: $16,200,000

- Building Envelope: $10,920,000

- Raised Access Flooring: $5,560,000

- Electrical & Cooling: $21,500,000

- Fire Protection: $4,000,000

- Security Systems: $3,050,000

- Interior Finishes: $6,100,000

- Utility Interconnections: $6,350,000

Total Hard Costs: $81,900,000

Soft Costs & Fees

- Architecture & Engineering: $3,300,000

- Permits/Entitlements: $1,290,000

- Commissioning: $970,000

- Legal & Professional: $1,300,000

- Construction Insurance: $880,000

- Testing & Inspections: $970,000

- FF&E & Setup: $1,350,000

- Contingency: 5% of Hard Costs

- Miscellaneous/Other: $980,000

- Developer Fee: $2,720,000

Total Soft Costs: $17,855,000

Capitalization

- Construction Loan: 70% LTC, 9.20% fixed

- Equity Contribution: 30% of total project cost

Tenancy & Lease‑Up

All leases are 10‑year full-service gross with 0% expense recovery. Power absorption is linear by tenant with defined ramp rates.

Phase I – Lease Start: Month 27, Ramp-Up Start: Month 30

CloudCorps Inc.: 6.0 MW, $210/kW/month. Absorption: 500 kW/month

SkyFabric Solutions: 3.0 MW, $215/kW/month. Absorption: 300 kW/month

CoreOne AI: 2.0 MW, $225/kW/Month. Absorption: 333 kW/month

Phase II – Lease Start: Month 36, Ramp-Up Start: Month 39

TerraEdge Hosting: 4.0 MW, $220/kW/month. Absorption: 333 kW/month

VaultStack Networks: 2.0 MW, $230/kW/month. Absorption: 222 kW/month

Phoenix Cloud Exchange: 3.0 MW, $235/kW/month. Absorption: 375 kW/month

Operating Expenses – Stabilized Year

- Utilities: $75.00/kW/month → $26,100,000 annually

- Maintenance: $11.00/kW/month → $2,640,000 annually

- Staffing & Security: $5.25/kW/month → $1,260,000 annually

- Insurance: $0.55/kW/month → $132,000 annually

- G&A: $0.85/kW/month → $204,000 annually

- Management Fee: 3.0% of Effective Gross Revenue

- CapEx Reserve: $1.25/kW/month → $300,000 annually

- Property Taxes: $1,380,000 annually

At stabilization, axis will refinance construction debt with permanent financing:

Interest Rate: 6.25% fixed

Amortization: 25 years

Origination & Closing Fees: 1%

Exit Fee: 1% at Month 72

Permanent financing will be repaid at sale/exit.

Capital Markets Benchmarking

Market Cap Rate (Today): 6.00%

Market Cap Rate (At Sale): 6.75%

These benchmarks will be used to estimate stabilized value and terminal pricing.

The Tasks

Total Project Costs

- Compute total development costs, cost per rentable SF, and cost per kW of IT load.

Lease‑Up Cash Flows

- Build a monthly lease‑up schedule, including linear absorption for each tenant and rental cash flows.

Stabilization Month

- Identify when the project achieves stabilized occupancy and revenue.

Refinance Proceeds

- Project permanent financing proceeds and debt payoff at exit.

- Analyze project cost relative to stabilized yield.

Return Metrics

- Calculate levered/unlevered IRR, equity multiple, and net profit over the life of the investment.

Do you want to create a real estate financial modeling case study that perfectly suits your educational or professional needs? Check out our A.CRE Real Estate Case Studies Creator Assistant!

Download the Hyperscale Data Center Development (Case Only) PDF

In addition to the web-based case, we’ve created a PDF version to download and use offline. As with our real estate financial models, this case study is offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming). Just enter a price together with an email address to send the download link to, and then click ‘Continue’.

To complete your analysis for this case, consider using our Data Center Development Model, which is ideally suited for modeling ground-up hyperscale and modular data center projects like Andes Digital Gateway. This purpose-built tool helps you accurately structure multi-phase lease-ups, model development cash flows, layer in financing assumptions, and calculate institutional-quality return metrics.You can find the model HERE.

We occasionally update these cases. Paid contributors will receive lifetime access to the case, and all updates.