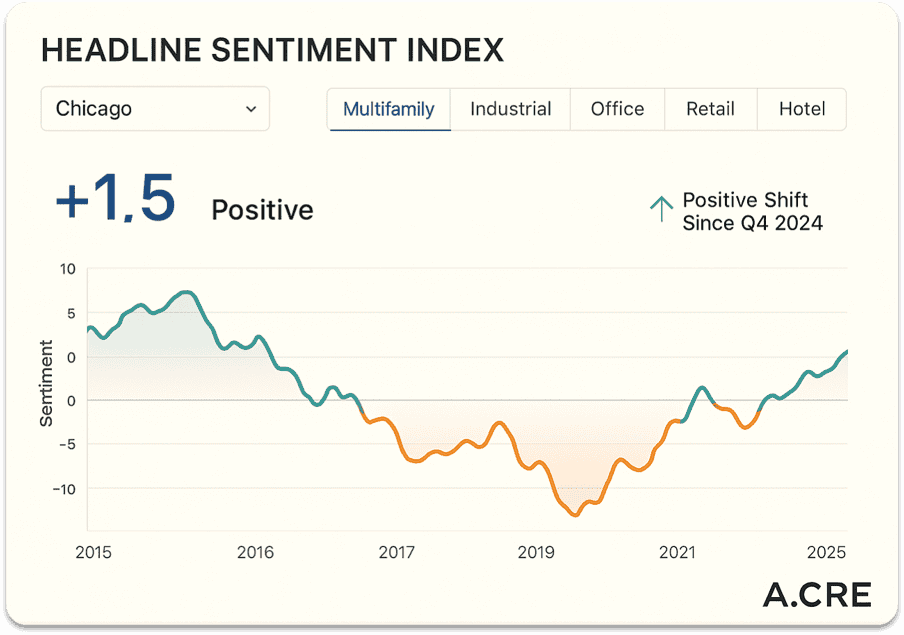

Real Estate Headline Sentiment Index – Help Shape It, Get Early Access

Want a better way to track what’s happening in CRE markets—before traditional metrics catch up?

We’re partnering with Marquette University to build a powerful new AI-powered metric called the Real Estate Headline Sentiment Index (REHSI) —and we need 30-seconds of your time to help guide it (and in return, we’ll get you free early access!).

How You Can Help – Complete This 30-Second Survey

Complete this 30-second survey to tell us which local real estate news sources you rely on.

That’s it. Just complete this quick 30-second survey, and you’ll help us build a smarter, more representative index.

What You’ll Get in Return

- Free early access to the CRE Headline Sentiment Index – Projected to be released in 2025

- A direct role in shaping how sentiment is measured in your markets

- An edge in making faster, smarter investment decisions

We’re partnering with a top university’s CRE program to build this index using natural language processing (NLP) and AI. The index analyzes thousands of headlines daily, scoring sentiment across property types, geographic regions, and timeframes—providing an up-to-the-minute read on how markets are feeling.

Why a Headline Sentiment Index for CRE?

Sentiment indices have long been used in finance to quickly gauge market mood. We believe commercial real estate deserves the same.

Traditional CRE metrics—cap rates, vacancy, absorption—are powerful but lagging. A sentiment index can capture the mood of the market in real time, flagging shifts in perception before they show up in the data.

This is especially powerful in today’s environment, where having a few days’ edge can mean the difference between getting in early… or getting in too late.

How CRE Pros Will Use This

Here’s how we expect real estate professionals to use the CRE Headline Sentiment Index:

- Spot Early Market Shifts: Capture directional changes in sentiment before they show up in the comps.

- Validate Investment Theses: Test your assumptions against the pulse of the market.

- Augment Underwriting: Layer sentiment data into your due diligence process to gauge risk and upside.

- Act in Real Time: Use the index to adjust strategy as new headlines roll in.

And over time, we plan to integrate the index into A.CRE modeling tools, case studies, and AI workflows—so this becomes a live input, not just a static number.

Take the Survey → Help Shape the Index

We’re not building this in a vacuum. We’re building it for CRE professionals—and with your help.

Which local publications do you read? What newsletters land in your inbox? Who’s writing the headlines that shape your view of the market?

Let’s make this index smart, representative, and useful—together.

Final Word

The CRE Headline Sentiment Index has the potential to better inform how we understand market momentum. But it only works if it reflects what you read and trust.

Help us build it. Get early access. And get ahead of the next move.