Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Real Estate Headline Sentiment Index – Help Shape It, Get Early Access

Want a better way to track what’s happening in CRE markets—before traditional metrics catch up?

We’re partnering with Marquette University to build a powerful new AI-powered metric called the Real Estate Headline Sentiment Index (REHSI)…

Exploring Tokenization in Commercial Real Estate

I have always been interested in developing technology trends, and, in the spirit of exploring future possibilities in our industry, I wanted to discuss a developing trend of tokenization in commercial real estate. If you're not yet familiar…

Obstacles and Opportunities in the Colombian Real Estate Market: What the Smart City Expo Taught Us

During the celebration of the Smart City Expo 2023 in Bogota, Colombia, we were presented with valuable opportunities to learn and have a better understanding of the country's real estate market. This outstanding event brought together experts,…

A.CRE AT SMART CITY EXPO BOGOTA 2023!

From May 31 to June 2 of this year, the Smart City Expo was held in Bogota, Colombia, and focused on implementing sustainable and smart development in cities.

The event recognized cities as spaces that concentrate people, capital, and creativity,…

Adventures In CRE’s Events Calendar

We have begun to compile a calendar of events for some of the more well known trade organizations in the industry in order to give our readers a one stop place to find out about events that are happening throughout the US and internationally.…

The State of Real Estate Crowdfunding

Following the housing crash of 2007 - as regulations were introduced and credit tightened - emerging companies were left with little or no access to the capital markets. In an effort to ameliorate the credit crunch, Congress drew up the Jumpstart…

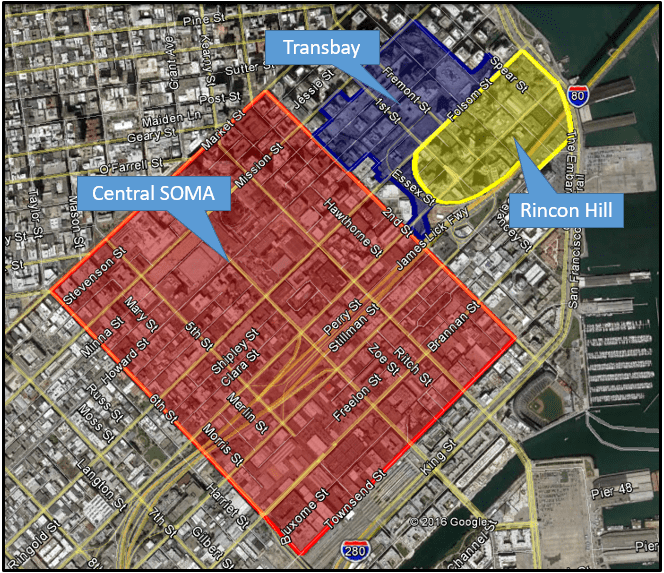

San Francisco Development Explosion! – Interactive Map & Side Project

San Francisco's downtown area is currently going through an unprecedented, skyline redefining transformation. So many incredible developers and architects are in the process of leaving their mark on this city and it's all happening or will…

Another Shot at Stuy Town – Blackstone’s $5.3 Billion Bet

Styuvesant Town-Peter Cooper Village, otherwise known as Stuy Town, is back in real estate news. Blackstone, together with Ivanhoe Cambridge and CWCapital Asset Management, have agreed to buy the 11,232-unit apartment complex for…

CRE Market Spotlight: Camden, NJ

After decades of being statistically one of the poorest cities in the country, it seems there are finally big changes coming to the city of Camden, NJ. With an extensive and generous state sponsored tax credit program luring big businesses to…

NYC Office Building Brings 2nd Highest Price Ever

If there's one thing I remember from my pre-2008 days, it was seeing a lot of stories like this. Are we in bubble territory yet?

SL Green Realty has agreed to buy CIM Group's 11 Madison Ave. The 29-story office tower in Manhattan,…

Prologis to Acquire KTR Capital in JV with Norges

It was announced last week that Prologis, the world's largest industrial REIT, has agreed to buy KTR Capital Partners for $5.9 billion. KTR owns and operates 70 million square feet of real estate across the U.S.

I think the deal is interesting…

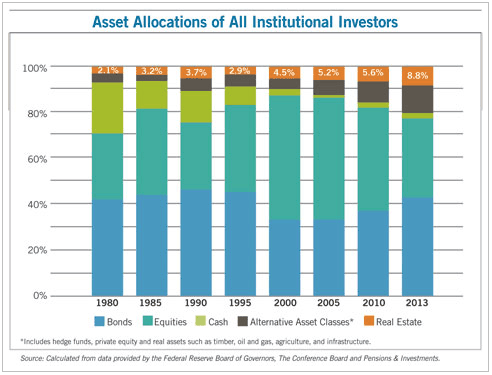

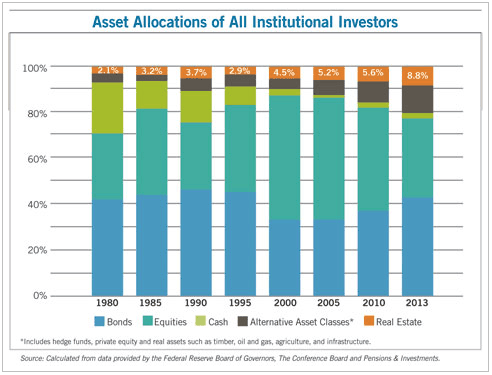

The Fourth Major Asset Class

David Funk, a professor of mine and the former director of the Baker Program in Real Estate at Cornell University, recently published some interesting research into asset reallocation by institutional investors that more heavily favors commercial…

GE Capital to Sell RE Assets to Blackstone, Wells Fargo

GE is unwinding its financial companies, and as a consequence, is selling off its real estate assets. Blackstone and Wells Fargo have reportedly agreed to buy GE Capital's real estate assets for $23bn. This is the largest deal of its kind since…

Blackstone to Buy 2nd Tallest Building in U.S.

At $1.3bn, The Blackstone Group is set to become the next owner of the iconic Willis Tower (formerly the Sears Tower) in Chicago, IL. The group selling the building, bought it for $841mm in 2004.

A few links with deal specifics:

http://www.bloomberg.com/news/articles/2015-03-16/blackstone-group-agrees-to-buy-chicago-s-willis-tower

http://www.benzinga.com/trading-ideas/long-ideas/15/03/5331305/blackstones-willis-tower-purchase-set-a-record-but-is-it-a-ba

http://www.chicagobusiness.com/article/20150306/NEWS12/150309828/blackstone-in-talks-to-buy-willis-tower-for-1-5-billion

Frequently…

S&P: Real Estate to Become its Own Sector

As further evidence that real estate is fast becoming the fourth major institutional asset class, S&P has announced that it will create a new sector for the industry.

"S&P Dow Jones Indices, a leading provider of financial market…