Prologis to Acquire KTR Capital in JV with Norges

It was announced last week that Prologis, the world’s largest industrial REIT, has agreed to buy KTR Capital Partners for $5.9 billion. KTR owns and operates 70 million square feet of real estate across the U.S.

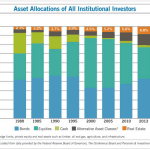

I think the deal is interesting because, besides being one of the largest deals of the year, Prologis plans to buy KTR through a joint venture with Norges Bank Investment Management, which manages the giant Norwegian pension fund. Norges will hold a 45% interest in the venture, which amounts to a $2.655bn investment for the pension fund. This is further evidence that, as large institutional investors continue to reallocate capital away from bonds, stocks, and cash to commercial real estate, real estate is fast becoming the fourth major asset class.

For more information on the Prologis / KTR Capital Partners deal see:

Wall Street Journal: ‘Prologis to Buy KTR Capital for $5.9 Billion‘

PRNewsWire: Prologis Signs Definitive Agreements to Acquire $5.9 Billion Portfolio from KTR Capital Partners

REIT.com: Industrial REIT Prologis Buying KTR Capital for $5.9 Billion

Frequently Asked Questions about the Prologis Acquisition of KTR Capital

What is the value of the Prologis-KTR Capital acquisition deal?

The total acquisition deal is valued at $5.9 billion, making it one of the largest commercial real estate transactions of the year.

Who is KTR Capital Partners and what do they own?

KTR Capital Partners is a real estate firm that owns and operates 70 million square feet of industrial real estate across the United States.

How is the acquisition being structured?

Prologis is acquiring KTR Capital through a joint venture with Norges Bank Investment Management, which manages Norway’s sovereign wealth fund. Norges will own 45% of the venture, contributing $2.655 billion to the acquisition.

Why is this deal significant for commercial real estate investing?

The deal highlights a broader trend of large institutional investors reallocating capital into commercial real estate, signaling its rise as a core global asset class alongside stocks, bonds, and cash.

Who is Norges Bank Investment Management?

Norges Bank Investment Management manages the Norwegian sovereign wealth fund, one of the world’s largest, and is increasingly investing in global real estate alongside institutional partners like Prologis.

Where can I read more about this acquisition?

You can find more details at:

Wall Street Journal: Prologis to Buy KTR Capital for $5.9 Billion

PR Newswire: Prologis Signs Definitive Agreements to Acquire $5.9 Billion Portfolio from KTR

REIT.com: Industrial REIT Prologis Buying KTR Capital for $5.9 Billion