Exploring Latin America’s Real Estate Markets: Chile

The real estate market in Latin America continues to offer a landscape of economic and urban realities that invite strategic analysis. In our previous installment, we explored the case of Argentina, a complex market but full of opportunities for those who understand its local dynamics and resilient real estate culture. (You can check out that article here: Exploring Real Estate Markets – Argentina).

In this edition of our “Exploring Real Estate Markets” series, we focus on the Chile real estate market, one of the region’s most stable and transparent in macroeconomic terms. With a track record of responsible fiscal policies, strong institutions, and an investment-friendly environment, the Chilean real estate market has characteristics that stand in stark contrast to other Latin American countries.

Despite facing recent political and social tensions, Chile continues to stand out for its transparency, access to financing and its growing sophistication in real estate products. We will explore in detail the economic fundamentals that underpin the sector, the most dynamic segments – from multifamily and high-rise developments to logistics assets – as well as the risks to consider in the new political and economic cycle.

This analysis offers a current, in-depth view of the Chile real estate market, highlighting opportunities and risks for investors and developers.

Chile: The current economic climate and its impact on the real estate sector

In 2025, the Chilean economy faces a moderate growth environment, with the Central Bank projections estimating GDP expansion between 1.75% and 2.75%, driven by a rebound in domestic demand and a copper price projected at $4.25 per pound. However, structural challenges remain, such as fiscal debt reaching 41.7% of GDP and year-on-year inflation of 4.4% in May, exceeding the Central Bank’s target range.

This economic context has a direct influence on the real estate sector. After a 13% drop in home sales in 2024, a 5%–10% rebound is expected in 2025, driven by improved mortgage access and declining interest rates. In addition, the demand for sustainable housing in the Chile real estate market has grown by 20%, with 30% of new Santiago developments earning green certifications.

However, the sector faces challenges, such as unemployment in the construction sector that will intensify in 2025 due to the completion of works started during the pandemic. Despite these challenges, the Chile real estate market is showing signs of recovery, with opportunities in segments such as multifamily and high-rise developments, especially in key urban areas.

Chile’s current economic climate presents both challenges and opportunities for the real estate sector. The combination of prudent fiscal policies, a moderate economic recovery, and trends towards sustainability could create a favorable environment for investors who understand local dynamics and seek to position themselves strategically in this evolving market.

Chile: A Real Estate Market in Trouble?

As 2025 approaches, the real estate market in Chile is facing one of its most complex scenarios in the last decade. According to the most recent report by Colliers, the figures reflect a persistent drop in investment, the bankruptcy of companies in the sector and growing unemployment that compromises the ability of the sector to recover. Although a slight reactivation is projected driven by the moderate easing of mortgage credit and the drop in rates, business distrust and regulatory restrictions continue to significantly limit the development of new projects.

Real Estate Market Overview

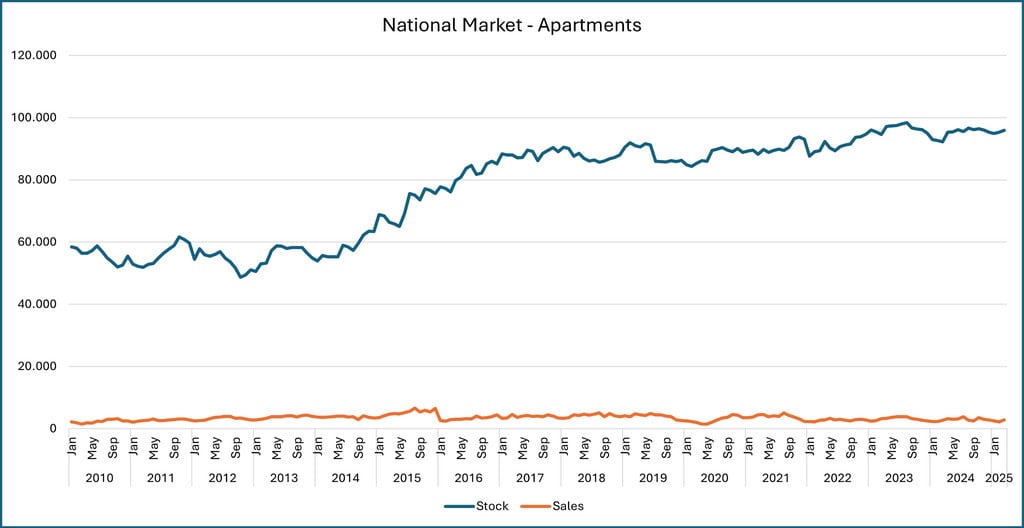

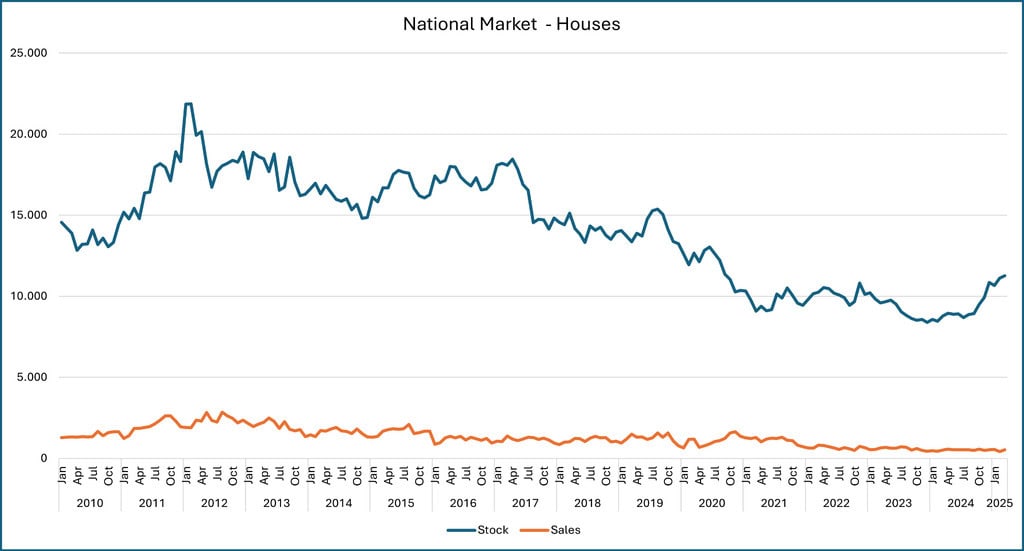

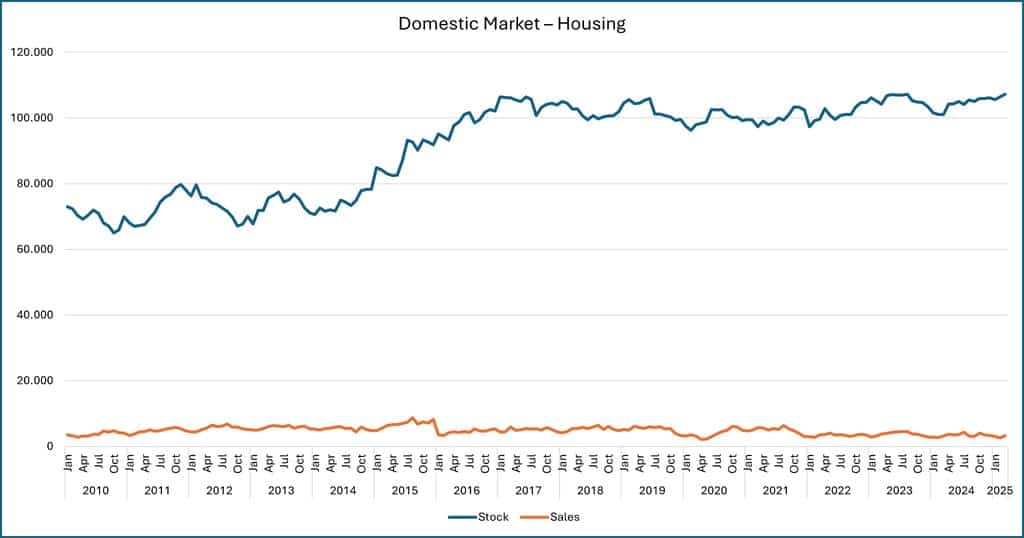

- The real estate market did not rebound in 2024; it has been in decline since 2018.

- Real estate investment has fallen sharply, reflecting low business confidence.

- Some construction companies have gone bankrupt, increasing unemployment in the sector.

Home Sales and Projections

- Annual apartment sales fell by 50% between 2018 (22,520 units) and 2024 (11,400).

- By 2025, a slight rebound in sales is expected (5%-10%) due to the drop on interest rates and greater access to credit.

- Estimated revenue from new projects by 2025: between 7,000 and 8,000 units, of which half will be blank sales.

Permitting and New Projects

- Building permits fell 40% in 2024 compared to 2023, and 70% compared to the 2018–2019 average.

- Projected permits for 2025: 17,263 homes, the lowest figure since 2002.

- Of the 2024 permits, between 5,000 and 7,500 correspond to subsidized housing.

Factors of Impairment

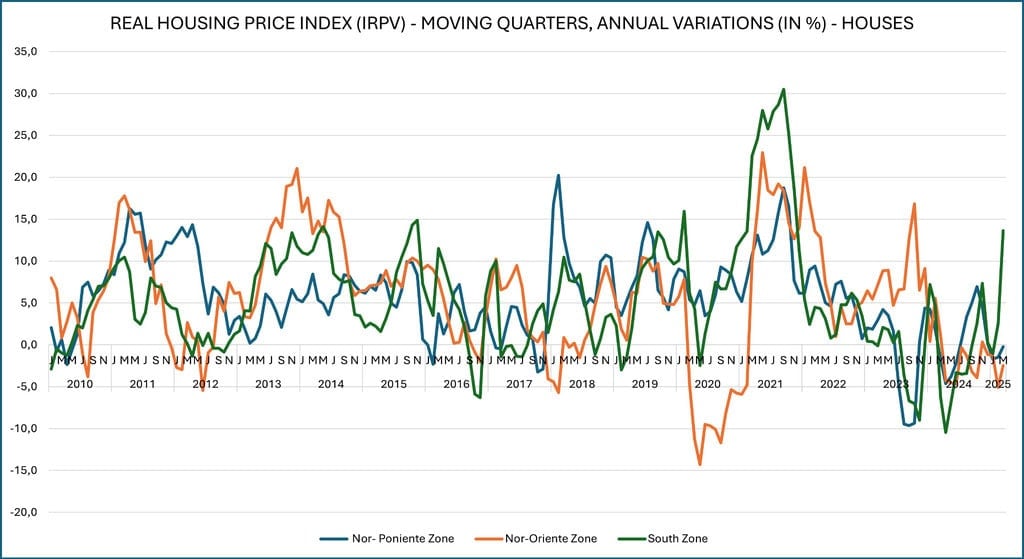

- Housing prices increased by 55% in the last decade; moderate increase in real wages.

- Half of the increase is due to the increase in land prices.

- The Communal Regulatory Plans (PRC) limit height and density, affecting projects for middle sectors.

Supply-Demand Mismatch and Regulations

- Municipal regulations require homes over 80 m², while 80% of the demand is for 43 m² apartments.

- This mismatch discourages private investment, since it is not allowed to build the type of housing with the highest demand.

Taxation and Costs

- 50% of the increase in costs is attributed to new taxes, including VAT on housing (since 2015).

Graphic: Sales in the National Real Estate Market – Apartments

Sources: Macroeconomics and Construction Report. January 2025, MACH 67, of the Chilean Chamber of Construction.

Graphic: Sales in the National Real Estate Market – Houses

Sources: Macroeconomics and Construction Report. January 2025, MACH 67, of the Chilean Chamber of Construction.

Graph: Sales in the National Real Estate Market – Housing

Sources: Macroeconomics and Construction Report. January 2025, MACH 67, of the Chilean Chamber of Construction.

Note: In Chile, the main distinction between house, apartment and housing lies in its structure and location: a house is an independent construction, usually on its own land. An apartment or flat is a residential unit within a building with multiple housing units. The word housing is a general term that encompasses both houses and apartments.

Governmental, fiscal and monetary policies, economic trends and investment levels in Chile: Impact on the real estate market

In the current Chilean context, fiscal, monetary and regulatory policies are playing a determining role in the behavior of the real estate market. From the fiscal front, the country faces a public debt that stands at around 41.7% of GDP, which has set off warning signs among analysts and economists. This situation has led to a cross-cutting call to restructure the public spending model, promoting an agenda of reforms that, although necessary, could imply a reallocation of the national budget that affects investment in infrastructure or housing subsidies in the short term (El País, 2025). From a monetary perspective, the Central Bank maintains the Monetary Policy Rate at 5%, seeking to contain inflation which, although falling, is still above the target range with 4.1% year-on-year as of May of this year.

This economic outlook generates mixed effects on the real estate sector. On the one hand, monetary stability and moderating inflation have begun to translate into more favourable credit conditions, which could provide impetus to the revival of mortgage loans after two years of contraction. At the same time, government programs that promote access to housing—especially through targeted subsidies—remain relevant pillars, although their future scope will depend on fiscal availability and the administration’s political priorities.

As for investment, the Central Bank’s projections anticipate GDP growth between 1.75% and 2.75% by 2025, largely thanks to the rebound in domestic demand and the favorable price of copper, which is estimated at around $4.25 per pound (Reuters, 2025). However, private investment in residential construction is still showing signs of weakness, with a projected growth of just 0.4% for this year, after a sharp drop in sales during the previous period (Enlace Inmobiliario, 2025). This situation generates an unequal environment where certain segments, such as multifamily and industrial assets, are attracting 86% of national real estate investment, while others – such as social housing or regional developments – face significant lags (LinkedIn Insights, 2025).

At the level of structural trends, the sustained progress of sustainable projects stands out. In Santiago, at least 30% of new developments incorporate green certifications, driven by a demand that has grown by 20% compared to the previous year (Revista Economía, 2025). This reflects a paradigm shift in real estate value criteria, where energy efficiency, environmental quality, and compliance with ESG standards are beginning to influence purchase and financing decisions.

In summary, Chile presents a transition environment in which signs of reactivation coexist with fiscal pressures and structural challenges. For the informed investor, this context represents an opportunity to position themselves in high-potential segments, provided that they have an accurate reading of the political-economic environment and an adequate risk mitigation strategy.

Keys to the Chilean real estate sector: prices, financing and dynamics of the construction company

The Chilean real estate market is going through a period of significant adjustments, influenced by macroeconomic factors, financing conditions and the evolution of the construction industry.

House Prices

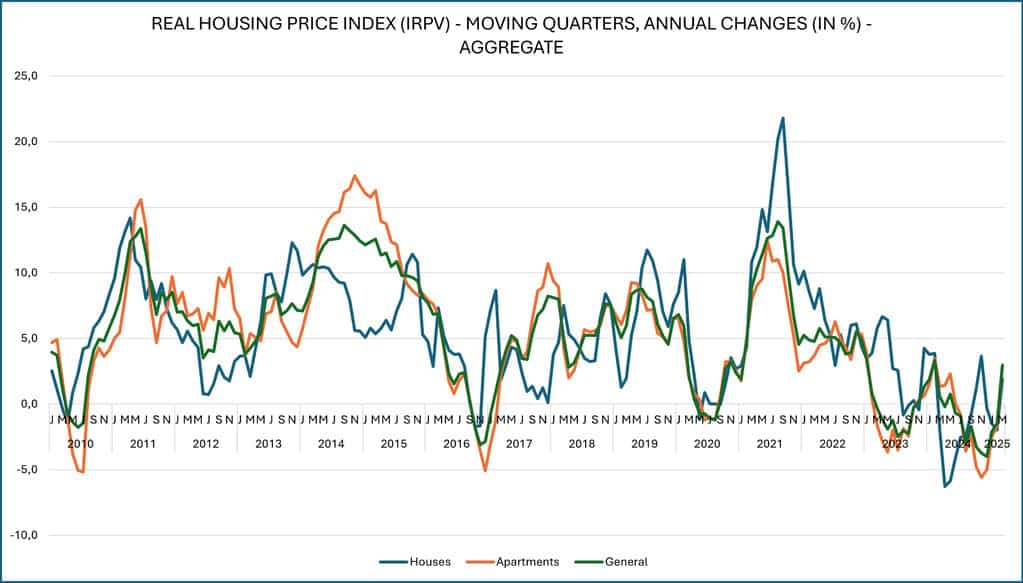

During the first quarter of 2024, the median sale price of apartments in Greater Santiago reached 69.5 UF/m², while houses stood at 56.9 UF/m², both with an annual increase of 2.4%. However, the cumulative value of sales showed a decrease of 14% compared to the same period of the previous year, reflecting a contraction in demand, as has occurred in large fluctuations during the last few years.

Graph: REAL HOUSING PRICE INDEX (IRPV) – HOUSES

Sources: Macroeconomics and Construction Report. January 2025, MACH 67, of the Chilean Chamber of Construction.

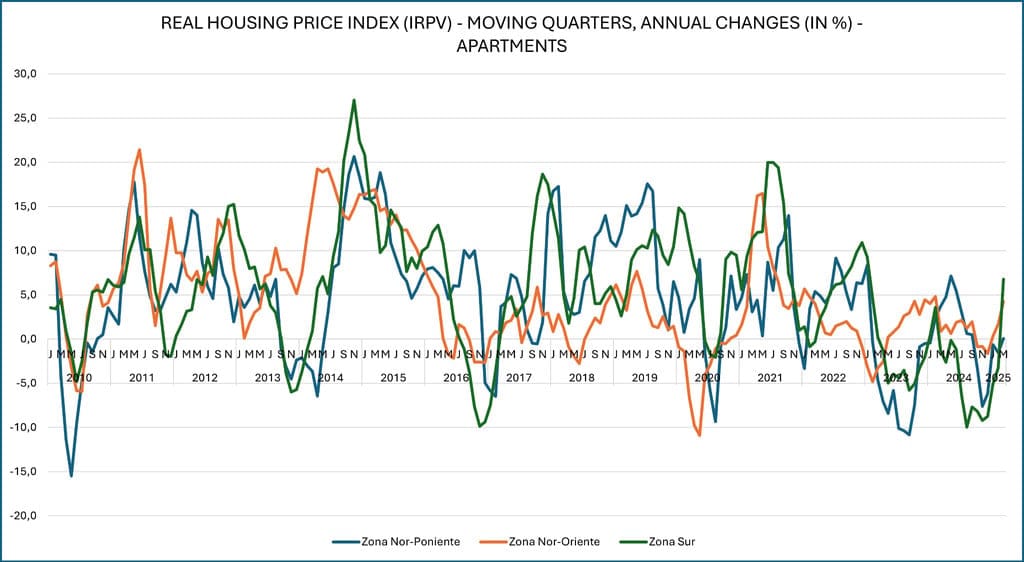

Graph: REAL HOUSING PRICE INDEX (IRPV) – APARTMENTS

Sources: Macroeconomics and Construction Report. January 2025, MACH 67, of the Chilean Chamber of Construction.

Graph: REAL HOUSING PRICE INDEX (IRPV) – AGGREGATES

Sources: Macroeconomics and Construction Report. January 2025, MACH 67, of the Chilean Chamber of Construction.

Financing

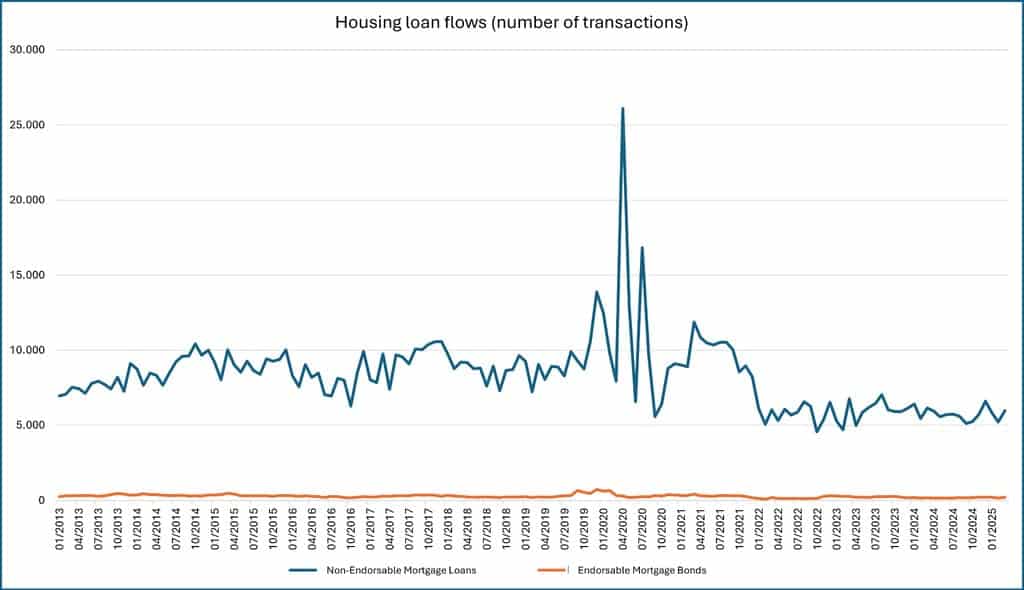

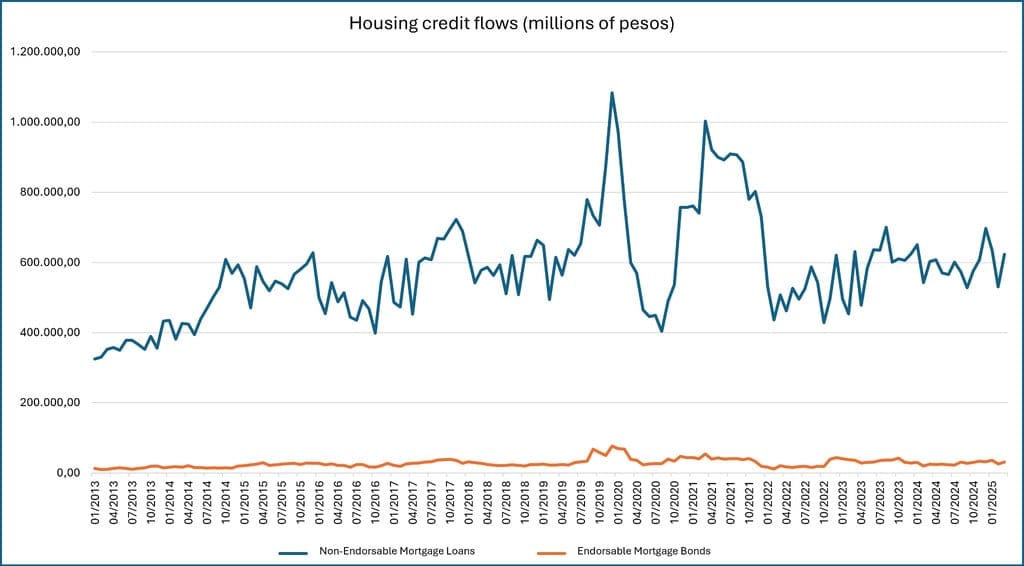

Access to mortgage credit has faced restrictions due to tighter financial conditions and increased access requirements. This has made it difficult to acquire housing, especially for low- and middle-income sectors.

Graph: Flows of loans for housing (millions of pesos)

Sources: Best-CMF. (s.f.). Integrated reports on the Chilean financial system. Financial Market Commission. https://www.best-cmf.cl/best-cmf/#!/reportesintegrados

Graph: Housing credit flows (number of operations)

Sources: Best-CMF. (s.f.). Integrated reports on the Chilean financial system. Financial Market Commission. https://www.best-cmf.cl/best-cmf/#!/reportesintegrados

Construction Dynamics

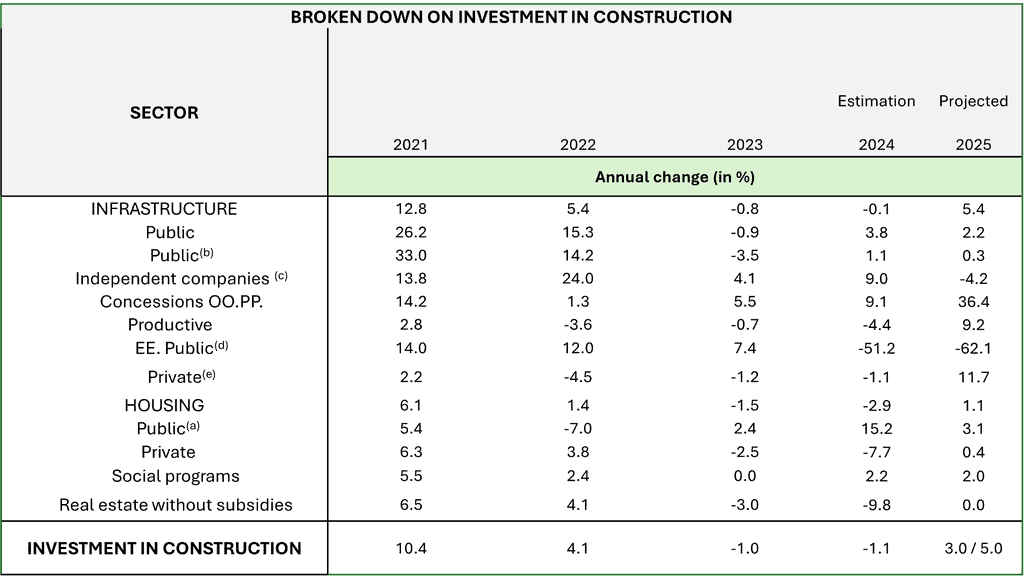

Chile’s construction sector has slowed significantly, affecting the broader real estate market outlook, with a 5.5% drop in the start of new works during the first half of 2024 compared to the previous half-year. This decline is attributed to factors such as rising material costs and tight credit requirements.

Graph: INVESTMENT IN CONSTRUCTION (DISAGGREGATED)

Sources: Macroeconomics and Construction Report. January 2025, MACH 67, of the Chilean Chamber of Construction.

In summary, the Chilean real estate sector faces significant challenges in terms of pricing, financing, and construction activity. The combination of weakened demand, credit constraints, and a slowing construction industry poses a complex scenario that requires attention and adaptive strategies from market players.

Construction activity and new buildings in Chile: recent developments and prospects for 2025

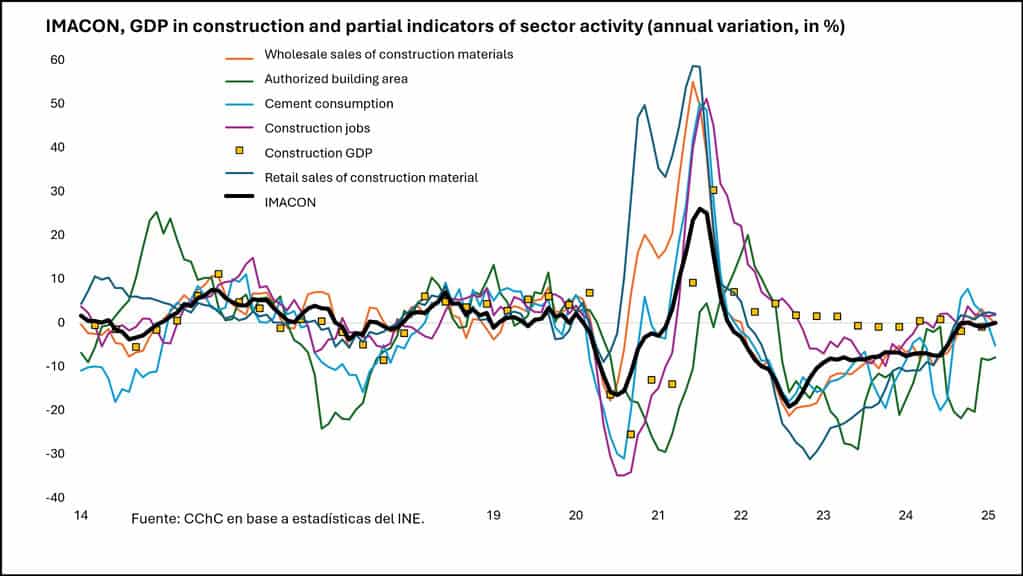

In 2025, the construction sector in Chile shows signs of moderate recovery after several years of contraction. According to the Chilean Chamber of Construction (CChC), a 4% increase in total investment in construction is projected, driven mainly by the development of private productive infrastructure in areas such as mining and energy.

However, activity in new residential buildings still faces challenges. Data from the National Institute of Statistics (INE) indicate that the authorized area of building permits experienced a negative year-on-year variation of 18% in April 2025, reflecting a decrease in the intention to build new works. i

In terms of revenues, large companies in the sector have shown signs of recovery. The Construction Revenue Index of Large Companies in Building Construction registered a positive year-on-year variation of 2.1% in the first quarter of 2025, while in Civil Engineering Works the increase was 10.9% in the same period.

Geographically, the activity has been heterogeneous. A report by ICONSTRUYE indicates that, in February 2025, the North Zone presented a positive performance, with amounts traded 9% above the average for 2024. In contrast, the Metropolitan Region experienced a considerable decrease of 30% compared to January, placing it 12% below the average of the previous year.

Despite these challenges, investment in housing is expected to grow by 1.1% in 2025, with a 3.1% increase in Public Housing and a slight increase of 0.4% in Private Housing, although it would still remain below historical levels.

Graph: IMACON, construction GDP and partial indicators of sectoral activity (annual change, in %)

Sources: Macroeconomics and Construction Report. January 2025, MACH 67, of the Chilean Chamber of Construction.

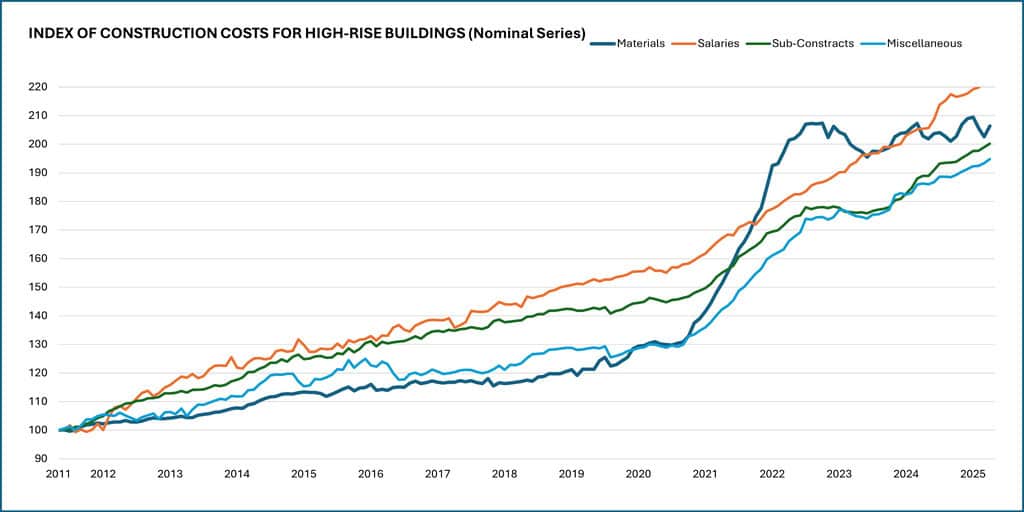

Land valuation and building permits.

The value of urban land in Chile has undergone significant variations in recent years, influenced by factors such as the scarcity of available land, the expansion of infrastructure, and urban policies.

According to the Institute of Urban and Territorial Studies of the Pontificia Universidad Católica de Chile, in the third quarter of 2023, 295 land offers were registered in the 34 communes of Greater Santiago, with an average price of 9.29 UF/m². In contrast, in the regional capital cities, the average price was 5.08 UF/m², with Iquique standing out with an average value of 32.12 UF/m².

The scarcity of land in urban areas has led developers to resort to land with existing constructions, which increases the costs of executing projects and, consequently, raises housing prices.

To promote transparency in the land market, the Ministry of Housing and Urban Planning has implemented the Urban Land Market Observatory, a tool that provides detailed information on the value of land in different municipalities of the country.

Graph HIGH-RISE BUILDING COST INDEX (Nominal Series)

Sources: Macroeconomics and Construction Report. January 2025, MACH 67, of the Chilean Chamber of Construction.

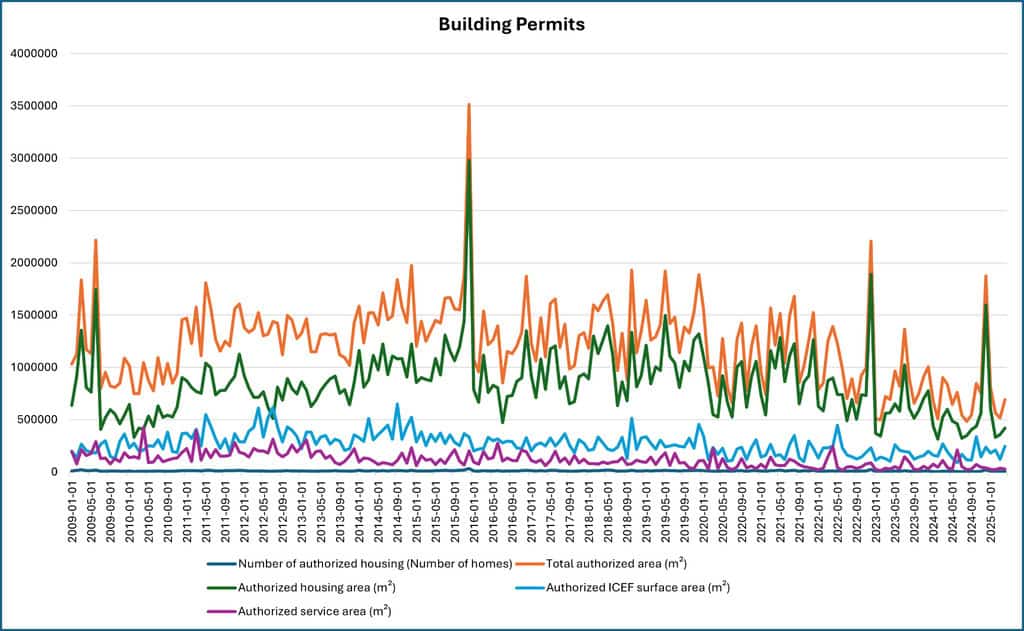

Building permits: recent developments and measures

The number of building permits in Chile has shown a downward trend in recent years. In July 2024, only 2,966 new homes were approved, representing a 76.7% drop compared to the same month a year earlier, marking the lowest level since records began in 1991.

This decrease in permits has had a direct impact on construction activity, contributing to a significant deficit in housing supply and affecting investment in the sector.

In response to this situation, on January 14, 2025, Law No. 21,718 came into force, which seeks to streamline the processing of building permits, reducing times and simplifying administrative processes. Among its main measures, it establishes a maximum period of 30 working days for the Municipal Works Directorates to issue observations on a project; If there are no observations in that period, the permit will be understood to be automatically approved. In addition, the digitization of procedures is encouraged and the responsibilities of the professionals involved in the process are clarified.

Graphic: Building Permits (PE)

Sources: Macroeconomics and Construction Report. January 2025, MACH 67, of the Chilean Chamber of Construction.

Foreign Investment in Real Estate

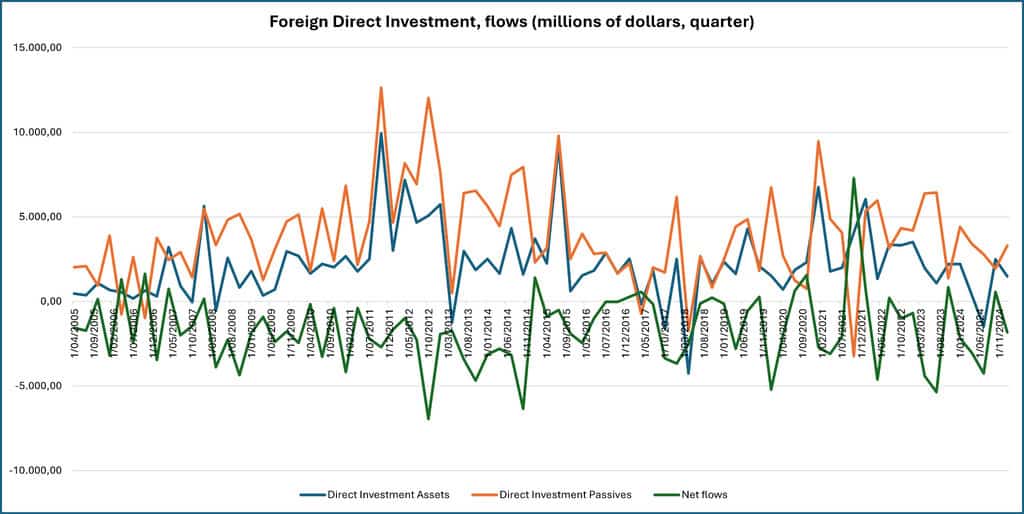

In recent years, Chile real estate market continues to attract foreign direct investment (FDI), supported by macroeconomic stability and pro-investment policies. In 2023, the country reached an all-time high in FDI, registering a net flow of US$21,738 million, which represented an increase of 19.2% compared to the previous year and 50% above the average of the historical series.

This growth is mainly attributed to equity participation (US$10,704 million) and reinvestment of profits (US$8,844 million), reflecting investor confidence in the Chilean market. Although the real estate sector does not lead in investment amounts, it has shown signs of recovery and emerging opportunities, especially in sustainable and urban infrastructure projects.

In 2024, FDI in Chile reached US$15,319 million, the third highest figure in the last nine years. Although it represents a decrease of 29.5% compared to the previous year, it remains above the historical average, evidencing a continuity in the confidence of foreign investors.

The Chilean government has implemented measures to encourage investment, such as the “Let’s Invest in Chile” plan, which seeks to increase total investment and improve access to financing for strategic projects. These initiatives, together with institutional stability and a commitment to sustainability, position the country as an environment conducive to investment in the real estate sector.

In summary, Chile presents a favorable outlook for foreign investment in the real estate sector, supported by proactive government policies, economic stability, and a focus on sustainable projects. Although there are challenges, the opportunities for investors who understand local and global dynamics are significant.

Graph: Foreign Direct Investment, flows (millions of dollars, quarter)

Sources: Central Bank of Chile. (n.d.). Foreign direct investment (FDI).

https://www.bcentral.cl/areas/estadisticas/inversion-extranjera-directa-ied

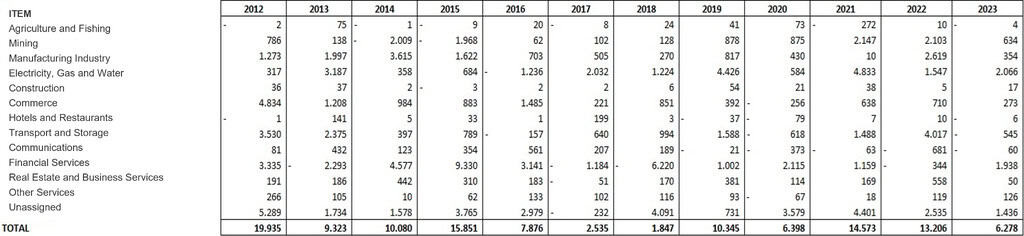

Graph: ACTIVE DIRECT INVESTMENT FLOWS BY ECONOMIC SECTOR

Sources: Central Bank of Chile. (n.d.). Foreign direct investment (FDI).

https://www.bcentral.cl/areas/estadisticas/inversion-extranjera-directa-ied

Real estate trends in Chile for 2025: between recovery and structural transformation

The Chilean real estate market in 2025 is in a transition phase, marked by signs of moderate recovery and the consolidation of new structural dynamics.

Context and recent developments

After years of contraction, the sector is showing signs of stabilization. According to Colliers, an increase in home sales is estimated at between 5% and 10% by 2025, driven by a moderate reactivation of the supply of mortgage loans and the reduction of interest rates. However, challenges remain, such as a drastic drop in investment, bankruptcies of construction companies and a rise in unemployment in the sector.

Current situation and key statistics

- The real estate market in Chile reached an approximate value of USD 10.88 billion in 2024, with a projected growth rate of 4.1% between 2025 and 2034.

- In Santiago, a 5% growth in the real estate market is projected by 2025, with transactions estimated at USD 8,000 million.

- The rental segment continues to recover, with significant growth in the multifamily market where an annual increase of 22% is projected until 2025.

Emerging trends

- Demand for sustainable housing and flexible spaces: Interest in green and energy-efficient properties is on the rise, reflecting a paradigm shift in real estate value criteria.

- Digitalization and PropTech: The adoption of digital technologies in real estate is transforming the way properties are bought, sold, and leased, improving efficiency and user experience.

- Growth in peripheral areas: Areas close to large cities, which offer tranquility, security and more space, are gaining prominence, representing opportunities for those looking for a home away from the noise, but without giving up the proximity of urban centers.

Real estate events in Chile for 2025

- Expo Vivienda- August 29-31, 2025

Expo Vivienda is the event that brings together in one place the real estate and financing offer for housing, design and equipment for the home. Expo Vivienda is consolidated as the meeting point of the national real estate sector, bringing together in one place the supply and demand of this important national sector.

The event aims to: 1. Know the wide range of projects with and without subsidies 2. Educate the audience about the different forms of financing for housing 3. Finding a life experience in one place 4. Presence of the most important leaders of the real estate industry to find solutions to the challenges faced by the Chilean market.

More information: https://www.expovivienda.cl/quienes-somos/

- Fevent – June 17-19, 2025

A fair that brings together the main leaders and outstanding brands in technology and sustainability to offer you a comprehensive vision of how you can take your home to the next level. We will explore innovations that not only improve energy efficiency and comfort, but also promote a greener and more responsible lifestyle. From advanced home automation systems to cutting-edge security and audio solutions, our goal is to provide you with the tools and knowledge you need to transform your home into a model of modernity and sustainability.

More information: https://www.fevent.cl/

- Expo Real Estate Chile – October 22 and 23, 2025

Expo Real Estate Chile is one of the most relevant meetings in the real estate sector in Latin America, designed to connect developers, investors, brokers, financial institutions and suppliers in the field. This fair and congress brings together in a single space the main investment opportunities, market trends, technological solutions and commercial strategies applied to the real estate business.

More information: https://exporealestatechile.com/

Explore upcoming opportunities, expand your network, and stay up to date with key industry trends.

Check our calendar here: A.CRE Events

Some of the main Real Estate Projects in Chile

Located on the Biobío River, the Industrial Bridge is a key infrastructure to improve connectivity between Hualpén and San Pedro de la Paz. With a length of 2.5 km, it is designed for the transit of vehicles, pedestrians and cyclists. Its construction, which began in 2021, is 78% complete and is expected to be inaugurated in the first half of 2025. This project will be integrated with the future Pie de Monte Route, strengthening the road network of Greater Concepción.

Located in front of the Bicentennial Park in the Cerrillos commune, the Pan American Village was initially conceived to accommodate the athletes of the Santiago 2023 Pan American and Parapan American Games. The complex consists of 17 buildings housing a total of 1,355 apartments, with surfaces ranging from 45 to 60 m². After the sporting event, these apartments are being adapted to become social integration housing, benefiting approximately 5,400 families. The project stands out for its sustainable design and its integration with green areas, being awarded the 2023 Urban Contribution Award in the category “Best Social Integration Project”.

This urban cable car will connect the communes of Providencia, Vitacura and Huechuraba, crossing the Metropolitan Park and linking the financial districts of Sanhattan and Ciudad Empresarial. With a length of 4.2 km, it will be the first cable car integrated into the public transport system in Chile. Work began in December 2023 and is expected to be completed in 2025.

This project will replace the old railway bridge over the Biobío River, connecting Concepción and San Pedro de la Paz. The new bidirectional structure will be 1,886 meters long and will have two electrified lines, including a 320-meter tunnel on Cerro Chepe. With an investment of approximately USD 270 million, it is expected to be completed by the end of 2025.

In partnership with Cox Energy, Green Atacama will develop two desalination plants in northern Chile. The first, with a daily capacity of 85,000 m³, will supply the mining industry, while the second, of 400,000 m³ per day, will be used for agricultural irrigation. Construction of the first plant is scheduled to begin in 2025, supporting the sustainable development strategy in the region.

6. Eco-Barrio La Platina – La Pintana, Santiago

Developed on the land of the former La Platina Estate, this housing project includes the construction of 881 houses and 322 apartments in its first phase. The design of the La Platina Eco-Neighborhood incorporates principles of sustainability and green urbanism, including bike paths, green areas, a park with a medicinal garden, spaces for free fairs and a boulevard of commercial premises and services. The initiative seeks to improve the quality of life of residents through inclusive and environmentally friendly urban planning.

Conclusions: Status and future prospects of the Chilean real estate market

The Chilean real estate market is going through a period of profound transformation, marked by a prolonged contraction of activity, regulatory adjustments, and new demands from demand. Although projections for 2025 anticipate a slight recovery driven by lower rates and some reactivation of mortgage credit, regulatory restrictions, rising land prices and weakened private investment continue to exert pressure on the sector, especially in the residential segment.

In this context, the Chile real estate market presents structural challenges and investment opportunities for real estate professionals who can adapt to evolving market dynamics: the incorporation of sustainability criteria, the commitment to housing solutions with a smaller surface area, and the use of technologies that speed up the planning and execution of projects will be decisive in navigating the current uncertainty. For investors, developers and real estate services companies, the Chilean market continues to be a relevant terrain on the Latin American map, although it requires a prudent, strategic and long-term reading.

References

- Central Bank of Chile. (2023). Chilean real estate market 2022: evolution and recent characteristics. https://www.bcentral.cl/contenido/-/detalle/mercado-inmobiliario-chileno-2022

- (2024, December 27). Real estate market: Trends in 2025. https://blog.toctoc.com/mercado-inmobiliario-tendencias-de-este-2025/

- Diario Financiero. (2024, December 21). 2025: Another bad year for the housing market [Op-ed]. https://www.df.cl/opinion/columnistas/2025-otro-mal-ano-para-el-mercado-inmobiliario

- (2024). Future of the real estate sector: trends and challenges for 2025. https://urbani.cl/futuro-del-sector-inmobiliario/

- El Diario Inmobiliario. (2024, December 26). Analysis of the residential market in Chile: growth and prospects for 2025. https://eldiarioinmobiliario.cl/noticias/analisis-del-mercado-residencial-en-chile-crecimiento-y-perspectivas-para-2025/

- Colliers Chile. (2024, January). Real estate market projections 2025. https://www.colliers.com/es-cl/articulos/santiago/2025-1401-proyecciones-mercado

- Central Bank of Chile. (n.d.). Foreign direct investment (FDI). https://www.bcentral.cl/areas/estadisticas/inversion-extranjera-directa-ied

- Chilean Chamber of Construction (CChC). (n.d.). Information Center. https://cchc.cl/centro-de-informacion

- Financial Market Commission (CMF). (n.d.). Real Estate Statistics – Average property value UF/m². https://cmfchile.cl/portal/estadisticas/617/w3-propertyvalue-29560.html

- Central Bank of Chile. (2023, September). Financial Stability Report – Second half 2023. https://www.bcentral.cl/documents/33528/133329/EEE_141.pdf/4230e8a9-4b6c-ea4e-ddd3-100830d83d15?t=1694689994487

- Chilean Chamber of Construction. (2025, January). Macroeconomics and Construction Report (MACH), No. 67. https://cchc.cl/centro-de-informacion

Frequently Asked Questions about the Chile Real Estate Market (2025)

How is the Chilean real estate market performing in 2025?

The Chilean real estate market is undergoing a complex transition. While projections suggest a 5%–10% rebound in home sales due to improved mortgage access and lower interest rates, challenges persist. These include a decline in investment, bankruptcies of construction companies, and a rise in sector unemployment. “The Chilean real estate market presents structural challenges and investment opportunities for professionals who can adapt to evolving market dynamics.”

What are the main economic factors impacting Chile’s real estate sector?

Key economic factors include a projected GDP growth of 1.75% to 2.75%, inflation at 4.4% (above the Central Bank’s target), and a fiscal debt level of 41.7% of GDP. “Monetary stability and moderating inflation have begun to translate into more favourable credit conditions,” but fiscal pressures may affect infrastructure and housing subsidies.

Which real estate segments are attracting the most investment in Chile?

Multifamily and industrial assets are currently the most attractive, receiving 86% of national real estate investment. “Other segments – such as social housing or regional developments – face significant lags.”

What role is sustainability playing in the Chilean housing market?

Sustainability is becoming a major value driver. “At least 30% of new developments in Santiago incorporate green certifications,” and demand for sustainable housing grew by 20% year-over-year. This shift reflects growing interest in energy efficiency and ESG-compliant developments.

What challenges are affecting housing supply and development in Chile?

Key challenges include regulatory restrictions like PRC plans that limit building height and density, a mismatch between supply and demand in unit sizes, and increasing construction costs—half of which are attributed to taxation. “Municipal regulations require homes over 80 m², while 80% of the demand is for 43 m² apartments.”

What is the current state of financing and mortgage availability?

Mortgage credit conditions are improving after a period of restriction. “A moderate reactivation of the supply of mortgage loans and the reduction of interest rates” is supporting a slight market rebound, although financing remains difficult for lower-income buyers.

How are building permits and construction activity trending in 2025?

Building permits are at historic lows. “In July 2024, only 2,966 new homes were approved – the lowest level since records began in 1991.” Although Law No. 21,718 aims to streamline approvals, overall construction activity remains subdued with a projected 4% investment growth mainly in non-residential infrastructure.

What is the status of foreign direct investment (FDI) in Chilean real estate?

FDI reached US$15.3 billion in 2024—above the historical average despite a 29.5% drop from the previous year. “Although the real estate sector does not lead in investment amounts, it has shown signs of recovery and emerging opportunities, especially in sustainable and urban infrastructure projects.”

Which major real estate projects are underway in Chile in 2025?

Highlighted projects include the Industrial Bridge (Biobío River), Pan American Village (Cerrillos), Bicentennial Cable Car (Santiago), New Biobío Railway Bridge, Green Atacama Desalination Plants, and Eco-Barrio La Platina (La Pintana). These developments reflect trends in infrastructure integration, sustainability, and social housing.

What future trends should investors watch in the Chilean market?

Emerging trends include the rise of multifamily rentals, sustainable building standards, digitalization through PropTech, and growth in peripheral urban areas. “The incorporation of sustainability criteria and the use of technologies that speed up project planning and execution will be decisive in navigating the current uncertainty.”