All About Careers in Real Estate Finance and Debt (Updated June 2024)

Real estate debt and finance jobs encompass a wide range of roles and responsibilities, but generally professionals working in this area are responsible for originating, managing, sourcing, and/or assessing debt investments. Roles might include originating new senior, secondary, and mezzanine debt; servicing existing loans; and seeking out financing for one’s own equity investments.

Search our list of jobs in real estate finance and debt or use our advanced search page.

Typical Debt and Finance Job Titles

Because of the varied nature of this category, titles differ depending on the firm and role. At traditional banks with exposure to real estate debt, the titles follow typical banking titles (Analyst, Associate, VP, Director, Managing Director, etc.) Outside of banking, there is little convention to naming in this area and so the applicant should read the description well to insure the position is what they are looking for.

Where They Work

Finance and debt professionals work in both firms that originate and service commercial real estate debt such as banks, life insurance companies, and mortgage REITs as well as firms that make equity investments (development, acquisition) in roles that require the professional to raise debt for the firms investments.

General Duties and Responsibilities

Duties and responsibilities in real estate debt and finance jobs are highly variable, reflecting the diverse range of roles and organizational contexts in which these professionals operate. In a typical day, professionals may engage in a variety of tasks such as analyzing financial data, assessing loan applications, and managing existing loan portfolios.

For those involved in originating debt, duties often include evaluating the creditworthiness of potential borrowers, structuring deals to meet both lender and borrower needs, and negotiating loan terms. For individuals tasked with managing existing loans, responsibilities might involve monitoring the financial health of borrowers, ensuring compliance with loan covenants, and managing risk by keeping abreast of market trends and regulatory changes. Additionally, those in roles that support the sourcing of debt for equity investments may focus on identifying potential financing sources, presenting proposals to lenders, and coordinating with internal teams to ensure alignment of financing strategies with broader investment objectives.

To fully understand what a specific finance job entails, make sure to carefully review the job description. These descriptions will explain the expected tasks, necessary skills, and desired experience level, to provide a clear picture of what the role will require.

Common Requirements

An undergraduate degree in finance and/or business is typically required of younger professionals. The more advanced the role, the greater the need for an advanced degree (real estate finance or MBA) and/or experience with real estate debt investments. At a minimum, an applicant will need to have a high proficiency working with Excel and a firm understanding of real estate finance principles.

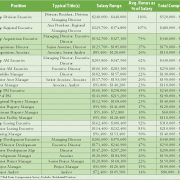

How Much do Real Estate Acquisitions Finance and Debt Professionals Make?

See our section on salaries in real estate for more information.

Conclusion and Resources

In conclusion, real estate debt and finance jobs offer diverse opportunities within various organizations such as banks, life insurance companies, and mortgage REITs. Understanding the specific roles and their requirements is crucial for anyone looking to enter or advance in this field. By leveraging resources and educational offerings, you can enhance your knowledge and skills and position yourself effectively in the competitive commercial real estate market.

To further help you as you plan your career, we’ve developed a variety of these career and education resources here at A.CRE that we’ve found valuable as we’ve blazed our own career paths (see below). Moreover, for those ready to actively pursue new opportunities, consider using our Cover Letter Composer tool. This custom GPT is designed to help you craft compelling cover letters tailored to various roles in commercial real estate, enhancing your applications and improving your chances of landing an interview in this competitive field. Utilizing resources like this can be a significant step towards advancing your career in CRE.

CAREER RESOURCES AT A.CRE

- A.CRE Commercial Real Estate Job Board

- Day in the Life Series

- General Content on Careers in CRE

- Help with CRE Interviews

EDUCATION RESOURCES AT A.CRE

- A.CRE 101

- Deep Dive Series

- Glossary of CRE Terms

- Series on Graduate Programs (MBA and Masters) in Real Estate

- Learn real estate financial modeling with the A.CRE Accelerator

Frequently Asked Questions about Careers in Real Estate Finance and Debt

What types of jobs fall under real estate finance and debt?

Jobs in this area include originating senior, secondary, and mezzanine loans; managing existing loan portfolios; servicing debt; and sourcing debt for real estate acquisitions or developments.

Where do real estate finance and debt professionals typically work?

These professionals are employed by banks, life insurance companies, mortgage REITs, and equity investment firms that need to raise and manage debt for their projects.

What are typical titles in real estate finance roles?

In banks, titles align with traditional structures such as Analyst, Associate, Vice President, Director, and Managing Director. In non-bank settings, titles vary more widely and depend on firm-specific conventions.

What do professionals in real estate debt and finance do?

Responsibilities range from analyzing loan applications and structuring deals to monitoring borrower compliance and identifying new financing sources. Duties depend on whether the role focuses on origination, servicing, or internal financing support.

What qualifications are needed to work in real estate finance?

An undergraduate degree in finance or business is typically required. More advanced roles may require an MBA or Master’s in real estate finance and direct experience with real estate debt. Proficiency in Excel and real estate finance principles is essential.

How do I know what a real estate finance job entails?

Job descriptions are key—review them carefully to understand responsibilities, required skills, and experience levels. This is especially important given the variety in job functions within the field.

What kind of salary can I expect in real estate finance and debt?

Salaries vary by role, experience, and firm type. For detailed compensation data, see A.CRE’s section on salaries in real estate.

Why is this field important in the real estate industry?

Debt is a critical component of most real estate transactions. Professionals in this field help structure, fund, and manage that debt, making their work essential to real estate development, acquisition, and investment strategies.