Real Estate Salary and Benefits (United States 2017)

Several years ago, we published a careers in real estate series where we discussed the various job sectors, business fields, and job functions that exist in the real estate industry. Additionally, we broke down compensation in real estate (salary + bonus) by position and level for 2014. Since then, each year we’ve followed up that series with a summary look at pay in various roles and working with various property types in real estate. Here’s what pay in real estate looks like for 2017.

Have a real estate job open at your firm you’d like to share with the A.CRE community? Post the job here for free.

Source of Compensation Data

Every year, real estate consulting firm CEL & Associates publishes its National Real Estate Compensation & Benefits Survey. The survey is the industry standard for pay statistics across 190 real estate positions in the United States. Nearly 400 companies participate to provide confidential compensation data for their employees working in all major real estate sectors, fields, and functions.

The survey is well-respected. It has been conducted annually for more than 20 years and is done in partnership with the National Association of Office and Industrial Properties (NAIOP) and the National Apartment Association (NAA). Results are available in a couple of formats:

- A 400+ page comprehensive paper covering salary trends, policy questions, bonus pay structures, quarterly breakdown, and pay details by company type, location, and size is available for purchase.

- A robust summary of the survey results is available to download for free.

Changes in Real Estate Salary and Bonus – 2016 vs. 2017

I think the headline, although not wholly unexpected, is that compensation growth in real estate has moderated. While pay rose anywhere from 6% – 11% from 2014 to 2016, increases from 2016 to 2017 have moderated significantly; especially for those in more senior positions. This makes sense. A lot of value had been created in the mid-to-late innings of this cycle, thanks to a robust CRE market, that senior folks had been handsomely rewarded for. Now, as rents flatten, vacancies rise, and valuations temper, compensation (especially bonuses) is likewise flattening.

With that said, total compensation still grew from 2016 to 2017 across property types, position levels, and role. In the positions we analyzed, total compensation grew anywhere from 1.7% – 3.7%, with most positions seeing a 2.5 – 3.0% increase year-over-year.

Real Estate Compensation in 2017

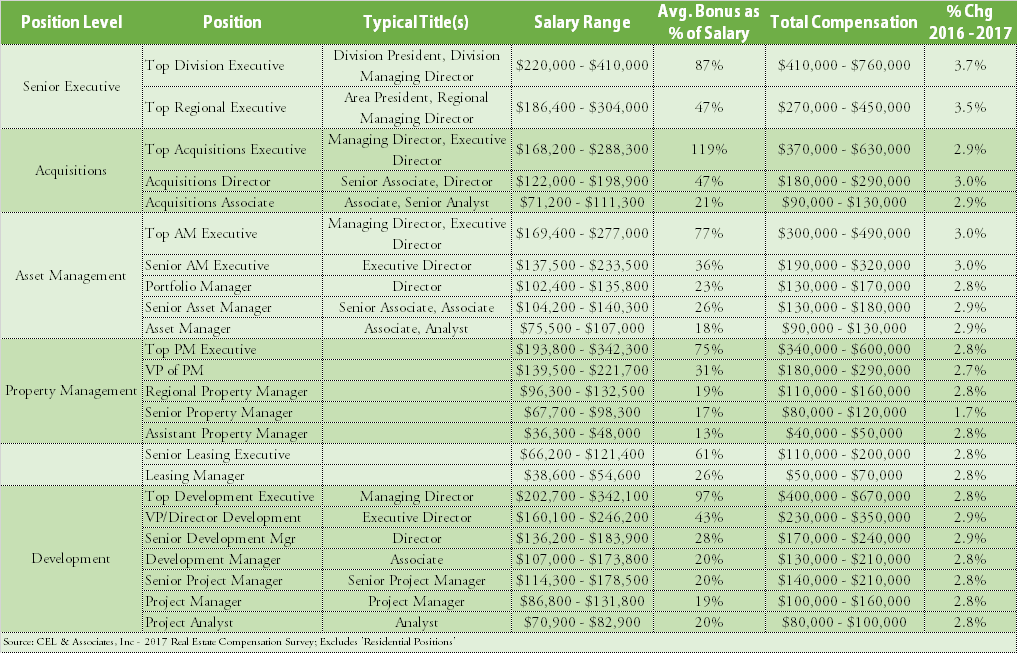

I’ve taken the comprehensive summary (linked to above) and condensed it down to the information and positions that I believe are most relevant to our readers. These are Analyst through Managing Director positions at industrial, office, retail, and multifamily focused real estate firms working in acquisitions, asset management, property management, and development. I’ve calculated and reported total pay, or the sum of salary and bonus, as well as the percent change in total compensation from 2016 to 2017 for each of the positions.

Browse hundreds of the acquisitions, development, asset management, and real estate investment banking jobs using the A.CRE Job Board.

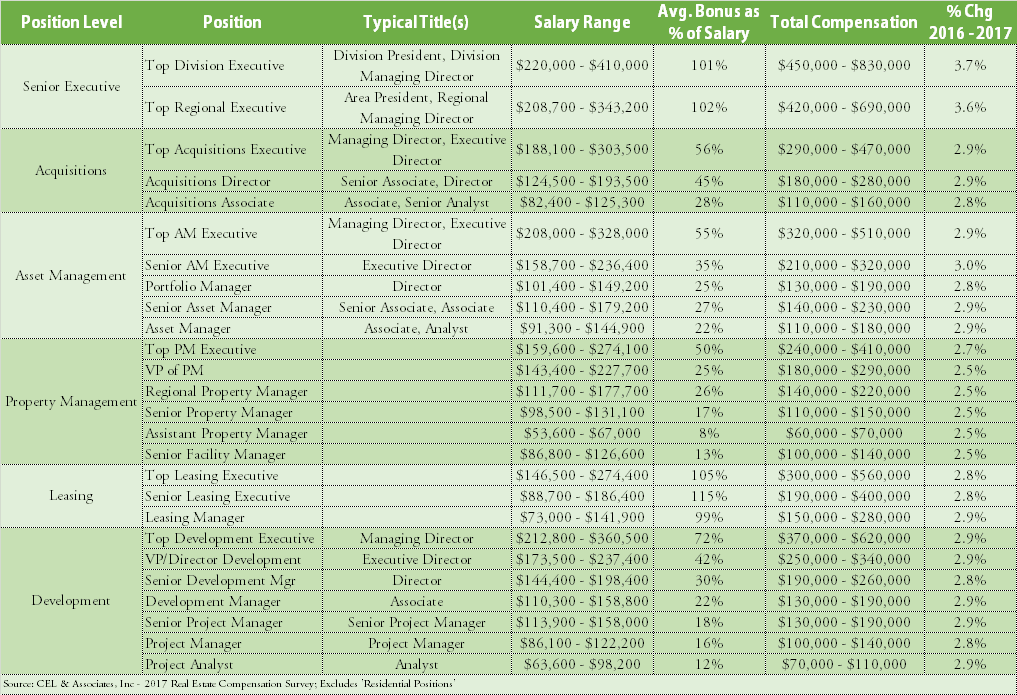

Summary of 2017 Pay (Salary plus Bonus) for Office and Industrial Real Estate Professionals

For real estate professionals working at firms focused on office and industrial properties, pay grew anywhere from 2.5% to 3.7%. As with most roles in real estate, bonus as a percent of total compensation is higher for the more senior roles and lower for the more junior roles. For acquisitions professionals in office and industrial for instance, on average the bonus makes up 28% of an Associate-level professional’s pay while the bonus makes up 56% of the acquisitions executive’s pay.

Acquisitions and Asset Management professionals working at office and industrial real estate firms earn about the same in all, with total compensation weighted more towards variable compensation for acquisitions professionals while asset management professionals earn slightly higher base salaries.

Summary of 2017 pay for acquisitions, development, management, and leasing professionals working with office and industrial properties.

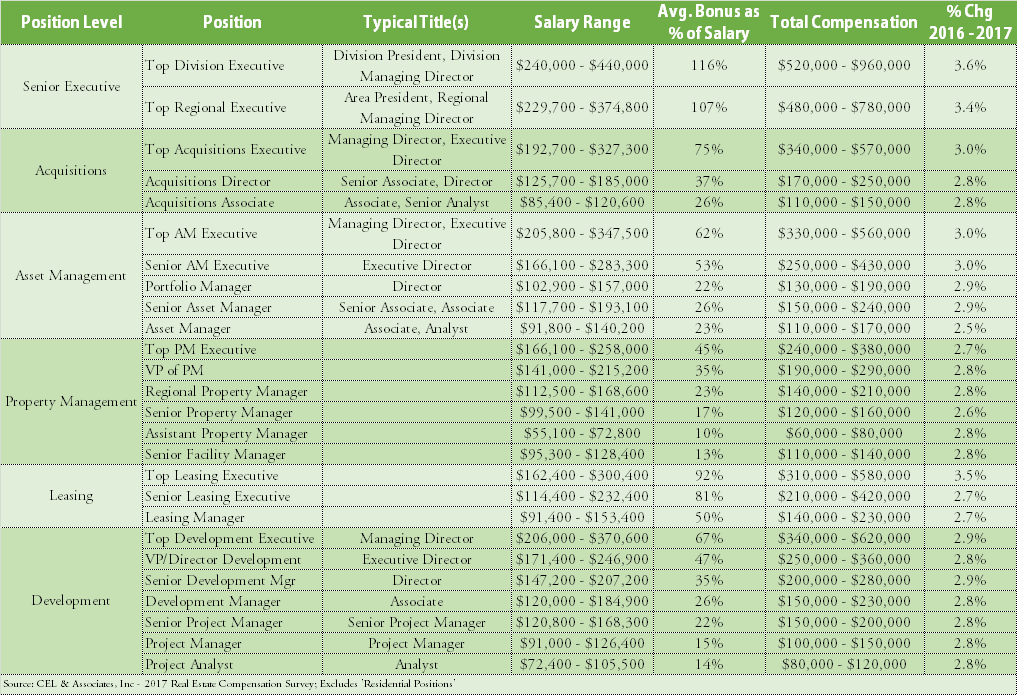

Summary of 2017 Pay (Salary plus Bonus) for Retail Real Estate Professionals

Generally speaking, Retail real estate professionals enjoy both a slightly higher base salary and average bonus then their office and industrial counterparts. Total compensation grew 2.5% – 3.6% year-over-year for the retail positions we analyzed, with the delta between compensation growth for senior executives compared to the rest shrinking dramatically compared to 2016. Newly-minted MBA and Masters in Real Estate graduates can expect to earn in retail-focused Associate-level positions on average anywhere from $80,000 – $170,000.

Summary of 2017 pay for acquisitions, development, management, and leasing professionals working with retail properties.

Summary of 2017 Pay (Salary plus Bonus) for Multifamily Residential Real Estate Professionals

We’ve added multifamily residential positions to our analysis this year, and there are some interesting differences between this property type and the others. First, on average the bonus as a percent of salary is lower for multifamily positions compared to their office, industrial, and retail counterparts. This is likely due to the less volatile nature of multifamily investment. Base salaries compare well with the other property types.

Students coming out of undergrad and moving into an analyst level position in multifamily development can expect, on average, total compensation in the high 5 figures; with approximately 20% of the total coming from bonus.

Summary of 2017 pay for acquisitions, development, management, and leasing professionals working with residential (multifamily) properties.

Conclusion on 2017 Real Estate Pay

So what does this mean for you? One big takeaway from the survey is that commercial real estate professionals are very well paid. This is a lucrative career with significant upside, both for employee-minded and entrepreneurial-minded people. Opportunities abound in a variety of tracks – from asset management to development – for those with the formal real estate education and experience to go after them. So enjoy digging into this report and I hope you use this data to your benefit in your next salary negotiation!

Frequently Asked Questions about Real Estate Salary and Benefits (United States 2017)

Where does the compensation data come from?

The data is sourced from the CEL & Associates National Real Estate Compensation & Benefits Survey, which collects confidential compensation data annually from nearly 400 U.S. real estate companies.

How much did real estate compensation grow from 2016 to 2017?

Compensation growth from 2016 to 2017 moderated, with increases ranging from 1.7% to 3.7%. Most roles experienced a year-over-year increase between 2.5% and 3.0%.

Which roles had the highest bonus-to-salary ratios in 2017?

Senior acquisitions professionals in office and industrial sectors had the highest ratios. For example, an acquisitions executive’s bonus made up 56% of their total compensation.

How did retail real estate compensation compare to office/industrial in 2017?

Retail professionals generally earned higher base salaries and bonuses than their office/industrial counterparts, with total compensation growth of 2.5%–3.6% in 2017.

What compensation can new real estate graduates expect in retail roles?

New MBA or Master in Real Estate graduates entering Associate-level retail positions could expect to earn between $80,000 and $170,000 in total compensation.

How does multifamily compensation differ from other property types?

Multifamily roles tend to have lower bonuses as a percent of salary compared to other sectors, likely due to the lower volatility of multifamily investments. Base salaries are comparable.

What’s the compensation outlook for junior roles in multifamily development?

Analyst-level professionals entering multifamily development positions out of undergrad could expect total compensation in the high five-figure range, with about 20% coming from bonus.

Is commercial real estate still a well-paying career path?

Yes, commercial real estate remains a lucrative career with strong compensation and career growth potential, especially for those with formal education and relevant experience.