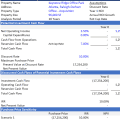

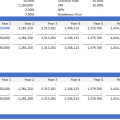

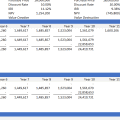

IRR vs Discount Rate Analyzer Model

The IRR vs. Discount Rate Analyzer Model is a simple yet powerful educational tool designed to help real estate professionals understand the dynamic relationship between an investment’s internal return (IRR) and the investor’s required return (Discount Rate). Built in Excel, this model also illustrates how changes in purchase price impact both IRR and Net Present Value (NPV), thereby providing a clear, intuitive framework for pricing real estate deals. (View description of model)

Note: Compatible with Microsoft Excel 2013 and newer.

To make this tool accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (choose ‘Free’ if you need) or maximum (your paid support helps keep the content coming – typical real estate Excel tools sell for $100 – $300+ per license).

Instructions: 1) set a price, 2) tell us where (email address) to send the model, 3) enter payment details (if applicable), and then 4) click ‘Proceed with Download’. The system will send you a download link, as well as add the file to your ‘My Downloads’ page.

SKU: N/A

Category: Real Estate Excel Models

Tags: excel, Real Estate Financial Modeling, Models, DCF, Asset Management.

Related products

-

A.CRE Self Storage Development Model

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page -

Back-of-the-Envelope Office, Retail, Industrial Acquisition Model

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page -

Multifamily (Apartment) Acquisition Model in Excel

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page