Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

3-Tiered Acquisition Debt Module

This is a 3-tiered debt module that will allow the user to add one to three tiers of debt to his or her real estate DCF model. Includes the option to layer in senior debt, secondary debt, and mezzanine debt; calculate interest on either…

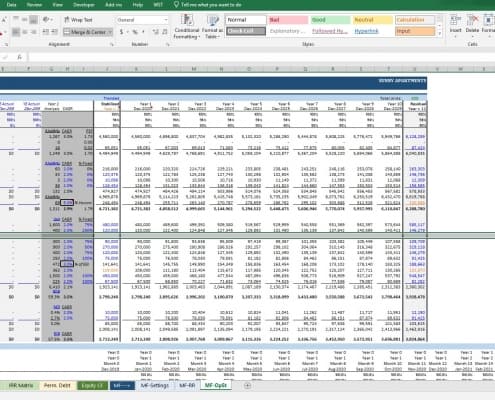

Quick Tutorial: Add Line Items to OpSt Sheet in All-in-One

I was recently asked the question whether it's possible to add more other income or operating expense line items to the MF-OpSt or ORI-OpSt worksheets in my All-in-One Model for Underwriting Acquisitions and Development. Short answer is: out…

Deep Dive: Understanding Acquisitions: The Letter of Intent (LOI)

The Letter of Intent - Legal Issues

The letter of intent is a critical document that is written up at the beginning of a potential real estate transaction between either a prospective buyer and seller or a prospective tenant and landlord.…

Graduate Real Estate Series: Columbia University MS.RED (Updated 2.2.2019)

The Columbia University Master of Science of Real Estate Development (MS.RED) program is an intensive, three term (one year) graduate program in real estate offered through Columbia University's highly ranked Graduate School of Architecture,…