Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

All-in-One (Ai1) Walkthrough #1 – Permanent Debt Tab (Updated Nov 2019)

In an effort to provide greater instruction on how to use our All-in-One Underwriting Tool for Real Estate Development and Acquisition, we've developed a series of walkthrough videos and posts on the methodology behind the various components…

Using Conditional Formatting in Real Estate Financial Modeling

Your real estate financial models are only as good as their ability to be used by others. Or in other words, if others can't figure out how to use your model, it isn't worth much! So when building real estate financial model templates, besides…

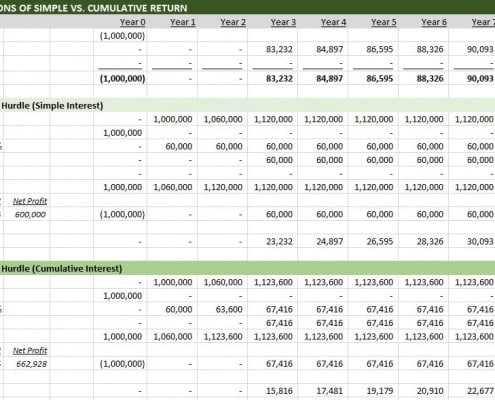

Preferred Return – Simple Interest vs. Compound Interest

A concept common to real estate partnership structures, preferred return refers to the preference given to a certain class of equity partners when distributing available cash flow. The preferred return is generally calculated as either a percentage…