Letter of Intent for Office Leasing

Today we’re going to be diving into what is typically the very first legal document presented to a Landlord who is renting commercial office space: the letter of intent for leasing. At the end of this post, find a link to download a template office leasing LOI as well as a video walk through of the document.

As they say, you never get a second chance at a first impression. The Letter of Intent plays an important role in the tone and parameters of the negotiation process. It conveys the indicative terms in the tone and perceived level of professionalism from the party if they want to pursue a transaction and a business relationship for many years to come.

Note from Spencer: This is the first in a growing section we call ‘A.CRE Legal‘. One of Texas’ top real estate attorneys, Ronald Rohde, has graciously offered to share his time, expertise, and open his library of real estate legal templates for the A.CRE audience. Click here to learn more about Ron or to contact him directly.

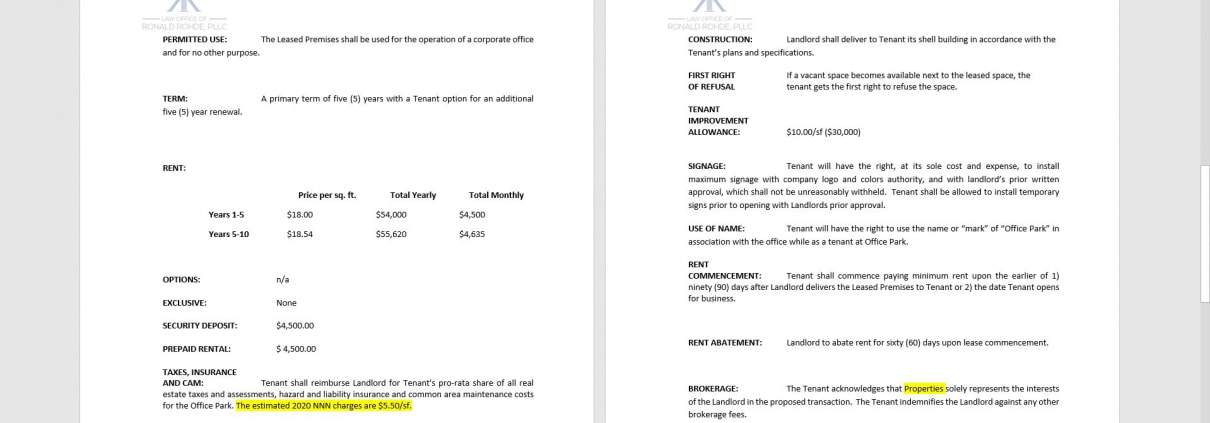

The specific terms usually include leased premise description, price per square foot, due diligence period, security deposit, execution date, commencement date, financial reporting obligations, parties to the lease, permitted uses, assignability, etc.

You never get a second chance at a first impression and the Letter of Intent is that first impression.

When it makes sense to use this Letter of Intent

The assumptions that I will make are that you’re a corporate entity formed either for the special purpose of leasing real estate for your business or utilizing your regular operating business entity. Often my clients work with a commercial broker who prepares and submits the LOI. However, there are plenty of Tenants who forgo a broker and request their attorney submit the LOI directly.

As a generalization, the commercial broker serves as a barometer of market rates, local industry trends, perhaps personal relationships with the corresponding broker, etc. A commercial attorney cannot be a complete substitute for a local broker, but some tasks can be jointly fulfilled by a buyer and his or her attorney.

I’m also going to present several different Letter of Intent samples for scenarios such as an institutional level owner, mom and pop or family owned property, and any unique situation for approaching foreign sellers, etc.

A Legal Document, But not an enforceable agreement

A Letter of Intent is designed to be a legal document, but not an enforceable agreement. That is to say, its a legal document with precise definitions and commonly understood clauses, but despite signatures from both parties, there is not an enforceable agreement requiring one party to complete the described transaction.

There are many legal documents or clauses which may not be designed to be enforced in a court of law. For example, a Memorandum of Understanding between two companies could go into great detail describing how the two companies would work together, but absent a second, enforceable agreement, the MOU would not be sufficient in a court of law.

Some clauses may want to be enforceable such as confidentiality, litigation rules, attorney’s fees, etc. Be very careful about mixing clauses within a broader agreement. Word choice must be carefully considered if you are introducing enforceable clauses.

LOI are typically non-binding, but parties must be careful not to draft a binding LOI as it does happen and courts have enforced terms of an LOI as if an actual agreement. On July 18, 2017, the Dallas Court of Appeals reversed a jury verdict of more than $535 million against Enterprise Products Partners LP, leaving Energy Transfer Partners LP (ETP) empty handed. That maintains the presumed standard of “non binding” language as a catchall when other terms appear to conflict. That sound was the audible release of midstream joint venturers breathing a collective sigh of relief.

Premise Description in the LOI

For commercial office leases, the leased premise should be identified with enough particularity that the Landlord knows which space on which property the Tenant is interested in, especially if they own multiple properties with similar characteristics. The leased premises should also include any reference to key assumptions about shared common access such as entrances, parking locations, etc. Precision on what you are interested in will demonstrate appropriate due diligence.

Lease Price in the LOI

Price is seemingly just a number. But just how much does an office lease cost? What are the components that the Landlord is legally able to charge? Think of the major categories of lease expenses that would influence the “deal or no deal”.

While you want to present a competitive offer, you also don’t want to waste time, your own and the sellers, by pursuing a deal that will die once the full extent of the scope of Landlord permissible charges are discovered.

Due Diligence Period in the LOI

Often the Tenant will include a Tenant Improvement credit for the Landlord to pay for customization of the lease space. What is the condition of the office space and how much work needs to be done to make the space ready for occupancy? Once a construction estimate is created, next decide how much of that cost the Landlord should pay. Do you have your contractors prepared to enter the property? In a competitive market, having a shorter due diligence period, combined with accurate estimates, can produce a very short review period. This however, requires thoughtful pre-offer preparation and a system which can be implemented quickly and frequently without fail.

Security Deposit in the LOI

The security deposit can also be a a tools used by Landlords to mitigate risk of nonpayment of rent. Tenants often can use this to offset a lower annual rent, but increasing the likelihood of complete payments.

On the other hand, putting cash in their hands does two things. A) it drastically increases your cost in recovering those funds if withheld and B) prevents the Tenant from earning an investment return on those funds.

How much needs to be deposited to be taken seriously? This is an area where a broker will be able to advise based on prior experience, but a multiple of monthly rent is a good rule of thumb. The Security Deposit can often be used to offset a Landlord desire for corporate or personal guaranty on the Lease.

Keep in mind that this often translates to a six-figure deposit. Be prepared to walk away if your initial terms reflect what you need for a deal. Again, higher earnest money demonstrates stronger likelihood of performing through the lease term. There is also the corresponding amount of risk if the Lease encounters conflicts in financial responsibility.

Timing in the LOI

Execution date and commencement date, this is perhaps the most common issue when calculating deadlines despite it appearing to be a simple function of timing, but given multiple rules for “later of” or construction delays with no apparent source, there is often disagreement between the Landlord and the Tenant on date deadlines. If you can clearly describe consequences in a timeline with construction delays, you will have a smoother journey towards taking occupancy.

Financial Reporting Obligations in the LOI

This would describe in very broad terms, what the Tenant intends to provide to the Landlord either prior to Lease signing on ongoing during the life of the Lease. Typical financial statements would include federal tax returns, profit and loss statements, cash flow, balance sheet, etc.

Ongoing obligations usually consist of a subset of these. Unaudited annual profit and loss with tax returns are common. The goal is to provide enough security to the Landlord of the financial health of the Tenant without placing an undue burden on the Tenant nor disclose so much information that it undermines your business.

Parties to the Lease and Permitted Uses in the LOI

Parties to the lease and permitted uses are often related, but sophisticated parties may utilize a “Leasing entity” this is a Single (Special) Purpose Entity which is solely used for signing the Lease and does not directly have title to cash or revenue within the company. The entity does not hold any assets and will require a Landlord to see this distinction and require corporate guaranty to compensate.

How the company intends to utilize the space may also factor in to which entity signs the Lease. Think of whether you will have daily customers, client trainings, or deliveries of product.

Final Thoughts on the LOI for Office Leasing

I have covered many, but not all of the possible terms which make it into your next Letter of Intent. The purpose will always remain the same and different Tenants will structure different elements to convey their own unique purpose.

If you’re in a Tenant’s market, perhaps all you need to do is jot down an email indicating a mild interest in the property and the Landlord will fill your inbox.

Understanding your goals in relation to the Landlord’s goals given that they likely do not know who you are, what Leases you’ve honored in the past, and how interested you are in this property, the LOI can be a very important document.

Walkthrough of the Letter of Intent for Office Leasing

As a companion to the above, I’ve created a walkthrough of this letter of intent. If you have any questions, don’t hesitate to reach out.

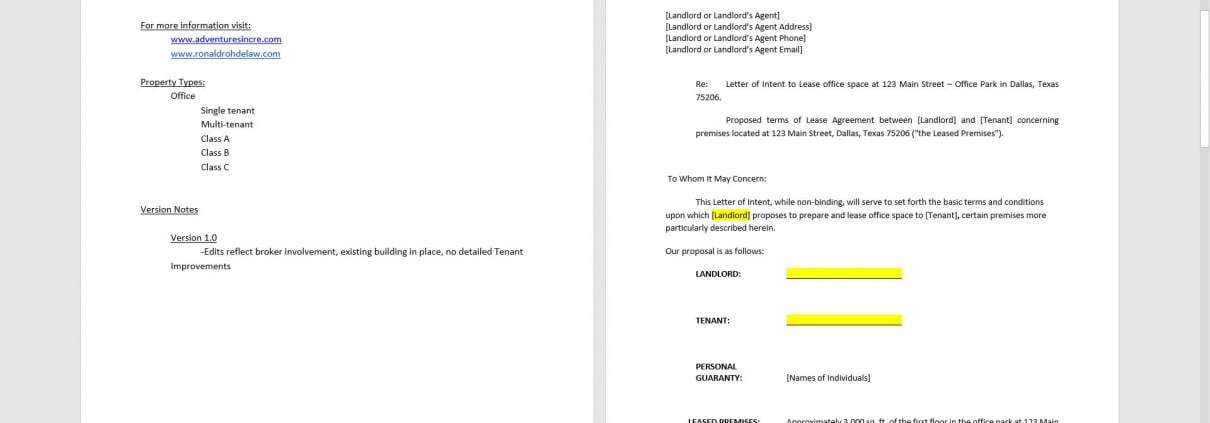

Download the Letter of Intent for Office Leasing

To make this legal template accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming – typical legal document templates sell for $100+). Just enter a price together with an email address to send the download link to, and then click ‘Continue’.

We regularly update the template (see version notes). Paid contributors to the template receive a new download link via email each time the model is updated.

Frequently Asked Questions about the Letter of Intent for Office Leasing

Version Notes

v1.0

- Initial release