Capital Expenditure

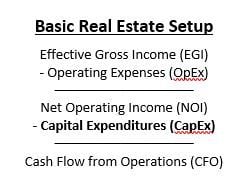

In real estate, an expenditure with a useful life greater than a year. Referred to colloquially as CapEx, Capital Expenditures are depreciated over their useful life (e.g. a $100,000 expenditure with 10-year useful life = $10,000 depreciation each year for 10 years). In contrast, operating expenses are fully depreciated in the year they occur. In real estate modeling, capital expenditures fall below net operating income due to their volatile (sporadic) nature.

Putting ‘Capital Expenditures’ in Context

Scenario:

Empire Property Management, an asset management firm based in New York, recently acquired a 250,000-square-foot power center in Syracuse, NY, known as Syracuse Square Power Center. This property is a core-plus asset, meaning it’s relatively stable but requires some improvements to maintain its competitive edge and market value. One of the immediate concerns identified during the due diligence process was the aging roof, which had begun to show signs of wear and tear, including leaks and energy inefficiency.

Application of Capital Expenditures:

After taking control of the property, Empire Property Management decided to replace the roof—a significant capital expenditure (CapEx) with a projected cost of $750,000. The new roof is expected to have a useful life of 25 years, which means the expenditure will be depreciated over this period. For financial reporting and tax purposes, the firm will record $30,000 annually as depreciation ($750,000 ÷ 25 years).

Impact on Financials:

Unlike regular operating expenses, which are fully expensed in the year they occur, the $750,000 spent on the new roof will not immediately affect the property’s Net Operating Income (NOI). Instead, this CapEx will be recorded “below the line,” meaning it will be reflected in the cash flow analysis but not in the NOI calculation.

This approach ensures that the property’s NOI remains an accurate reflection of its operational performance, undistorted by large, sporadic expenses like a roof replacement. However, potential investors and lenders will still scrutinize the property’s CapEx history and future CapEx plans to fully understand the asset’s long-term cash flow potential and overall financial health.

Conclusion:

In this scenario, Capital Expenditures play a crucial role in maintaining and potentially enhancing the value of Syracuse Square Power Center. While the $750,000 roof replacement is a significant outlay, it is essential for preserving the property’s structural integrity and attractiveness to tenants, thereby supporting long-term income stability. Empire Property Management’s decision to undertake this CapEx reflects a strategic approach to managing a core-plus asset, where maintaining and improving the property is key to realizing its full potential.

Frequently Asked Questions about Capital Expenditures (CapEx)

What is a Capital Expenditure (CapEx)?

Capital Expenditure (CapEx) in real estate refers to an expenditure with a useful life greater than one year. Examples include major repairs, replacements, or upgrades like roofing, HVAC systems, or elevators.

How is CapEx different from operating expenses?

Operating expenses are fully deducted in the year they occur, while CapEx is depreciated over its useful life. CapEx also appears below the line in real estate financial models, whereas OpEx is part of the Net Operating Income (NOI) calculation.

How does CapEx affect Net Operating Income (NOI)?

CapEx does not impact NOI directly because it is recorded below the line. NOI reflects the property’s operating performance, excluding sporadic or large expenditures like CapEx.

How is CapEx treated in financial reporting?

CapEx is depreciated over its useful life for accounting and tax purposes. For instance, a $750,000 roof replacement with a 25-year useful life would be depreciated at $30,000 per year.

Why do investors and lenders review CapEx history?

CapEx history provides insight into how well a property has been maintained and helps evaluate future cash flow needs. It can affect risk assessments, valuation, and decisions on financing or acquisition.

What is an example of CapEx in a real estate deal?

In the Syracuse Square Power Center case, Empire Property Management spent $750,000 on a roof replacement—a CapEx expected to last 25 years. This cost was depreciated annually at $30,000 and excluded from the NOI calculation.

Click here to get this CRE Glossary in an eBook (PDF) format.