Preferred Return – Simple Interest vs. Compound Interest

A concept common to real estate partnership structures, preferred return refers to the preference given to a certain class of equity partners when distributing available cash flow. The preferred return is generally calculated as either a percentage return on contributed capital or a given multiple on contributed capital, and must first be paid before common equity (i.e. the sponsor / general partner) has a right to promoted interest.

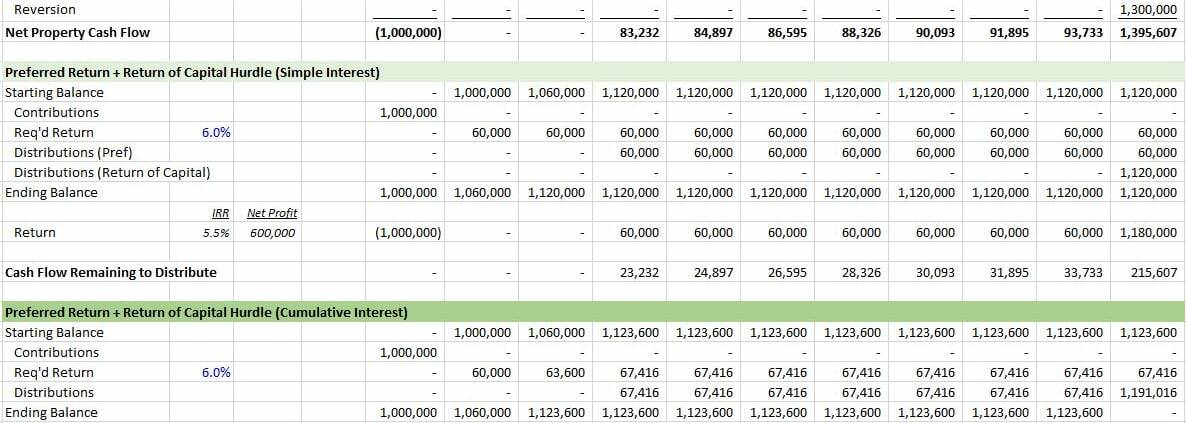

Simple Interest vs. Cumulative Interest When Calculating Preferred Return

How Preferred Return Fits in the Real Estate Waterfall

In a typical real estate partnership distribution waterfall, the preferred return comes first. For example:

- First, cash flow will be distributed to the partners in accordance with their partnership percentages until the Limited Partner has achieved an annualized, cumulative preferred return equal to 8.0% ; after which

- Second, excess cash flow will be distributed to the partners in accordance with their partnership percentages until each Partner’s capital account balance has been reduced to zero; after which

- Third, excess cash flow will be distributed (a) 75% to the partners in accordance with their partnership percentages, and (b) 25% to the General Partner as a promote until the Limited Partner has achieved a 12% internal rate of return; and

- Lastly, the balance will be distributed (a) 60% to the partners in accordance with their partnership percentages, and (b) 40% to the General Partner as a promote thereafter.

In the above example, all cash flow is distributed to the partners until the Limited Partner has earned an annual, cumulative preferred return of 8.0%. It is not until that preferred return has been hit, that the excess cash flow is available to pay down capital or pay promoted interest to the General Partner.

Check out a few examples of real estate waterfalls in our Library of Real Estate Financial Models

Implications of Simple vs. Cumulative Interest

There are various methods and metrics used to calculated preferred return. Preferred return is most often calculated as a percentage of contributed capital, but that return may be figured using simple interest (i.e. calculated on contributed capital to date) or using cumulative interest (i.e. calculated on contributed capital plus on any unpaid preferred return to date).

The resulting internal rate of return to the capital partner can be quite different between the two calculation methods, with the difference more pronounced in scenarios with insufficient cash flow in earlier years to cover the preferred return.

- Click here to download the example file used in this video

Frequently Asked Questions about Preferred Return – Simple Interest vs. Compound Interest

What is a preferred return in a real estate partnership?

A preferred return is the priority return given to certain equity partners (typically Limited Partners) before other equity holders—such as the sponsor or General Partner—receive promoted interest. It is usually calculated as a percentage or multiple of contributed capital and must be met before profit-sharing shifts to other tiers in the distribution waterfall.

Where does the preferred return fit in the distribution waterfall?

It generally appears at the first tier of the waterfall. For example:

All cash flow goes to investors until the Limited Partner achieves the preferred return (e.g., 8% annualized cumulative).

Then, capital is returned to partners.

After that, excess cash flow is split between LPs and the GP as promote (e.g., 75/25) until a target IRR is met.

Finally, the promote split may shift again (e.g., 60/40) for remaining profits.

What is the difference between simple interest and cumulative (compound) interest for preferred returns?

Simple interest: The preferred return is calculated only on the original contributed capital to date.

Cumulative (compound) interest: The preferred return is calculated on contributed capital plus any unpaid preferred return, allowing the unpaid portion to accrue and itself earn interest.

This difference can significantly affect total returns, especially when early-year cash flows are insufficient to meet the preferred return.

How does the calculation method affect investor returns?

Using cumulative interest generally increases the Limited Partner’s effective return because unpaid preferred return balances grow over time and must be paid before the GP participates in promote. The IRR to the capital partner can therefore be materially higher with cumulative interest compared to simple interest.

Why might a sponsor choose simple interest over cumulative interest?

Sponsors may prefer simple interest because it limits the accrual of unpaid preferred returns, reducing the amount owed to investors before the GP can earn promote. This can be especially beneficial to the sponsor in projects with tight early-year cash flow.

When is cumulative interest more favorable for investors?

Cumulative interest benefits investors most when cash flow in the early years is insufficient to meet the preferred return. The unpaid amount compounds, ensuring they are compensated for the delay in payment before the GP receives any promoted interest.

Can preferred returns be based on something other than contributed capital?

Yes. While most preferred returns are calculated as a percentage of contributed capital, they can also be structured as a multiple on contributed capital (e.g., 1.5x before promote) or tied to other agreed-upon benchmarks.

Where can I see examples of preferred return waterfalls?

A.CRE provides a Library of Real Estate Financial Models that includes multiple waterfall examples showing preferred returns, capital return tiers, and promote splits in various scenarios.