The Road to Stabilized NOI – Loss to Lease in Multifamily Property Underwriting

The calculation of stabilized Net Operating Income for a property is synonymous with building a stabilized proforma. This modeling process starts by estimating revenues and then the expenses, which means we must adjust the anticipated revenues minus the given expenses to evidence normally stabilized operations of the property.

It sounds simple enough but the precise calculation of this value is much more of an art than a science. There is a lot of work involved in the search for a pro forma (Stabilized) NOI and, therefore, the real estate professional who can tread this road with precision is highly valued.

Note from Arturo: This is the first post of the Road to a Stabilized NOI. This series of content intends to show the road that real estate professionals must follow to reach a Stabilized NOI, in this sense, beyond the calculations, the objective is to reflect what is behind the decisions that must be taken concerning the subscription of each one of the items that make up the proforma of a real estate property.

The reason for this is that beyond calculating each item that makes up a pro forma, the value of NOI is a function of the underwriting decisions that are made for each of those items. So, behind each decision, there is a comprehensive analysis of the income and expenses directly related to the operation of the property, located in the property’s historical income statement.

Comparing the contractual rent with the market rent, knowing the tenants, as well as verifying that each of the income and expenses of the property are sustainable over time (not sporadic), are aspects that will also determine the calculation of a stabilized NOI.

In summary, I would say that the more valuable data that is at your fingertips and, of course, handled properly, the better the assumptions or inputs you use as a real estate professional along the way, making the resulting pro forma NOI much more accurate.

BUT WHAT EXACTLY IS A PROFORMA?

In the real estate sector, a proforma is synonymous with a financial projection that provides an estimate of expected revenues, operating expenses, and the potential profitability of a real estate investment.

Although the pro forma is built on assumptions and estimates, the pro forma is an essential tool for real estate professionals, as it allows them to make informed decisions and assess risk.

When we encounter the term ‘pro forma NOI,’ we refer to the stabilized projection of Net Operating Income. This projection includes all revenues and expenses directly related to property operation, factoring in occupancy, rent, market expenses, and their persistence over time.

MULTIFAMILY PRO FORMA

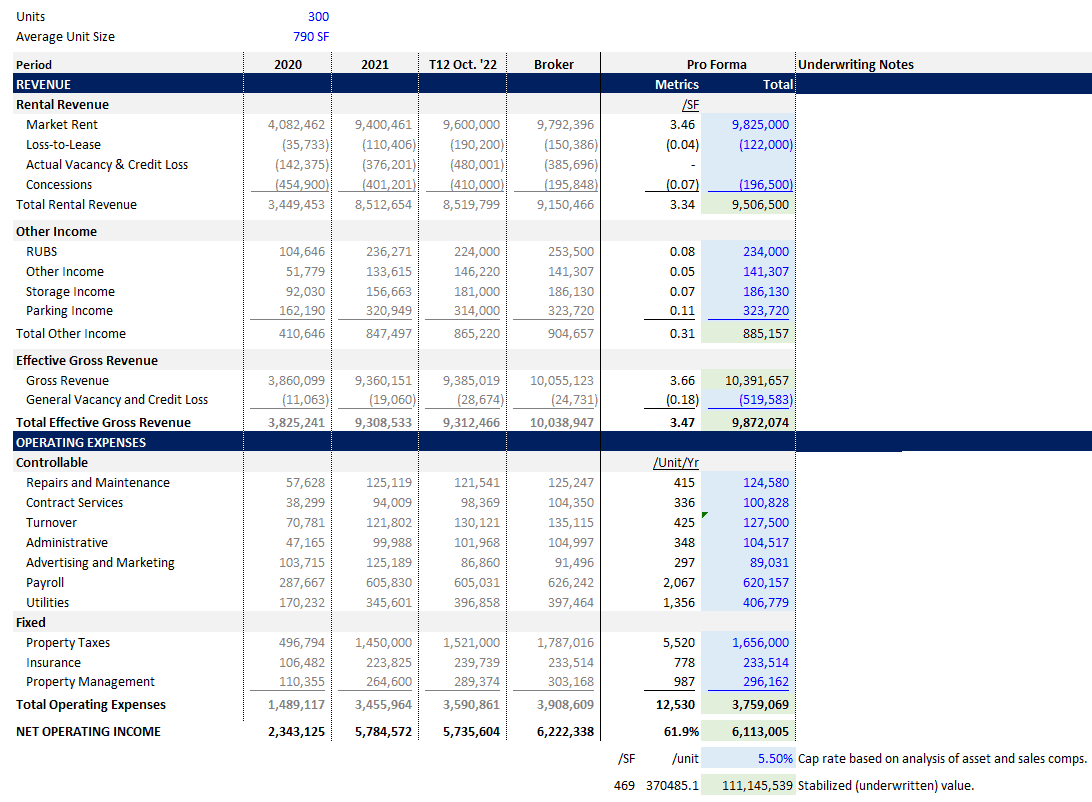

The following image is an example of a proforma for a multifamily property:

Multifamily pro forma

Briefly describing the image, we can say that once we have established the value of each of the items that make up the proforma (blue font), we calculate the stabilized Net Operating Income, using the formula:

Net Operating Income = Effective Gross Revenues – Operating Expenses

Thus, Net Operating Income is the net income that a property generates in a given period of time, after deducting operating expenses, but before deducting capital expenditures and debt service.

EFFECTIVE GROSS REVENUES

Given the above, the calculation of the effective gross revenues is the first step in the search for stabilized NOI.

In detailing our proforma example, you will notice that we start by calculating the total rental income. That means we must start from our potential gross rent, also called market rent, which represents the absolute maximum we could earn if all the units in the multifamily property we are analyzing were occupied at market rate.

We must then adjust this rent by subtracting, for example, actual vacancy, rental loss, bad debts, concessions, model units, employee units, etc. to finally arrive at total rental income.

A LOOK AT LOSS TO LEASE IN THE UNDERWRITING OF MULTIFAMILY PROPERTIES

In this first post in the series the road to a stabilized NOI, I want to talk to you about this widely used concept in multifamily property underwriting, known as the loss to lease.

In fact, in the Real Estate Financial Modeling Accelerator Q&A, we have covered this topic extensively. Simply put, when an Accelerator member is interested in learning more about a given topic, just ask through the Accelerator Q&A forum.

The “Q&A” is a fascinating, and learning area of the A.CRE Financial Modeling Accelerator, where participants send us their questions related to the academic and professional training offered by this program.

First, the loss to lease is the difference between the actual rent and the market rent of the occupied units, i.e., it reflects the difference between contractual and actual market rental rates.

In this sense, the loss to lease simply takes into account the lost rent of the occupied units, in other words, what should be earned if all occupied units were rented at the market price.

SO, WHAT IS THE REASON FOR CONSIDERING THE LOSS TO LEASE?

The reason for considering “Loss to Lease” is to capture the mismatch between contract rent and market rent, in this sense, loss to lease helps the real estate professional to anticipate the changes that will occur in the actual rent in the future.

So, if you are looking at acquiring a multifamily property with a contract signed 6 months ago, it is likely that the property will be below market rate today, of course, if the market rent is increasing.

In addition, we must keep in mind that rent increases will not occur instantaneously, but rather the lease will expire at a certain point in time over time.

However, there is also the possibility that you may have an above-market rate if the market rent is declining. In this case, instead of there being a loss to lease there is actually a lease gain.

I recommend you consult the Bite-Sized Real CRE Lessons – A.CRE 30 Second Video Tutorials and our Glossary of Terms, to clarify any doubts regarding a certain term.

CASE STUDY

Imagine that you are part of an investment team, and you are analyzing the possibility of acquiring a multifamily building of 200 units, all with an area of 572 SF, in this case, there are 150 units occupied and leased at an average value of $1000/unit.

Now, if the tenants of those 150 units were to leave today and you were able to lease those units at an average market rate of $1100/unit, ultimately the loss to lease would be equal to:

Market rent – Contract rent = $1100/unit – $1000/unit = $100/unit

Loss to Lease = $100/unit x 150 units = $15000/month (180,000/year)

In this case, the market rent is the potential gross rent at the time of the valuation, however, there are units that are currently rented below the market rate, thus, representing a loss of market rent on existing leases.

At first glance, as an investor, you might think of a rising rent, but remember that you can’t buy the property and raise all the rents to market rate on day one. Therefore, you will have to do it step by step as the leases come up for renewal, there is a loss to lease to consider!

MEANING OF THE VALUE OF THE LOSS TO LEASE

Whenever we are reviewing a proforma, we must interpret the value of a loss to lease. First of all, the loss to lease depends on the length of the lease, in other words, the longer the length of the lease, the further away from the market rent.

Similarly, the value represents the landlord’s ability to achieve renewals at market rates. Think about this, when an existing tenant agrees to renew at the end of their lease term, the landlord must have the ability to sign that renewal at a rental rate equal to the market rate.

However, you will often find that landlords will simply increase the rent by a reasonable percentage that may or may not reflect the actual change in market rent during that period. That happens in markets where the market rent is growing by a fairly high percentage (more than 10% in a year), and consequently, the landlord does not want to pass all of that burden on to existing tenants.

Finally, this value will also give you a picture of how well-managed and marketable a given property is, not in vain, poorly managed properties are far from market rent.

A very high loss to lease value could be synonymous with a long standard lease term and poorly managed properties.

In this sense, companies and professionals in the real estate sector must have a clear vision of this value, which will allow them to make a fair comparison with the hypothesis of the broker or real estate agent who built the proforma. However, this vision must have a scientific basis (statistical data), represented by own data, purchased data, or data that is free in the market.

It is important to note that, at the asset management level, loss to lease is generally reported on a monthly basis.

FINAL NOTES

I would like to close this post by reflecting on this example:

Assume that the market capitalization rate of a given property is 5%, and there are also 2 scenarios in which loss to lease causes the stabilized NOI to vary by $30,000, for example:

Stabilized NOI of Scenario 1 = $3,000,000

Stabilized NOI of Scenario 2 = $3,030,000

By applying the direct capitalization method to calculate the value of the property, we obtain:

Direct Capitalization Method = Stabilized NOI ÷ Market Capitalization Rate

Property value in Scenario 1 = $3,000,000 ÷ 5% = $60,000,000

Property value in Scenario 2 = $3,030,000 ÷ 5% = $60,600,000

As you can see, the variation caused the value of the property to change by $600,000! This illustrates the sensitivity of property value to changes caused by the loss to lease in the stabilized NOI.

In this sense, the decisions you make as a real estate professional with respect to the underwriting of each of the items that make up a pro forma, such as loss to lease, will determine the accurate calculation of a stabilized NOI.

The valuation that results from the pro forma net operating income calculation will only be as good as the decisions you made in modeling each of the items that make up such a pro forma!

Frequently Asked Questions about Loss to Lease in Multifamily Property Underwriting

What is a pro forma NOI in multifamily underwriting?

A pro forma NOI (Net Operating Income) refers to the stabilized projection of NOI, incorporating all revenues and expenses directly related to operating the property. It includes assumptions about occupancy, rent, expenses, and their persistence over time.

What does “Loss to Lease” mean in a multifamily context?

Loss to Lease is the difference between the market rent and the actual (contract) rent of the currently occupied units. It reflects the lost rental income due to units being leased below current market rates.

Why is Loss to Lease important in underwriting?

Loss to Lease captures the mismatch between current contract rents and market rents. It helps professionals anticipate future rent adjustments and assess how much rental income could improve upon lease renewals at market rates.

How is Loss to Lease calculated?

Loss to Lease = (Market Rent – Contract Rent) × Number of Occupied Units.

For example, if 150 units are rented at $1,000 but the market rent is $1,100, then Loss to Lease = ($1,100 – $1,000) × 150 = $15,000/month.

Can Loss to Lease be a positive number?

Yes. When the market rent is higher than the contract rent, Loss to Lease is positive, indicating a potential income opportunity. If the contract rent exceeds market rent, this results in a lease gain.

What does a high Loss to Lease value indicate?

A high Loss to Lease could indicate long-term leases signed below current market rates or poor property management. It highlights a gap between what the property currently earns and what it could potentially earn.

Does Loss to Lease affect property valuation?

Yes. Since Loss to Lease impacts the stabilized NOI, it can affect property valuation. A difference of $30,000 in NOI at a 5% cap rate can change the property’s value by $600,000.

How frequently is Loss to Lease reported?

At the asset management level, Loss to Lease is typically tracked and reported on a monthly basis.

Why can’t rents be raised immediately to market rate after acquisition?

Because existing leases are legally binding until expiration. Rent increases can only occur as leases renew, which may take time depending on lease terms.