American-Style Waterfall

A common method for distributing investment cash flow between two or more partners. An American-Style waterfall refers to a form of equity waterfall where the sponsor (i.e. general partner) is eligible to receive a promote (i.e. carried interest) before the limited partner has received a full return of capital and earned a preferred return. As such, distributable cash flow during operations and distributable cash flow at a capital event are treated differently.

While referred to as American-style, this form of real estate partnership waterfall is common worldwide including in Europe. It is often preferred by general partners as it front loads distributions to the general partner.

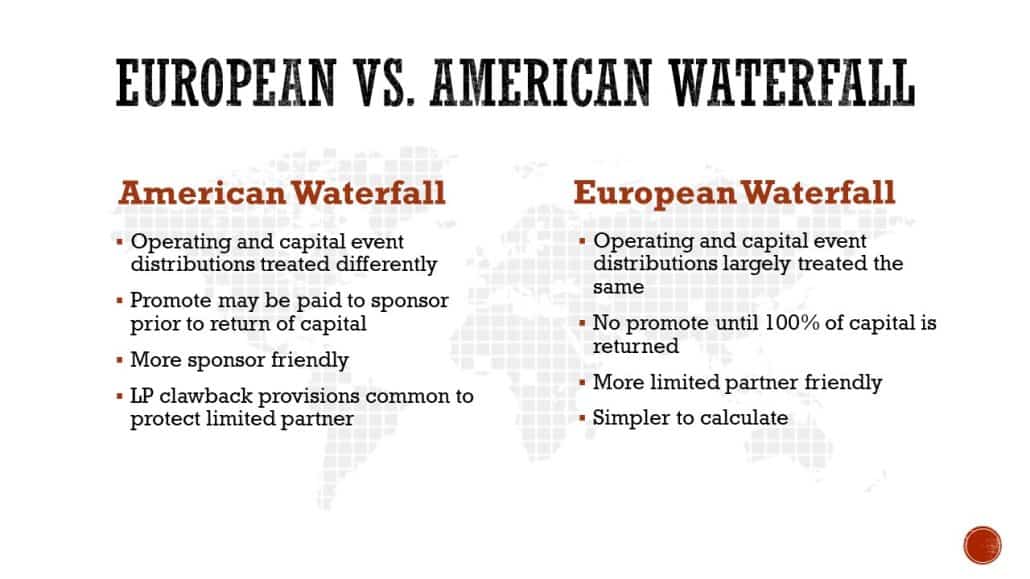

An American-Style Equity Waterfall compared to a European-Style Equity Waterfall

Putting ‘American-Style Waterfall’ in Context

Hypothetical Scenario: Peachtree Logistics Hub Development

Overview:

Pinecrest Development, a real estate developer based in Atlanta, Georgia, is embarking on an opportunistic development project to build a state-of-the-art industrial fulfillment center named Peachtree Logistics Hub. This project will cater to the increasing demand for e-commerce distribution facilities in the region.

Project Details:

- Location: Atlanta, Georgia

- Property Type: Industrial – Fulfillment Center

- Project Size: 500,000 square feet

- Estimated Development Cost: $50 million

- Estimated Completion Time: 18 months

- Projected Stabilized Net Operating Income (NOI): $4 million per year

Capital Structure:

- Total Equity Required: $20 million

- Debt Financing: $30 million (60% Loan-to-Cost ratio)

- Equity Partners:

- General Partner (GP) – Pinecrest Development: Contributing $2 million (10% of total equity) and receives a 20% promote above an 8% return to the LP. GP also receives a 4% development fee and 100bps on equity asset management fee.

- Limited Partners (LPs): Contributing $18 million (90% of total equity).

American-Style Waterfall Distribution Structure:

During Operations:

- Preferred Return to LPs: 8% Cash-on-Cash Preferred ReturnLPs receive an 8% cash-on-cash preferred return on their invested capital from the distributable cash flow during operations before any distributions to the GP.

- Remaining Distributions:Any remaining distributable cash flow is shared between the LPs and GP based on their contribution percentages. GP receives a promote of 20% of the remaining cash flow and their pro-rata share (10% of the remaining 80% cash flow), totaling 28%. LPs receive 72%.

At Capital Event:

- Preferred Return to LPs: 8% IRRLPs receive an 8% Internal Rate of Return (IRR) on their invested capital at the time of a capital event (e.g., sale or refinancing) before any distributions to the GP.

- Return of Capital:After the preferred return, LPs receive a return of their initial capital contribution.

- Remaining Distributions:Any remaining profits are shared between the LPs and GP based on their contribution percentages. GP receives a promote of 20% of the remaining profit and their pro-rata share (10% of the remaining 80% profit), totaling 28%. LPs receive 72%.

Click here to get this CRE Glossary in an eBook (PDF) format.