The Road To A Stabilized NOI – Vacancy And Credit Loss In Real Estate Underwriting

Considering the potential vacancy loss as well as tenant default on an income-producing real estate property represents another key underwriting decision that real estate professionals must make when transitioning to a pro forma (Stabilized) NOI.

Note from Arturo: This is the second post of The Road to a Stabilized NOI. This series of content intends to show the road that real estate professionals must follow to reach a Stabilized NOI, in this sense, beyond the calculations, the objective is to reflect what is behind the decisions that must be taken concerning the subscription of each one of the items that make up the proforma of a real estate property.

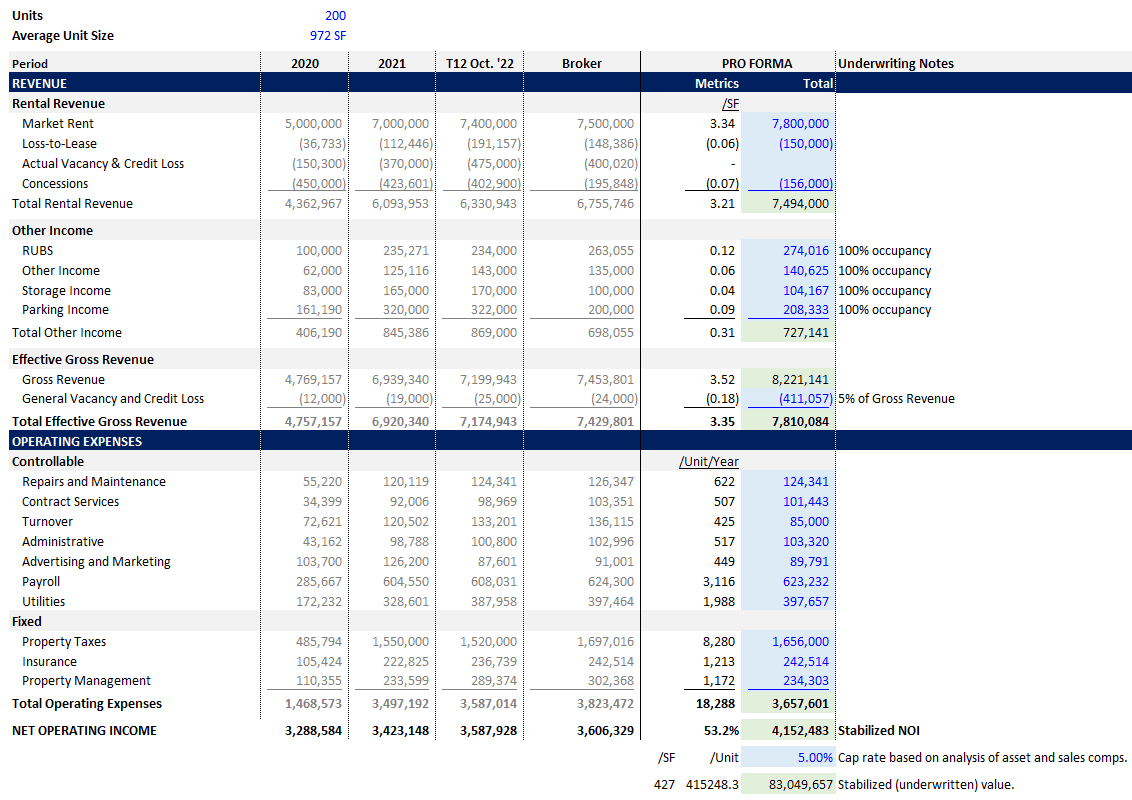

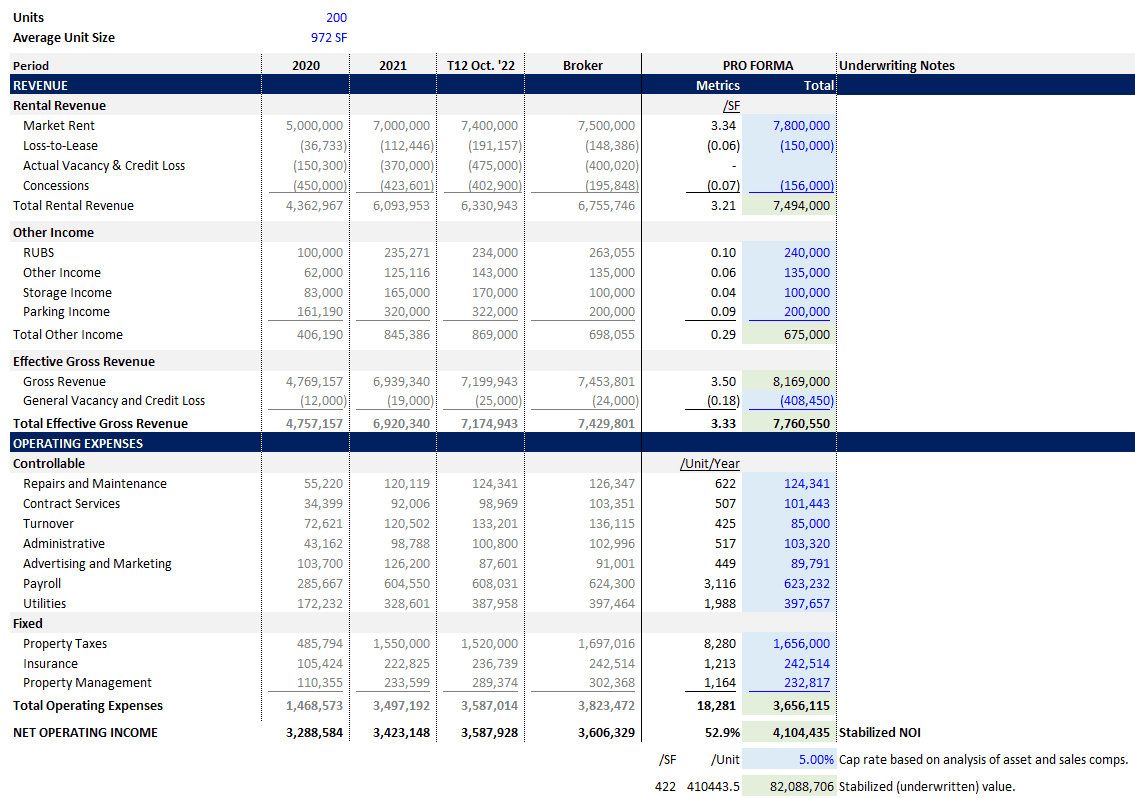

In the following pro forma template, you can see the “Actual Vacancy and Credit Loss” and “General Vacancy and Credit Loss” items, which represent adjustments to the “Rental Income” and “Other Income” that you are likely to encounter when constructing or reviewing the proforma for a given property.

Multifamily pro forma

But what exactly is actual vacancy and credit loss?

Actual vacancy may reflect what occurred based on the property’s historical income statements or what is expected to occur in a defined manner, for example, in the case of long-term leases where the expiration of the lease is known, probable vacancy is also known. Credit loss, on the other hand, takes into account the losses generated when a tenant does not pay the rent.

In this sense, both losses affect the income or profit generated by the rental of the property, as you can see in the proforma.

How do you underwrite it?

Since the actual rent is a moving target, and our starting point in the proforma is the total potential rent, i.e., the market rent, the adjustment representing actual vacancy is based on the price for which we could rent those vacant units, yes, I mean the market rent of those units today.

Actual Vacancy = Market Rent x Vacant Units

This means that it is generally a historical item and not a value containing a projection, so it serves as the basis for defining the “General Vacancy and Credit Loss” hypothesis or assumption used in the forward projections.

A Look At Actual Vacancy And Credit Loss In Long-Term Leases (Retail, Industrial, And Office Properties)

Retail, industrial, and office properties are synonymous with long-term contracts, which means that the expiration date of the contract is known, and with it the likely vacancy.

In this case, we could consider the vacancy in the “Actual Vacancy and Credit Loss” item of the pro forma, as well as in the Other Income items, i.e., without considering 100% occupancy. It is also possible that in these cases the proforma will separately account for actual vacancy as well as actual credit loss.

Finally, the “General Vacancy and Credit Loss” item would represent a kind of contingency to account for unforeseen losses in future periods (forecast).

So, what does general vacancy and credit loss represent?

First, general vacancy is a market-driven assumption, in this sense, we could say that this assumption looks at market forces and then assumes that a percentage will remain unrented, in other words, it takes into account the possible vacancy loss due to market conditions, as well as the expected credit loss due to tenant default.

How to apply the general vacancy and credit loss factor?

I begin by saying that in the Real Estate Financial Modeling Accelerator Q&A, we have covered this topic extensively. Simply put, when an Accelerator member is interested in learning more about a given topic, just ask through the Accelerator Q&A forum.

In this regard, there are a couple of ways to apply the general vacancy and credit loss factor, which are discussed in the A.CRE Financial Model Accelerator, the first is by considering a general vacancy factor as a percentage of total rental revenue, and the second, as a percentage of gross revenue.

General Vacancy And Credit Loss Factor As A Percentage Of Gross Revenue

A quite logical structure in the application of the factor could be represented by the transfer of all the “Actual Vacancy and Credit Loss” to the “General Vacancy and Credit Loss” line item of the proforma.

This means that, instead of considering the “Actual Vacancy and Credit Loss” in the “Rental Income” section, we are considering a “General Vacancy and Credit Loss” oriented to adjust the “Gross Revenue” (Total Rental Revenue + Other Income).

So, even though the “Actual Vacancy and Credit Loss” would equal zero, all revenues will be adjusted based on a fair overall vacancy factor in the market, as shown in the proforma above.

Case Study Of The Application Of The General Vacancy And Credit Loss Factor In Underwriting Properties With Short-Term Lease (Multifamily Properties)

Imagine that as a real estate professional, you are building a pro forma to “market” a multifamily property of 200 units, each with 972 SF, and that has a current occupancy of 96%, in this case, the action of marketing is key, since it will determine the reasons for presenting a higher NOI.

Multifamily properties are synonymous with short-term leases, so a vacancy is less likely to be known, in this sense, a logical way to consider general vacancy and credit loss would be to use the general vacancy factor.

I recommend you consult the Bite-Sized Real CRE Lessons – A.CRE 30 Second Video Tutorials and our Glossary of Terms, to clarify any doubts regarding a certain term.

So, using the following multifamily proforma example, let’s calculate or gross up the other income reflected by the Broker (Agent) assuming the property is 100% leased, in other words, let’s divide the other income by the 96% occupancy.

Now, it is time to adjust that income, using a market rate factor or expectation that reflects how full the property will be and how likely it is that the tenants will pay the rent, using the item “General Vacancy and Credit Loss”.

In this case, I will use a factor of 5%, i.e., we are anticipating that market forces will determine that, of the 200 units, 10 will be vacant for the entire year, thus reducing each of the sub-items housed in “Total Rental Revenue” and “Total Other Income”.

That means we could consider all items above Gross Revenue to be based on 100% occupancy, so the “General Vacancy and Credit Loss” item would account for actual vacancy, unplanned vacancy, as well as credit loss.

In other words, the item would be calculated as follows:

= (General Vacancy and Credit Loss Factor) x (Total Rental Revenue + Total Other Income)

In the following picture you can see the pro forma of the described case study:

But how is the general vacancy and credit loss percentage obtained?

That’s a great question! First, the general vacancy and credit loss are based on the context, the real estate company, and the objective of our analysis.

In this sense, the scientific basis for such a percentage (as, for example, the 5% used above) is based on the historical vacancy and credit loss in the entire market for the type of property analyzed.

The investigation of submarket vacancy, as well as vacancy in comparable properties, and, finally, the checking of historical vacancy and credit loss on the property itself (Rent Roll and Actual Historical), also influence the value of that percentage.

General vacancy and credit loss of 5%?

Visualizing the scenario of the previous case study, let’s assume that the average occupancy rate in this multifamily property has averaged 96% for the last 8 years.

The submarket research reveals that in the last 15 years, the vacancy rate is 6%, and the current submarket vacancy rate is 5.5%. Finally, the forecast for the submarket rate is 6.5% in the next 5 years.

So, as a real estate professional, you should underwrite an appropriate general vacancy rate. Okay, now that we know the scenario, let’s analyze why I selected 5% above.

Certainly, the general vacancy and credit loss rate of the submarket has been 6% for the last 15 years, but it is also true that the property under analysis has performed better than the submarket for the last 8 years (4% vacancy) and will probably continue to do so in the coming years.

In this sense, a factor of 5% is a reasonable value of “General Vacancy and Credit Loss”!

General Vacancy And Credit Loss As A Percentage Of Total Rental Revenue

It is also very common for “General Vacancy and Credit Loss” to be applied as a percentage of “Total Rental Revenue”.

The reason is that in these cases, vacancy is already included in the “Other Income” items, so adjusting “Gross Revenue” with a vacancy factor would effectively double discount “Other Income”.

Think of those cases where “Other Income” is not correlated with occupancy. For example, in densely populated cities where parking is scarce, parking income is often not correlated with occupancy.

In other words, there may be a very high percentage of occupied parking lots, but that does not mean that the occupancy is also very high, indeed, there may be a very low percentage of occupancy of the property. Therefore, applying a “General Vacancy and Credit Loss” factor to “Gross Revenue” would not be appropriate in this case.

General Vacancy and Credit Loss would be calculated as follows:

= (General Vacancy and Credit Loss Factor) x (Total Rental Revenue)

Final Notes

There are different ways to account for vacancy and credit loss in the real estate industry, however, whenever you read or hear the phrase actual vacancy you might ask yourself; how much income has been lost on those vacant units? So, the actual vacancy is a historical value that is reported by the accounting area and is based on the actual performance of the property. On the other hand, “General Vacancy and Credit Loss” you could simply associate with cuts or adjustments to either “Gross Revenue” or “Total Rental Income”.

While it is true that the more valuable data you have at your fingertips and, of course, the better the assumptions or inputs you use as a real estate professional on the road to a stabilized NOI, we must also add that this value also depends on the motives of the analysis, in other words, a seller will be more aggressive looking for a higher NOI, but on the other hand, a buyer will be more conservative looking for a lower NOI.

The understanding of each of the items that make up a proforma, as well as the proper handling of the data provided by the context in which the property is located, will determine the decisions you make regarding vacancy and credit loss in search of a stabilized NOI!

Frequently Asked Questions about Underwriting Vacancy and Credit Loss to Reach a Stabilized NOI

What is actual vacancy and credit loss?

Actual vacancy reflects income lost from currently vacant units based on market rent, while credit loss accounts for unpaid rent due to tenant defaults. These are historical or expected near-term losses reflected in the pro forma.

How do you calculate actual vacancy?

Actual Vacancy = Market Rent x Vacant Units. This calculation uses today’s market rent to estimate income loss due to current vacancies.

What is general vacancy and credit loss?

General vacancy and credit loss is a market-driven forecast representing anticipated future vacancy and tenant default. It’s used to adjust forward-looking revenue projections and reflects assumptions based on market and historical data.

How is general vacancy and credit loss applied in a pro forma?

It can be applied as a percentage of either gross revenue or total rental revenue, depending on whether “Other Income” is occupancy-dependent. The formula is:

= General Vacancy and Credit Loss % × (Total Rental Revenue + Other Income) or

= General Vacancy and Credit Loss % × Total Rental Revenue

How do you determine an appropriate general vacancy rate?

You should analyze the subject property’s historical vacancy, submarket trends, and comparable assets. For instance, if a property has historically outperformed the submarket, you might underwrite a lower general vacancy rate.

Why might actual vacancy be zero but a general vacancy adjustment still applied?

Even if current occupancy is 100%, a general vacancy adjustment is used to account for future unplanned vacancies and defaults, ensuring the revenue forecast isn’t overly optimistic.

When should general vacancy be applied only to rental revenue (not gross revenue)?

When other income (e.g., parking) is not correlated with occupancy, applying the vacancy factor only to rental income avoids double-counting the loss.

How do short-term vs. long-term leases impact vacancy underwriting?

Short-term leases (e.g., multifamily) involve less predictable vacancy, so general vacancy assumptions are more commonly used. Long-term leases (e.g., retail, office) allow you to model known expirations and anticipated vacancies in detail.

Why do buyers and sellers underwrite vacancy differently?

Sellers often minimize vacancy assumptions to present higher NOI. Buyers tend to be more conservative, using higher general vacancy factors to protect against downside risk.