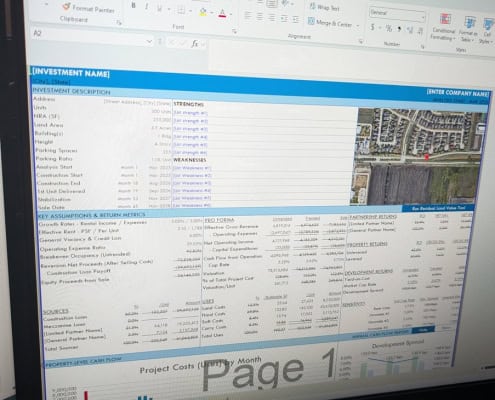

Real Estate Financial Modeling Accelerator (Updated January 2026)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Welcome to Season 6: The CRE Era of AI | S6E1

In this opening episode of Season 6, the Adventures in CRE team—Sam Carlson, Spencer Burton, and Michael Belasco—returns with a powerful message: the age of AI in commercial real estate has arrived. Kicking things off with energy and insight,…

Land Development Model – Multi-Scenario (Updated Aug 2025)

Over the years, we've shared eight development-focused real estate financial models and numerous development-specific tools to the A.CRE Library of Excel Models. Nevertheless, there's been a hole in the development offerings in our library.…

Cómo Calculan los Prestamistas el Interés de los Préstamos en los Bienes Raíces Comerciales (Actualizado Agosto 2025)

En esta primera entrega de nuestra serie sobre préstamos hipotecarios para bienes raíces comerciales, exploramos cómo los prestamistas realizan el cálculo de intereses hipotecarios que aplican a los préstamos en este sector. Además, haremos…

Understanding Stabilization Through The Lens Of Operating Expense Ratio

The term “stabilized” is deeply embedded in the language of real estate. It shows up frequently in financial models, offering memoranda, development strategies, and underwriting assumptions. So frequently, in fact, that its meaning is often…

A.CRE Build-to-Rent (BTR) Development Model (Updated Aug 2025)

Build-to-rent (BTR) has become more and more common in CRE and now accounts for a meaningful share of development. In the past, we've recommended A.CRE readers use our Apartment Development Model for BTR analysis. However, as we've received…

Excel’s Stale Value Formatting: What It Means and Why It Matters (Updated Aug 2025)

We recently received an email from an A.CRE reader using one of our real estate financial models with a curious question. He explained that many of the cells in his model suddenly had a strikethrough applied to the text. Naturally, he wondered…