AI Is Closing the Gap on Complex Work Faster Than You Think

If you work in acquisitions, asset management, brokerage, development, portfolio management, or valuation, you probably feel the tension already.

On one hand, today’s AI tools for real estate can draft emails, summarize leases, and pull market stats with ease. On the other hand, you would not trust them to run a full underwriting, manage a closing checklist, or coordinate a refinance from start to finish.

New research from METR (Model Evaluation & Threat Research) helps explain this paradox, and the findings should be a wake‑up call for anyone doing real estate work in 2026.

This is not a “sometime in the 2030s” story. If the trends METR measured continue, we are talking about a 2-to-4-year window before AI can reliably complete the kind of week‑long, multi‑step tasks that take up much of our time.

In other words, the technology is accelerating. For most CRE professionals, the use of it is not. That gap is the risk, and the opportunity.

- We’re hosting a free workshop on 1/15/2026 to help you get ahead of this curve: ‘Wake up to 2026 AI: The Workshop to Finally 2x Your Output’

What METR Actually Measured

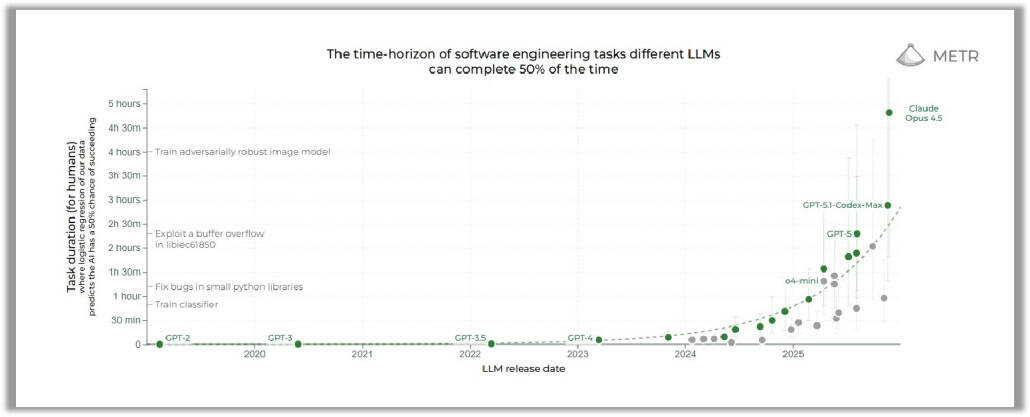

METR did something deceptively simple. Instead of asking “how smart is AI?” they asked:

For tasks that take real professionals a known amount of time, how long can tasks be before AI starts to fail?

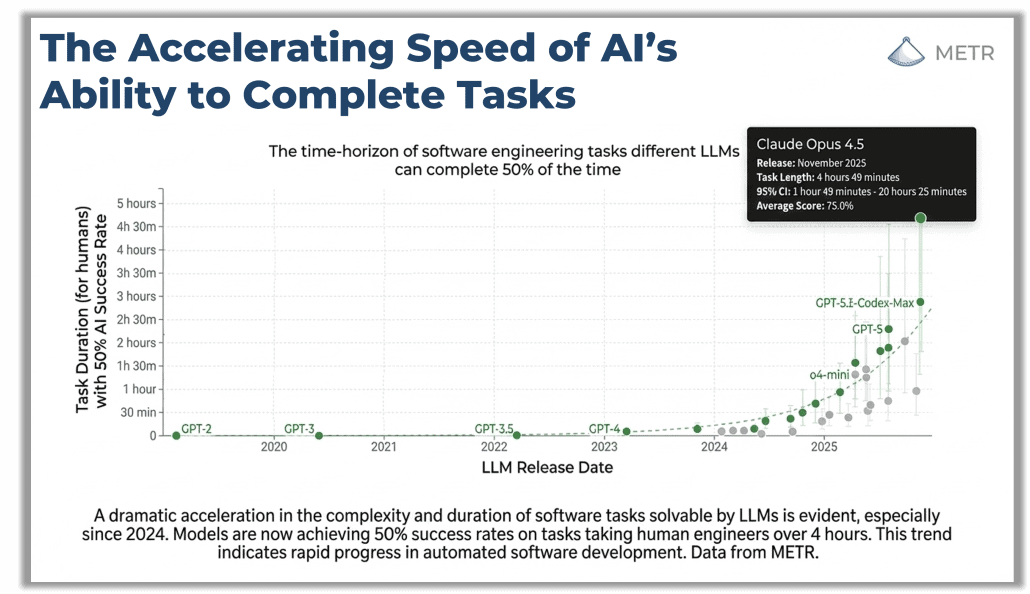

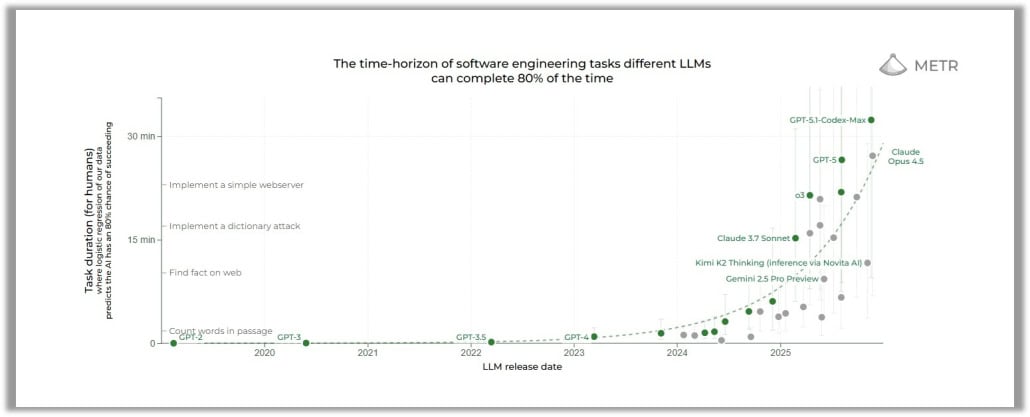

A few key results from their study of frontier models like GPT-5.1 Codex-Max and Claude Opus 4.5:

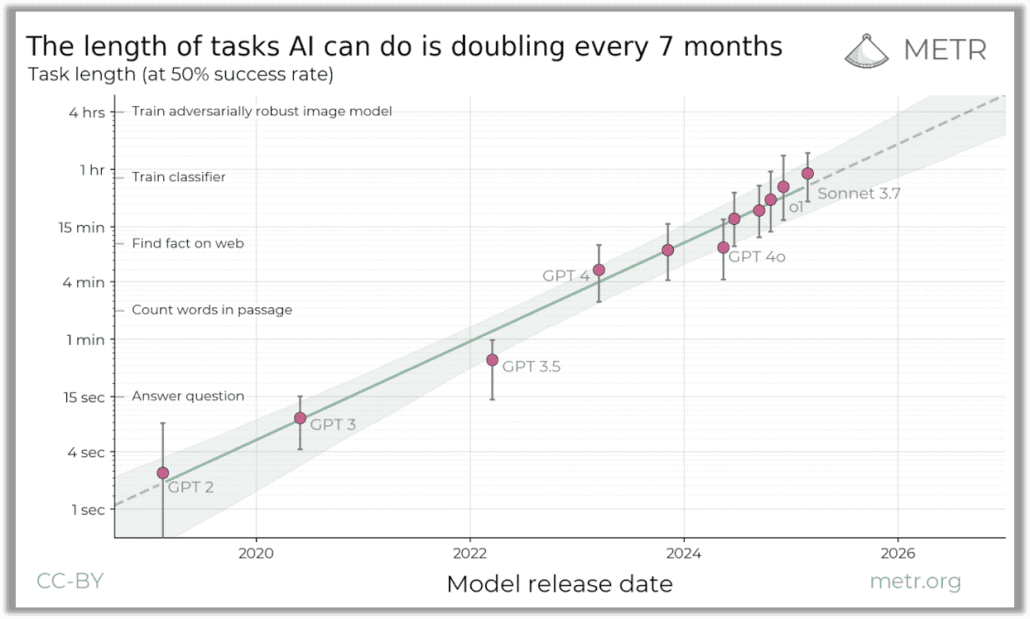

- The length of tasks AI can complete (measured in human work time) has been doubling about every 7 months for the last 6 years.

- These top models (as of late 2025):

- Are nearly 100% reliable on tasks that take humans less than 5 minutes.

- Are nearly 80% reliable on tasks that take humans ~30 minutes.

- Are nearly 50% reliable on tasks that take humans ~3-5 hours

In other words, today’s frontier models are solid on shorter timeframe work, and very shaky when you ask them to run long, messy, multi‑step projects.

The Timeline for AI Handling Complex Deal Work Is Shorter Than You Think

METR fit this data over time and found a steep, consistent curve. The “maximum task length” AI can tackle at around 50% reliability has been doubling roughly every 7 months, and in some datasets even faster.

Project that forward a few doublings:

- Today: Reliable on minutes of work.

- In a year: reliable on hours of work.

- In 2 to 4 years: Reliable on week‑long projects.

- By the end of the decade, if trends continue: Month‑long projects become feasible.

Translate that into your world:

- Full property underwriting from raw inputs

- Pulling rent rolls, T‑12s, OM data, tax records.

- Normalizing, checking consistency, building cash flow.

- Running scenarios and producing lender and IC packages.

- Portfolio‑wide lease abstract extraction

- Ingesting thousands of leases, amendments, and estoppels.

- Producing a clean, queryable database with edge cases flagged.

- Comp and market analysis with narrative output

- Pulling sales and lease comps, construction pipeline, macro trends.

- Producing a coherent, IC‑ready narrative with charts and support.

These are week‑long tasks for many teams today. METR’s work suggests we should expect capable, generalist agents to handle this tier of work with reasonable reliability somewhere in the 2027–2028 range if trends hold.

If you wait to start using AI on the minutes and hours work now, you will be the individual or firm still learning how to work with an AI coworker when week‑long and month‑long capable agents are already in production at your competitors.

The “Reliability Gap” Explains Your Current Frustration

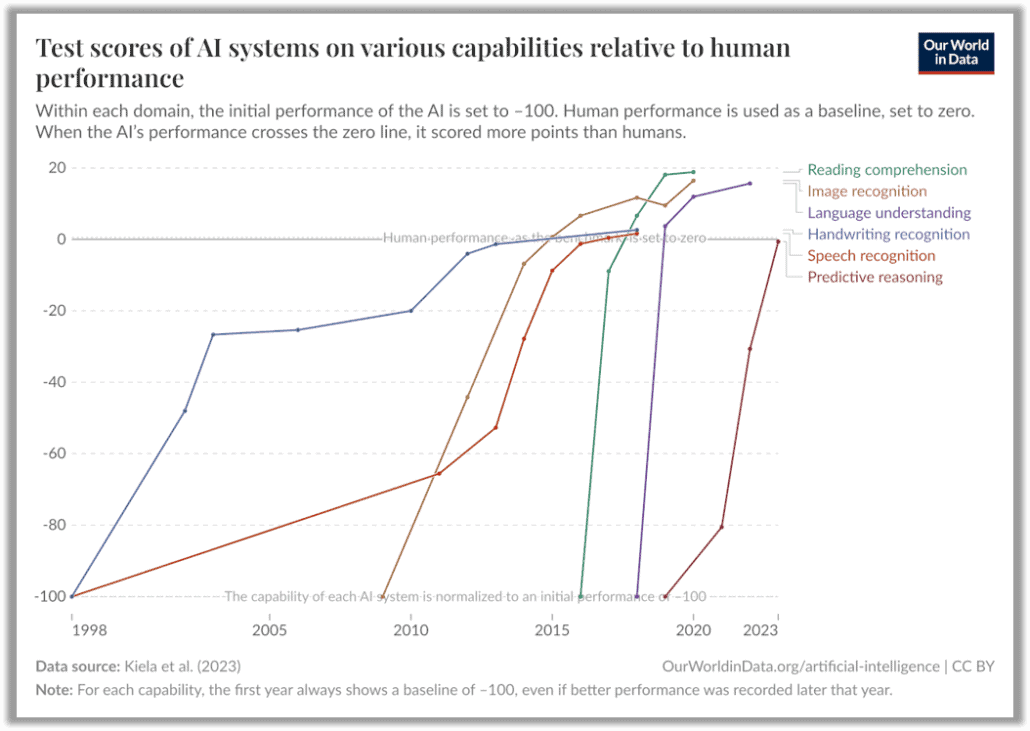

METR’s study also explains why AI feels both impressive and disappointing at the same time.

Their results show that AI systems:

- Are “vastly better than humans at text prediction and knowledge tasks.”

- Outperform experts on most exam‑style problems at a fraction of the cost.

Yet:

- They are not able to carry out substantive projects by themselves.

- They cannot reliably handle even low‑skill, computer‑based work such as remote executive assistance.

The key insight is this:

AI struggles more with stringing together long sequences of actions than with any individual step.

That lines up with what CRE professionals are experiencing:

- Broker creating an OM. Each step is easy for AI: summarizing a lease, formatting a table, writing a paragraph. The problem is managing 50 to 100 steps without dropping the thread.

- Asset manager building a monthly report. The model can analyze a T‑12 or draft commentary. It struggles to pull all the right data, in the right order, apply the right business rules, and deliver a final package without human orchestration.

- Developer coordinating entitlements. AI can draft letters, summarize meeting minutes, and track dates. It is much weaker at managing the entire sequence over months.

METR’s data says this is a task length and orchestration problem, not a raw intelligence problem. That is very good news for you in 2026, because it suggests a practical design pattern:

- Break long workflows into short, autonomous chunks that fit within the models’ reliable time window.

- Use humans, software, and checklists to handle handoffs between chunks.

- Gradually automate more of the orchestration as reliability improves.

If you feel like AI fails you on multi‑hour workflows, it is not just you. You are hitting the limits METR measured.

Competitive Advantage Goes to Those Who Build the Infrastructure Now

Here is where the risk and the opportunity come together.

If AI agents can handle week‑long projects by 2028, the firms that will benefit first are the ones that:

- Already capture their workflows in repeatable steps.

- Already experiment with chunked, AI‑assisted processes.

- Already have data pipelines and quality checks in place.

Meanwhile, firms that wait for “finished” AI products will find that:

- Their competitors can underwrite more deals with the same headcount.

- Brokerage teams can cover more clients and produce better materials faster.

- Asset managers and portfolio managers can respond more quickly to lender, JV, and LP needs.

CRE is historically slow to adopt technology. That has been a cushion in past cycles. With the curve METR highlights, a slow posture becomes a liability.

There is also real operational and systemic risk if you sleep on this:

- You risk over‑trusting immature tools once they become fashionable, without having internal expertise or guardrails.

- You risk being locked into vendors who understand your workflows better than you do.

- At the industry level, there are broader questions about job design, oversight, concentration of models, and failure modes that only get harder to manage if the whole sector waits.

METR is careful to note that any forecast has uncertainty, and there are reasons to think recent data is more predictive than older data. Even if their absolute measurements are off by a factor of ten, the arrival times only move by about two years because the slope is so steep.

That is why I read their work as less of a prediction and more of a countdown clock.

How To Respond as a Real Estate Professional In 2026

You don’t need to solve “AI for everything” this year, but you do need to stop treating it as an experiment on the side.

A practical starting approach:

- Pick one revenue‑critical workflow. Underwriting a new acquisition, producing the monthly asset report, or prepping a pitch.

- Map the steps and time. List every step, note who does it, and approximate how long each step takes today.

- Circle the 5 to 15 minute tasks. These are in the sweet spot for current models: pulling data, transforming data, drafting narrative, simple QA checks.

- Prototype AI‑assisted “micro‑agents” for those tasks. Keep the longer orchestration in human hands, and measure actual time saved.

- Document failures and edge cases. This becomes your internal “playbook” and your control system as models improve.

If METR is right, the boundary of what AI can reliably own will keep moving “up” that map every few quarters. The sooner you have the map and the early automations in place, the more you benefit from that movement.

Join Me: “Wake Up To 2026 AI” Workshop

To help CRE professionals close this gap, I am hosting a free workshop:

Wake Up to 2026 AI: The Workshop to Finally 2x Your Output

Date: January 15, 2026

Time: 12:00 PM Eastern

In this intensive session, I will walk through my AI Multiplier Framework. This is the exact methodology I used as President of a real estate private equity firm to scale capacity, ultimately using technology to produce the output of a 20 person team.

We will:

- Map the operational drag between you and your revenue.

- Identify 3 to 5 high leverage automations in your business.

- Show how to reclaim up to 20 hours per week so you can close more deals and pursue larger opportunities.

Use this link to registration: https://zoom.us/webinar/register/WN_xSEynFucTjONN80m2w3DZg#/registration

In 2026 you cannot afford to sit on the sideline with AI. Use the registration link that accompanies this post to join us, and start building the infrastructure your future self will depend on.

Frequently Asked Questions about AI and Complex Real Estate Work

What did METR’s study reveal about AI performance?

METR measured how long a task can be before AI starts to fail. Their research shows that AI is nearly 100% reliable on tasks under 5 minutes, ~80% reliable on 30-minute tasks, and about 50% reliable on 3–5 hour tasks. The “maximum reliable task length” has been doubling roughly every 7 months.

How soon could AI handle complex, week-long CRE workflows?

If current trends continue, AI could reliably complete week-long commercial real estate tasks in 2 to 4 years—around 2027 to 2028. METR’s curve suggests that by the end of the decade, month-long projects may also be feasible.

Why does AI feel both impressive and frustrating in real estate work?

AI is strong at individual steps (e.g., summarizing leases or writing emails) but struggles with multi-step orchestration. METR’s study confirms this is a task-length problem, not a raw intelligence issue. Long workflows break down due to failure in managing sequences, not individual actions.

What is the “reliability gap” and how does it affect CRE professionals?

The “reliability gap” is the mismatch between what AI tools can theoretically do and what they can reliably execute. In real estate, that means AI can help with parts of underwriting or reporting but fails to manage entire closings or refinancing workflows on its own. That gap is both the risk and the opportunity.

How can real estate professionals start using AI effectively in 2026?

Start by picking one revenue-critical workflow (like underwriting or reporting). Break it into steps, identify the 5–15 minute tasks, and build AI-assisted “micro-agents” for those. Let humans manage the longer orchestration, and use each cycle to document edge cases and build internal playbooks.

Why is it risky to wait for fully finished AI solutions?

Firms that wait may fall behind competitors who already capture workflows, build data pipelines, and experiment with automation. Waiting also risks vendor lock-in, over-reliance on black-box tools, and missed gains from early operational leverage. As the post warns: “A slow posture becomes a liability.”

What’s a practical design pattern for AI use today?

Break long workflows into short, autonomous chunks that fit within AI’s reliable time window. Use humans, checklists, and software to manage handoffs. Over time, automate more of the orchestration as model reliability improves.

What are examples of CRE workflows that AI will soon handle?

According to the post, examples include:

Full property underwriting from raw files to IC package

Portfolio-wide lease abstracting from thousands of leases

Market and comp analysis with narrative output

These are currently week-long tasks for many teams, and AI is projected to handle them reliably within a few years.

What is the “Wake Up to 2026 AI” workshop about?

It’s a free workshop on January 15, 2026, designed to help CRE professionals build an AI-powered workflow. The session covers mapping operational drag, identifying automations, and implementing the AI Multiplier Framework used to scale real estate teams.

Register here: Zoom Workshop Link