What to Look for in a 1031 Qualified Intermediary – A Real Estate Investor’s Checklist

With several decades of experience in commercial real estate, we’ve become adept at navigating the complexities of 1031 exchanges. Recognized as a powerful tool in the United States, 1031 exchanges allow for the compounding of lifetime real estate returns pre-tax by deferring capital gains tax from one investment property to the next. However, the effectiveness of a 1031 exchange hinges significantly on its proper execution. Failure in this regard can lead to substantial tax liabilities.

A pivotal element in these transactions is the Qualified Intermediary (QI). The QI doesn’t just facilitate; they are instrumental in ensuring that the exchange is both efficient and compliant with IRS regulations.

The challenge, however, lies in the abundance of QIs available, each with varying levels of expertise and capability. Choosing the right QI is thus not just a matter of preference but of crucial importance. The consequences of a poor choice could be dire, including significant financial repercussions. In this post, we aim to demystify the process and outline key factors (i.e. the checklist) to consider when selecting a 1031 Qualified Intermediary.

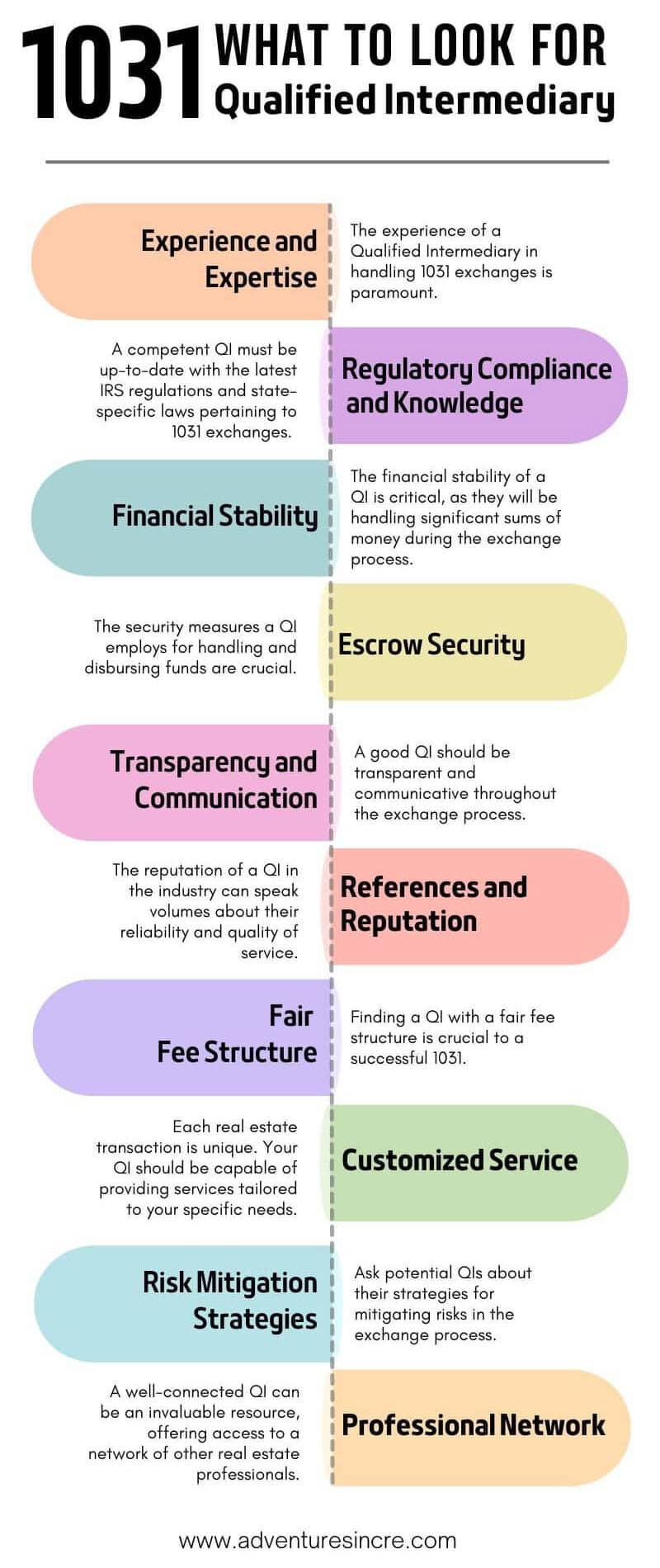

- Download our free infographic: What to Look for in a 1031 Qualified Intermediary – A Real Estate Investor’s Checklist

Important Note: This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

What is a 1031 Qualified Intermediary?

A 1031 Qualified Intermediary (QI) is a neutral third party who plays an indispensable role in facilitating 1031 exchanges, a process that involves deferring capital gains tax by exchanging investment properties. The QI holds the sale proceeds from the relinquished property and uses them to acquire the replacement property. This role is crucial in ensuring the investor does not have direct access to the funds, thereby maintaining compliance with IRS rules governing 1031 transactions.

Fee Structure of a Qualified Intermediary

The fee structure of a QI varies depending on the complexity of the transaction and the services provided. Typically, QIs charge a flat fee for standard delayed exchanges. This fee generally covers services such as preparing the exchange agreement, coordinating with the closing agent, and holding the exchange funds.

For more complex exchanges, like reverse or construction/improvement exchanges, QIs might charge higher fees due to the additional work and risk involved. It’s important to note that while comparing fees is essential, the decision should not be based solely on cost but also on the QI’s experience, reputation, and the specific needs of your exchange.

Qualifications for Becoming a 1031 Qualified Intermediary

The qualifications for becoming a 1031 QI are not heavily regulated at the federal level. Essentially, any individual or entity that is not a disqualified person, as defined by the IRS, can serve as a QI. A disqualified person is typically someone who has had a formal relationship with the investor, such as an attorney, accountant, broker, or relative, within the two-year period preceding the transaction. It’s crucial for a QI to be an independent party to ensure unbiased facilitation of the exchange.

Despite the lack of federal requirements, some states have implemented specific regulations that may include licensure, insurance standards, and guidelines for escrow account management. Given this variation in state laws, it’s essential for investors to be aware of the regulations in their respective states when selecting a QI.

In addition to these formal requirements, the best QIs often have a background in real estate or law and a thorough understanding of tax regulations related to property exchanges. This expertise enables them to navigate the complex rules surrounding 1031 exchanges and provide valuable guidance throughout the process.

A Checklist – What to Look for in a 1031 Qualified Intermediary

So, how do you select a qualified intermediary for your 1031? Here is a checklist you can use when recommending/selecting a 1031 QI:

1. Experience and Expertise

The experience of a Qualified Intermediary in handling 1031 exchanges is paramount. A seasoned QI brings a wealth of knowledge and understanding of complex tax codes and real estate regulations. You should look for someone who has a proven track record of handling various types of exchanges, especially those that align with your property/portfolio. An experienced QI can foresee potential issues and address them proactively, ensuring a smooth transaction.

Inquire about specific cases the QI has handled, especially those similar to your situation. Their ability to navigate challenging scenarios, like tight deadlines or unique property types, will be crucial in managing your exchange effectively. A QI who has successfully facilitated a diverse range of exchanges will likely have the agility and expertise to handle your transaction competently.

2. Regulatory Compliance and Knowledge

A competent QI must be up-to-date with the latest IRS regulations and state-specific laws pertaining to 1031 exchanges. Given the ever-evolving nature of tax laws, their ongoing commitment to education and staying informed is a must. Their expertise in legal and tax aspects ensures that your exchange complies with all regulatory requirements, thereby safeguarding you against legal pitfalls.

Ask potential QIs about their approach to staying current with tax laws and real estate regulations. This could include their professional development practices, memberships in relevant organizations, or attendance at industry seminars. Their ability to articulate recent changes in legislation and how these impact 1031 exchanges is a good indicator of their competency and reliability.

3. Financial Stability

The financial stability of a QI is critical, as they will be handling significant sums of money during the exchange process. A financially robust QI reduces the risk of mismanagement or insolvency, which could jeopardize your funds. Ensure that they have a strong financial track record and are transparent about their business health.

It’s equally important to confirm that the QI has adequate insurance coverage, including fidelity bonds and errors and omissions insurance. This coverage protects your assets against potential fraud, negligence, or mishandling of funds by the QI. Ask for proof of their insurance policies and verify their coverage amounts to ensure they are sufficient to cover the scale of your transaction.

4. Escrow Security

The security measures a QI employs for handling and disbursing funds are crucial. They should have robust procedures to manage escrow accounts, ensuring that your funds are protected throughout the transaction. Confirm that they use segregated accounts for each client, which is vital for protecting your assets, particularly in the event of the QI’s financial troubles.

Discuss with the QI their process for releasing funds, including any safeguards they have in place to prevent unauthorized access. A reliable QI should have clear, stringent protocols for fund disbursement, requiring multiple levels of verification before any transaction is completed. This adds an additional layer of security to your exchange.

5. Transparency and Communication

A good QI should be transparent and communicative throughout the exchange process. They should provide clear, regular updates and be readily available to answer any questions or concerns you may have. This level of communication is key to building trust and ensuring that you are informed at every step of the exchange.

Evaluate their communication style during your initial interactions. Are they prompt in their responses? Do they provide detailed and clear information? The ability to communicate complex concepts in an understandable manner is crucial, especially in a process as intricate as a 1031 exchange.

6. References and Reputation

The reputation of a QI in the industry can speak volumes about their reliability and quality of service. Seek references from other investors or industry professionals who have worked with them. A reputable QI will have a history of successful exchanges and positive client feedback.

Don’t hesitate to ask for testimonials or case studies. Also, consider conducting independent research, such as asking for references and following up with those references. The feedback from past clients can provide valuable insights into the QI’s professionalism and efficiency.

7. Fair Fee Structure

Finding a QI with a fair fee structure is crucial to a successful 1031. Ensure that their fees are transparent and commensurate with the services they provide. Some QIs might charge a flat fee, while others might have variable fees based on the complexity of the exchange.

Discuss in detail what services are included in their fee. Be wary of hidden costs or additional charges that may arise during the process. A reputable QI will be upfront about their fees and provide a clear breakdown of charges.

In terms of what to expect. Here is an example of a reasonable flat-fee structure for a 1031 QI with typical services offered:

- Standard Exchange (Sell your existing property first, buy a replacement property second): $1,200.

- Tax optimization consulting

- Audit protection

- Attorney guarantee

- Reverse Exchange (Buy a replacement property first, sell your existing property second): $6,000.

- Exchange accommodation titleholder creation

- Tax optimization consulting

- Audit protection

- Attorney guarantee

- Improvement Exchange (Improve or develop your replacement property with exchange equity): $7,000.

- Exchange accommodation titleholder creation

- Tax optimization consulting

- Audit protection

- Attorney guarantee

A reputable QI earns their fee at closing and offers a refund for any upfront payments if the exchange doesn’t proceed for any reason. They should also commit to a ‘no hidden fees’ policy, ensuring that you won’t face unexpected charges at closing related to the 1031 exchange.

8. Customized Service

Each real estate transaction is unique, and your QI should be capable of providing personalized services tailored to your specific needs. This is particularly critical in complex or high-value exchanges where a one-size-fits-all approach falls short. My primary issue with larger QIs is their tendency to offer generic solutions that may not suit every transaction or, conversely, their services might be prohibitively expensive.

When selecting a QI, it’s essential to discuss how they would manage specific scenarios or challenges unique to your exchange. Can they provide innovative solutions for atypical situations, or do they revert to a standard protocol that might not be the best fit? A QI’s ability to offer customized strategies and adapt to the particularities of your transaction is a strong indicator of their expertise and dedication to client-focused service. This flexibility and attentiveness are what set apart a competent QI, especially in a market crowded with providers who might lack the agility to cater to specialized demands.

9. Risk Mitigation Strategies

Ask potential QIs about their strategies for mitigating risks in the exchange process. This includes how they handle contingencies such as delays in closing or issues with property identification. A skilled QI will have established procedures to manage risks effectively, ensuring that your exchange is not jeopardized.

Their ability to anticipate potential problems and implement preemptive measures is critical. This proactive approach not only minimizes risks but also instills confidence that your transaction is in capable hands.

10. Professional Network

A well-connected QI can be an invaluable resource, offering access to a network of other real estate professionals, such as attorneys, accountants, and brokers. These connections can be particularly beneficial in complex exchanges or in navigating specific market conditions.

Inquire about the QI’s professional affiliations and their relationships with other industry experts. A QI who is well-integrated into the real estate community can bring additional insights and opportunities to your exchange.

Conclusion – Choosing a 1031 Qualified Intermediary

In conclusion, selecting the right 1031 Qualified Intermediary is a decision that carries significant weight in the realm of commercial real estate investing. By carefully considering factors such as experience, regulatory knowledge, financial stability, and the ability to provide personalized services, investors can ensure a seamless and compliant exchange process. Remember, the right QI is not just a facilitator but a crucial partner in safeguarding and maximizing your investment.

For a quick reference to these key points, download our informative infographic: What to Look for in a 1031 Qualified Intermediary – A Real Estate Investor’s Checklist. This handy tool encapsulates the essential checklist items, helping you make a well-informed decision in your journey through 1031 exchanges.

Frequently Asked Questions about Choosing a 1031 Qualified Intermediary

What is a 1031 Qualified Intermediary (QI)?

A QI is a neutral third party who facilitates 1031 exchanges by holding proceeds from the sale of a relinquished property and using them to purchase the replacement property, thereby ensuring IRS compliance. “The QI holds the sale proceeds… and uses them to acquire the replacement property.”

Are there specific qualifications to become a QI?

There are no federal licensing requirements, but QIs must not be disqualified persons (e.g., a recent attorney, broker, or relative). Some states impose additional regulations like insurance standards. “Essentially, any individual or entity that is not a disqualified person… can serve as a QI.”

What should I prioritize when selecting a QI?

Look for experience, regulatory knowledge, financial stability, secure escrow processes, clear communication, strong reputation, fair fees, custom service, risk mitigation strategies, and a strong professional network. “Choosing the right QI… is a crucial partner in safeguarding and maximizing your investment.”

How are QI fees typically structured?

Most QIs charge a flat fee for standard exchanges (e.g., $1,200). More complex exchanges like reverse or improvement exchanges may cost $6,000–$7,000 due to added complexity. “A reputable QI earns their fee at closing and offers a refund… if the exchange doesn’t proceed.”

Why is financial stability important in a QI?

A financially sound QI reduces the risk of mismanagement or insolvency while holding your funds. Check for fidelity bonds and errors and omissions insurance. “Ensure that they have a strong financial track record and are transparent about their business health.”

How does a QI ensure security of escrowed funds?

Reputable QIs use segregated escrow accounts and have strict protocols requiring multiple levels of verification before releasing funds. “Confirm that they use segregated accounts… and require multiple levels of verification.”

Should I consider a QI’s communication and transparency?

Yes. A good QI should offer timely, clear communication and proactively update you throughout the process. “This level of communication is key to building trust…”

How do I verify a QI’s reputation?

Ask for references, client testimonials, and case studies. Independent research and peer feedback are also useful. “Seek references from other investors or industry professionals… A reputable QI will have a history of successful exchanges.”

Is customized service important when selecting a QI?

Yes, especially for complex or high-value exchanges. Avoid generic services that don’t fit your unique transaction needs. “A QI’s ability to offer customized strategies… is a strong indicator of their expertise.”

How can a QI help mitigate risk during an exchange?

They use contingency procedures, strong escrow practices, and proactive planning to manage issues like delays or property ID challenges. “A skilled QI will have established procedures to manage risks effectively.”