Compensation in Real Estate (United States 2023)

Several years ago, we published a careers in real estate series where we discussed the various job sectors, business fields, and job functions that exist in the real estate industry. Additionally, we broke down compensation in real estate (salary + bonus) by position and level for 2014.

Since then, each year we’ve followed up that series with a summary look at pay in various roles and working with various property types in real estate. Here’s what pay (salary plus bonus) in real estate looked like in 2023.

Master real estate financial modeling and command more pay in the marketplace. Join our Real Estate Financial Modeling Accelerator Program to land the job, get the raise, and learn to model your own deals. Join the Accelerator today.

Have a real estate job open at your firm you’d like to share with the A.CRE community? Post the job here for free.

Source of Compensation Data

Every year, real estate consulting firm CEL & Associates publishes its National Real Estate Compensation & Benefits Survey. The survey is the industry standard for pay statistics across 190 real estate positions in the United States. Nearly 400 companies participate to provide confidential compensation data for their employees working in all major real estate sectors, fields, and functions.

The survey has been conducted annually for more than 20 years and has often been done in partnership with trade organizations such as NAIOP. In 2023, CEL appears to have partnered with RCLCO. And while they initially shared the summary results of their survey – as they have done in each year since inception – unfortunately that report is no longer publicly available and thus job seekers such as yourself can no longer access it. This, of course is unfortunately, and we hope is simply an oversight on CEL’s part and not a broader decision to limit access to this report to only employers (or job seekers willing to pay thousands for the report).

Real Estate Compensation in 2023

The summary report has been condensed down to the information and positions that are most relevant to our readers. These are Analyst through Managing Director positions at industrial, office, retail, and multifamily focused real estate firms working in acquisitions, asset management, property management, and development.

The reported total pay has been calculated, or the sum of salary and bonus, as well as the percent change in total compensation from 2013 to 2022 and 2020 to 2023 for each of the positions.

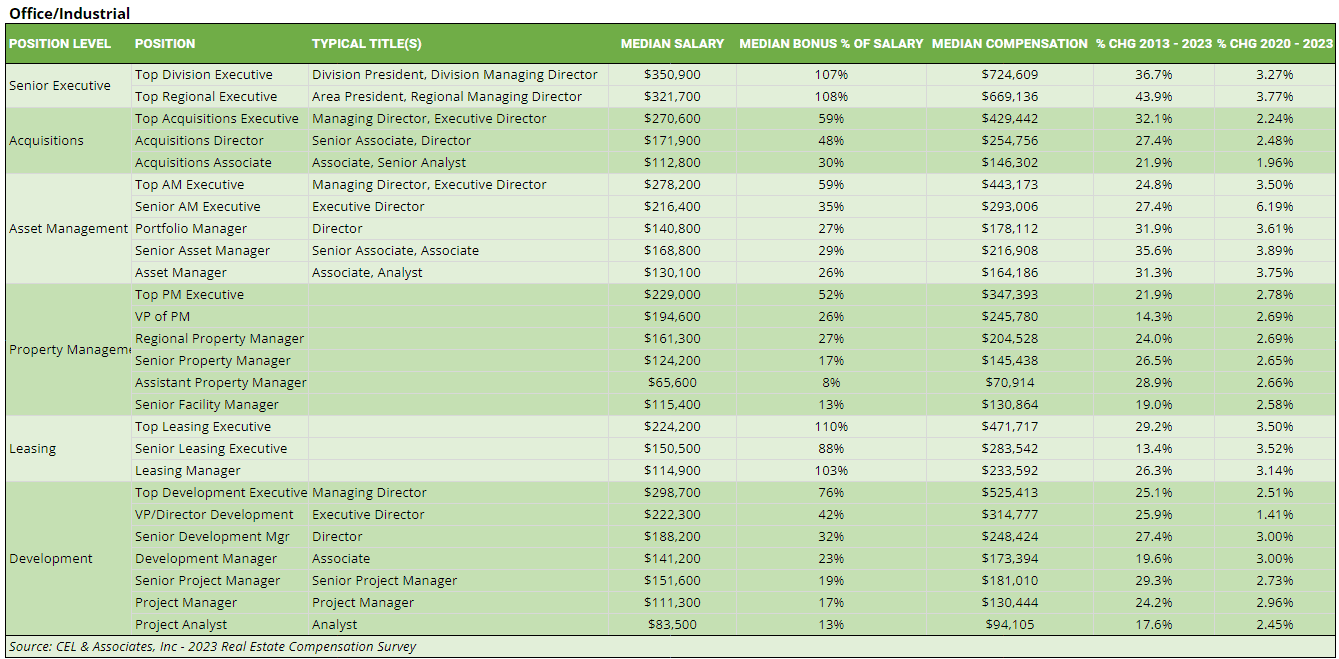

Summary of 2023 Pay (Salary plus Bonus) for Office and Industrial Real Estate Professionals

For professionals in firms focused on office and industrial properties, compensation growth from 2022 to 2023 was more stable compared to previous years. Median compensation increases ranged between 1.41% and 6.19%, with Senior Asset Management Executives seeing the highest increase at 6.19%. Median bonuses averaged around 51%, with senior roles receiving significantly higher bonuses. For example, Top Leasing Executives and Leasing Managers earned bonuses up to 110% and 103% of their salaries, respectively, while Acquisitions Associates received a median bonus of 30%, and Asset Management professionals earned bonuses ranging from 26% to 35%, depending on seniority.

Overall, Asset Management professionals experienced the most significant compensation increases, especially at the senior level. Property Management and Leasing roles saw steady, moderate growth, with senior roles in these areas reporting compensation increases of around 2.5% to 3.5%. Development roles showed the smallest increases, with Top Development Executives receiving just 1.41% growth. Despite the slower growth rate, the industry continues to offer competitive variable compensation, especially for senior executives, and substantial bonuses remain a key part of total compensation packages.

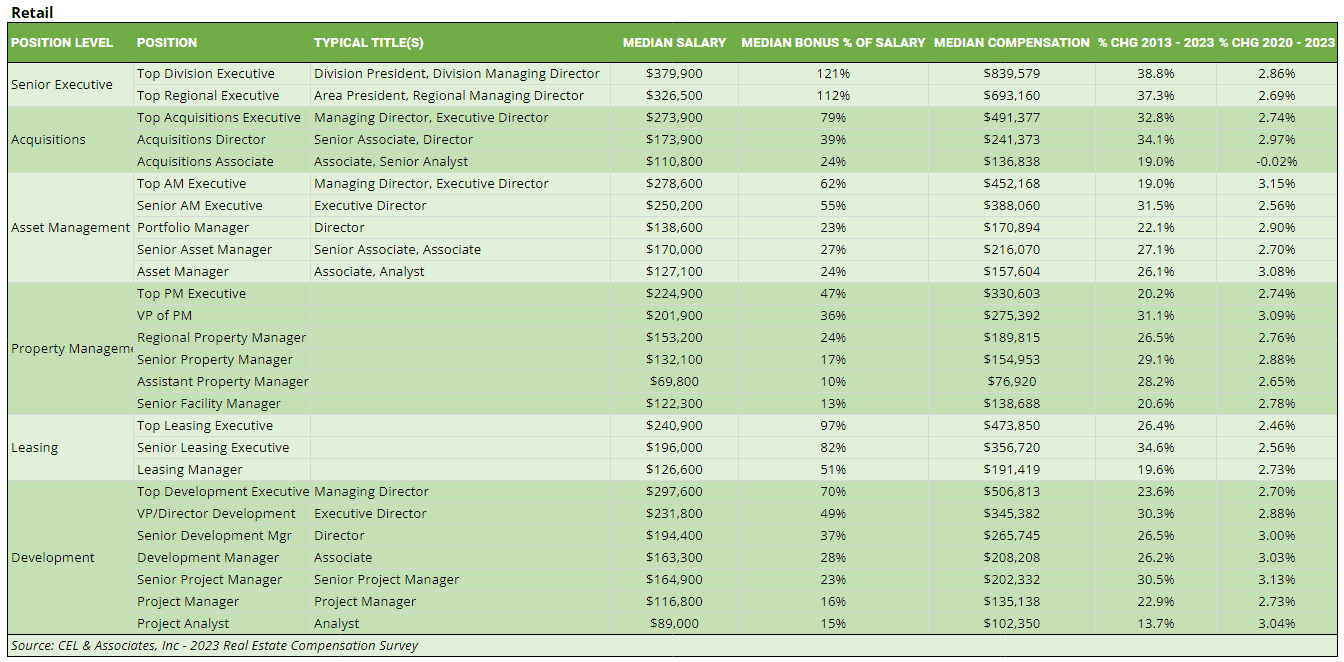

Summary of 2023 Pay (Salary plus Bonus) for Retail Real Estate Professionals

For retail real estate professionals, compensation growth in 2023 was more moderate compared to previous years, with increases in total compensation ranging from 2.56% to 3.15%. Senior Executive roles saw the highest median compensation growth, with Top Division Executives experiencing a 2.86% increase, followed by Senior Asset Management Executives at 2.56%. Acquisitions roles, especially for Associates, showed stable growth, with a median bonus of 24%. Property Management and Leasing roles also saw moderate increases in total compensation, averaging around 2.6% to 3.0%. Bonuses as a percentage of salary varied significantly, with Top Leasing Executives receiving a 97% bonus, while Development Executives saw bonuses of around 70%.

Overall, senior positions in retail continued to outperform those in other real estate sectors, such as office and industrial, in terms of total compensation. Junior retail professionals also benefited from steady increases, particularly in Development and Asset Management roles. For MBA and Masters in Real Estate graduates entering Associate-level positions in retail, compensation ranged from $135,000 to $297,600, with Development and Asset Management roles generally offering higher salaries than Acquisitions and Property Management.

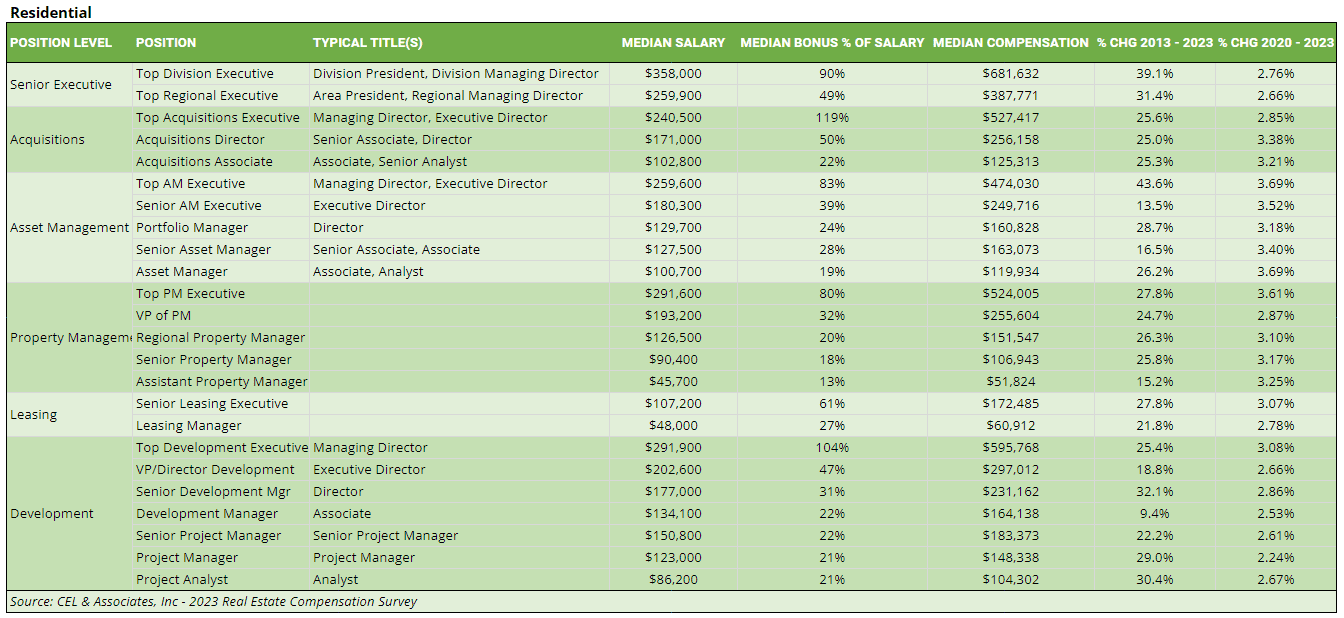

Summary of 2023 Pay (Salary plus Bonus) for Multifamily Real Estate Professionals

In the residential real estate sector, compensation growth in 2023 continued to reflect stable increases across all positions. The bonus as a percentage of salary for residential professionals remained competitive, with senior roles like Top Acquisitions Executives receiving bonuses of up to 119% of their base salary, and Top Development Executives receiving bonuses of 104%. Junior roles, such as Acquisitions Associates and Asset Managers, had more modest bonuses at 22% and 19%, respectively. The growth in median compensation ranged from 2.53% to 3.69% from 2020 to 2023, with Asset Management roles showing the highest growth.

For early-career professionals in residential acquisitions, asset management, and development, total compensation varied, with Analyst and Associate positions earning median salaries from $86,200 to $134,100. Bonuses accounted for around 21% to 31% of their total compensation. While the total compensation growth for junior professionals was slightly higher than the previous year, senior roles in residential continued to offer higher variable compensation, with the sector experiencing competitive but stable growth compared to other real estate asset types.

Changes in Real Estate Salary and Bonus – 2022 vs. 2023

On average, compensation growth from 2022 to 2023 was more modest across sectors, reflecting a stabilization in pay increases compared to the previous year. The residential sector saw increases ranging from 2.53% to 3.69%, while retail and office/industrial sectors saw growth closer to 2.5% to 3.5%, particularly in senior executive roles. However, these increases remained below the growth rates seen in 2022. Acquisitions and development roles continued to offer strong bonus percentages, with top executives receiving up to 119% of their base salaries in bonuses.

Despite the slower pace of growth, senior roles, especially in residential and retail real estate, still saw competitive compensation increases. As the visual data shows, senior positions, particularly those in acquisitions, development, and asset management, continue to outpace junior roles in terms of both salary and bonus growth.

Earn more by leveling up your real estate financial modeling skills – check out the A.CRE real estate financial modeling Accelerator program.

Changes in Real Estate Salary and Bonus – 2013 vs. 2023

From 2013 to 2023, real estate compensation grew significantly, with total pay increasing by an average of 34.7%. Senior roles, such as Division Presidents and Top Acquisitions Executives, saw some of the highest increases, with compensation growth often exceeding 40%, driven by substantial base salary and bonuses. Retail and residential roles, in particular, saw strong growth in compensation, reflecting the industry’s focus on rewarding performance in these sectors.

Mid-level and junior positions also experienced notable increases, although at a more modest pace, with compensation growth averaging between 25% and 30% in sectors such as office, industrial, and retail. The trend toward higher bonuses, especially in sectors like retail and residential, highlights the industry’s shift toward performance-based pay. As bonuses now make up a larger portion of total pay, roles that directly contribute to firm success, like acquisitions and asset management, continue to offer strong compensation growth.

Conclusion on 2023 Real Estate Pay

In 2023, the real estate industry continued its trend of rising compensation, albeit at a slower pace compared to the rapid growth seen in 2022. The residential, retail, and office/industrial sectors all experienced stable but modest compensation increases, with total compensation rising between 2.5% and 3.7%. Senior positions, particularly in acquisitions, asset management, and development, continued to offer the highest variable compensation, with bonuses accounting for a significant portion of total pay, especially in roles tied to firm success.

Understanding these trends is essential for real estate professionals across sectors, including acquisitions, development, asset management, leasing, and property management, as they navigate salary negotiations and career growth opportunities. We hope this report provides valuable insights into the current compensation landscape and helps professionals align their expectations with market trends in real estate pay.

Frequently Asked Questions about Compensation in Real Estate (United States 2023)

Where does the 2023 compensation data come from?

The data is sourced from the CEL & Associates National Real Estate Compensation & Benefits Survey, which compiles pay data from nearly 400 U.S. real estate firms across 190 job roles. The 2023 survey was conducted in partnership with RCLCO.

Which job functions are included in the compensation summary?

The summary covers compensation for roles in acquisitions, asset management, property management, leasing, and development, from Analyst through Managing Director levels, across industrial, office, retail, and multifamily sectors.

What were the compensation trends in the office and industrial sectors in 2023?

Median compensation growth ranged from 1.41% to 6.19%, with Senior Asset Management Executives seeing the highest gains. Bonuses were significant, with Top Leasing Executives receiving up to 110% of base salary. Development roles saw the slowest growth at just 1.41%.

How did compensation change in the retail real estate sector in 2023?

Retail sector compensation increases ranged from 2.56% to 3.15%, with senior executives experiencing the highest growth. Top Leasing Executives had bonuses as high as 97% of salary. MBA-level Associates in Development and Asset Management earned between $135,000 to $297,600 total.

What were the key compensation patterns in residential/multifamily real estate in 2023?

Compensation grew by 2.53% to 3.69% from 2020 to 2023. Senior roles earned large bonuses: up to 119% for Top Acquisitions Executives and 104% for Top Development Executives. Analyst and Associate salaries ranged from $86,200 to $134,100, with bonuses of 21% to 31%.

How did compensation change from 2022 to 2023 across all sectors?

Compensation growth slowed in 2023 compared to 2022, with increases averaging 2.5% to 3.7% across sectors. Despite slower growth, senior executives—especially in acquisitions, development, and asset management—continued to receive strong bonus-heavy compensation packages.

What long-term compensation growth has been seen since 2013?

From 2013 to 2023, total real estate pay rose by an average of 34.7%. Senior roles like Division Presidents and Top Acquisitions Executives saw increases over 40%, while mid-level and junior roles experienced 25% to 30% growth. Bonus pay now comprises a larger share of total compensation.

Which real estate roles offered the highest bonuses in 2023?

Top bonuses were found in senior roles:

Top Acquisitions Executives: up to 119%

Top Leasing Executives: around 110%

Top Development Executives: 70–104%

These figures reflect a strong emphasis on performance-based compensation.

How can professionals increase their earning potential in real estate?

Improving technical skills—especially in real estate financial modeling—is key. A.CRE recommends joining the Real Estate Financial Modeling Accelerator Program to gain modeling proficiency, stand out in the job market, and command higher pay.