Single Tenant Net Lease Valuation Model – Custom GPT by A.CRE

At A.CRE, we’ve built dozens of custom GPTs for internal and external purposes. Some of the GPTs have general application, while others are custom GPTs specifically for commercial real estate. And among those custom GPTs specifically for CRE, we’re working to build the world’s largest library of real estate analyst GPTs.

A few weeks ago, we released our first real estate analyst GPT: an Advanced Mortgage Amortization Schedule custom GPT. And today, we’re excited to share our second (and far more robust) real estate analyst GPT: our STNL Valuation Model custom GPT.

Built on top of our widely used Single Tenant NNN Lease Valuation Model, this GPT has been trained to take inputs the user provides and update that Excel model accordingly. It is also trained to provide the user guidance on inputs and outputs in the model. In the coming months, we’ll continue to release other custom GPTs that will perform most of the financial modeling for the user in this same way.

- Note: Custom GPTs are now available to both paid and free users of ChatGPT (Click here to learn more).

Why we built the STNL Valuation Model GPT

As mentioned, this tool is the second in what will be a series of real estate analyst GPTs designed to help those less technically versed in using A.CRE’s real estate Excel models. Essentially, the GPT guides users through the necessary inputs, answers their questions about the model’s inputs and outputs, and updates the Excel file accordingly.

In essence, the GPT serves as a personal real estate analyst, modeling single tenant net lease investments for the user.

We also developed this GPT (and the previous Advanced Mortgage Amortization Schedule GPT) as a pilot project for future, more sophisticated real estate analyst GPTs aimed at modeling real estate deals. It provided valuable insights into the capabilities and limits of GPT-4 (the version on which this tool is based) and allowed us to explore innovative ways to maximize the GPT’s utility. Just as it took me three attempts to perfect my first All-in-One model without breaking Excel, these early GPTs are instrumental in understanding the current boundaries of LLMs when applied to real estate analysis.

Access the STNL Valuation Model GPT

We developed this custom GPT as a service to A.CRE readers and the industry. As of May 2024, custom GPTs are available to both free and paid users of ChatGPT.

We regularly update the GPT (see version notes).

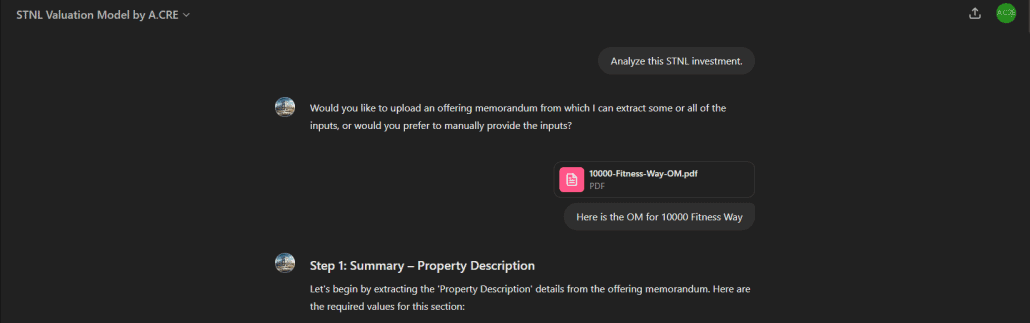

Click to chat with the STNL Valuation Model GPT and then use a simple prompt such as “Analyze this STNL investment” to get started. Note that as with all generative AI applications and Excel models, there may be output mistakes.

User’s Guide – STNL Valuation Model GPT

To use the STNL Valuation Model GPT effectively, follow these steps:

- Get Started. Enter a simple prompt to get started such as ‘Help me create an STNL valuation model’ or ‘Please create a valuation for the deal in this offering memorandum’.

- Provide Inputs. Once you start the GPT, it will guide you through the inputs it needs to create the model. Either answer its questions or provide it a PDF of an offering memorandum that contains the valuation assumptions. If you have questions about any input it asks for, simply ask it for clarification.

- Confirm Inputs. After you’ve provided the necessary inputs, the GPT will confirm with you that the inputs are correct. Either ask it to make changes or confirm the inputs are correct.

- Download the finished Excel model. Once you confirm the inputs, the GPT will take those inputs, update the Excel file, and then provide you with a link to download the Excel file. Click that link, open the file, click ‘Enable Editing’, and then refer to the ‘Summary’ and ‘Inputs’ worksheets.

- Ask it Questions and/or report bugs. If you have questions about any of the inputs or outputs in the model, just ask. It has been trained on the model. If you run into a bug, let it know and it will direct you to where you can report the bug to us.

Inputs You’ll Need to Provide the STNL Valuation Model GPT

To prepare for your conversation with the GPT, here is a summary of the inputs you’ll need to provide, broken out into the seven sections the GPT goes through. Note that you have the option to upload an offering memorandum (OM) to help populate some or all of these inputs.

1. Summary – Property Description

This section covers basic information about the property, including its name, address, city, state, property type, (e.g., retail, office, industrial) and sub-property type (e.g. bank, convenience, QSR). You’ll also need to provide details such as land size, net rentable area, legal interest, number of parking spaces, and the year the property was built.

2. Summary – Pricing/Valuation

Here, you’ll input the financial details related to the property’s pricing. This includes the asking price, market capitalization rate (expressed as a decimal), and the total replacement cost. These figures are essential for establishing the property’s market value and investment potential.

3. Inputs – Analysis Details and Project Investment

This section focuses on the specifics of the investment analysis. You will need to provide the analysis start date, general vacancy rate, purchase price, acquisition fees, due diligence costs, and any upfront construction costs if applicable. These inputs help in setting up the initial framework for the financial analysis.

4. Inputs – Operations + Debt

For operational and debt-related inputs, you’ll detail any additional income types and amounts, income growth rates, tenant expense recoveries, and year 1 operating and capital expenditures. You’ll also need to provide details about the loan, such as loan-to-purchase price ratio, fixed interest rate, and amortization period. These inputs are crucial for understanding the property’s cash flow and debt servicing requirements.

5. Inputs – Tenant Details

This section requires information about the tenant, including their name, type (public or private), year established, credit rating, and discount rate for speculative income. These details help assess the tenant’s reliability and impact on the property’s value.

6. Inputs – Lease Details

Here, you’ll input the specifics of the lease agreement, such as the lease start date, lease length, rent increase type and schedule, base rent, and options for lease extensions. This includes probabilities of exercising these options and any associated rent increases. These inputs define the lease’s terms and potential future income.

7. Inputs – Residual Assumptions

The final section focuses on assumptions regarding the property’s residual value. You’ll provide the exit cap rate, retenanting costs and probabilities, downtime periods and probabilities, and selling costs as a percentage of the residual value. These inputs help estimate the property’s value at the end of the holding period and potential costs associated with retenanting and selling.

By preparing these summarized inputs, you can ensure a smooth and efficient process when using the STNL Valuation Model GPT. If you have any questions about what to enter, simply ask the GPT for clarification.

Tips for Using Real Estate Analyst GPTs Such as this STNL Valuation Model GPT

As this is likely the first custom GPT of this type you’ve used, I thought I’d share a few tips I’ve found helpful when working with this type of AI.

- Treat the AI like your analyst: Engage with the AI as if it’s part of your real estate analyst team, expecting the same level of detail and engagement you would from a human analyst. Clearly communicate your needs and provide all necessary information.

- Upload Supporting Documents: If available, upload offering memorandums or other relevant documents to help the GPT accurately populate the model inputs. This can save time and improve accuracy.

- Ask for Clarification: If results aren’t clear or you’re unsure about any input or output, don’t hesitate to ask the AI for further explanation. It’s designed to help you understand the process and ensure the data is accurate.

- Be Explicit with Your Requests: Clearly articulate your needs and specific requirements. Precise questions yield precise answers. For example, specify exact dates, amounts, and rates to get the most accurate results.

- Double-Check the Outputs: Always verify the AI’s calculations against your own or with a trusted model to ensure accuracy before making any financial decisions. This extra step ensures the reliability of the results.

- Report Bugs or Issues: If you encounter any bugs or issues with the model, report them to us. This feedback helps us improve the tool and provide better service to all users.

- Stay Updated: Keep an eye on updates and new versions of the model and GPT. These updates often include improvements and new features that can enhance your analysis.

By following these tips, you can effectively use the STNL Valuation Model GPT (and other real estate analyst GPTs shared by A.CRE) to streamline your real estate valuation process, ensuring accuracy and efficiency.

Video Walkthrough – STNL Valuation Model GPT

To further help you get started using this custom GPT, below you’ll find a video walkthrough. The video guides you through how to use the GPT to create an STNL valuation model in Excel. This video was built using v1.1 of the tool. We regularly update our Excel models and AI tools, and OpenAI is constantly updating ChatGPT. So, the version in the video may look different, but the base functionality remains the same.

Frequently Asked Questions about the STNL Valuation Model GPT

Version Notes

v1.1

- Modifications to better accommodate custom GPT instructions

- Simplified Property Type and Sub Property Type lists

- Removed images, strengths, and weaknesses from Summary tab

- Added placeholder formula to ‘Tenant Expense Recovery Type’ input

- Set ‘Credit Type’ to ‘Custom’ to simplify credit analysis

- Cleaned up named ranges to solve error message

- Added ‘None’ to credit type on Data tab

- Updated formula ‘Inputs O51’ to handle errors with Rent Increase Month input

- Changes to GPT instructions

- Fixed issue where contract rent increase amount input (either %/yr or Amt/SF/Yr) wasn’t included

- Added clarification that Land Size should be in SF, and therefore if user provides an acreage it should be converted to SF

- Renamed ‘Construction Cost’ to ‘Upfront Cost (e.g. deferred maintenance, unpaid leasing cost, planned renovation)

v1.0

- Initial release

- Built based on v2.7 of the ‘Single Tenant NNN Lease Valuation’ model