UCLA Anderson – MBA Real Estate Profile

Note from Michael: This profile is part of The A.CRE MBA Real Estate Series highlighting some of the world’s top MBA programs with concentrations in real estate. Each profile has been written by a current or former student of the program and is written from their unique perspective on the school and its real estate offerings. A huge thanks to Kelly Kaine for taking the time to write this profile of Anderson. Kelly’s bio is provided at the end of the post.

Before coming to UCLA Anderson, I was working in land-use consulting, entitlements, and permitting in Los Angeles. I chose to come to Anderson to continue to develop my real estate network in Southern California, supplement my engineering undergraduate degree with finance curriculum, and to take advantage of the multitude of resources available at Anderson for students interested in real estate, including the Ziman Center for Real Estate. The student culture at Anderson and focus on sharing success was another key factor in my choice to attend Anderson.

Real Estate Opportunities and Exposure

My experience at Anderson has been fantastic, even considering the majority of my two years there were remote due to COVID. I was able to achieve my goal of pivoting to real estate development and owe my success largely to how well the resources at Anderson prepared me for recruiting. The opportunity to participate in the UT Austin National Real Estate Challenge during my first year was critical to my learning experience and getting to know my peers at Anderson as well as real estate MBA students across the country. The real estate classes offered at Anderson are robust and the option to do an academic internship during the school year is another plus of being located within the bustling Los Angeles market. Anderson’s location allows for easy access to alumni and industry professionals for coffee chats, happy hours, career nights, and for various off-campus real estate events.

The Association for Real Estate at Anderson (AREA)

AREA is the professional club for real estate students on campus, and is heavily involved in all things real estate at Anderson. Most likely due to Real Estate’s status as one of the smaller specializations on campus (usually between 15-30 interested students),

the core group of students recruiting for real estate become very close through our ACT (Anderson Career Teams) experience and carry that forward into an active club. We have weekly meetings, and host events including Dinner for Eight (where 8 students get to have a meal with a local real estate professional),

Real Estate 101 Presentations (where an alum or other local professional gives a presentation on their career or a topic of their choosing), Industry Night, Networking Happy Hours, Days on the Job Recruiting Events, Case Competitions, Corporate Presentations, Mentorship Programs, Admissions Events, and weekly learning sessions where a student from within the club gives a brief presentation on their previous real estate position (if any) or another topic that they are interested in.

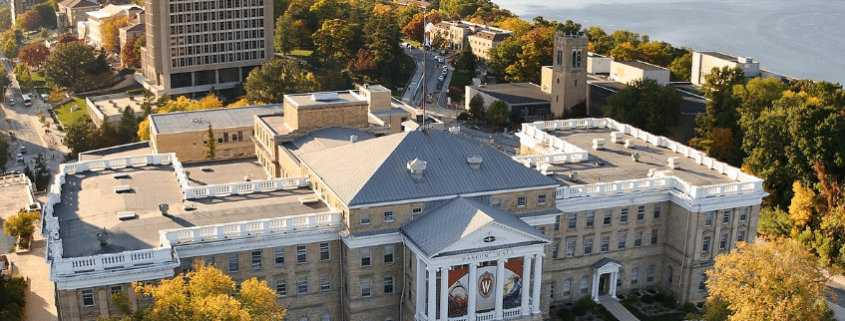

UCLA Anderson students at the UT Austin National Real Estate Challenge

The Association for Real Estate at Anderson has been an excellent resource, providing a wide variety of programming and networking opportunities as well as a committed group of fellow students who are passionate about helping each other succeed. I felt as if I had a complete support community from my first day on campus, as second years worked to help first-years manage course schedules, recruiting priorities, and target companies.

Students and Industry Professionals networking at the annual Real Estate Industry Night

Ziman Center for Real Estate

The Ziman Center, a joint center of UCLA Anderson School of Management and UCLA School of Law, was formed in 2001 with a directive to create and steward UCLA’s activities surrounding the topic of real estate. Ziman is an invaluable, on-site, resource that coordinates networking and learning opportunities for real estate students across UCLA’s undergraduate and graduate schools. Because Ziman also serves as a research center, it hosts frequent panels and speakers. The staff at the Ziman are always available to help plan events in conjunction with AREA and help facilitate networking and mentorship programs. One highlight is the Dinners for Eight (D48s) that the Ziman Center and AREA plan throughout the year.

UCLA Anderson AREA Students at a Dinner for Eight at The Grove in Los Angeles

Real Estate ACT (Anderson Career Teams) and IPT (Interview Prep Teams)

Our Real Estate ACT (Anderson Career Teams) Group, taught by second-year students and aimed at preparing the core group of real estate students for the recruiting season, was a great learning experience but also served to bring our smaller group of real estate students even closer together. ACT is held in the fall quarter and then IPT begins in the winter quarter when real estate interviews and recruiting picks ups. IPT is also taught by second-year students who have successfully gone through the internship recruiting process and have firsthand experience to share and feedback to provide.

UCLA Anderson first-year students in ACT Class with second-year coaches

Conferences

UCLA puts on an annual Proptech Conference in conjunction with AnderTech, a tech club that’s one of the largest at Anderson. 2021’s keynote speaker was the CEO of Fundrise and also featured many panels with local entrepreneurs and investors in the space.

In addition, during the 2022 school year, UCLA launched lunch and learn seminars that are open to all Anderson students. They often focus on topics relevant to those who may want to invest in real estate but are not pursuing it as a career. A recent class, for example, was on “Purchasing Your First Home” and another had a focus on purchasing and operating an investment property.

Course Offerings

Urban Real Estate Finance and Investing

The introductory real estate course for students specializing in Real Estate, Urban RE Investing starts with a brief overview of the various Property types, and continues (on a fairly high level) to review various elements of the development, construction, financing (both equity and debt), and management of real estate.

Professor: Paul Habibi

Cases in Real Estate Investments

The primary goal of the course is to develop an understanding of the principal issues involved in real estate investment and finance. Topics covered will include: real estate financial analysis and valuation in a variety of contexts (single and multi-family residential, commercial/industrial, shopping center, and hotel properties); diversification of real estate assets in a portfolio; real estate taxation, including 1031 transactions; real estate law; the development process; securitization of real estate (including REITs) and other means of financing real property ownership and investment; leasing; work-outs of troubled properties.

Professor: Eric Sussman

Entrepreneurial Real Estate Development

This class takes a deeper dive into the development process, starting with how to find and purchase high-potential sites, the entitlement process, construction financing & management, and stabilization. This is one of the most popular courses at Anderson.

Professor: Paul Habibi

Real Estate Economics, Capital Markets, and Securitization

Exploration of linkages between real estate, macroeconomy, and capital markets. New insights as to structure and practice of macroeconomic regulation, crisis policy formulation, and related capital markets and real estate outcomes.

Professor: Stuart Gabriel

Real Estate Law and Taxation

This practically oriented course will familiarize students with important legal and tax issues in real estate. The course will cover basic legal concepts in title & ownership, contracts & land acquisition, financing, possessory and non-possessory interests, involuntary liens, eminent domain, commercial & residential leasing, landowner liability, litigation and real estate agency. In the area of taxation, the concepts will include business structure, acquisition & debt, capitalization, depreciation, leasing & tenant improvements, passive and at-risk loss restrictions, capital gain treatment, Section 1231 and 1250, like kind exchanges and deductions on hybrid-use property. The course will cover basic laws and regulations, but also weave in issues of planning and policy. Students will analyze case studies and problems. They will learn how to conduct tax and legal research, and will be responsible for preparing a research memorandum on the tax and legal issues related to a real estate issue. Through the research assignment, students will develop analytical and research skills in a legal and tax context.

Professor: Gonzalo Friexes

Recognizing and Resolving Legal Issues in Real Estate Businesses

This course is designed to alert students to key legal issues facing different segments of the real estate business, impart a familiarity with possible outcomes when a legal issue arises, and create a framework for working with (or, where appropriate, without) lawyers to identify and resolve legal issues. The course will help the businessperson be a better consumer of legal services and prepare that person to manage the legal function in business situations.

Affordable Housing Development and Finance

The course will familiarize students with the site selection and acquisition process, and will explore the complexities associated with land use, entitlements, programming, and the political landscape. Next, the course will focus on the financial modeling of affordable housing development with the various financing tools available to affordable housing developers, including low-income housing tax credits, tax-exempt bond financing, and various federal, state and local funding sources. Finally, students will explore other “hot” topics related to affordable housing development, including disruptive technologies, public policy related to homelessness, and other topical news stories.

COVID-19, Real Estate, and Capital Markets (Spring 2020)

This course explores the linkages between the 2020 global COVID-19 pandemic and outcomes in U.S. real estate and real estate capital markets. The course commences with overview and discussion of COVID macroeconomic disruption and related monetary and fiscal policy response. It then turns to assessment of COVID implications for real estate and related capital markets, the latter including pricing and securitization of both residential and commercial mortgages as well as operations of new Federal Reserve real estate liquidity vehicles. Among real estate markets, the course evaluates COVID-19 impacts on owner-occupied and for-rent residential housing, retail, industrial, and other real estate sectors. The course includes discussion of COVID-related policy interventions by all levels of government to provide rent relief, stem property foreclosure, and encourage ongoing provision of low-income affordable housing.

Professor: Stuart Gabriel

Browse Other MBA In Real Estate Profiles

About Kelly Kaine: My name is Kelly and I am a second-year student at the UCLA Anderson School of Management specializing in Real Estate. I am originally from Half Moon Bay, CA, and I graduated from UCLA in 2014 with a B.S. in Civil Engineering. After undergrad, I worked for one year as a geotechnical engineer before spending four years at Crest Real Estate. Crest is a land-use consulting, entitlement, and permit expediting firm in Los Angeles. It was during my time at Crest that I knew I wanted to work as a developer and decided to pursue my MBA at UCLA Anderson. I spent my summer internship with Greystar and will be starting full-time as a Development Associate with Greystar post-graduation.

Original 2017 Article

About Laurel Casey: My name is Laurel and I am a first-year student at UCLA Anderson School of Management specializing in Real Estate. I am originally from San Diego, CA, and graduated from Yale University in 2012 with a double major in History and Economics. After Yale, I spent two years working as a legal analyst in the Merchant Banking Legal Division of Goldman Sachs in New York City. In this role, I found myself increasingly drawn to the transactions that the Real Estate Principal Investment Area was working on and decided to pursue a career on the business side of the industry. I took a position as a Financial Analyst in the Commercial Real Estate Debt Group of Wells Fargo in Los Angeles. This was a great first role in real estate, providing exposure to all of the different property types (from office and multifamily to self-storage and industrial), various borrower types (from one-guy shops to major institutional investors), and projects (from ground-up construction to stabilized properties).