Underwriting a Tenant with Private Credit (Updated June 2024)

Recently, we had an Accelerator member ask a question about how to accurately determine a credit rating and spec income discount rate for a private tenant in a single tenant net lease deal. While the scenario specifically involved a medical office tenant (a doctor’s practice), the application could easily be applied to a number of tenants.

In short, the doctor had been in practice at the location for a number of years. But how would you assess the risk profile of such a tenant? Public companies have transparent financials, with readily available public credit ratings from the major agencies. Gauging risk for a private company can be a bit tricker. So, in my response, I helped answer two questions

- How can you underwrite the credit of a private company or individual? and

- What would be a reasonable rate to discount the cash flows?

When You Might Need to Underwrite Private Credit in Real Estate

So, this question came up in regard to using our Single-Tenant Net Lease Valuation model. That particular model requires that you input two different discount rates: a credit discount rate and a speculative discount rate.

The credit discount rate relates to the rate at which the credit cash flows (i.e. in-place contract cash flows tied to the existing lease) are discounted in the present value calculation. The speculative discount rate relates to the rate at which the speculative cash flows (i.e. future cash flows NOT tied to an existing lease) are discounted in the present value calculation. The sum of the discounted cash flows for the two cash flow types (i.e. speculative and credit), is the theoretic value of the property.

The Accelerator member was underwriting a property where the tenant was a private dental practice, with no public credit rating was available. And therefore, the it became necessary to derive an appropriate credit discount rate with minimal information. I shared one possible methodology for accomplishing that.

Are you an Accelerator member? Learn more about using the DCF method for valuing real estate in the core curriculum of the Accelerator. Not yet an Accelerator member? Considering joining our comprehensive real estate financial modeling training program available and take your skills to the next level.

1. Create a Private Credit Rating

In terms of the first question, private credit (i.e. the discount rate for the Credit Income of private entities or individuals) is tough to underwrite. This is because no two private companies (or individuals) are the same. It really depends on the creditworthiness of the business and/or the individual personally guaranteeing the lease.

So, for instance, if Bill Gates personally guarantees the lease, the credit quality would essentially be AAA and would therefore merit a very low discount rate (e.g. UST + 50 bps) for the credit income.

In contrast, if the private company is on the brink of bankruptcy and has no solid personal guarantor behind the lease, the credit quality is essentially junk (e.g. D) and might merit a discount rate in the 15%-20% range.

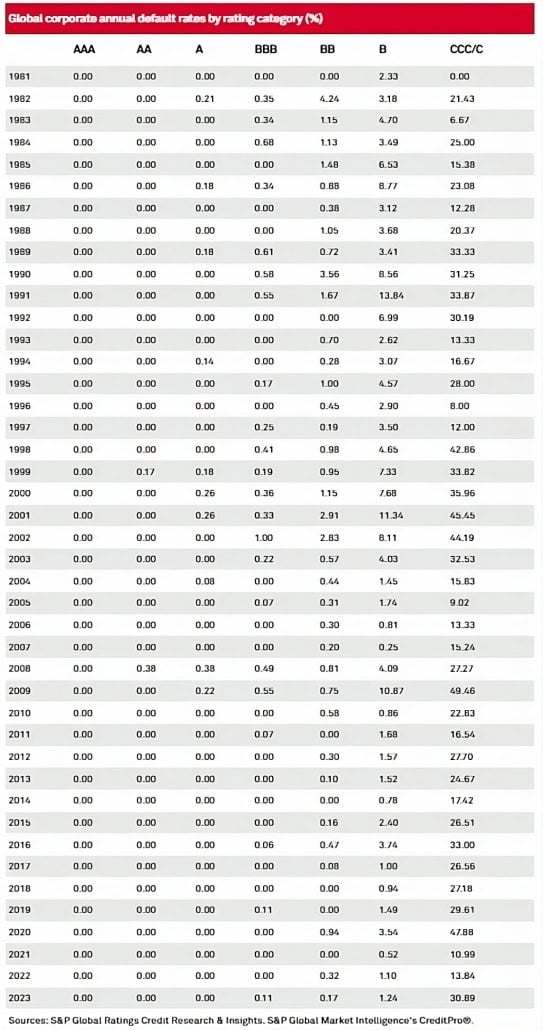

One way to solve for this is to make your own best estimate of likelihood of default over the next ten years. This is a best guess, of course, but should help you arrive at a relatively appropriate credit rating equivalent. Once you’ve made that assumption, you can compare that likelihood to the cumulative default rates by S&P-rated companies over the past thirty years (see below) to derive your own private credit rating.

2. Use the Private Credit Rating to Estimate a Bond Yield Equivalent

With that private credit rating developed, you would then find the bond yield of the equivalent public credit, and add some real estate risk and illiquidity premium (e.g. 100 bps) to that rate to arrive at a credit income discount rate. This involves comparing your estimate of default risk of the private tenant with the default risk of companies rated publicly.

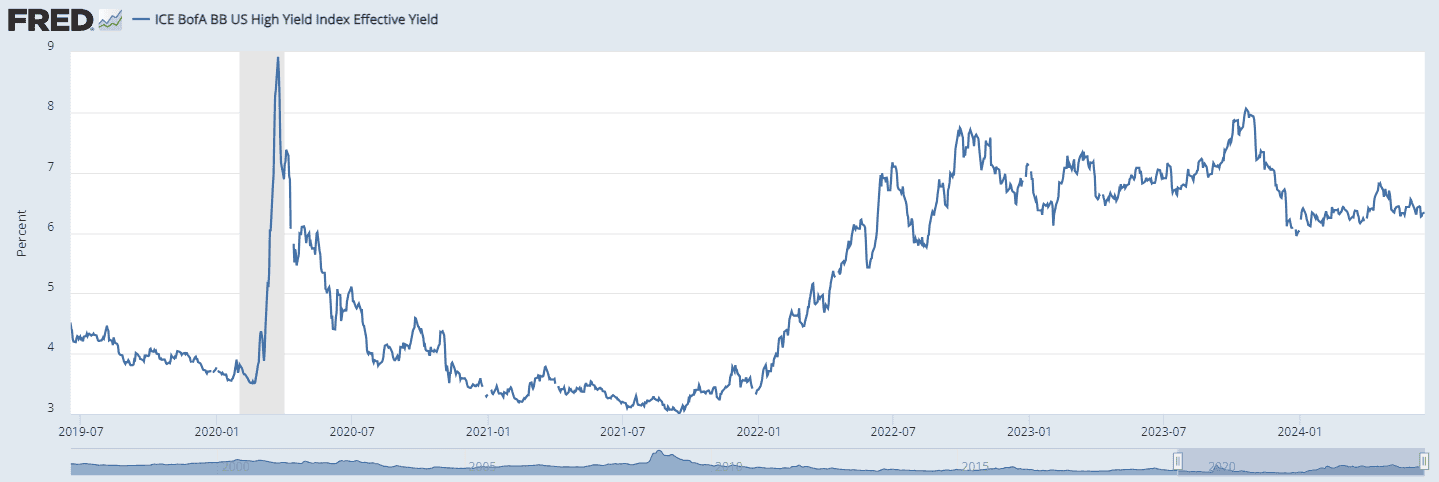

So, for instance, imagine your analysis determines that the tenant has a 10% chance of defaulting over the next ten years. That is approximately equivalent to the 10-year default rate of a BB to BB+ equivalent credit on S&P. BB corporate bonds currently trade at about a 6.4% yield. Add 100 bps to that to arrive at a credit income discount rate of 7.4%.

3. Estimating a Speculative Discount Rate

In terms of speculative discount rate, that’s much simpler. Consider the cap rate of a non-corporate credit medical office tenant, and then add projected rent growth (e.g. 2%). So, for instance, if a medical office (without a corporate guarantee) typically trades at a 6.0% cap rate and you expect an average 2% growth in rent over the next ten years, then you would use an 8.0% (6% + 2%) speculative discount rate.

Conclusion

Hopefully, that gives you an idea of how to approach these types of scenarios. You will bring a lot of value to your position in being able to apply some well-thought-out analysis where there is ambiguity. Accurately identifying risk is a major part of CRE underwriting and an opportunity where you can really prove your worth.

Finally, where it may apply, and for more targeted guidance in your tenant valuations, consider using our specialized STNL Valuation Model GPT. This tool is designed to help increase your valuation precision, especially when dealing with private tenants like we discussed in this article. It integrates seamlessly into your workflow, providing actionable insights and a systematic approach to determine credit ratings and appropriate discount rates. Explore the capabilities of this tool here.

Frequently Asked Questions about Underwriting a Tenant with Private Credit

Why do private tenants require special underwriting?

Unlike public companies, private tenants do not have transparent financial statements or public credit ratings, making it more difficult to assess creditworthiness and associated risks.

What is the credit discount rate used for in STNL analysis?

The credit discount rate is used to discount in-place contract cash flows tied to the existing lease. It reflects the perceived credit risk of the tenant over the lease term.

How can I estimate a private tenant’s credit rating?

You estimate the likelihood of tenant default over a 10-year period, then compare that to historical default rates for S&P-rated companies to assign an equivalent private credit rating.

How do I calculate a credit discount rate from a private credit rating?

Once you determine a credit rating equivalent, look up the corresponding public bond yield (e.g., BB = ~6.4%) and add a real estate risk/illiquidity premium (e.g., 100 bps). Example: 6.4% + 1% = 7.4% discount rate.

What is a speculative discount rate and how is it determined?

It discounts projected future cash flows after the lease expires. Estimate it by adding expected rent growth (e.g., 2%) to a comparable market cap rate (e.g., 6%). Example: 6% + 2% = 8% speculative discount rate.

What model can I use to analyze a single-tenant net lease deal?

Use the A.CRE Single-Tenant Net Lease Valuation Model, which separates credit and speculative income streams and allows for nuanced discounting of each cash flow type.

How should personal guarantees be factored into the credit analysis?

If a highly creditworthy individual (e.g., Bill Gates) personally guarantees the lease, the credit can be treated as very low risk (e.g., AAA equivalent), and the discount rate adjusted downward accordingly.

Why is underwriting private credit important in CRE?

Accurately identifying tenant credit risk ensures proper valuation and mitigates the risk of income loss. It also demonstrates analytical skill and adds value in the investment process.