Why CRE Deals May be Better Off Following a Project Finance Structure

In this article, we discuss the anatomy of two business structures – Project Finance and Corporate Finance – and why a Project Finance Structure is best suited for CRE deals by making the fund management process more investor friendly.

Note from Spencer and Michael: This is another post in a growing series that we call ‘International CRE’. Written by CRE professionals based outside of the United States, this series is a collection of deep dives into various CRE topics relevant to real estate professionals all over the world. One of the reasons we love the International CRE series is that things are not done the same in one country to the next, and this series highlights those differing perspectives.

This particular post is written by our friend Padmaa Iyer. Padmaa is an India-based Real Estate Fundraising Strategist and Chartered Accountant. She is also a long-time A.CRE reader and graduate of our Accelerator Program. A huge thank you to Padmaa for sharing her knowledge with the A.CRE community!

How choosing the right finance structure in CRE deals can make or break decisions

In the case of a typical everyday business, the founder develops their goods/services, hits the market, gains some traction, and then gradually seeks out more and more capital to aid their growth and expansion plans.

But a real estate business is quite different in the sense that it needs HEAVY UPFRONT INVESTMENTS – either in buying land and developing it into a suitable property type or in acquiring and running a ready property.

Because of this upfront investment required in real estate, as a sponsor, you’ll need to think out your scale of operations right from the start. You’ll need to thoughtfully work on your capital stacking strategies before raising funds.

What do you think is the single biggest factor that your investor audience will be interested to see in your deal? Obviously, aside from your own skin in the game!

The answer is certainty. There are a couple of things that certainty means to investors:

- A robust infrastructure that helps them enter the investment swiftly

- That their capital is going to be applied directly to the stated purpose of the investment

- That the risks involved in the investment are measurable and isolated from your other businesses

- No ambiguity in estimating as well as later receiving the returns

- Easy Exit at an opportune time with minimal tax and other regulatory hassles

To provide this certainty to investors you’ll need a clear business structure.

Choosing the proper structure is a very critical decision that will not only help in defining the legal framework within which to operate but also provide a strong sense of direction to the numbers in your financial model during your fund-raising process.

There are 2 major kinds of business structures we’ll talk about today, project finance and corporate finance.

In this article we’ll look at:

- What a Project Finance Structure is and why it’s best suited for CRE deals

- What a Corporate Finance Structure is and why is it unsuitable for CRE deals?

- Use Cases of Project Finance Structure

- The Takeaway

WHAT IS A PROJECT FINANCE STRUCTURE? WHY IS IT BEST SUITED FOR CRE DEALS?

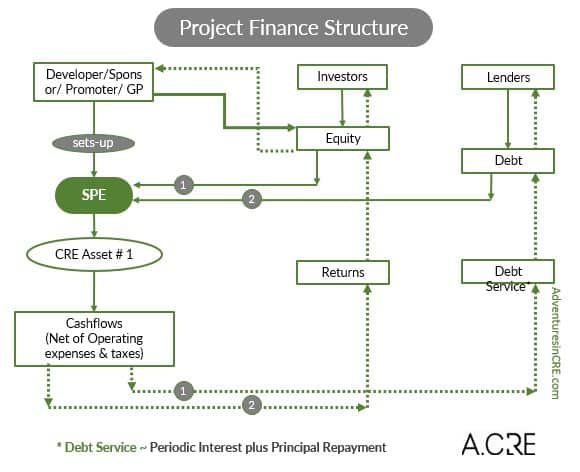

The special purpose entity is the central theme of project finance structures. Each CRE investment is housed in a separate legal entity exclusive to itself. This is for 4 main reasons:

1. Isolated Risks and Returns

The risks and returns associated with each CRE investment belong to the SPE alone in a project finance structure. They don’t get jumbled up with other businesses the owners of the SPE may have.

As a result, the SPE has its own books of account that document the entire lifecycle of the CRE investment, from formation and financial closure to development to operations to the final sale.

2. Increased Bankability

The standalone credibility of the project becomes the main focus in a project finance structure.

Since risks and returns from the investment are independent of other businesses, obtaining capital becomes easier.

Financing costs get optimized as structuring the deal becomes straightforward.

3. Sound Exit Planning

Well-detailed documentation of the SPE’s financial performance enables fetching the right valuations at the time of exit.

It also adds to the credibility of its standalone financial health.

4. Easy Exit

SPE’s with the underlying investment can stay on forever in this structure type, so the exit plan is simple. The ownership can change hands by simply transferring shares in the SPE to the next buyer.

WHAT IS A CORPORATE FINANCE STRUCTURE? WHY IS IT UNSUITABLE FOR CRE DEALS?

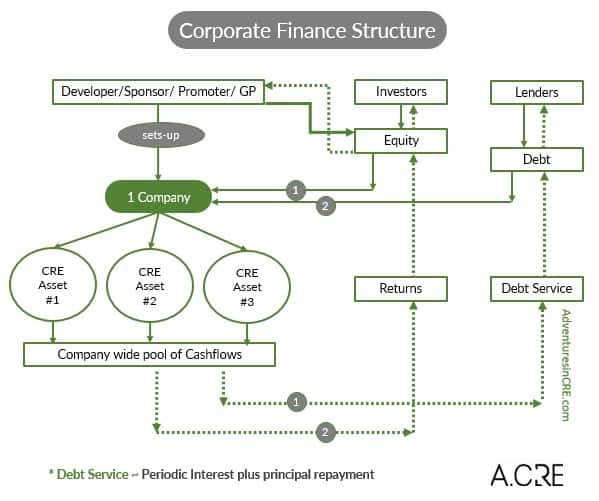

Corporate Finance structure is mostly unsuitable for CRE Deals.

This is a traditional practice in several developing property markets, but it may be unsuitable for CRE deals. This is for 5 reasons:

1. Unclear Funding goals

The developer may be developing several projects at one time. They usually seek credit for new acquisitions as well as the completion of ongoing projects. Their goals are not specific.

2. Unclear Cashflow Profile

Because of the fungible cash pool, the cash flow profile for each of the projects is not clearly identified.

Determining the borrowers’ project-specific periodic debt servicing capacity is a challenge.

3. Difficulties in Financing

4. High Credit Risks

Credit given is at high risk of diversion of funds, project mismanagement, and market risks.

5. Difficult Exit

Exit for investors from one specific asset is not possible, making exit planning for an investor difficult.

USE CASES OF PROJECT FINANCE STRUCTURE

These legal outfits below have been designed in various jurisdictions while keeping in mind the principles of project financing we discussed above.

- Series LLC in the US

- (Check out Ron Rohde Law’s video on the topic!)

- Variable Capital Company in Singapore

- Corporate Collective Investment Vehicle in Australia

To one end, the main use cases of a project finance structure will allow the sponsors/fund managers to maintain the sanctity of each business and give more flexibility, cost savings, and ease in legal compliances.

All to one end: Make your business more investor friendly.

Such SPE structures allow the sponsors/fund managers to: maintain the sanctity of each business, achieve cost savings and ease in legal compliances, and manage investments better.

Takeaway

Project finance structuring may not be cheap but is the most effective strategy for sponsors. Running a portfolio of different CRE investments and creating separate legal entities for each business will definitely add to the administrative, governance, and regulatory compliance costs.

But even then, protecting the sanctity of each investment goes a long way in keeping up the transparency for your stakeholders and saves you many a legal headache during your investing journey.

To sum it up, a project finance structure allows you to model (and track in real time) the cash flow patterns distinctly for each of your CRE deals for each of your investor classes. You’re able to think through the risk-return trade-off for every deal separately.

The certainty provided by a project finance structure is exactly what investors like to see.

That’s why CRE estate deals are usually better off following a project finance structure.

Frequently Asked Questions about Why CRE Deals May Be Better Off Following a Project Finance Structure

What is a Project Finance Structure in CRE?

A Project Finance Structure uses a special purpose entity (SPE) to house each CRE investment in a distinct legal entity. This setup ensures isolated risks and returns, increased bankability, sound exit planning, and ease of ownership transfer. “Each CRE investment is housed in a separate legal entity exclusive to itself.”

Why is Project Finance more investor-friendly?

Because it provides investors with certainty—that their capital is protected, applied properly, and the investment’s risks are isolated. The structure ensures transparency, measurable outcomes, and ease of exit. “The answer is certainty… risks involved in the investment are measurable and isolated from your other businesses.”

How does Project Finance improve bankability?

It allows the project to be assessed on its standalone merits, separate from the sponsor’s other businesses. This simplifies risk assessment for lenders and reduces financing costs. “The standalone credibility of the project becomes the main focus in a project finance structure.”

What makes exit planning easier under Project Finance?

Each investment has its own financials, making valuation straightforward. Ownership can be transferred by selling shares in the SPE. “The exit plan is simple. The ownership can change hands by simply transferring shares in the SPE to the next buyer.”

Why is Corporate Finance structure less suited for CRE deals?

Because it lacks project-specific clarity. Cash flows are pooled, funding goals are vague, and debt servicing capacity is hard to determine. This leads to inefficient financing and difficult investor exits. “Because of the fungible cash pool, the cash flow profile for each of the projects is not clearly identified.”

What are the risks of using a Corporate Finance structure in CRE?

Risks include fund diversion, project mismanagement, unclear debt obligations, and investor difficulty exiting from specific assets. “Credit given is at high risk of diversion of funds, project mismanagement, and market risks.”

Are there global equivalents of the Project Finance model?

Yes. Examples include:

Series LLC in the U.S.

Variable Capital Company (VCC) in Singapore

Corporate Collective Investment Vehicle (CCIV) in Australia

“These legal outfits… have been designed… while keeping in mind the principles of project financing.”

What’s the main drawback of Project Finance?

It can be more expensive and complex to administer due to added governance, legal, and compliance obligations. “Creating separate legal entities for each business will definitely add to the administrative, governance, and regulatory compliance costs.”

What is the ultimate advantage of Project Finance in CRE?

It provides transparency, protects each investment’s integrity, and allows customized modeling and risk-return assessment. “The certainty provided by a project finance structure is exactly what investors like to see.”